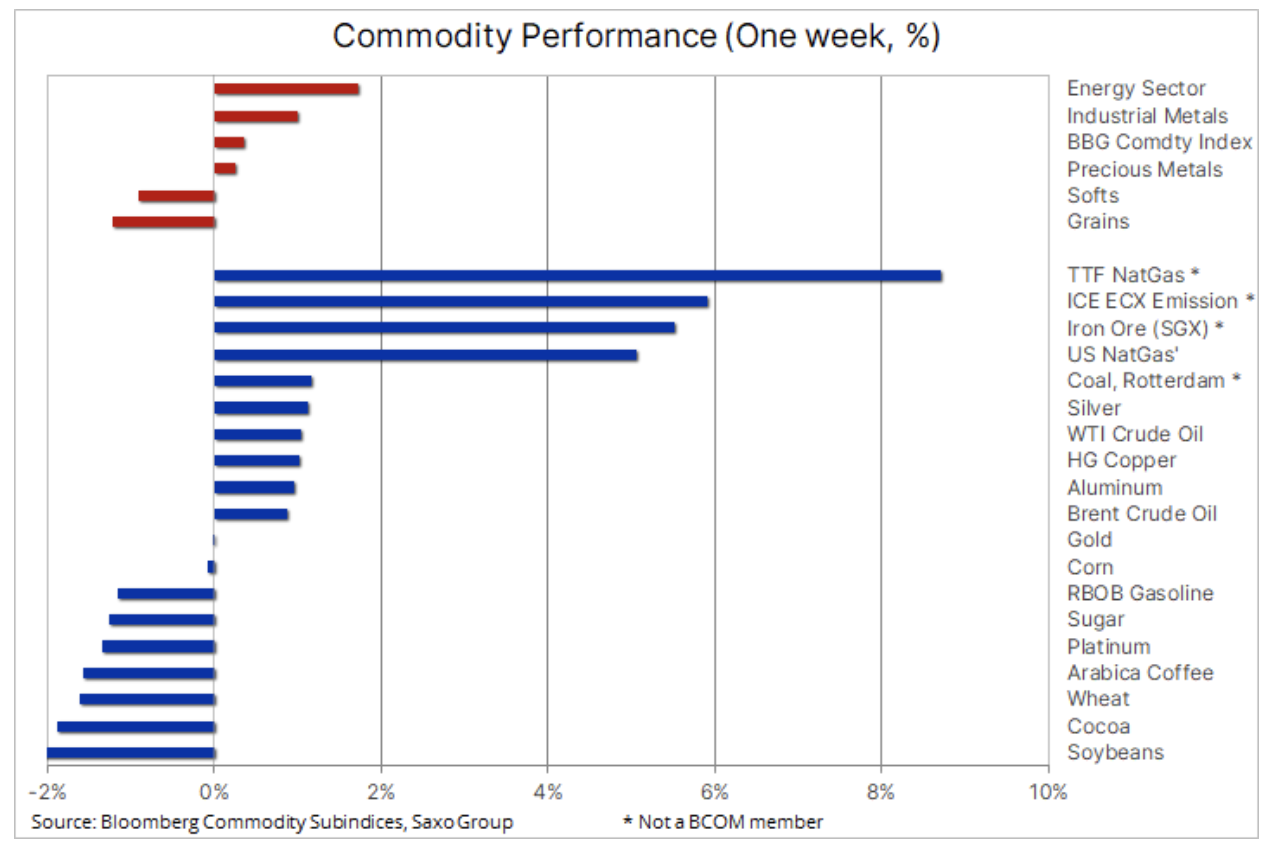

A strong week in the energy sector with carbon dioxide and natural gas

For the third consecutive week, commodity markets have seen growth; widespread gains in the energy and metals sectors counterbalanced point declines in the agricultural sector. As a result, the Bloomberg spot commodity index, which tracked the performance of the main commodity futures contracts with the nearest expiry date, was close to its ten-year high.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Still rising inflation is of key importance, to some extent as a result of higher input costs relative to appreciating commodities. "Factory" inflation, i.e. the Producer Price Index (Producer Price Index) producer price inde $ x, PPI), peaked in China since 2008, and the authorities are proposing to release state reserves of industrial metals as part of further efforts to cool commodity prices and curb inflation. In the United States, prices of consumer goods and services rose by 5% year on year, also the fastest pace since 2008, and core inflation is at its highest since 1992.

