MINT – Mexico, Indonesia, Nigeria, Türkiye. A chance for a "new BRICS"?

Acronym success BRIC caused economists, analysts and investors to look “another BRIC”. Some have been more or less successful. Some of them have disappeared without a trace. A horse with a row to the person who can decipher all the following abbreviations without using the Internet: CIVETS, VISTA, MIST, MIKT, TIMS. In today's article, we'll tell you what it is MINT and what are the advantages and disadvantages of the countries included in it.

MINT - is this the next BRICS?

MINT is an acronym from the first letters of a selected group of countries. These are: Meksyk, Indonesia, Nigeria and Turkey. The term itself was coined in 2011 thanks to the work of analysts and economists employed at Fidelity Investments. Fidelity is an asset management company, so they were keen to create “the new BRICS”. MINT gained popularity with support Jim O'Neillwho gained fame as the coiner of the term BRIC. Interestingly, all MINT members are also members of another group of countries called The NextEleven.

MINT countries are often categorized as “frontier markets”. On the one hand, they have great growth potential, but the scale cannot be compared to India or China. So they are between small developing economies and giants like the two largest members of the BRIC.

For enthusiasts of MINT countries, the popular view is that they are the next installment of the BRIC countries. However, if you look closely, you can see that these are completely different economies. However, defenders of the "new BRICS" concept say that economies such as Indonesia, Mexico and Turkey are not inferior to the potential Brazil, Russia and South Africa.

Where is the hidden potential of MINT?

When developing its list of prospective countries, Fidelity took into account numerous indicators that allowed it to assess countries in terms of potential. Each of these countries is considered to have great potential for development. All four countries have the following characteristics:

- a large population with a high percentage of people under 30,

- dynamically developed in previous years,

- growing middle class,

- willingness of citizens to set up their own business.

Countries with young populations were preferred. This is due to the fact that "young economies" use the so-called demographic pension. The inflow of a large number of people to the labor market reduces the pressure on wage increases. This makes the country more competitive in global markets. This encourages foreign companies to invest in these markets. If the young population is rich enough, domestic demand increases. The middle class, which is still young, spends money on real estate, cars and consumer products. This creates another engine of economic growth.

Another factor that was taken into account was the historical rate of economic growth. The faster and more stable the economic growth, the faster the country can converge. Unfortunately, some of the MINT countries have a problem with meeting this condition. An example is Nigeria, which is unable to fully use its potential. Nigeria has huge oil reserves, yet resources are being wasted. The country fails to raise the standard of living of its citizens in the same way that some have done Arabic countries.

The growth of the middle class causes, on the one hand, an increase in internal demand, and on the other hand, an improvement in the real estate market. The wider the middle class, the greater the chance of political stability in the country.

A large share of entrepreneurial people in the population results in the creation of many micro, small and medium-sized enterprises. Despite their frequent inefficiency, they play a very important role: they reduce unemployment. Less unemployment means a richer society and a chance for a part of society to get out of poverty.

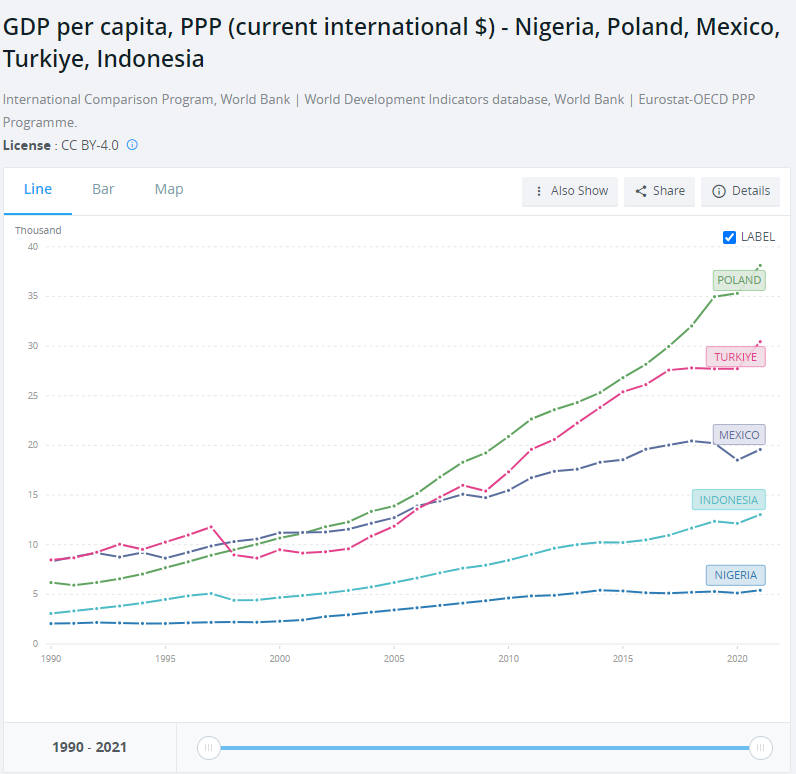

It is worth remembering that MINT countries are not at the same level of development. Nigeria stands out the most, which has a very low GDP per capita (even when purchasing power parity is taken into account). Türkiye, on the other hand, is the most developed economy in terms of GDP per capita. Mexico and Indonesia, on the other hand, are in the middle of the pack. Nigeria is not only the poorest country on the list, it is also developing very slowly.

source: World Bank

Why was Nigeria included?

