The euro exchange rate at the beginning of June and the latest information from the euro zone

today European Central Bank celebrates its 25th birthday. On 1 June 1998, the ECB was established to introduce the euro and protect its value. Today, more than 346 million Europeans in 20 countries use the euro every day. On this day, we are looking at the latest statements of people who are currently responsible for monetary policy in the euro zone, to which the euro exchange rate may also react.

Euro exchange rate and central bankers' comments

Let's start with the transcript of the talks from the last meeting of the European Central Bank. According to them, some members of the Governing Council of the European Central Bank (ECB) were in favor of raising interest rates by 50 basis points at the last monetary policy meeting in May. They argued that "constant inflation surprises" created an upside risk and that inflation was "projected to be above target for at least four years". As evidence that inflation is unlikely to fall fast enough, they cited diminishing risks of recession and rising price and wage pressures.

However, most of these members also signaled that they would accept a smaller interest rate hike, according to the minutes of the meeting. Ultimately, the rate hike by 25 basis points was accompanied by a message that further interest rate hikes would be justified.

“This decision was seen as striking the right balance between addressing the need for further rate hikes and taking into account heightened uncertainty about the speed and strength of monetary policy transmission.” the ECB said.

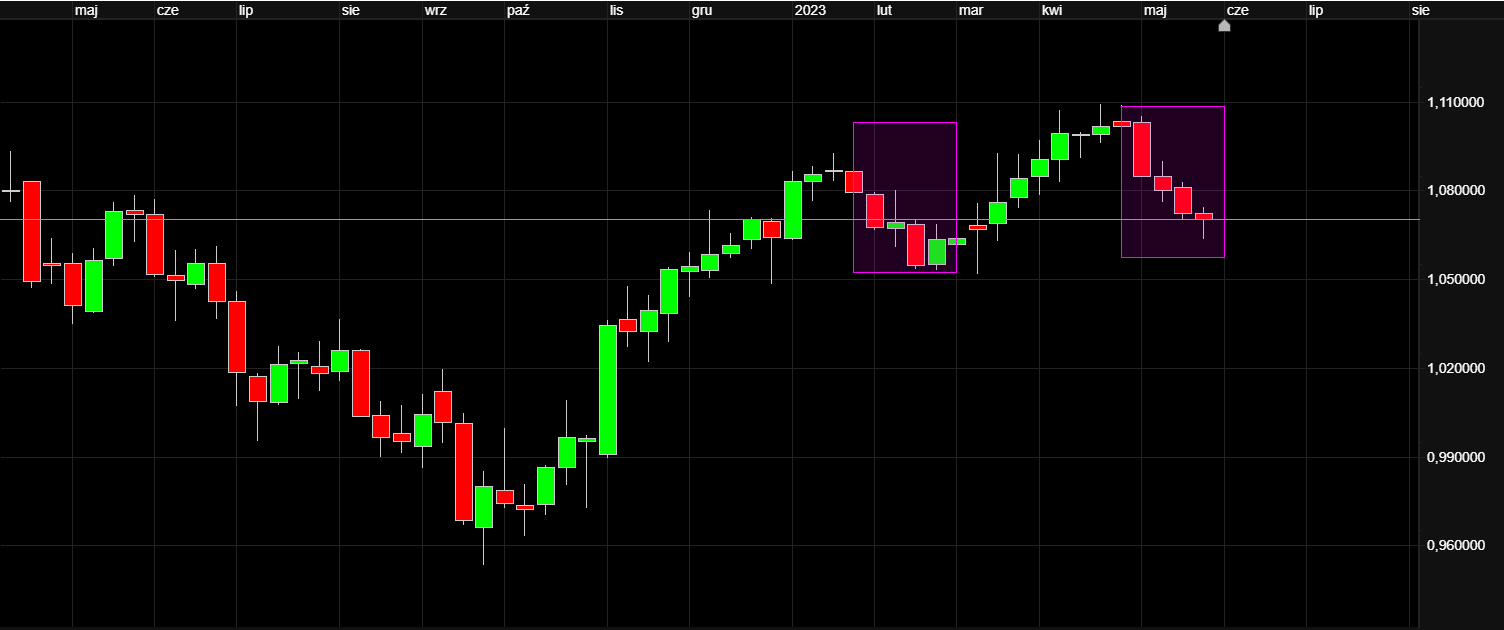

In May, the euro exchange rate fell the most against the dollar since April 2022. The single currency fell by almost 3% from the peak of 1,1100 to levels below 1,0700. This was facilitated by the increase in the strength of the US dollar. It seems that the dollar exchange rate rose due to expectations for a June interest rate hike in the US, which was not taken into account by investors a month ago.

Rate hikes in the euro zone by 25 points each

European Central Bank (ECB) Vice-President Luis de Guindos said on Thursday that interest rate hikes of 25 basis points (bps) were "the new norm" after the ECB moved from 50 bps to 25 bps in May. He said a "large part" of the ECB's rate hikes had been completed but “there is still some work to be done”.

De Guindos said recent eurozone inflation figures were "positive" but still far from the sustainable 2% target.

Christine Lagarde warns against high inflation for a long time

President of the European Central Bank (ECB) Christine Lagarde noted on Thursday that inflation in the euro area is too high and will remain for a long time.

In her speech at the meeting of the German bank in Hannover, Lagarde noted that "inflation is too high and will stay that way for too long"but promised that the ECB is "determined"to reach the target level of 2% "at the appropriate time". However, she clarified that uncertainty persists about the effectiveness or impact of policy measures, underlining "the need to continue our cycle of increases".

Lagarde specified that a new set of projections will be available at the June 15 meeting, which will help policy makers assess the next steps as they cannot confirm their satisfaction with the inflation outlook at the moment.

Inflation in the euro zone has fallen, the euro exchange rate is stable

Eurozone annual inflation fell to 6,1% in May from 7% in April, Eurostat said in a preliminary report on Thursday. The monthly consumer price index (CPI) was unchanged from April. The CPI excluding energy increased by 7% yoy and 0,3% month-on-month, while the core CPI excluding energy, food, alcohol and tobacco increased by 5,3% from May 2022 and 0,2 % from April.

The euro exchange rate remained stable. Couple EUR / USD starts June with an attempt to return above the 1,0700 level.

EUR/USD CFDs. CMC Markets platform Next Generation.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)