Michael Burry - "Big Long" story at GameStop

Company GameStop is one of the stars of 2021 when a group of American investors managed to lead to short squeeze many funds playing on the decline in the value of the company's shares. Many investors made a fortune from going long on GameStop. He also earned Dr. Michael Burrywho became interested in the company at the end of 2018. This is an example of a deal where you don't have to buy low and sell at the top to achieve a three or even four digit rate of return.. The aforementioned transaction is an example that high profits can be generated not only on prospective companies. It is important to buy shares in the company well below its intrinsic value (not to be confused with book value!). It was proved by Michael Burry, who is most often known from the film "Big Short". It was then that he made money from his short positions in the subprime real estate market. In this transaction, Michael Burry proved that he can earn in positions as well "Big Long".

Description of the GameStop market situation

For many years, GameStop has been a veritable dollar factory. It was a stable company with a recognizable brand. In 2012-2016, the company generated between $ 9 and $ 9,5 billion in revenues and generated approximately $ 600 million in operating profit. However, the business model was not tailored to changing consumer habits. Sales in stores began to decline, and more and more market investors were of the opinion that without a major change in operation, the company would plunge into more and more problems.

GameStop at the end of 2018 was not a very popular company by investors. This was due to an outdated business model. The company's competitive position became increasingly difficult. Stationary stores selling games and gaming accessories were slowly becoming obsolete. Although GameStop had its own online store, for many players a more convenient way to buy the game was to use the offer of platforms such as Steam. In addition, other game purchase channels were developing dynamically, such as: xbox live, Playstation Network or Nintendo Shop. What's more, console owners began to offer subscriptions, after which the player gets access to many titles. An example would be Microsoft "Game Pass". In addition, players did not have to go to the store to buy accessories such as keyboards, mice or armchairs. Only online stores began to appear on the market, offering home accessories delivery. The deteriorating market environment of the company meant that the company had to undergo restructuring. In 2017, plans were announced to reduce the number of stores by 150. The reason for the reduction was to improve profitability. Therefore, the least promising institutions were closed. In addition, GameStop decided to sell failed projects.

GameStop in 2018

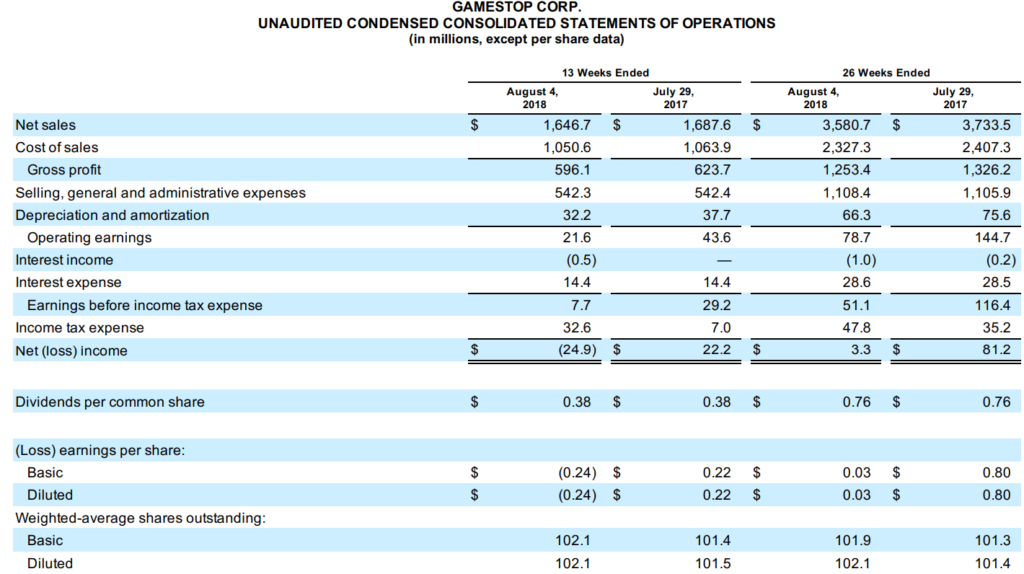

The company has a slightly different financial year than the calendar year. For this reason, Q2018 2018 closed with the company in August 2018. At the very beginning, it is worth seeing how the sales in QXNUMX XNUMX developed.

