Energy crisis: The bond market bear market will not spare anyone

The energy crisis will have severe ramifications for the bond market as it maintains price pressure, reducing the convenience of investing in fixed income instruments offering moderate spreads relative to their benchmarks. High inflation translates into more aggressive monetary policy around the world, even for central banks known for their extremely lenient policies such as EBC. That is why this year investors will avoid the risk of a rate hike, which will increase volatility in the markets. However, in a context of robust economic growth, lower-rated corporate bonds may prove to be less sensitive than high-rated bonds. In fact, junk bonds have a shorter duration than high-rated bonds, making them more resistant to interest rate hikes. Investors must prepare for a bear market in 2022 by navigating safely through choppy waters while keeping an eye out for potential future investment opportunities.

About the Author

Althea Spinozzi, Marketing Manager, Saxo Bank. She joined the group Saxo Bank in 2017. Althea conducts research on fixed income instruments and works directly with clients to help them select and trade bonds. Due to his expertise in leveraged debt, he focuses particularly on high yield and corporate bonds with an attractive risk-to-return ratio.

Althea Spinozzi, Marketing Manager, Saxo Bank. She joined the group Saxo Bank in 2017. Althea conducts research on fixed income instruments and works directly with clients to help them select and trade bonds. Due to his expertise in leveraged debt, he focuses particularly on high yield and corporate bonds with an attractive risk-to-return ratio.

Eurozone: Further support for corporate bond spreads after rate hikes

The ECB found itself tucked between a rock and a hard place: higher inflation and stifling growth. As long as policymakers believe that inflation is not a real threat, the central bank will maintain a very expansionary monetary policy. However, if inflation proves to be a probable threat, the ECB will be forced to implement a more restrictive monetary policy. In line with the symmetrical inflation framework adopted last summer, inflation should average around 2%. If it remains constantly above this level, the ECB will be compelled by statute to intervene. Therefore, the central bank's inflation forecasts for 2023 and 2024 will be in the spotlight throughout the year. Investors will be alert to the energy crisis, supply chain bottlenecks, and wages and labor supply, which may contribute to stronger price pressures. In addition, service sector inflation may increase as the Covid restrictions are lifted, which will further increase the upward pressure on inflation, even though economists expect commodity inflation to be moderate next year.

The positions of policymakers on inflation risk will become clearer over the course of the year. At the same time, we can assume that after the ECB meeting in December, monetary policy continues to support European corporate bond spreads. At the last monetary policy meeting, the central bank confirmed the end of the pandemic emergency purchasing program in March (Pandemic Emergency Purchase Program, PEPP), while determining that reinvestments will continue at least until the end of 2024. PEPP's “flexibility” was extended only to PEPP reinvestments, and not to the asset purchase program (asset purchase program, APP) as the market initially expected, though APP will be used to transition to the new rules. It will be increased from EUR 20 billion per month to EUR 40 billion in the second quarter of this year. Then, in the third quarter, it will be reduced to EUR 30 billion, and by the end of the year it will return to the level of EUR 20 billion. Any changes to this asset purchase program due to rising inflation could jeopardize corporate bond spreads.

The situation is different for European government bonds as quantitative easing will be cut in half this year unless the Covid pandemic worsens. European sovereign bonds will lose much of the support provided by the ECB in 2020-2021, triggering an upward trend in the yield curves. This will be especially visible in the case of German papers, which we expect to break above 0% in the first quarter of this year and increase towards 0,3% by the end of 2022. The expansive fiscal policy of the new German government, and thus a greater issue of federal bonds , will support the upward trend in the yields of long-term government bonds. However, if the ECB were to move towards rate hikes in 2023, the German Treasury yield curve would flatten while contributing to the widening of the spread between Italian and German government bonds. Ultimately, the performance of German government bonds will largely depend on how much yields rise US Treasury Securitiestaking into account that the correlation between them is almost 1.

