Gas crisis averted. Imports and consumption are falling

The beginning of the winter season was associated with great fears about the risk of spreading the gas crisis in Europe. The high level of magazines and the mild start of winter meant that this topic was silenced in the media, and the positive development of events was one of the main driving forces behind European stock indices. We are currently approaching the moment when the level of gas injected into storage facilities will exceed its consumption, which is a good moment to look at the current market situation.

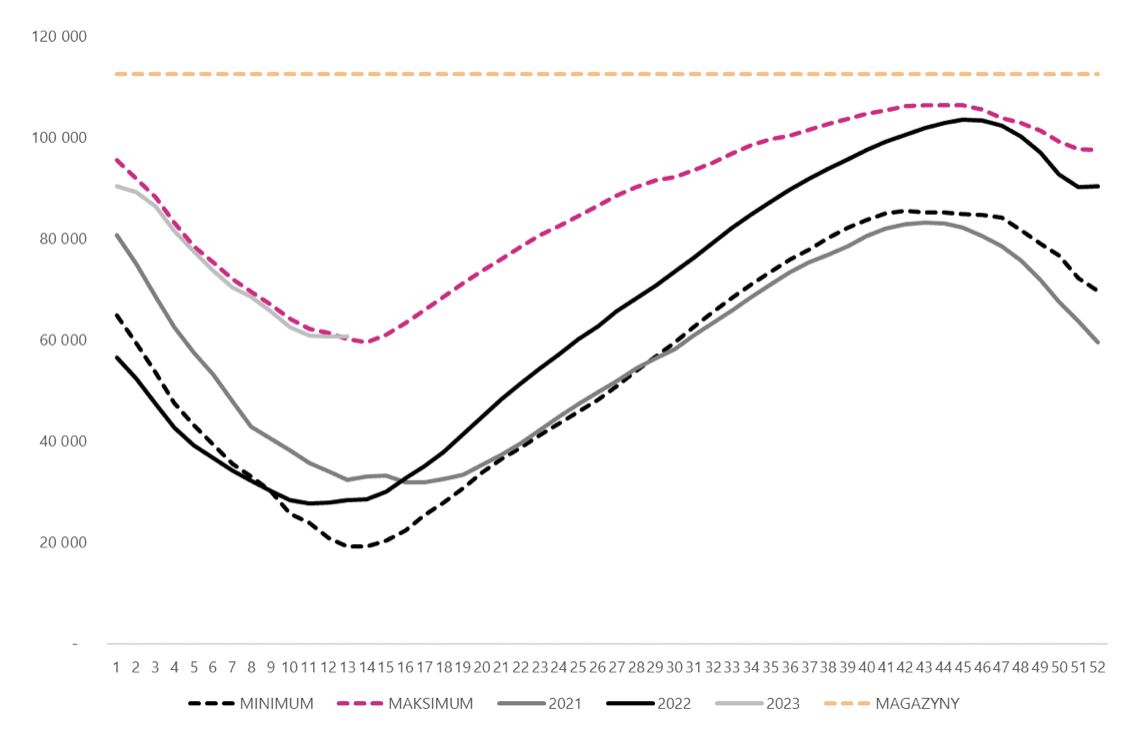

High level of warehouses

One of the main elements ensuring the safety of the system are gas storage facilities. Last year, due to unfavorable circumstances, the filling level of warehouses at the turn of the first and second quarter was below 30% of the maximum capacity. The preventive measures introduced by the European authorities as well as the development of the market situation contributed to the improvement of conditions and almost 100% filling of warehouses before the start of the winter period. This ensured a relatively comfortable situation and limited price pressure, which was visible almost throughout 2022.

The first quarter of this year was in line with market expectations, and the amount of gas stored in storage facilities oscillated constantly close to record levels. The current season of gas withdrawal from the storage facilities will be completed with a value exceeding 50% of the filling, which puts the entire system in a relatively comfortable position.

Fill level of gas storage facilities. Source: own elaboration based on Bruegel data

Taking into account the circumstances and market conditions, it is highly probable that most countries will replenish their warehouses faster than last year. It is possible that by the end of summer gas stocks in storage facilities will exceed 90%, i.e. the key, minimum level required by the European Commission.

