Industrial metals kick off the year with a strong hit thanks to signals from China

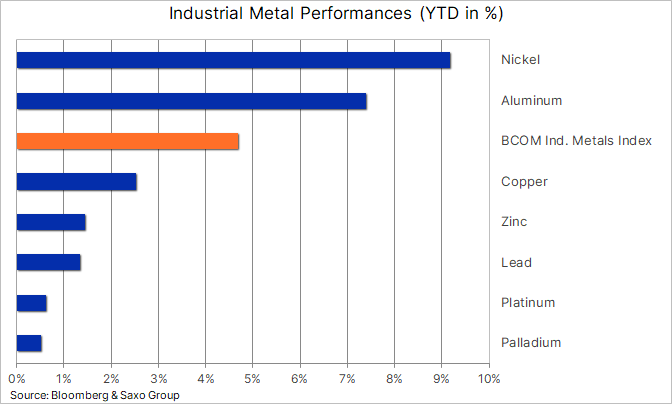

The industrial metals sector, like crude oil, started 2022 with strong growth, primarily with regard to nickel and aluminum, and copper is also showing signs of a rebound after months of sideline. The prospects of rising demand for electric vehicles, limited supplies and signs that China is stepping up its policy in response to the slowing economy have contributed to mitigating some of the macroeconomic risks that have negatively impacted the market in recent months, in particular related to the problems of the Chinese real estate sector.

In my December 1 article, I discussed the reasons why we predict further increases in copper and other industrial metals prices in 2022, not least because of the prospect of inelastic supply struggling to meet the demand for a green transition to electrification. In another article - published on November 19 - Peter Garnry, our director of equity markets strategy, also emphasized that copper is a key metal in driving a green transformation based on electric cars and modernizing the electricity grid infrastructure.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

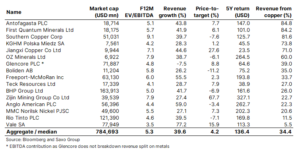

Moreover, the progressing global urbanization causes an increase in activity in the construction industry, which is one of the main factors in the demand for copper. In addition to describing how to get exposure to copper through futures, CFD and stock exchange funds, Garnry also unveiled its mining stock list, headed by the six companies with the highest exposure to copper.

What does China say?

While the global shift away from coal remains a key long-term driver of industrial metals demand and hence the risk of even higher prices, in the short term, the market is focused on China, where decades of high growth have stalled and some economists predict that in 2022, economic growth in this country will fall below 5%. It is widely believed that the Chinese authorities have set themselves a target of at least five percent growth this year, and the political response to do so has already been triggered. You should, inter alia, take into account the importance of economic and social stability for the Communist Party in the run-up to the 20th National Party Congress in 2022, a key party summit held every five years in the second half of the year.

The Chinese government has already signaled its desire to accelerate the pace of implementation of 102 major projects included in the development plan for 2021-2025. Many of these areas will require industrial metals to some extent as they relate to energy security, affordable housing, infrastructure development and logistics.

All of this could cause market conditions across the sector to be increasingly constrained, notably for nickel, which has hit its highest price in ten years, as demand among battery manufacturers, due to strong electric vehicle trends, has highlighted the problem. insufficient future supply. Despite months of concerns about the Chinese real estate market, copper inventories have remained low and, as a result, are exposed to the effects of rising demand.

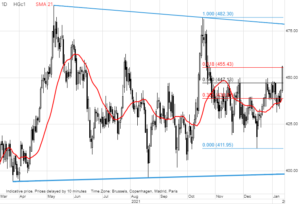

Copper rate

Copper high-grade broke out of its current range, and the upward move may now pull back on the momentum of cash managers who, after many months of sideline, have reduced their long HG copper position to 26 lots, well below the 000 high of 2020 91 flights and the record high of 600 of 2017. If a breakthrough above $ 125 per pound can be defended, only $ 000, a 4,47% retracement from the October-December markdown line that is already being tested, stands in the way of a further strengthening, originally towards the October high of 4,56 USD / lb.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)