The shock of the markets after Mario Draghi's speech

The President of the European Central Bank unexpectedly changed the rhetoric and did not rule out, or even suggested, easing the monetary policy and lowering interest rates. The eurodollar rate dropped immediately, and the German DAX index chart fired in search of new peaks.

During the Tuesday conference in Portugal, the President of the European Central Bank Mario Draghi surprised everyone. Known for his restraint, weighing words and messages about the not too strict message of the president, this time he explicitly admitted that the inflation target is at risk, so preemptive actions are possible.

Inflation in the euro area is low, not everyone happy

The increase in prices of consumer goods and services in the euro area is currently 1,2 percent. and it is worth emphasizing that this is the lowest result for over a year. What can be satisfactory for the average consumer, for whom a slow increase in prices means more shopping opportunities, is not at all pleased by the head of the most important bank in Europe.

"Our target is symmetrical, which means that if we are to" deliver "our inflation target in the medium term, inflation must be above this level in the future." - emphasizes Mario Draghi.

However, this was not what surprised investors the most, but the rest of his statement, which directly reveals how it will happen. From the president's speech there is a clear message that the ECB will change its policy - provided, of course, that inflation is still far from the target.

"In the event of no improvement, which will threaten the return of inflation to our target, additional monetary stimulation will be needed" - admitted Mario Draghi, who is leaving the ECB in October.

He also does not conceal that it is getting closer to the next cut in interest rates.

“Further interest rate cuts are still part of our instrumentation. There is also still room for an asset purchase program and the ECB will use all available means to implement price stability " Draghi added.

ECB's rhetoric is changing

The tone of the conference surprised investors. During the previous speech, Mario Draghi moved the date of changing interest rates to half of the year 2020 or later. Now he suggested that this could happen much earlier. At the same time it is worth noting that so far not only the date, but also the direction of interest rate change was uncertain, because their rate was also considered. Today the direction has changed by 180 degrees.

Nervously on the currency market

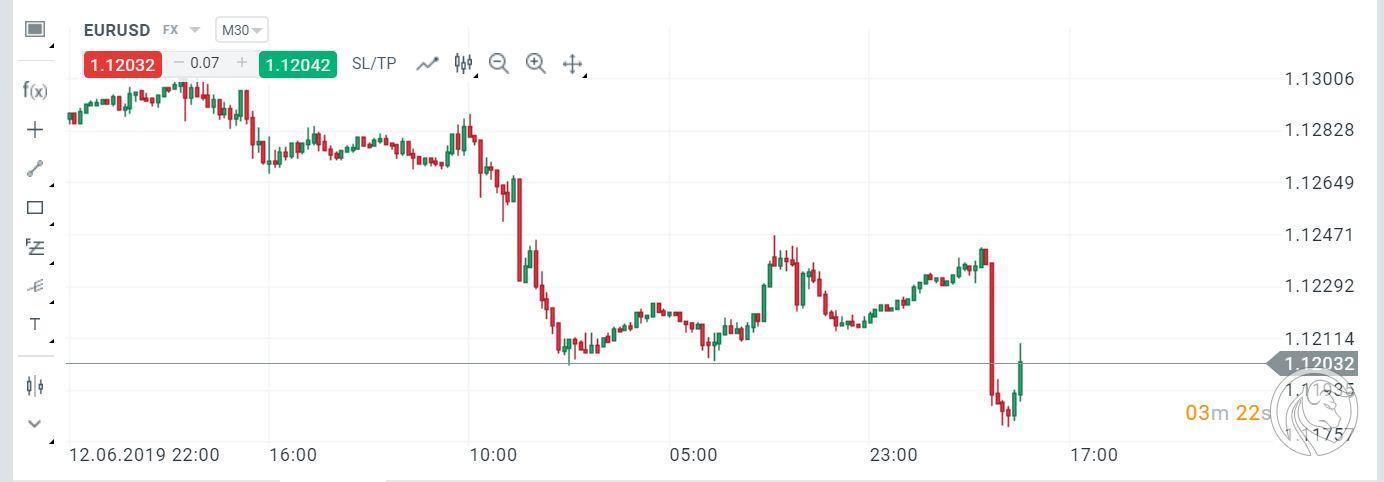

Already during the speech of the Italian President, we could observe the dynamic reaction of the market to his words. Course EURUSD virtually immediately fell and continued to move, during 30 minutes sliding down below 1,12 and setting a new minimum June. Of course, other euro pairs also fell.

Chart EUR / USD, M30 interval. Source: XTB xStation

Stock market indices that shot up were quite different. The most definitely German DAX, which before hours. 14 on Tuesday has already reached the ceiling of 12261 points, after an increase of 1,5 percent. At the same time, many investors could have been absorbed by the declines expected by the market, because the course dived almost by 100 points, and then definitely turn back. Indexes in the United Kingdom and the US also increased, although they did not respond so enthusiastically.

DAX 30 chart, M30 interval. Source: XTB xStation

This is not the end of market turmoil

This is just the beginning of the three-day ECB conference in Portugal. However, the market may overcome next information from other sources in the coming days. On Wednesday at 20 will learn about the Federal Reserve, and the head of the American Central Bank, Jerome Powell, will speak right after it. This is always news awaited by investors, so the volatility on currency pairs is guaranteed.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-300x200.jpg?v=1710999249)