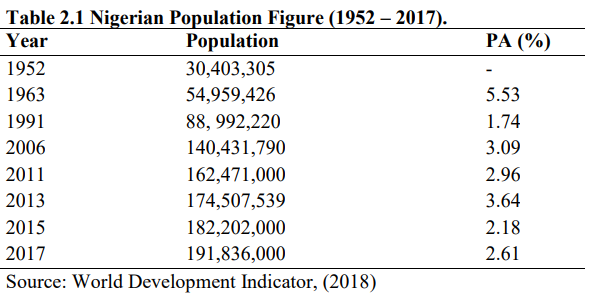

As you can see above, Nigeria is significantly behind the pack. So why was it added to MINT? The reason is having a large amount natural resources, possession large population and well capitalized and regulated banking sector. Therefore, these are good conditions for economic development. However, it is necessary to use natural resources properly and allocate profits from trade to the development of infrastructure. The next step should be to attract foreign investors. It is also the second largest economy in Africa (after Egypt). Thus, Nigeria accounts for a larger share of world GDP than South Africa, which is a BRICS member.

source: Structure and problems of Nigerian Economy, Amaka G. Metu, UCC Nwogwugwu & Kenechukwu Okeyika

In terms of export structure, Nigeria is a resource country. In 2020, the largest exports were: Petroleum (70,6%) and natural gas (13,9%). Despite this, the petrochemical sector itself is not the most important for the entire economy. The Nigerian economy is very developed, the mining sector does not exceed 10% of GDP.

The country continues to struggle with illiteracy and basic development problems. According to the 2018 National Literacy Survey, 36% of women and 27% of men have no education. More than 40% of households do not have access to electricity at home. Of course, in urban areas, 83% of households have access to electricity, but in rural areas this percentage is 39%. The country is therefore struggling with a huge social stratification. The inhabitants of cities located in the south of the country are in the best situation. On the other hand, households living in rural areas (especially in the central and northern part of the country) are in a difficult economic and social situation. This is a big problem for Nigeria. Moreover, a large percentage of the population still does not have access to the Internet. Less than half of the population aged 15-49 use the internet at least once a week.

Nigeria's economy is dualistic. On the one hand, there are developed, large companies, on the other, the ineffective sector of micro, small and medium-sized enterprises. According to research by Amak G. Metu, UCC Nwogwugwu & Kenechukwu Okeyika the sector of small and medium-sized enterprises employed over 70% of employees, but was responsible for about 15% of national production. This was due to the fact that these companies often operate in the gray economy and provide products and services with low added value.

Another problem of the country is corruption. According to Corruption Perceptions Index Nigeria ranks 150th in perceptions of corruption. This is a major barrier to development, as it makes it difficult to do business honestly in this country.

Despite a number of problems, Nigeria has a huge potential for development. Cities that will become local centers of prosperity can help. They will “radiate” the area and encourage people to migrate to cities. This will increase the level of urbanization and contribute to increasing the efficiency of the economy. For the time being, the country is developing below its potential, but it has a chance for rapid development. It is enough for successive Nigerian governments to focus on long-term economic policy.

Mexico - still below potential

The country seemed to be situated in an ideal place. It borders the United States, which should support the convergence process. However, since the 90s Mexico has been growing much slower than Poland, which has benefited from economic integration with the European Union. For Mexico being a member NAFTA did not quickly catch up in the level of development of Canada and the United States.

This does not mean that it is an economically and politically insignificant country. In terms of GDP in purchasing power parity (PPP), it is the 13th country in terms of the size of the economy. Mexico's GDP is slightly less than Italy's. Of course, the standard of living in Mexico is much lower than in Italy. The country has great potential due to its location and young population. Mexico is now a country with almost 130 million people. It is also a country where American companies invest a lot. Geographical proximity and competitive salaries make Mexico the industrial base of the United States (of course, China still dominates). It is therefore not surprising that the country as much as 76% of its exports go to the USA. Mexico may benefit even more if American companies start moving some of their business from China.

READ: How to invest in the Mexican market? Stocks, ETFs, indices [Guide]

The country also has a very developed capital market. The Mexican Stock Exchange is the second largest securities trading venue in Latin America (after the Brazilian Stock Exchange). It is worth mentioning that one of the richest people in the world lives in Mexico - Carlos Slim – whose net worth is estimated at $86 billion.

Mexico is also characterized by huge disproportions in economic development. The regions closest to the border with the United States have a much higher level of development than regions closer to the South. In addition, there are large disparities in people's earnings. This can be seen in the case Gini index, which for Mexico is 45,4. This is much more than in Western European countries (e.g. Germany 31,7). However, the last 25 years have seen a slow decline in the Gini index.

Mexico has great potential for economic development. However, it needs the introduction of a coherent, long-term development policy. The young population combined with the proximity of the USA and Canada create an opportunity for Mexico to accelerate its growth.