However, this did not discourage investors from entering the bond market, where yields on US government bonds fell to the lowest levels in the current cycle. This trend was a product of the fact that the market accepted the view Fedthat the spike in inflation is about to reverse, as well as the deluge of USD liquidity pumped into the market as the US Treasury continues to reduce its bill - ultimately below $ 500 billion by August 1 from a 2020 high of around 1 billion USD. Both lower yields and weaker dollar contributed to the improvement of risk appetite in all markets, including commodity markets.

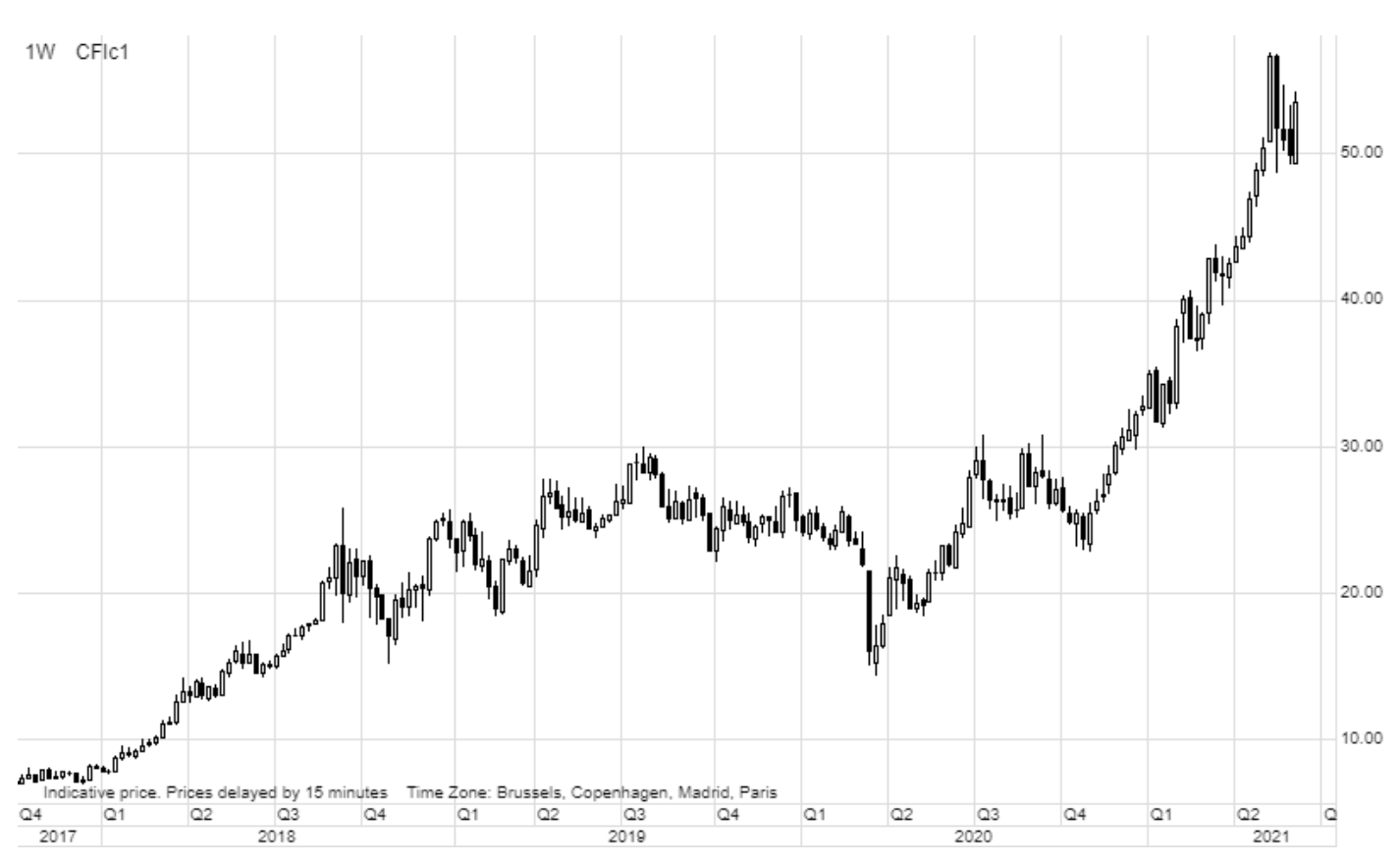

The biggest increase on a weekly basis was shown by two Eurocentric commodity futures contracts not listed on the commodity index, i.e. Dutch TTF gas (Dutch natural gas TTF) and ECX Carbon (carbon dioxide emissions). The TTF natural gas contract with the nearest expiry date - the European benchmark - hit the highest price in five months as a result of limited supply due to above-average temperatures, a temporary drop in supplies from Norway and Russia, and above all a further increase in the prices of EU carbon dioxide emission allowances above 53 EUR per tonne.