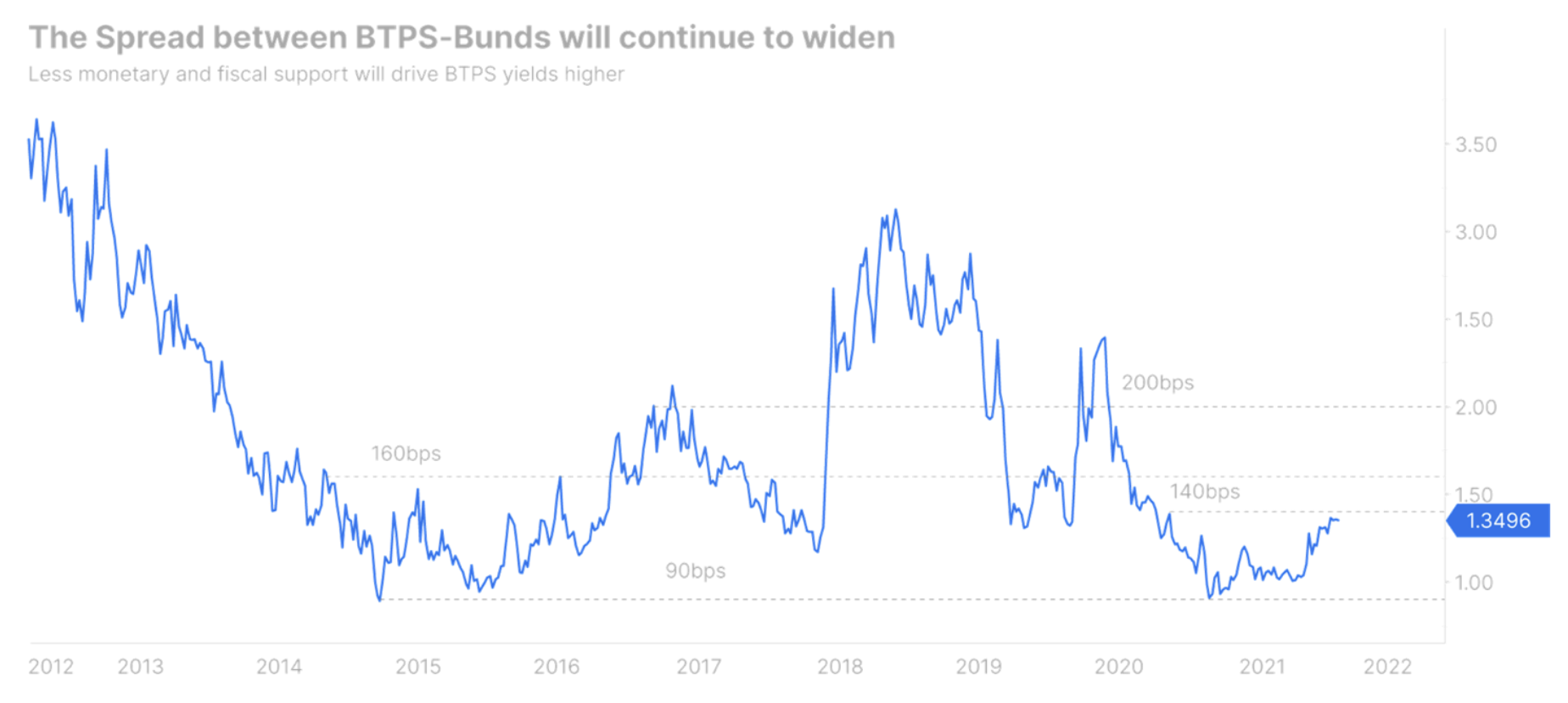

Investors in the bond market should pay attention to the periphery, in particular the spread between Italian and German government bonds.

Recently imposed restrictions in the wake of the next wave of Covid will affect high growth rates in Italy. In addition, Mattarella's departure from the post of president of the republic opens up the possibility of another political crisis, which could lead to new elections if Mario Draghi decides to change the workplace to the Quirinale. Therefore, it is safe to assume that the Italian-German spread will increase throughout the year, with most of this increase occurring in Q160 as political uncertainty remains high. Under the most optimistic scenario, in which Draghi will continue to lead the government as prime minister, the spread of Italian and German government bonds may increase to 200 bp. Suppose, however, that the former president of the ECB decides to step down from his current position to assume the presidency; in such a case the spread will probably increase to XNUMX bp. It may even briefly break above this level if there are new elections.

In the long run, however, we remain constructive about the spread between Italian and German government bonds. We do not expect the ECB to become as aggressive as the US Federal Reserve anytime soon, which would provide some support for European Treasuries. Moreover, the process of narrowing spreads in the euro area is likely to return as inflationary concerns ease. The new German government is actively seeking to improve European integration. At the same time, the ECB is committed to ensuring stability in European markets. Therefore, despite the bumpy road ahead of Italian government bonds this year, they remain an attractive investment for the so-called real money, i.e. for pension funds and insurance companies.

Higher yields will confuse the markets

After one year of describing inflation as "temporary", the US Federal Reserve is finally catching up in normalizing its monetary policy. As the unemployment rate dropped rapidly below 4% at the end of last year, it can realistically be expected that unemployment will return to pre-pandemic levels relatively soon. As a result, the central bank may focus on more pressing issues such as inflation. While price pressure is set to ease this year, there are signs that it may persist and remain above the Fed's target for long periods of time. Wages continue to rise, supply chain bottlenecks are likely to remain an issue until 2023 and productivity growth remains low. Due to the increasing political pressure to fight inflation, the Federal Reserve has been forced to change its accommodative stance and adopt a more aggressive stance than the market had originally envisioned, resulting in a significant flattening of the US yield curve.

