Industrial metals and oil expect a strong recovery in 2021.

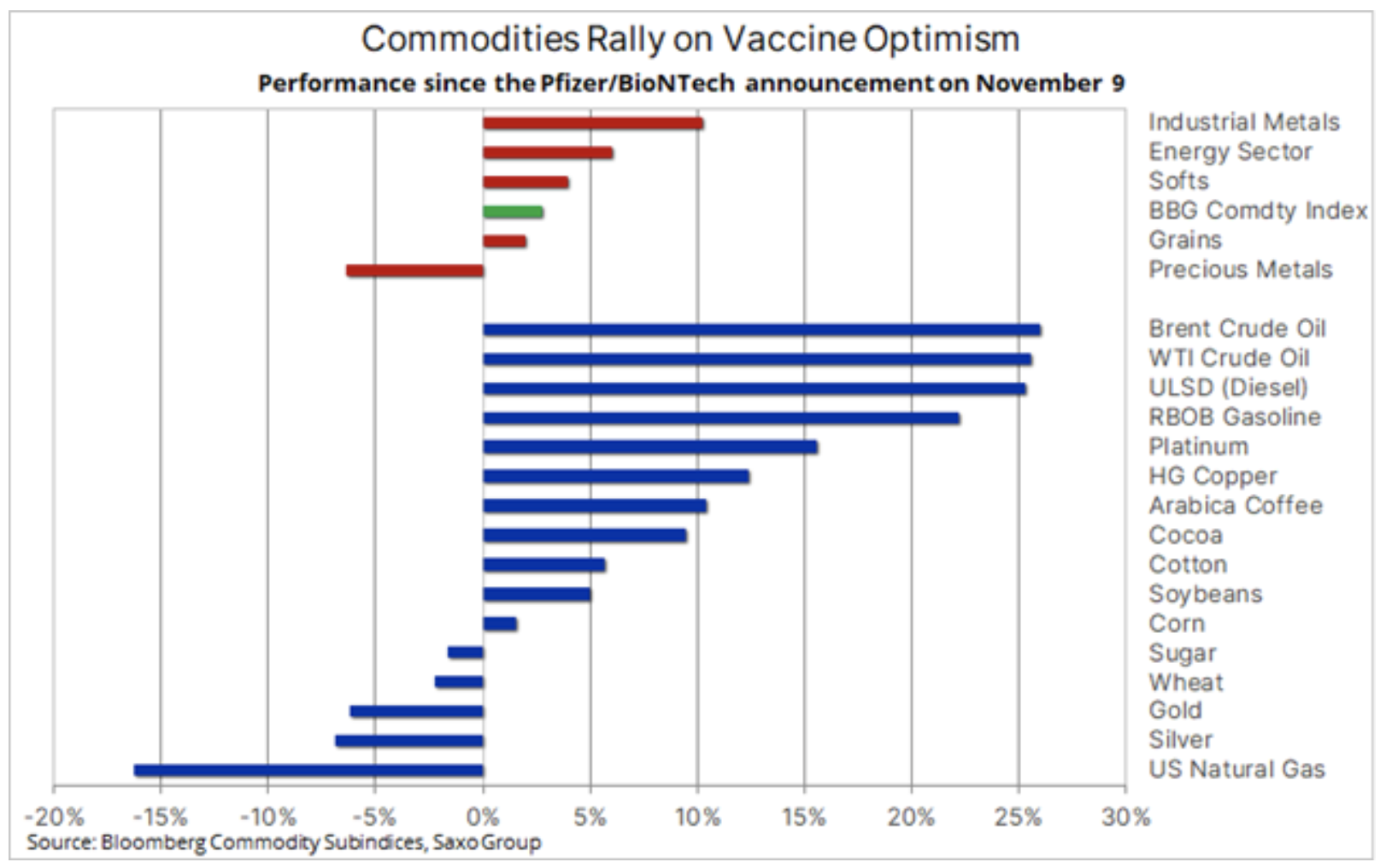

Optimism over the vaccine and incentives continues to drive up stock markets and drive up commodity prices while pushing the dollar down. Since the first in a series of vaccine announcements - in this case Pfizer / BioNTech - On November 9, many markets, in particular stocks related to the tech industry and one automotive concern, are acting like steroids. As a result, market conditions resemble those prior to the bursting of the tech bubble twenty years ago. With this in mind, we see an increased risk of ending the "party" and eventually returning to reality.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Raw materials, primarily industrial metals, crude oil and fuel products, have reacted strongly to the possibility that an already strong demand from Asia, in particular China, will increase even more after the specter of Covid-19 circulating over Europe and the United States finally will dissipate. As a result, some markets, in particular the energy sector, have managed to shake off another slowdown in fuel demand due to the increase in the number of cases and deaths from Covid-19.

Precious metals

Gold is still consolidating, and the current lack of momentum in a low-liquidity period increases the risk of volatility increases, particularly considering that it took just under a day for this metal to return to a relatively safe level above $ 1 / oz. Meanwhile silver It also fell after a rejection of $ 24,80 / oz. As we mentioned, this is the time of the year when profits are defended and a lack of momentum can lead to a significant price swing. The precious metals markets, and more recently the platinum market in particular, are currently complaining of a lack of momentum, while copper has yet to break through levels that may cause nervousness among speculative investors holding significant long positions.

Industrial metals

Industrial metals appreciated last week; Key commodity prices, ranging from copper to iron ore, have hit seven-year highs as a result of Asian traders. Iron ore surged more than 40% and hit $ 160 / t in Singapore Friday pending profit taking. This was the result of lower supply forecasts for Vale, the largest producer in the world after November shipments from Brazil fell to their lowest level in six months, as well as strong demand from China due to infrastructure stimulus causing inventory decline and enormous increased interest among speculative investors.