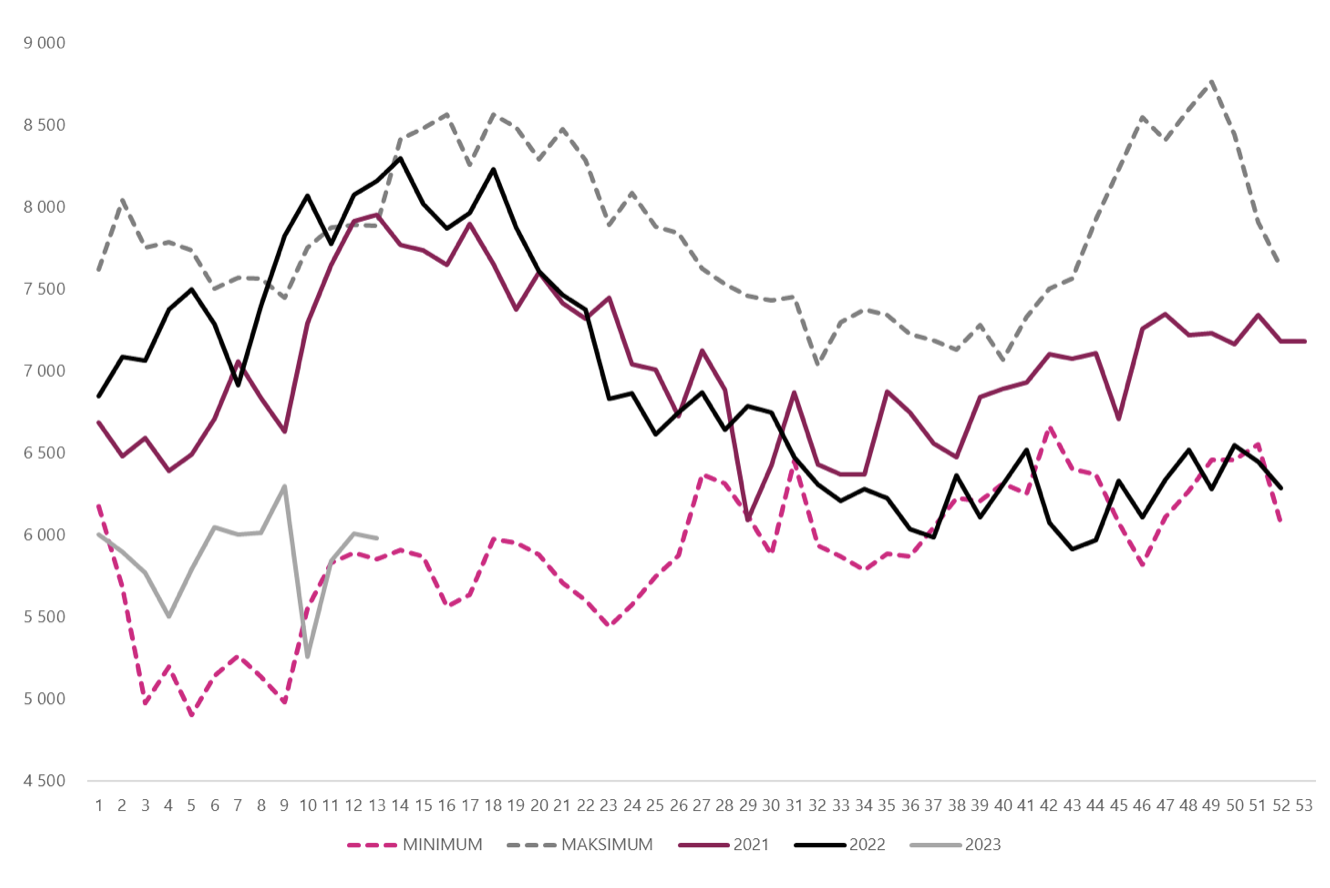

Gas imports are declining, as is gas consumption

The first weeks of 2023 confirm that the current situation is completely different from the one that prevailed in previous periods. Gas import to EU countries is at much lower levels than in 2021 and 2022. Such developments are the result of limiting supplies from Russia to a minimum. The shortages were largely compensated by LNG deliveries. However, despite this, the values from recent months indicate that the supply oscillates close to the minimum from recent years. In addition to LNG, near-record levels are being recorded for deliveries from Norway and the UK. Compared to previous years, imports from Algeria.