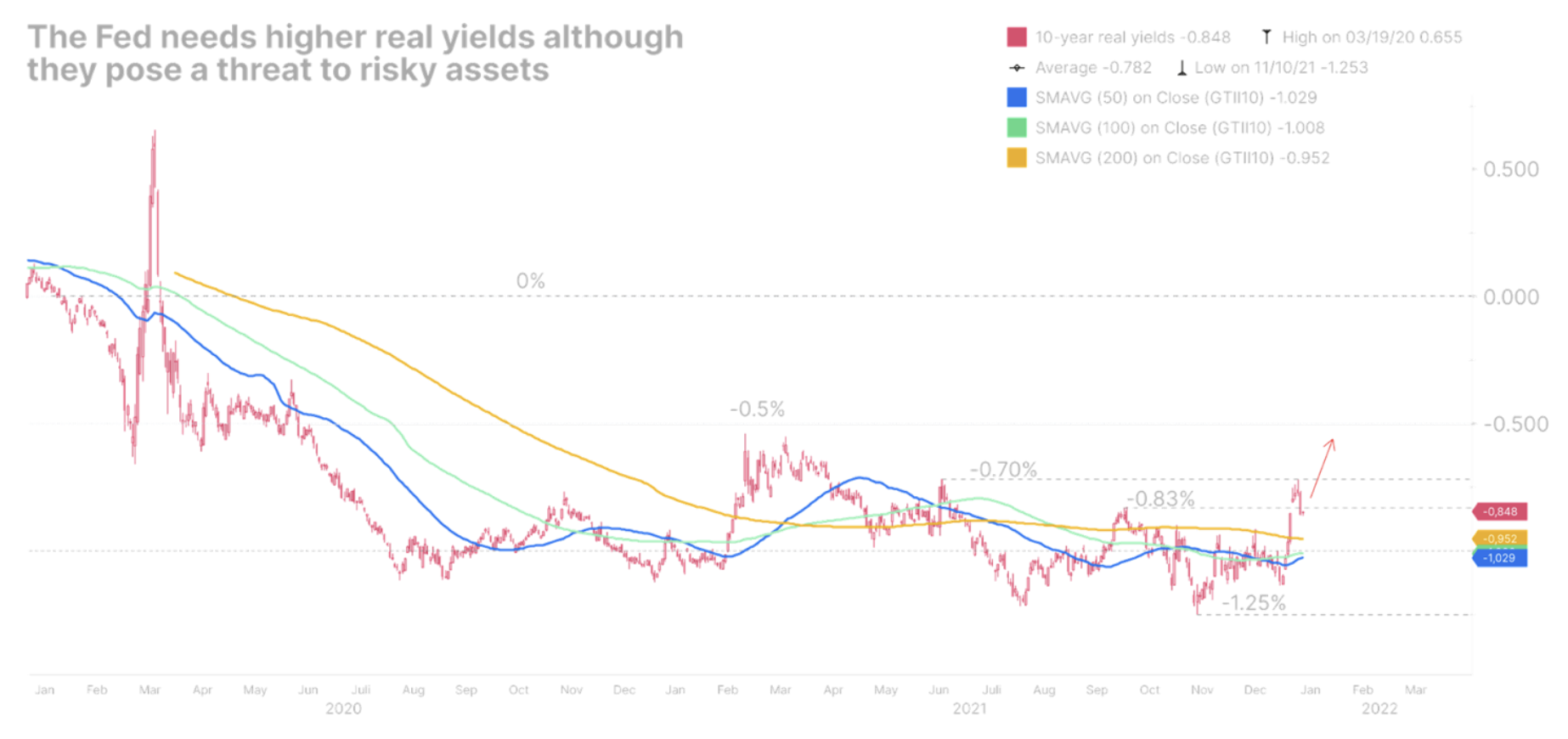

The flat yield curve is a problem for a central bank looking to raise interest rates as it exposes the economy to the risk of a yield curve reversal, which has historically been seen as a clear indicator of an impending recession. Real yields have never been so low or so deeply negative before the Fed started its hike cycle. Perhaps that is why, in an attempt to lift the yield curve, members of the Federal Reserve discussed the reduction of the Fed balance sheet.

There are indications that a bear market is starting to bear market, as a result of which the yield curve in the United States will move higher and, at the same time, there will be a bearish flattening. The short end of the yield curve will continue to rise in the face of more aggressive monetary policy. The long end of the yield curve will also move higher, albeit at a slower pace as yields remain tightened by slowing expectations for economic growth and increasing demand for US Treasuries. We expect 2-year bond yields to meet strong resistance at XNUMX% and end the year close to this value.

Real yields will ultimately drive nominal profitability growth. In fact, as the Federal Reserve becomes more aggressive, yields above the break-even point are holding back. At the same time, nominal yields go up, accelerating the rise in US inflation-protected government bond yields (Treasury Inflation-Protected Securities, TIPS). This is disastrous news for risky assets that are currently still supported by negative real yields but face the prospect of tighter financing conditions.

Such a move will have far-reaching consequences for corporate bonds. Long-term assets, such as investment grade bonds, will need to be re-valued. At the same time, junk bond spreads will widen under more restrictive financing conditions as real yields approach 0%. Therefore, we maintain a conservative position and our approach to the corporate bond market in an opportunistic manner. The only way to effectively navigate these markets is to precisely match corporate bonds with the shortest maturity possible and hold them until maturity to avoid capital losses. Although cash is toxic in an environment of high inflation, it is wise to stay liquid so that you can open positions whenever new opportunities arise in the future.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-300x200.jpg?v=1709556924)