Q2018 40 revenues decreased by more than $ 2,42 million, i.e. 623,7%. At the same time, the company reported a nominal decrease in gross margin on sales from $ 2017 million (Q596,1 36,96) to $ 36,20 million. In terms of percentage, the margin decreased from 542,3% to 50,46%. Despite declining revenues and a lower gross margin, S, G&A (sales, general and administration) expenses remained unchanged at $ 2,58 million. Considering that it is difficult for the company to cut costs due to the cost structure (salaries of employees, rental of premises), the decrease in operating profit was even greater and amounted to as much as 1,31%. The operating margin alone decreased during the year from 2018% to 32,6%. The net loss was due to higher tax liabilities which amounted to $ XNUMX million in QXNUMX XNUMX.

Not surprisingly, the company's revenues largely depended on sales of games and gaming accessories. The most important group of revenues were the so-called pre-owned and value video game productswhich accounted for 27,5% of revenues in Q2018 43,7 FY. It was also one of the better-margin segments of the company. In this quarter, the gross margin on sales of used games was 10%. Much more than in the case of new games (software and hardware) where the gross margin usually did not exceed 20-2018%. In the second quarter of fiscal 9,90, sales in the used games segment decreased by 49,7% or $ 28 million. At the same time, the gross margin on sales fell by $ 197,5 million during the year to $ XNUMX million.

The second product group that had the greatest impact on the level of gross profit on sales was the segment "Technology Brands", which included the Spring Mobile network and the management of AT&T, Simply Mac and Cricket Wireless stores. In Q2018 6,5 FY, gross profit on sales decreased during the year by $ 132,4 million to $ 19,4 million. However, due to a faster drop in revenues (by $ 73,8 million), the gross margin improved from 2017% (Q78,4 2018 FY) to XNUMX% (QXNUMX XNUMX FY).

In terms of liquidity, GameStop was in good shape. He had $ 279 million in free cash. Of course, inventories ($ 1 million) were a significant part of the current assets. GameStop had approximately $ 237 million in long-term interest liabilities. In H819 2018, the company had negative operating cash flows of $ 429,9 million. The reason was the need to reduce trade liabilities, which resulted in a cash outflow of $ 581 million. This caused cash to drop from $ 879 million (end of fiscal 2017) to $ 279 million. This was not unexpected as this was the company's operating cycle.

