Industrial metals: analysis of the silver and copper market situation

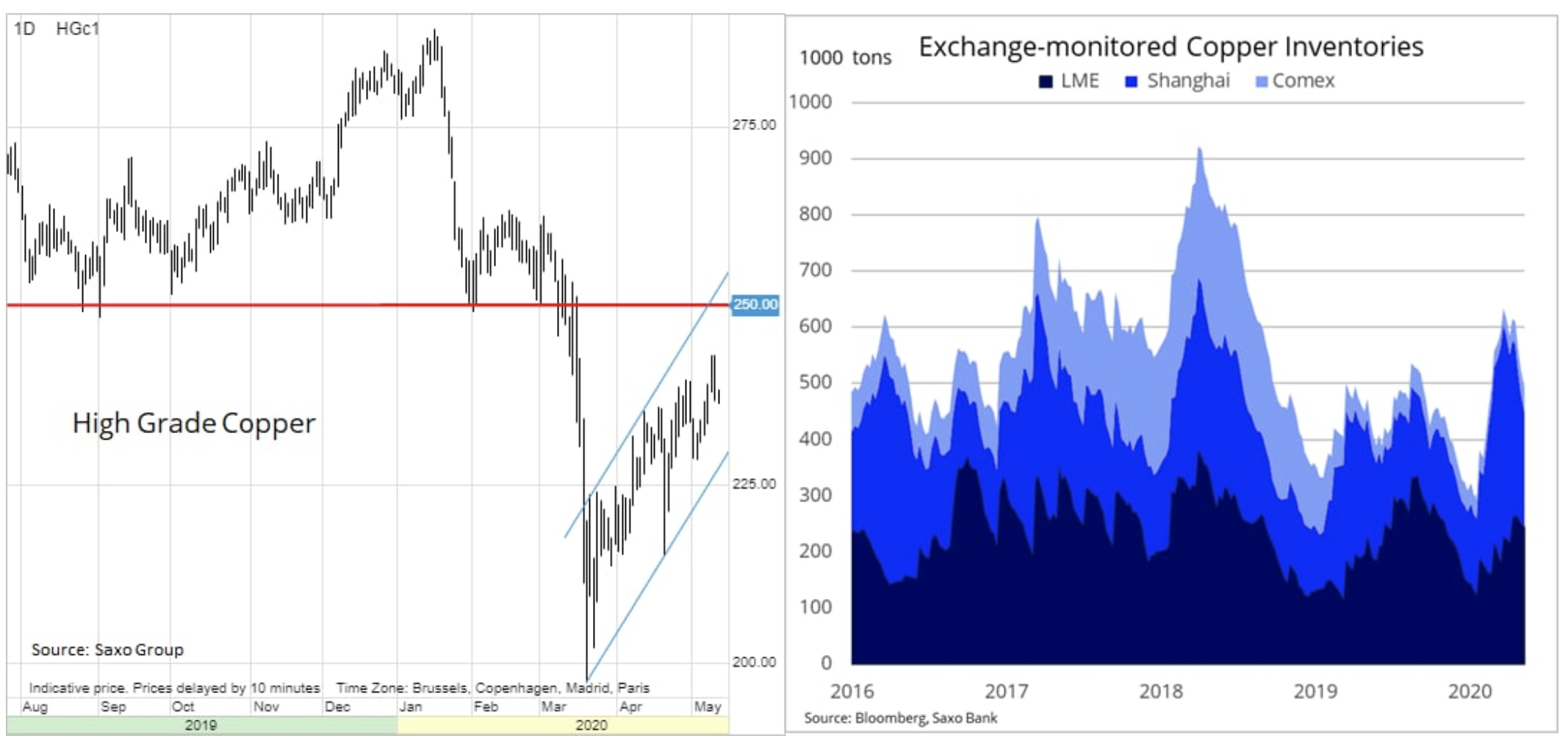

Industrial metals, such as copper, started the week solidly, reaching a seven-week maximum, and then returning down. Same as Petroleum and raw materials dependent on growth, copper has now followed an upward trend, and its prices are rising due to the fact that softening isolation leads to a revival of demand. Numerous initiatives of central governments and central banks have also contributed to improving sentiment in growth-dependent commodity markets. Improvement has occurred even despite the largest decline in global growth and rising unemployment since the Great Depression.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Industrial metals and perspectives

It is also beneficial to know from China that commodity traders massively accumulate fixed assets such as metals. Metal production companies have received cheap COVID-19 loans from banks and appear to have accumulated that money in goods, focusing on recovering prices, which is more profitable than their production activities.

Last week, a war of words or a blame game for COVID-16 between the United States and China caused the Chinese renminbi offshore (yuan) to strengthen rapidly to 7,15 before dropping to its current level of 7,10. It is unclear whether the accumulation of metals is the result of speculation related to a weaker currency or other economic phenomena. This behavior was to some extent supported by the recent price action, as a result of which the demand for some industrial metals was higher during trading hours on Asian exchanges.