Gas import to Europe. Source: own elaboration based on Bruegel data

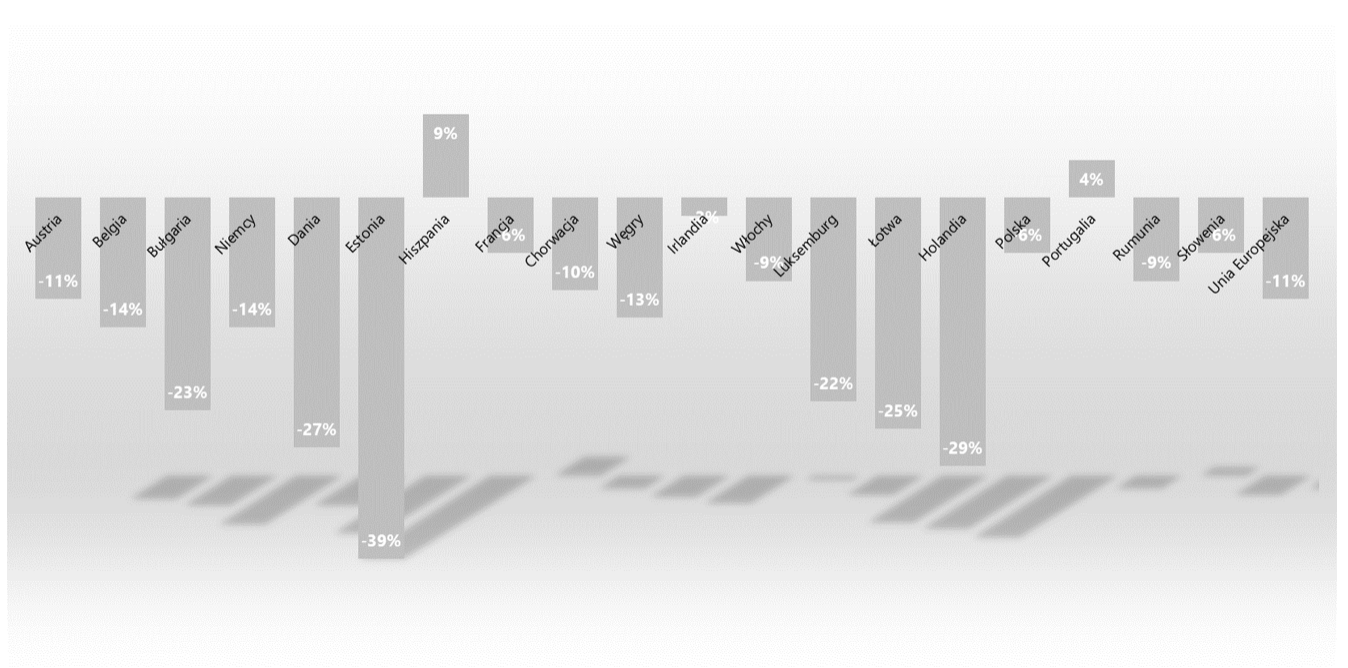

The factor that helps to stabilize supply shortages are restrictions on gas consumption in individual countries. Most countries have shown great flexibility in recent months and have adapted to prevailing market conditions. For example, in February this year, gas consumption in the EU decreased by as much as 2019% compared to the 2021-11 average.

Gas consumption in February 2023 compared to the average for 2019-2021. Source: own elaboration based on Bruegel data

Only in two countries: Spain and Portugal, the demand was higher than in the comparative period. Many countries were characterized by a significant decline in growth. The biggest drop in demand was recorded in Estonia (-39%). A significant decrease in demand also affected the Netherlands (-29%), Denmark (-27%), Latvia (-25%) and Bulgaria (-23%). Poland was among the countries with the lowest rate of gas consumption reduction (-6%).

