Precious metals break records [gold, silver]

Gold continues the impressive bull market; on Tuesday it again broke above USD 1 / oz to the highest level at the closing since 600. This last move was particularly admirable due to the fact that it occurred at a time when the dollar strengthened against many key currencies. The appreciation of the dollar was particularly noticeable in relation to the euro, which fell to almost the lowest level in three years, while gold valued in euro recorded a new record, ie EUR 2013 / oz.

Moreover, the boom took place despite declining concerns over the coronavirus (COVID19); the market - rightly or wrongly - is increasingly inclining to the opinion that this will be an event relating essentially to the first quarter. This is based on the assumption that central banks and governments will take all necessary steps to support a return to the uptrend for the remainder of this year.

Precious metals on top

Why, then, is the demand for gold so high while the situation in other markets is getting better and the dollar is getting stronger? In our view, the combined impact of additional interest rate cuts, more fiscal stimulus, negative real US bond yields and return of US shares to record levels will continue to contribute to strategic diversification and the demand for secure investment. In addition, there is an additional risk that the virus outbreak may take longer than anticipated.

January was a particularly worrying month for markets due to tensions between the United States and Iran and the coronavirus outbreak. In January, the volume of gold-backed equity funds held by investors rose by an average of 1,3 tonnes per day. In February, this volume, despite the aforementioned dollar appreciation and the recovery in the markets, has so far increased by 1,9 tons per day.

Gold extended the bull market on Wednesday, reaching its January high of USD 1 / oz. Considering the strengthening of this metal despite the aforementioned difficulties related to other markets, it is difficult to estimate what could stop or halt this boom at this stage. Silver, which saw a much deeper correction than gold last year, benefited investors' interest in precious metals. Almost half of the demand for silver comes from its industrial use; is the main reason for the fluctuations in the price of this metal amid concerns about the impact of the coronavirus on global economic growth.

Silver in the shade of gold

However, thanks to the weaker position of silver, the further boom has attracted traders looking for relative value. After getting support at $ 17,50 / oz, in the past few days silver had better results than gold; the price ratio of gold to silver fell again to 87 (ounces of silver against one ounce of gold).

Silver may face some resistance below $ 18,60 / oz (dashed line), while gold, in the absence of clear technical levels, may be moving towards the next round value of $ 1 / oz. After hitting the resistance at $ 650 / oz, however, it may stop first to estimate the support level in the higher ranks of value. As a result of a slight correction, the last high of 1 USD / oz may be tested.

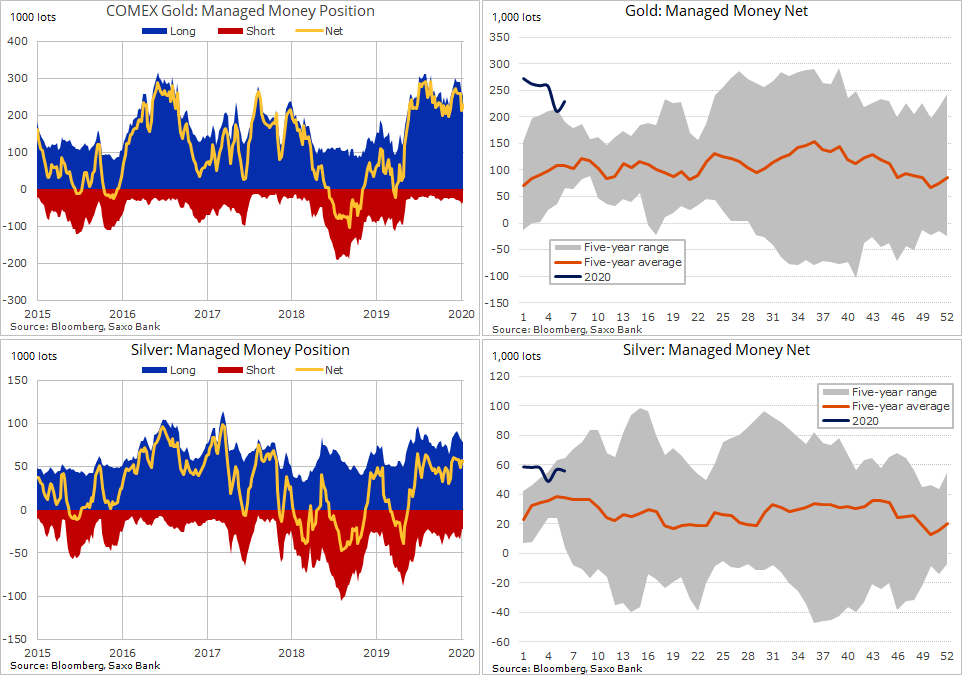

While the overall volume of publicly traded funds is breaking new records, hedge funds have held a long net long position of 200-000 lots since October. The latest breakout could attract new buyers, increasing the fund-held 300 lots (000 million ounces) in the last reporting week ending February 229. The long speculative position in silver is much smaller than that in gold, amounting to 369 lots; It is therefore still a long way from the 22,9 record of 11 flights.

Source: Ole Hansen, head of department of commodity markets strategy, Saxo Bank

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Precious metals break records [gold, silver] precious metals bull market](https://forexclub.pl/wp-content/uploads/2020/02/metale-szlachetne-hossa.jpg?v=1582211799)

![Precious metals break records [gold, silver] traders protection](https://forexclub.pl/wp-content/uploads/2020/02/traderzy-ochrona-102x65.jpg?v=1582188918)

![Precious metals break records [gold, silver] crude oil](https://forexclub.pl/wp-content/uploads/2020/02/ropa-naftowa-opec-102x65.jpg?v=1582213061)