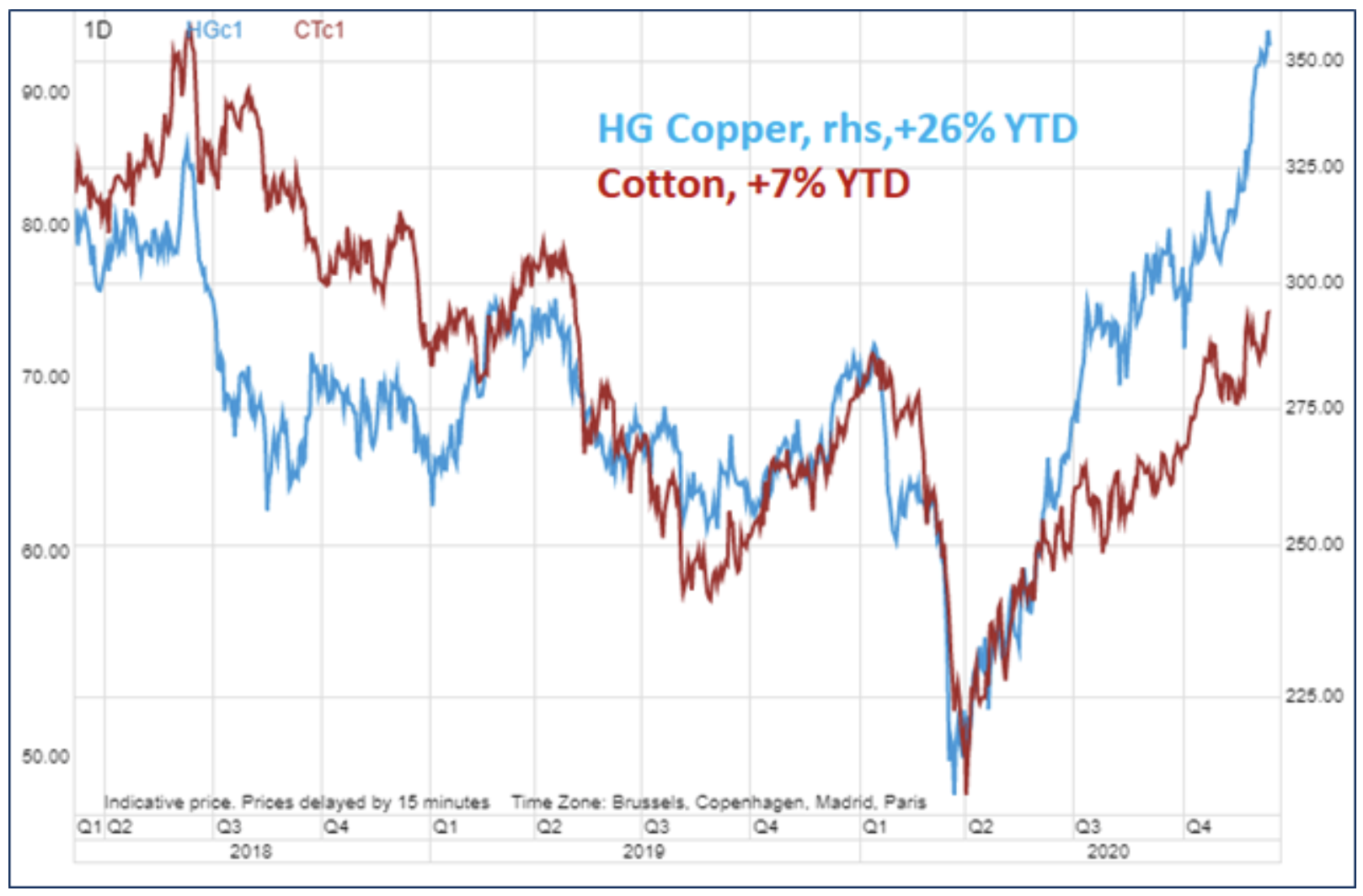

Simultaneously copper HG hit nearly $ 8 / t on the London Metal Exchange (LME) before taking profits. At the same time, and in a completely unrelated fashion, the price of cotton peaked in 000 months after the US Department of Agriculture sharply cut its global inventory forecast as production contracted 19-2020 to its lowest level in four years against the backdrop of falling production in India, Pakistan and, above all, in the United States.

If Dr. Miedź has a degree in economics, taking into account the usefulness of this metal in determining the state of the world, and in particular the Chinese economy, we can similarly say that Dr. Cotton has a doctorate in consumer behavior due to the use of this raw material in the estimation of the production of textile products. However, jokes aside - both of these phenomena emphasize the risk of a marked increase in outlays in 2021.