Last year, and in particular since November, ICE EUA futures contract corresponding to one ton carbon dioxide emissions it went up strongly to EUR 40, ie by 300% above the average price in the last five years. What happened in November? Most notably, the first vaccine was announced, signaling a clear path to global recovery; moreover, Joe Biden became president of the United States, preferring a more environmentally friendly policy.

the iron ore

Iron ore futures traded on the Singapore Stock Exchange also topped the table last week and surged strongly, consistently recovering from a 27% drop last month when China made its first and so far unsuccessful attempt to contain price increases raw materials. Contrary to government policy, demand from Chinese steel mills remains solid as the market considers possible supply disruptions in Brazil.

Agricultural commodities

Na cereal markets the situation varied, but they lost significantly on a weekly basis following the publication of the US Department of Agriculture (USDA) Monthly Report on World Agricultural Supply and Demand (WASDE). Maize saw a second weekly rise after the report found deliveries were below expectations due to strong demand from the ethanol and export sectors. In addition, forecast weather models predict drier conditions in a key growing region in the United States. Wheat remained unchanged on a weekly basis after recouping losses from the recent correction amid concerns that the drought would translate into a decline in production. At the same time, soybeans remained under pressure following the USDA's announcement that stocks would be greater than forecast as high prices would curb demand for soybean oil and meal.

Petroleum

Clothing for the third week in a row it saw an increase; Brent crude oil stabilized above USD 70, while WTI crude oil reached the highest closing price since 2018. The pace slowed down somewhat as the market - despite a very optimistic forecast for the second half of 2021 - began to wonder if the major part of the recovery in hemisphere demand west has not been included in the valuation anymore.

The potential short-term negative price effects of the Iran nuclear deal could be seen last Thursday, when algorithms that usually control a significant percentage of the daily volume of trading in the futures market fell short of breath after misreading the information on the lifting of sanctions by the United States against one specific citizen Iran, not to the whole country. This caused Brent and WTI oil prices to temporarily drop by more than 2% before returning to their previous levels. According to TankerTrackers.com, Iran's supertanker fleet currently stores 70 million barrels of gas condensate, a condition that has been growing recently due to insufficient demand from China, Iran's main customer.

The monthly oil market reports published by the EIA, OPEC and the IEA show a positive outlook for oil demand, with the IEA now predicting that global oil demand will return to pre-pandemic levels by the end of next year. While Iran's return to the world market in a few months' time would have the potential to provide the extra barrels needed by the end of this year, there is no doubt that OPEC + producers now have the opportunity and the power to dictate oil prices. However, by maintaining artificially limited supply in the market in the coming months, they risk that in 2022, when the IEA forecasts a 1,6 million barrel increase in non-OPEC production due to high prices, the chances of other players will be leveled.

Estimating a price target for a politically controlled commodity like crude oil is very difficult and despite the risk of a short-term correction, the current trajectory is pointing to an increase in prices, with the price of Brent crude oil close to its 2019 high of $ 75.

Precious metals

Gold i silver past consolidation period and the main phase of short-term gold coverage by long-term funds seems to be over.

After a slight correction so far, gold and silver attracted buyers as a result of the strongest CPI reading in several decades, but instead of supporting inflation against inflation, both metals rebounded as US Treasury yields hit another low in the current cycle as how the market came to the conclusion that inflation is temporary and the Fed will not start reducing asset purchases earlier than expected.

As the FOMC meeting scheduled for this week is unlikely to provide any new information on the reduction of asset purchases, the market will focus on the symposium in Jackson Hole at the end of August, awaiting the announcement of a possible policy change. 0,94-year real yields have dropped to their lowest level in a month, ie -1%, and due to the solid performance of silver, XAUXAG's relationship has reached a weekly low. Bullion traders should focus on resistance levels - most likely $ 904 followed by $ 1, while a close below the 916-day moving average at $ 1 could signal another loss of momentum; then the next downward target will be the 887-day moving average of $ 1.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response