Indonesia — the future economic giant

It is the 4th most populous country in the world. So the population is about 275 million people. So it is not surprising that if the government introduces wise policies and allows people to get rich, the next economic power will be born. Currently, the country is in 7th place in the world in terms of GDP calculated in purchasing power parity. It is not surprising then that it is a member of the G-20 organization. It is also the largest economy in Southeast Asia. There are both private and state-owned companies (over 140) in Indonesia. State-owned companies operate mainly in key areas for the government (e.g. energy, banking, insurance, construction). However, private companies are the engine of economic growth.

The great advantage of the country is a very young population, which will support domestic demand. The location of the country, which is close to the new center of the world, i.e. China and India, is also advantageous. Thanks to this, Indonesia will benefit from the strengthening of economic exchange. According to the forecasts of Joko Widodo (one of the most important entrepreneurs and politicians in Indonesia) the country is set to become the 4th largest economy in the world by 2045.

Another advantage Indonesia has is its wealth of raw materials, which allows it to increase its trade surplus. One of the most important export commodities of the country are coal, gold, iron and palm oil. Palm oil accounts for about 10% of Indonesia's total exports.

The economic center of the country is Jakarta, where more than 10 million people live. It is unquestionably the largest city in Indonesia. Second on the list, Surabaya has less than 3 million inhabitants. It is therefore not surprising that it is in Jakarta that the leading companies in Indonesia have their headquarters. The city is also home to the stock exchange, which is one of the largest in Southeast Asia.

Indonesia is an example of a country disregarded by many investors and politicians in Europe. However, it is already a large economy that has a chance for dynamic growth in the coming years. It is therefore worth getting to know the Indonesian stock market at least superficially.

Türkiye - Between East and West

It is a very interesting country. In terms of GDP per capita (PPP), it is the most developed of all MINT members. It also has a favorable location as a bridge connecting Europe and Asia. For many years, Türkiye was considered one of the most promising economies in the world. Turkey and Russia have been treated for many years as an ideal place to invest in shares of companies from Eastern Europe. This made the Istanbul Stock Exchange one of the most important stock trading centers east of the Oder and south of the Danube.

Currently, the country has problems with high inflation and maintaining high economic growth. Some economists and analysts blame the country's problems on the inappropriate economic policy of the Turkish government, which is ruled by Erdogan. Keeping interest rates low in an environment of high inflation results in a country having a very negative real interest rate. As a result, the Turkish lira (the currency of Turkey) is systematically losing against the US dollar.

READ: How to invest in Turkey? High inflation, low rates and a weak currency [Guide]

It is a country between east and west. Türkiye has been negotiating its accession to the European Union since 2005. However, the initial enthusiasm was followed by a slowdown in the pace of negotiations between the countries. Nothing suggests that the accession process will accelerate in the coming years. Instead, it is an important economy throughout Asia Minor and a role model for many poorer countries in the region.

Turkey is one of the largest producers of clothes, textiles, car engines, car accessories, building materials and household appliances in the world. Well-known Turkish brands include Beko, which is a manufacturer of household appliances.

For much of the XNUMXst century, Turkey experienced a dynamic rise in prosperity. This can be seen both in the growth of the country's GDP and the disposable income of households. Currently, GDP per capita (PPP) is about 64% of the EU average. As in other MINT countries, cities are the main centers of prosperity. They are the fastest to catch up with the most developed countries. In Turkey, the main urban centers are: Istanbul, Ankara and Izmir. If Turkey manages to deal with inflation, it will again become a "pet" of many funds investing in this region of the world.

Summation

MINT is an acronym from the first letters of countries such as Mexico, Indonesia, Nigeria and Turkey. All of these countries are characterized by a large population, favorable demographic trends and rapid economic growth. All of these countries, due to their potential, may very quickly become key economies in the world.

This does not mean that countries do not have their problems. Many of them struggle with economic slowdown (Mexico, Türkiye) and problems with inflation (Nigeria, Türkiye). It is also not a homogeneous group in terms of the degree of economic development. While GDP per capita (PPP) is similar for Mexico and Indonesia, Nigeria is very far behind in terms of development. Turkey, on the other hand, is the most developed country and is classified as a developed country rather than a developing one. Some allege that MINT has the same problem as BRIC. The point is that the BRIC countries are unequal in terms of potential. India and China distance countries such as Brazil and Russia. In the case of MINT, the country that distances the rest of the rate is Indonesia. This is due to the population potential and the fact that it is a country with a relatively high standard of living.

It is worth remembering that potential is not everything. Countries are still struggling with high corruption, maintaining stable economic growth. Moreover, sometimes countries experience political upheaval.

Mexico, Indonesia and Türkiye have a developed stock market. This is important because it gives foreign investors the opportunity to gain exposure to this market (e.g. through ETFs or directly buying shares on the market).

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Next Eleven (N-11) – Top players, i.e. Mexico, Turkey and South Korea [Part. AND] next eleven countries 1](https://forexclub.pl/wp-content/uploads/2023/05/next-eleven-countries-1-300x200.jpg?v=1684740403)