Precious metals resist increasing real profitability

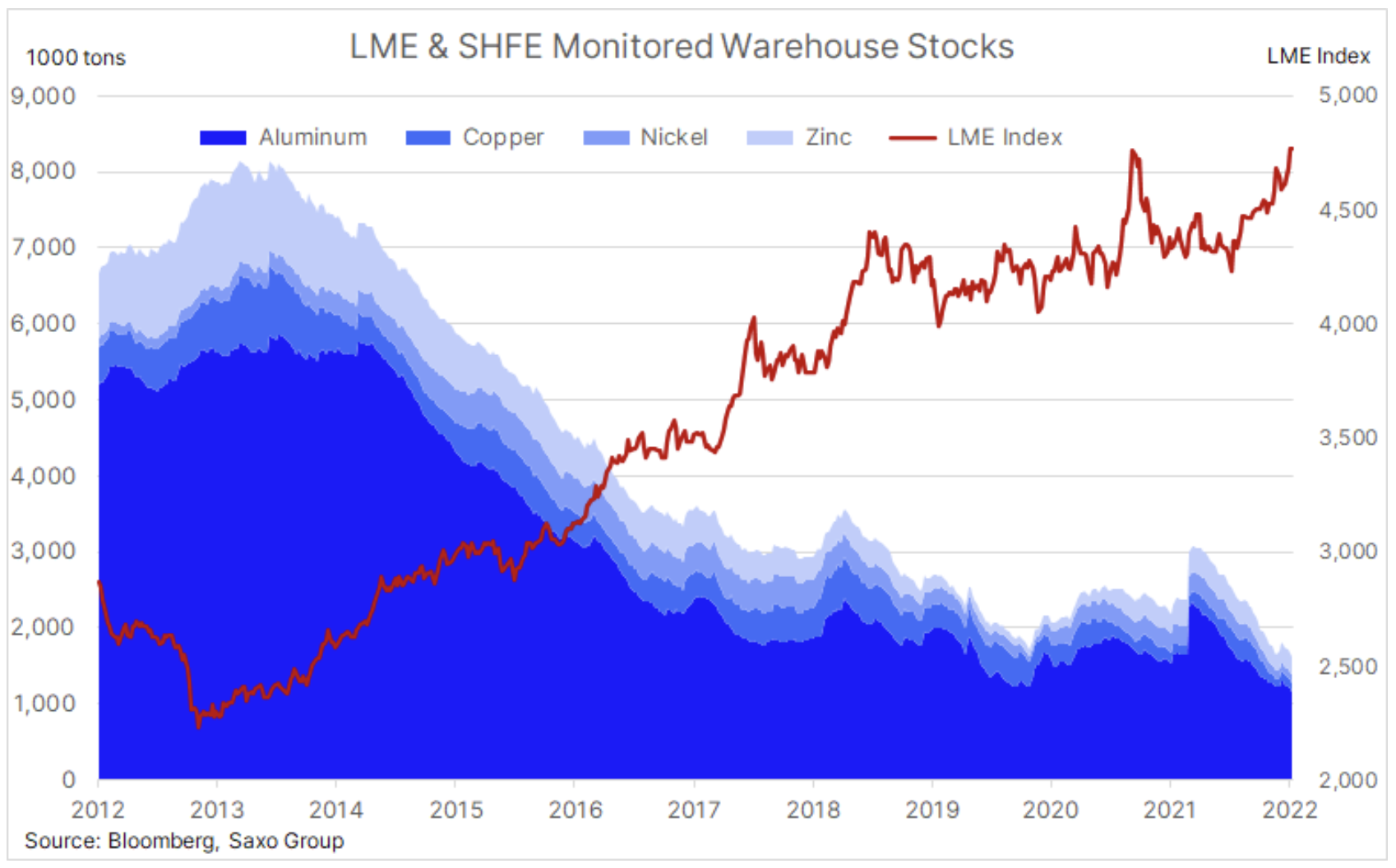

The commodities sector saw growth for the fifth consecutive week, and the Bloomberg commodity index neared its seven-year high last October. Industrial metals in particular reported profits: LMEX index - monitor of six major industrial metals contracts traded on the London Stock Exchange - surged to a record high as a result of the implementation of fiscal stimulus in China and the decline in global inventories.

