FOMC "minutes" supported gold prices

Gold rose to $1757,76 on Thursday. The increases are driven by the "minutes" pigeons from the last meeting FOMC. On the basis of technical analysis, gold has an open way to an increase around 1845 dollars.

Helped the "pigeons" FOMC

Yesterday, the gold market made a strong turnaround from the $1729,48-1733,96 support area. The impulse was the dovish minutes of the last FOMC meeting (so-called minutes). Investors could read in it that many representatives Fed supports a slower pace of interest rate increases. This contradicts the recent hawkish statements of Fed chairman Jerome Powell. It also fits in with the scenario preferred by the markets, in which interest rates in the US rise by 50 basis points in December, and the next hikes are in steps of 25 points.

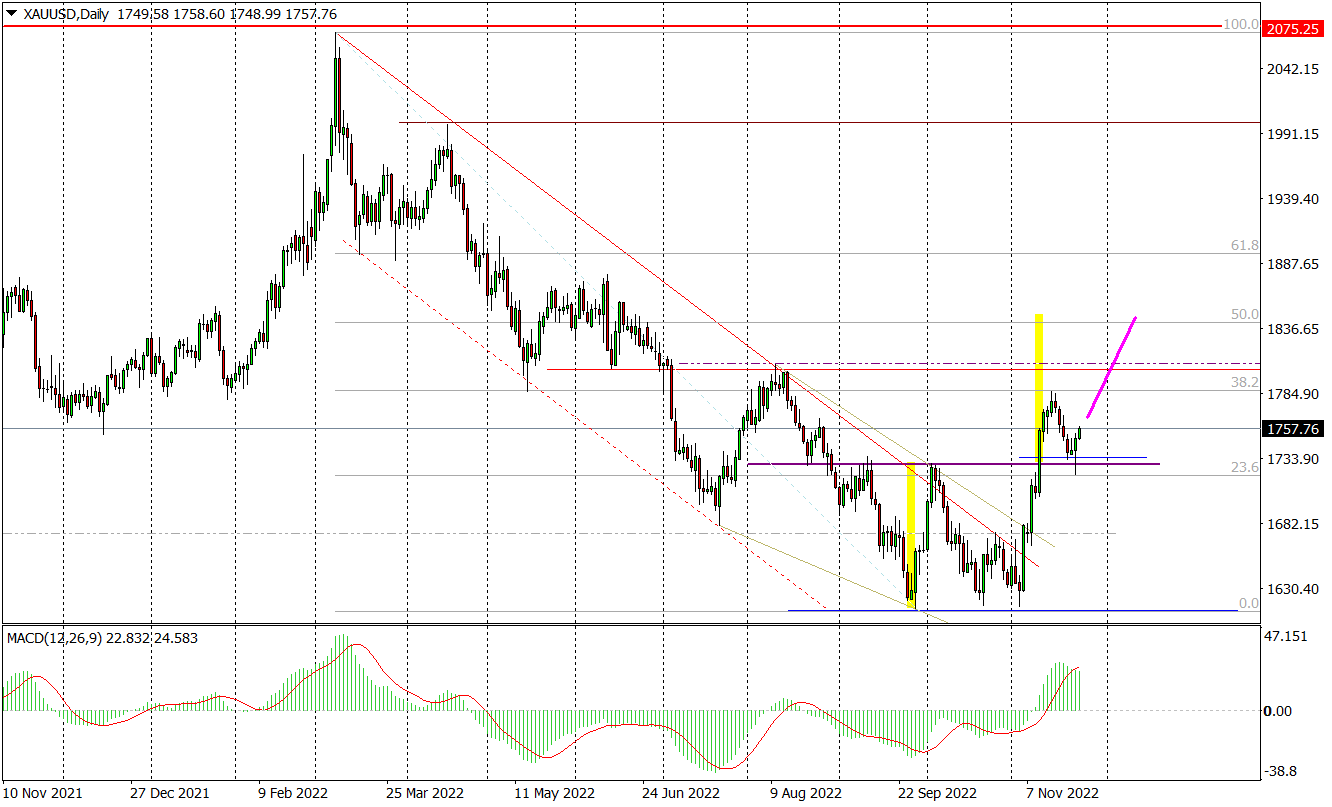

The FOMC minutes improved market sentiment while pushing gold prices higher. The current situation on the daily chart of this metal is quite clear. Yesterday, the chart made a strong turn from the neckline of the multi-month double-bottom pattern that was formed on November 10 (then the lower-than-expected US inflation data was released). This allows us to treat the earlier declines as a very deep, but still a return move to the neck line. In this pattern, the uptrends seen now are a return to filling the double bottom formation.

Gold predictions

The first target for the demand side is the November 15 local high of $1786,48. The next resistance zone is 1800-1807,84 dollars. Ultimately, however, gold should reach the level of 1845 dollars. It is determined by the minimum range of increases resulting from the formation of a double bottom.

Gold daily chart (XAU/USD). Source: Tickmill

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)