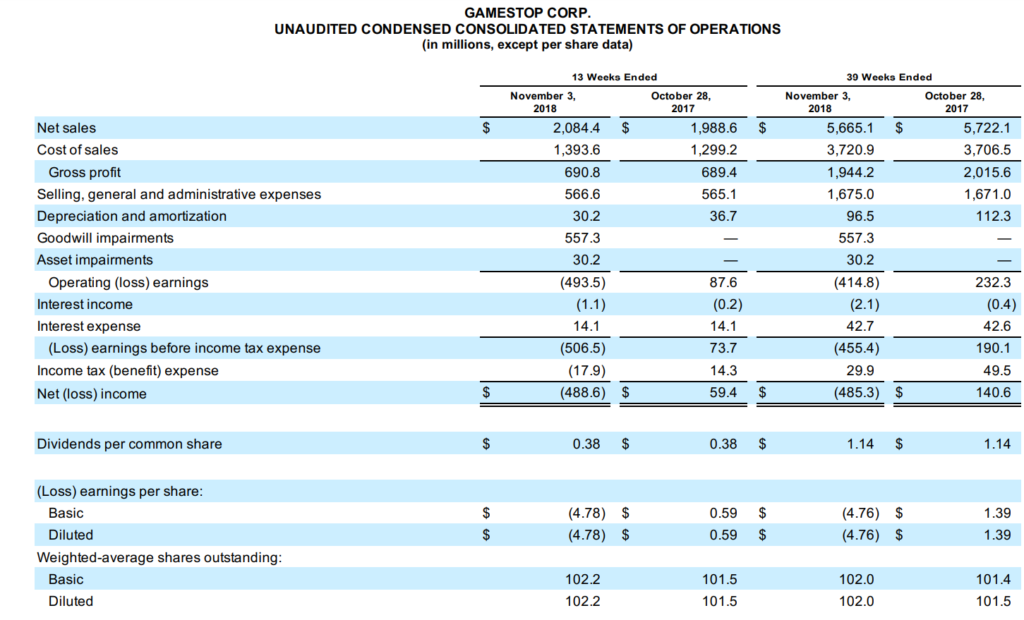

Revenues in the third quarter of 2018 increased year-on-year by approximately $ 96 million, or 4,82%. This was good news as it meant that concerns about the rapid erosion of the business model were premature. However, the data did not look as good as it went down to the gross profit on sales. In nominal terms, it increased by just $ 1,4 million. This meant that the gross margin fell from 34,7% (Q2017 33,1 FY) to 2018% (QXNUMX XNUMX FY). The reason for such a low increase in revenues was the decline in turnover in the most profitable segment (used games), which was not covered by better sales in other segments. At the same time, margin erosion affects almost all segments.

As was the case in Q2018 566,6. Despite declining revenues and lower gross margins on sales, S, G&A (sales, general and administration) expenses remained unchanged at $ 557,3 million. In addition, there was an impairment test that led to a write-off of $ 30 million on goodwill (goodwill) and $ 493,5 million on assets. This plunged operating profit to a shocking $ 93,8 million. After “clearing” the result from one-offs, the operating profit would be $ 4,50 million, so the operating margin would be XNUMX%. Not surprisingly, the net loss was due to the impact of one-off events.

In Q2018 34,6, the most important revenue group, which accounted for approximately XNUMX% of total GameStop sales, was the segment "New games software". Revenues amounted to $ 720,7 million and were higher than the year before by $ 70,8 million, ie by 10,8% y / y. The reason was good sales of new titles and expansion on the Nintendo Switch games market. However, the gross margin on sales itself did not look so good anymore. In nominal terms, gross profit on sales increased by $ 3,1 million, ie by 1,99% y / y. The gross margin on sales decreased from 24% to 22,1%. This meant that in order to be competitive with competing sales channels, GameStop had to pull off its margin. It was a negative trend and part of it "Market bears" it believed that the decline in margins would continue.

The second product group with the greatest impact on the gross margin was the sale of used games. In Q2018 43,1, the gross margin on sales was 50% and was 28,6 basis points lower than the year before. In nominal terms, gross profit on sales decreased by $ 13,4 million y / y. The reason was the drop in sales by as much as XNUMX% y / y.

In Q2018 454,5, cash rose to $ 790 million. Inventories increased by almost 2018 million and at the end of Q2 027 they amounted to $ 800 million. It was a standard practice for the company, as it had to stock up on the most important period in the company's sale, which was each quarter of the financial year. GameStop still had over $ 349 million in interest debt, however approximately $ 12 million was due over the next 9 months. After 2018 months of 179,2, GameStop had negative operating cash flow of $ -250,7 million. This meant that in QXNUMX the company managed to improve its operating cash flow by $ XNUMX million, despite the increased need for an increase in inventories. As a result, the level of cash improved.

In 2018, the company got rid of a smartphone chain called Spring Mobile for $ 800 million. The buyer was Prime Communications. It is worth mentioning that in 2013 GameStop acquired Spring Mobile for $ 1,5 billion. After the transaction, GameStop still had about $ 800 million in debt to pay.

So the company's situation was tough, but bankruptcy was certainly not a matter in the next few years. The company was still able to generate profits despite the shrinking gross margin on sales. The market was of a different opinion. From the beginning of 2017 to the end of October 2018, GameStop's share price fell by 36,3%. The company's capitalization was approximately $ 1,5 billion. Some investors saw the company as an opportunity to make a profit. Among them was the star of the subprime crisis - Michael Burry.