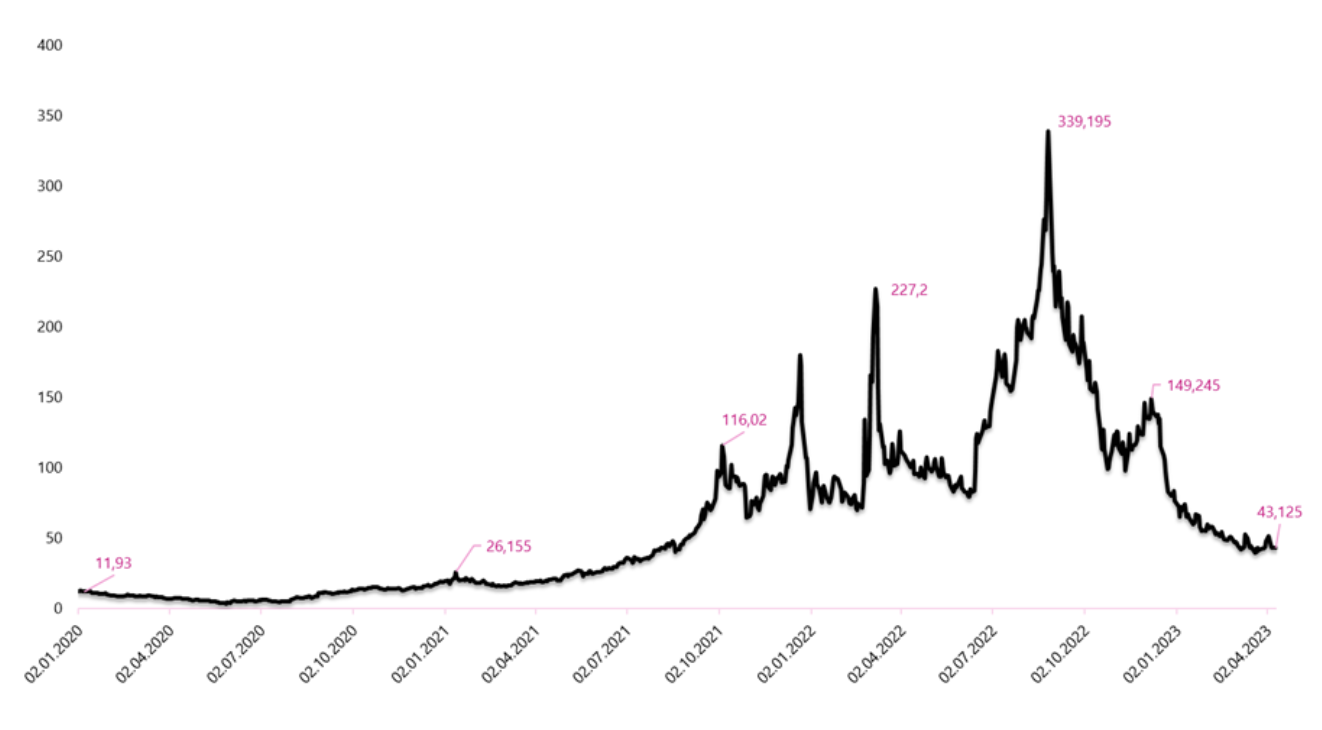

Prices definitely lower

The significant reduction in market pressures and tensions brought the gas price back towards its long-term average. Gas price from a peak of nearly EUR 350/MWh, it fell to values slightly exceeding EUR 40/MWh, which translates into over 80% traffic. Despite such a scale of decline, the raw material is still much more expensive than it was in 2011-2020. However, the current levels are acceptable for many market branches and allow normal functioning. The price shock that took place in 2021-2022 should be assessed as past, and the risk of a gas crisis has been significantly reduced and removed. In the near future, the market will try to find a new balance point, and the supply and demand side will adapt to the new environment. It is possible that the current price level of around EUR 40-50/MWh will balance both sides of the market.

Gas price on the TTF exchange (EUR/MWh). Source: own study based on Investing.com data

The stabilization of the situation on the gas market is good news for industrial companies, for which the cost of fuel purchase is an important element of the profit and loss account. Undoubtedly, the continuation of the positive trend may bring an improvement in the results of many companies, especially in the coming years, as one should be aware that many companies purchased gas in advance, which exposes them to the need to incur high costs throughout 2023.

Summation

The situation on the European gas market is slowly returning to balance. The effect of reducing market tensions and limiting the risk of a gas crisis is a gradual decrease in prices. Currently, the gas price is trying to stabilize at EUR 40-50/MWh, which is significantly lower than the rates recorded in the second half of 2021 and 2022. The favorable development of events is good news for companies for which the purchase gas is a significant cost element of the company's operations. In the coming quarters, companies that skilfully adapted to the new market conditions may be the beneficiaries of the situation and boast of results exceeding analysts' expectations. It is worth watching the reports of European companies from the industrial metals industry or companies from the chemical sector.

Source: Piotr Langner, WealthSeed Investment Advisor

Disclaimer

This document is only informative material for use by the recipient. It should not be understood as an advisory material or as a basis for making investment decisions. Nor should it be understood as an investment recommendation. All opinions and forecasts presented in this study are only the expression of the author's opinion on the date of publication and are subject to change without notice. The author is not responsible for any investment decisions made on the basis of this study. Historical investment results do not guarantee that similar results will be achieved in the future.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Will global warming help wheat? [Webinar] wheat raw materials webinar](https://forexclub.pl/wp-content/uploads/2024/03/pszenica-surowce-webinar-300x200.jpg?v=1711099347)