Lagarde has met market expectations

European Central Bank (ECB), like the day before the US Federal Reserve, did not change interest rates at its last meeting this year, leaving the deposit rate at -0,50 percent and the reference rate at 0,0. He further declares that interest rates will remain at current or lower levels until inflation outlook convincingly returns to levels close to 2 percent. in the projection horizon.

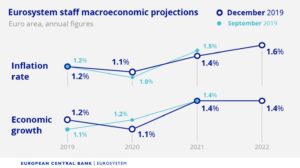

The bank slightly revised its inflation and economic growth forecasts for the euro area for the years 2019-2022, but still expecting a slight acceleration in the projection horizon of both variables, which was within the range of market expectations.

The new head of the ECB did not bring much new Christine Lagardewho, colloquially speaking, got into Draghi's shoes. Who was expecting some surprises and a turn in the ECB policy under a new leadership, he was severely disappointed. However, one could easily feel that Lagarde was saying a little what the markets wanted to hear. Namely, she pointed out that next year the eurozone will face a slow but systematic economic rebound. She said that although there is a risk of weaker data due to geopolitics, trade wars and emerging market weakness, the risk is lower than before.

The first reaction of the euro to the words of the new head of the ECB was positive. The single currency strengthened slightly. However, you have to be aware that Lagarde didn't really say anything new, hence the market reaction was a bit exaggerated. Just like the day before, the forex market's response to Powell's words. If all this compares with the situation on the EUR / USD daily chart, it can be concluded that the potential for further increases is limited and the 14 monthly downward trend line (currently 1,1160) remains unchanged. This leads to a different conclusion. Namely, that in such a system, the second half of December will bring back EUR / USD quotations. The first target is around 1,1050.

EUR / USD

Diagram EUR / USD, D1 interval. Source: MT4 Tickmill.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-300x200.jpg?v=1711601376)