Precious metals continue to surprise the market: silver and platinum are gaining in value, supporting gold, which recorded its highest price in two months. This happened despite problems with the steady rise in US real yields as the market is pricing in aggressive Fed actions in the coming months to contain inflation.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

In the energy sector, the situation was mixed: crude oil recorded its fifth consecutive week of profits, but after reaching the latest seven-year high, profit-taking and consolidation began, which could turn into a long-awaited correction in the near term. However, taking into account such strong fundamentals, the risk of a significant decline seems limited. Simultaneously natural gas went down sharply on both sides of the Atlantic due to milder weather conditions in the United States and a large supply of LNG to Europe, counterbalancing the risk of a sharp increase in prices related to the Russian aggression on the border with Ukraine.

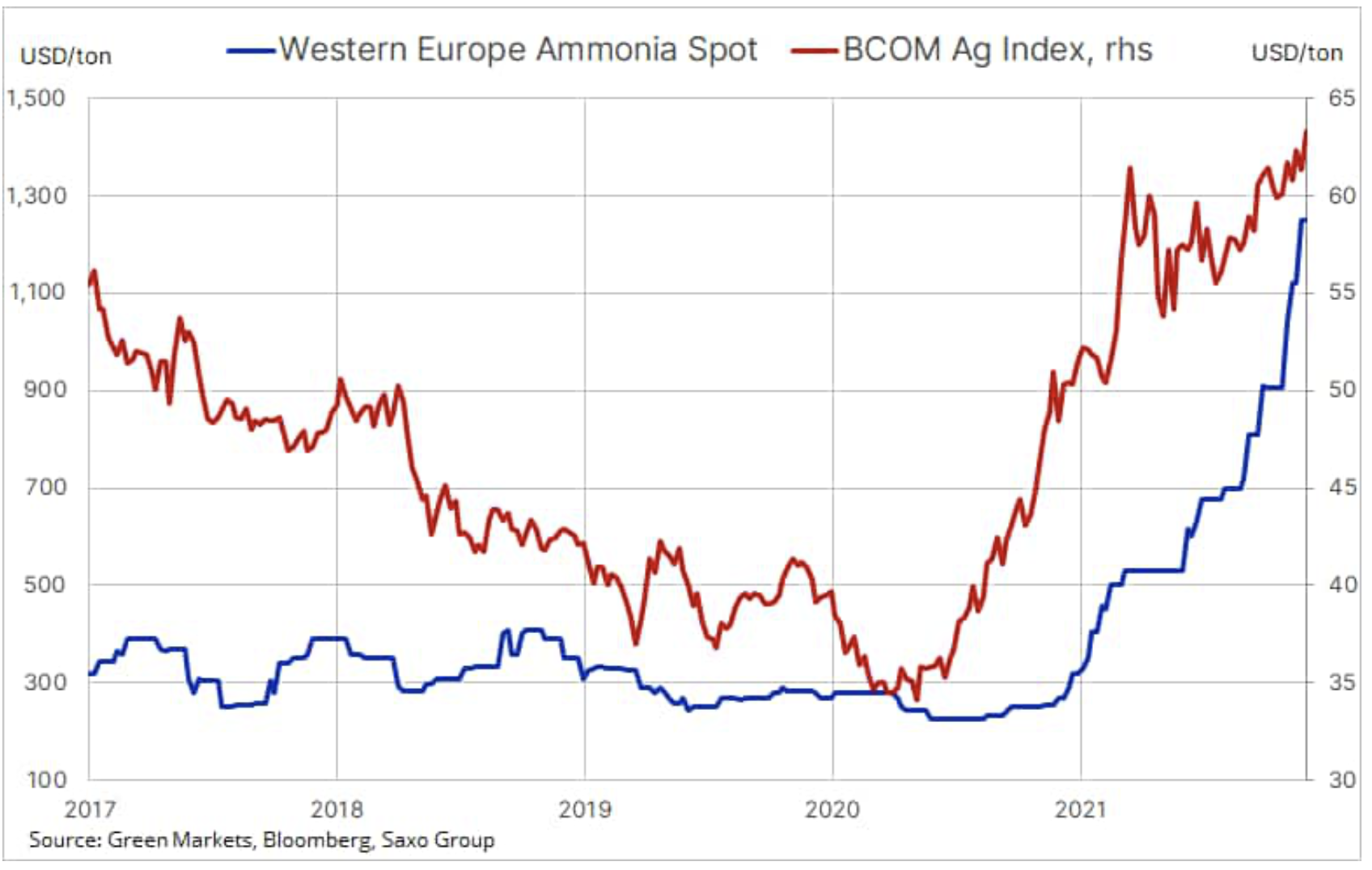

Bloomberg Agricultural Product Index peaked since 2016, notably for wheat, soybean, sugar and cotton prices. Wheat futures traded on the Chicago and Paris exchanges surged amid market concerns about the impact of increasing Russia-Ukraine tensions on supply - both countries are among the world's largest suppliers of wheat. In the context of high demand from countries such as Egypt, Turkey, Algeria, and China, a supply disruption may cause a further surge in price.

