Small holidays on the stock exchanges. Where are the further increases?

The bull market slowed down. Recent weeks have accustomed us to spectacular and extremely enthusiastic growths. The current few sessions can also be counted as positive without any doubt, but with visible inhibition. On one hand, one would like to quote a classic that sounds "nothing lasts forever", on the other hand, ask where the demand energy has gone. In fact, especially in the last dozen or so days, global markets have not been bothered by anything. Good mood could not be spoiled by the escalation of the conflict between the US and China, or by the specter of a recurring epidemic. Therefore, will the next sessions be a bucket of cold water poured on the stock exchanges? Will we keep the current enthusiasm, only falling into a small correction?

A small withdrawal gives you the opportunity to shop

If we have been following the markets closely in recent sessions, it was not difficult to see a few hesitations. One could get the impression that we are just witnessing a change in the trend, which is almost idyllic since the first loosening restrictions in global economies. Therefore, the last supply impulses could have been treated rather as the realization of current profits and a place where subsequent investors join the ongoing sentiment. On the other hand, we can treat it as a warning saying that there are still bears on the market, and the longer the impulsive euphoria lasts, the de facto the chance for a solid correction increases.

Positively on the stock exchanges, but only for a moment?

One can not ignore such important issues (in the context of good moods of investors) of new announcements regarding assistance programs for economies. Voices come from virtually every market, and promises last month had no bottom. Whether they can actually be made translate 100% into nominal support, it will turn out in the near future. The list of positives also includes reports of cooperation between the United States and Huawei, which until now had some restrictions on the use of American technology. In fact, all news about cooperation is received positively by the markets. From this perspective, we should expect to "sustain" enthusiastic moods.

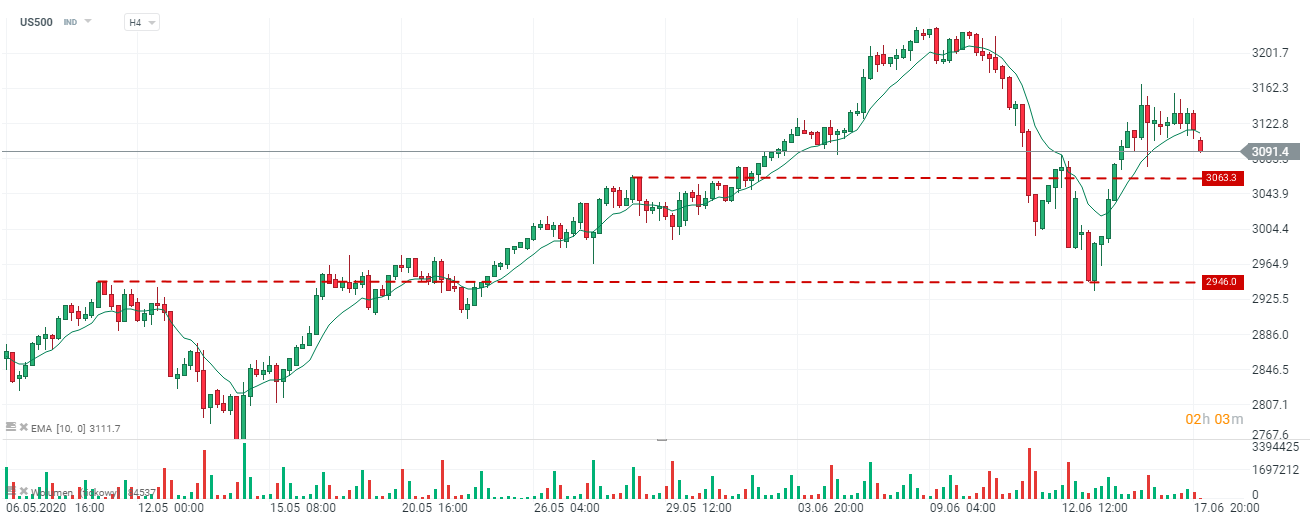

Chart US500 (CFD on S & P 500), interval H4. Source: xNUMX XTB xStation

It is well reflected in the American index of 500 best companies. As you can see the discount from recent days has been "pulled" from the market by another wave of buyers. Sentiment certainly favors bulls.

Texas break an idyll?

All good things end sooner or later. Above the bullish sentiment some black clouds are gathering, which are now accumulating particularly heavily over Texas. The industrial basin of the United States has a high daily increase in coronavirus incidence. In this region, 10% of new cases of infection increase overnight. Is this a reason to worry? For now, we can say no. This is a single "small wave" of incidence and we should not be further agonizing. On the other hand, knowing and remembering the course of the most intense stages of the disease in many countries is not difficult to fear. A strong increase in new coronavirus cases in this region (even strategic on US industry) would be associated with a return to old restrictions. Will this episode be a bit confusing in current trends? I think so. It is enough to remember the sell-off, which followed impulsively after wider discussions about relapse. If the situation in the US actually changes (to the detriment) we can deal with a solid correction and reversal of current trends.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)