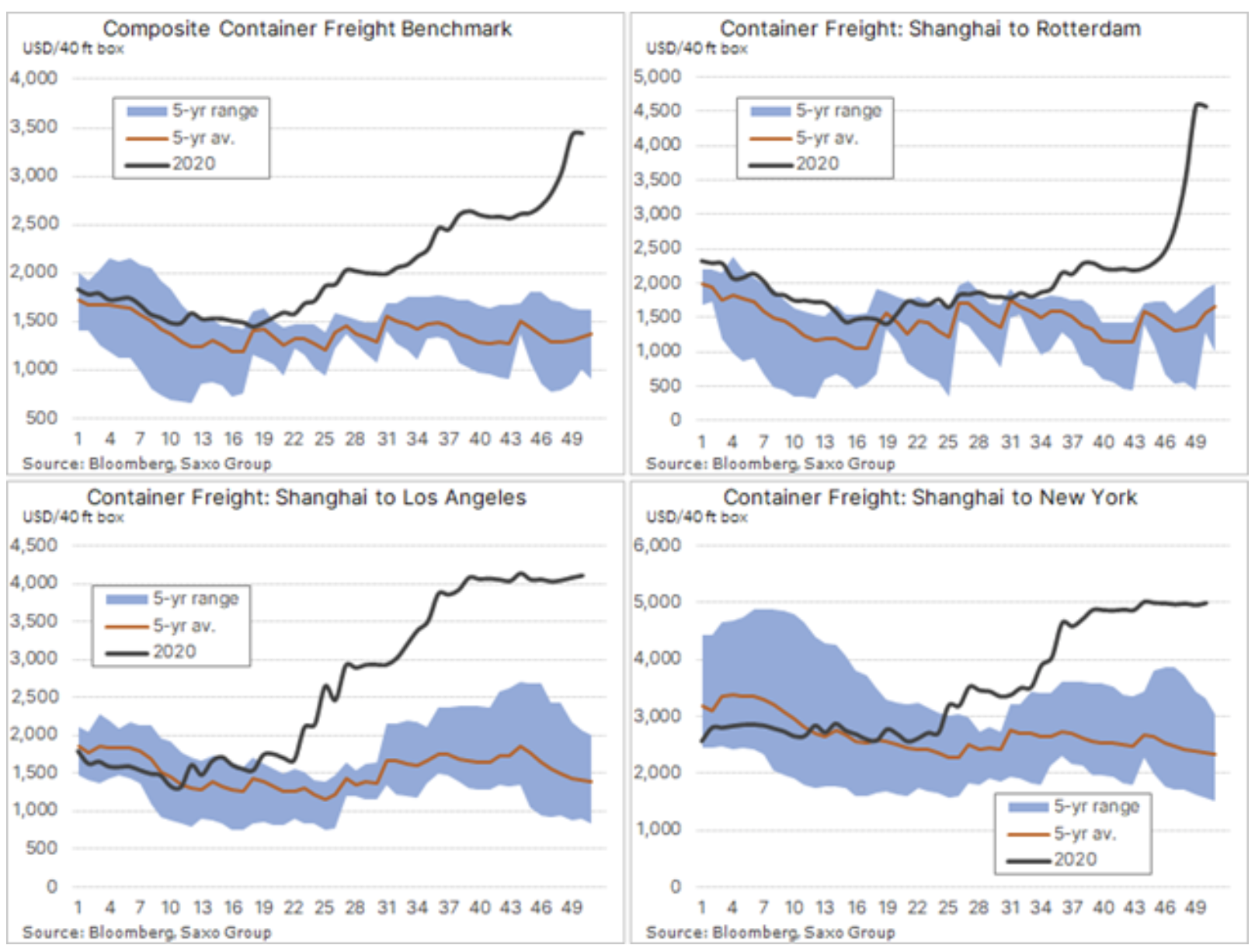

Let's stay on the topic: in recent months we have seen a dramatic increase in the cost of shipping containers from China to other countries. Incentives and public support implemented in Europe and the United States in the first stage of the pandemic contributed to a significant increase in consumer spending. Much of these incentives went to China in exchange for consumer goods, while Chinese demand in these markets was relatively weak. This has led to a disturbance in the market, and ports around the world have filled up with empty containers that should be returned to the Middle Kingdom. As a result, the cost of renting a 4-meter container from Shanghai to Los Angeles exceeded $ 000, and to Rotterdam - $ 4, with the five-year average in both cases being around $ 500.

Petroleum

Clothing continues to grow; last month both WTI and Brent crude oil, the world's two benchmarks, gained almost a quarter. Last week, Brent oil returned to $ 50 / b for the first time since Saudi Arabia's unfortunate declaration of the price war in early March. This was in the week of US oil inventories spike, while fuel demand continued to slow in an unchecked pandemic, underlining the market's readiness to take the broader outlook beyond weak short-term fundamentals and expectations of a rapid recovery from the vaccine. mainly in the second half of 2021

Considering the behavior Brent oil since June and oscillating around the key technical Fibonacci levels marked on the chart, the assumption that the market may try to consolidate around the current levels is justified. While energy stocks are likely to rise on the expected future recovery in oil prices and earnings, the physical oil market needs a daily rebalancing to avoid the negative effects of an increase in inventories. In the context of the current problems with the introduction of lockdowns around the world, the price of oil may currently exceed the levels justified by the current fundamentals.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![CRB index – one of the popular commodity market benchmarks [Guide] crb index](https://forexclub.pl/wp-content/uploads/2024/05/indeks-crb-184x120.jpg?v=1715055656)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)