Michael Burry starts shopping

Michael Burry is famous for non-obvious market transactions. It often takes a position opposite to market sentiment. Of course, this is not always successful. This was the case, for example, in the case of buying shares in Tailored Brands, where the restructuring process was ruined by a pandemic. In the case of GameStop, he decided that the market sell-off was too high. Admittedly, it was not a company with a strong moat and great long-term prospects. However, it was still a company with a very recognizable brand, profitable business. To better understand the company's situation, it is worth looking at a long-term perspective:

| 2015FY | 2016FY | 2017FY | |

| revenues | 9 363 | 7 965 | 8 547 |

| operational profit | 660 | 501 | 444 |

| operating margin | + 7,05 % | + 6,29 % | + 5,19 % |

| net profit | 403 | 304 | 35 |

| OCF | 657 | 537 | 435 |

| CAPEX | 173 | 143 | 113 |

| FCF | 484 | 394 | 322 |

| Cash | 450 | 669 | 854 |

| Interest debt | 345 | 815 | 818 |

Source: own study

The valuation was also tempting as it was slightly less than 5 times the FCF (free cash flow) generated for 2017. Additionally, the company had no net debt. Of course, the high level of cash was in part a necessity to keep the business going. However, despite this, the company was not valued too expensive by the market.

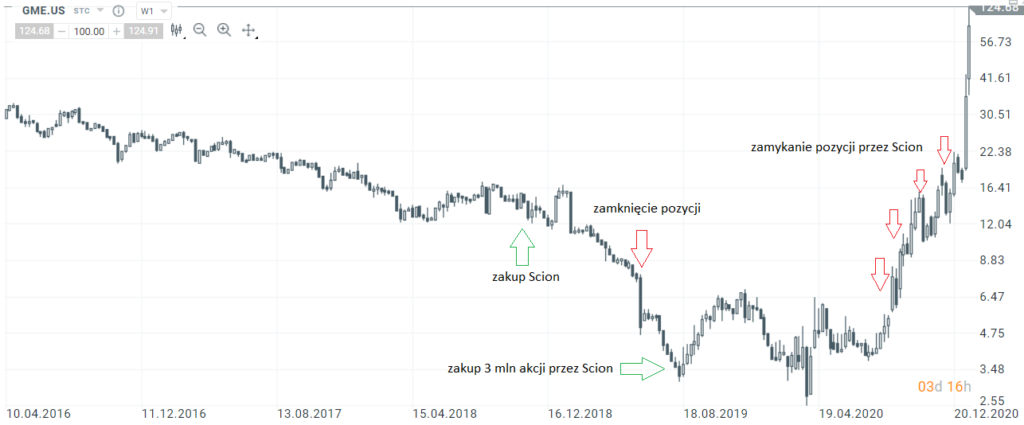

According to the 13F report prepared by Sion Asset Management LLC for Q2018 6,5, GameStop appeared in the fund's portfolio, holding 536% of all Scion's assets. Michael Burry purchased 862 shares of the company. In the following quarters, Scion was very active in the field of GameStop stock trading. This can be seen in the table below:

| Apple Lossless Audio CODEC (ALAC), | the number of actions | value | stock change q / q |

| Q2018 XNUMX | 536 862 | $ 6,775 million | +536 862 |

| IQ 2019 | 650 000 | $ 6,604 million | +113 138 |

| Q2019 XNUMX | 0 | $ 0 million | - 650 000 |

| Q2019 XNUMX | 3 000 000 | $ 16,56 million | +3 000 000 |

| Q2019 XNUMX | 2 350 000 | $ 14,288 million | -650 000 |

| IQ 2020 | 3 000 000 | $ 10,515 million | +650 000 |

| Q2020 XNUMX | 2 750 000 | $ 11,935 million | -250 000 |

| Q2020 XNUMX | 1 703 400 | $ 17,375 million | -1 046 600 |

| Q2020 XNUMX | 0 | 0 | -1 703 400 |

Source: own study

Interestingly, Michael Burry got rid of GameStop shares in Q2019 XNUMX. The reason was disappointing data from the last quarters of the company. As a result, a block of 650 shares was sold. However, after 000 months, Scion Capital acquired as much as 3 million shares in GameStop at an average cost of just over $ 3. He also started a "war" with management and issued an open letter. In August 4, he wrote to the Board of GameStop demanding a share buyback to take advantage of the low prices to buy shares below their intrinsic value. In December 2019, GameStop announced plans to buy back 2019 million of the company's shares (less than 34,6% of the company's shares). He was to allocate about $ 35 ml for this purpose. So it was a company with a Graham cigarette butt patch (from cigar butt).