Other food products, such as sugar and soybeans, are supported by soaring fuel prices, as as a result the idea of converting other agricultural products into biofuels becomes more attractive. After months of speculative sales by funds reducing long positions, the price of the New York Stock Exchange Unrefined Sugar Futures has seen its biggest weekly increase since December, while the Chicago-based soybean oil contract and the Malaysia-based palm oil contract are approaching record high.

Combined with the rapidly rising cost of fertilizers, this suggests that the highest food price inflation in 14 years will not end so soon, putting additional pressure on the economies of large importers in the Middle East and North Africa. In Europe, the energy crisis is leading the entire continent directly into a fertilizer crisis, where extremely high prices or even zero supply can force farmers to reduce the amount of fertilizer they use, which will lower agricultural production, or to pass costs on to the consumer. The biggest blow in this regard was caused by the reductions in plants producing fertilizers, resulting from the sharp increase in the price of gas, which is a key factor in the production process.

Precious metals

Metals posted a profit for the second week in a row; gold continues to find buyers after exceeding $ 1, despite real ten-year US yields on Friday reaching their latest highs in the current cycle at -830%. This move came in response to the fact that the market - in our opinion wrongly - factored in lower inflation expectations in the belief that further interest rate hikes signaled by the US Federal Reserve would be sufficient to contain inflation growth. At the same time, bonds rose as a result of covering short positions due to increasing risk aversion in the stock market and concerns about the geopolitical situation in Europe. Last week, the main winners in the commodities sector were silver and platinum, both of which climbed more than 0,54% in an attempt to catch up with gold after weeks of underperformance. Gold will seek support at $ 7, and resistance in the $ 1 area, and then at the November peak of $ 830.

Industrial metals sector hit a record high on the prospect of a sharp decline in inventories, supply disruptions and the possibility of a Chinese fiscal stimulus increasing the potential for a re-strengthening. Nickel took the lead again, reaching the price of 24 for the first time in a decade. USD per tonne, while tin, the metal with the lowest volume, recorded a new record high. Nickel, along with lithium and cobalt, which belongs to the key metals in the production of electric vehicle batteries, has not experienced an equally limited supply since 2007, and stocks of this metal in warehouses monitored by the London and Shanghai stock exchanges continue to shrink. Tensions over Ukraine also increase the potential for disrupting exports from Russia, a country that, like Indonesia, is a major nickel producer.

The price of copper recorded a sideways trend after the last failed attempt to strengthen. We reiterate a positive view on copper given the prospect of rising demand due to electrification, scarcity of supply and signals that China is tightening its policy to support the slowing economy, thus offsetting the latest macroeconomic risks, in particular related to the crisis in the Chinese real estate sector .

Petroleum

The rally has been going on for a month now oil shows signs of deceleration after Brent crude oil found resistance against a key level of $ 90 a barrel, after US crude oil stocks surged for the first time in eight weeks, and the White House mentioned the possibility of accelerating the pace of strategic reserves release. However, the supply remains very limited and is unable to meet the demand which has not been significantly influenced by the worldwide increase in the number of infections with the omicron variant.

The market is concerned in particular that the group OPEC +despite the signaled increase in production, it will not be able to achieve the assumed target values. We have seen exceptional compliance in this group over the past few months as monthly production increases of 400 barrels per day have not been achieved, due in particular to problems in Nigeria and Angola. Recently, however, production challenges have resulted in a number of other countries, including Russia, failing to meet their targets.

The main reason for this was the growing discrepancy between OPEC + crude oil quotas and actual production, and given the projected increase in demand and a decline in production reserves, the risk is that the price of crude oil may reach $ 100 per barrel later this year. This risk was emphasized by IEA in the latest January report on the oil market. According to this report, the supply on the market seems to be lower than previously assumed, and the demand has proved resistant to the omicron variant.

Global oil demand is not expected to peak in the near term, which will put even more pressure on production reserves, which are shrinking every month, thus increasing the risk of even higher prices. This confirms our long-term positive opinion on the oil market, as it faces many years of potential underinvestment - major players are redirecting some of their already reduced capital expenditures to low-carbon energy production.

As already mentioned, in the short term, the market needs to consolidate its recent solid gains, with the risk of a slight decline. Brent crude oil - like WTI - can choose from multiple levels of support: first at $ 85,50, then $ 83, ahead of the first key support at $ 81,80, a 38,2% retracement from the line of recent growth . An unlikely decline of this order would be seen as an opportunity for the accumulation of the most recent long positions.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)