On Monday, HG copper reached an eight-week high of 2,43 USD / lb, after which it lost momentum. Information from China is still encouraging: The People's Bank of China announced further actions to support the economy while decreasing the level of stocks monitored by the Shanghai futures exchange. In our view, however, be careful. The increase in supply after the resumption of production, which was affected by the virus, forces us to ask ourselves whether the increase in demand, in particular from Chinese producers, is enough to generate a surplus of stocks this year.

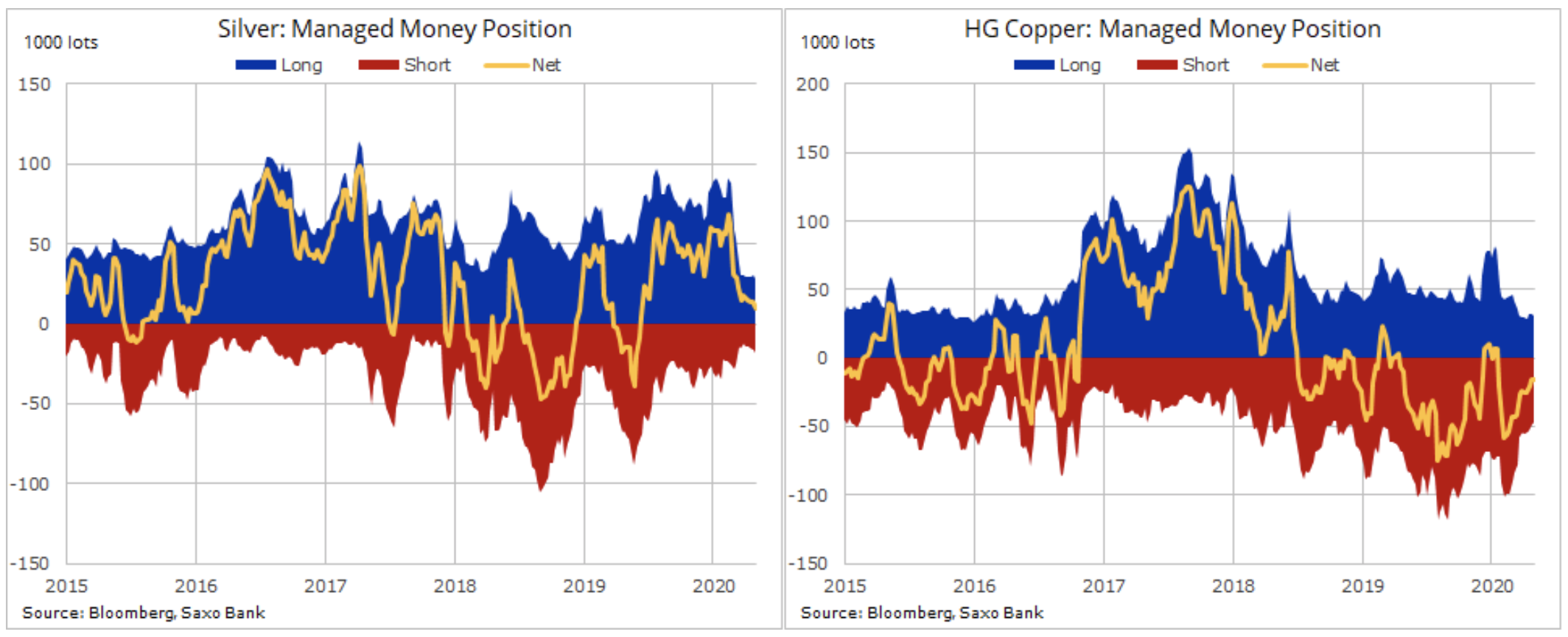

Therefore, we remain skeptical about the ability of HG copper to permanently strengthen above the key resistance at 2,50 USD / lb, an area that has been providing support for three years until the March breakup and a decline to 2 USD / lb. Hedge funds have maintained a short net position since January, when COVID-19 spread outside China. Further strengthening will additionally cover short positions, however, with such unfavorable economic forecasts, a long-lasting technical breakthrough is necessary for a long position to appear.

Silver with good sentiment

Meanwhile silver gained wind in the sails as a result of the bull market in industrial metal markets. After recording a historic discount against gold on March 18, 127 ounces silver per ounce of gold, the semi-precious metal returned to level 110, which is the lower limit of the range. The technical formation after the price action from recent weeks looks promising: the ratio of gold to silver goes down, while silver has attempted to break the latest downward trend.

In the context of investment flow, there is a significant discrepancy between tactical trading companies, such as most hedge funds, and long-term investors, both retail and institutional, using silver-based listed funds. The Commitments of Traders report for the week ending May 5 showed that hedge funds, concerned about a decline of almost 40% in the period from February to mid-March, reduced their upward positions in silver by 85% compared to February, reaching an eleven-month minimum. In addition to a slight decline in March, investing in ETF since January, they have been consistently buying silver-based funds. The current overall volume owned by investors has reached a record level of 21 tonnes.

At this stage, it is too early to assume that silver has gained enough impetus to recover some of the losses against both the dollar and gold. For this to happen, this metal must first fall below 109 in the XAU / XAG relation and / or above USD 16,15 / oz in the case of SILVERJUL20 - April maximum and abolition by 61,8% from the discount from February to March.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response