Michael Burry's transactions on GameStop, own elaboration. Chart Source: XTB xStation.

GameStop after Burry's investment

| 2018 | 2019 | IQ 2020 | Q2020 XNUMX | Q2020 XNUMX | |

| revenues | 8 285 | 6 466 | 1 021 | 942 | 1 005 |

| operational profit | 321 | -7 | -104 | -96 | -84 |

| operating margin | + 3,87 % | -0,00% | -10,19% | -10,19% | -8,35% |

| net profit | -673 | -471 | -165 | -111 | -19 |

| OCF | 325 | -415 | -49 | 193 | -185 |

| CAPEX | 94 | 79 | 7 | 11 | 15 |

| FCF | 231 | -494 | -56 | 182 | -200 |

Source: own study

The results in 2019 were not the best. In 2018, the net loss was largely "accounting" as the company managed to generate 231 million positive free cash flow (FCF). On the other hand, in 2019, negative cash flow from operating activities (OCF) was added to the net loss. As a result, in 2019 the company reported a net debt of approximately $ 690 million. This was an unprecedented value in the company's recent history, as GameStop usually had more cash than interest liabilities.

In 2020, the situation continued to be difficult. The COVID-19 period had a negative impact on the company's revenues. At the same time, due to relatively rigid costs, GameStop generated an operating loss in each of the first three quarters. In the 9 months of 2020, the company generated negative FCF of $ 74 million. The company saved itself by selling off its assets. GameStop has sold $ 95,5 million worth of real estate and equipment.

The market slowly began to notice that despite the difficult financial situation and unfavorable market changes, GameStop is undervalued. As a result, throughout 2020, the share price increased by over 200%. The aforementioned increase was used by Michael Burry, who began to significantly reduce the position from the second half of 2020. At the end of the year, he no longer owned any of the company's shares. Apart from making a profit on the deal, Burry did not seem to be enthusiastic about the changes taking place within the company. Their face was Ryan Cohen. It is estimated that Michael Burry made about $ 250 million on GameStop. However, if he had held the stock a little longer, his profit would have been many times greater.

Ryan Cohen comes into play

Ryan cohen

GameStop was also looking for external financing as it needed funds to transform the business. In 2019, advanced talks with Sycamore Partners continued. However, no binding contract was signed. However, the company found itself on the radar of an investor who wanted to change the outdated business model. That someone was Ryan Cohen who started to increase his stake in the company. In In August 2019, the entity he controls, RC Ventures, announced that it held 9,98% of shares in the company. Ryan Cohen was the CEO and co-founder of Chewy, which is one of the market leaders in selling pet products online.

Owing to his almost 10% stake in the company, Cohen decided to put pressure on the old management board and force a change of the business model. In November 2020, he published an open letter demanding a thorough restructuring of GameStop. According to him, the traditional sales channel (stationary stores) does not fit the current times. For this reason, it should reduce the number of outlets (closing non-profit ones) and put emphasis on online sales. The main areas of growth were supposed to be e-sport, mobile games and streaming games. Of course, the transformation process itself was supposed to be lengthy. This resulted, inter alia, from from store lease contracts. The average contract expiry time was 24 months. After the low-profit or even loss-making stores were closed, the freed up cash had to be allocated to the development of the online channel. At the same time, GameStop was to announce a significant limitation of operations outside the United States, because the company had the greatest recognition on the domestic market.

Of course, such a radical change also required changes within the company. Thanks to Cohen's effort, the management team has changed. In the first quarter of 2021, Elliott Wilke became the new CGO (Chief Growth Officer), who for 8 years worked in various managerial positions in Amazon (including as Director Amazon Fresh Stores).

It is also worth remembering that the company has also changed the positions of CEO and CFO. In June 2021, the current CEO, George Sherman, was replaced by Matt Furlong, who had served as Country Leader at Amazon Australia for the previous two years. Mike Recupero, who worked for 17 years at Amazon, became CFO and became Vice President and CFO of North America Consumer. Before that, Mike served as Vice President and CFO of Amazon Prime Video.

The rest of the GameStop history is a cult part of the stock exchange's history. Squeezing out short positions caused the share price to increase several times at the beginning of 2021.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)