Strong growth in real yields fights for domination against the risk of stagflation

After Monday's decline - the biggest in three months - the price of gold remains within the range. Strong profitability increase US treasury bonds and the fact that the market is now pricing in two consecutive 75bp rate hikes undermines gold's ability to protect investors from rising inflation. The success or failure of the fight against inflation before the economy starts to feel its effects has become the main topic that will determine the final trajectory of the gold price.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Mixed sentiment among investors

The reaction of gold to Friday's higher-than-expected inflation reading in the United States and the decline in consumer sentiment underline the divergent investor sentiment that has kept gold within its range for some time. Throughout the year, gold struggled with rising government bond yields while finding support from investors seeking protection against inflation, the stock market and geopolitical risk. The fight culminated on Monday as traders scared of higher-than-expected inflation began to put pressure on the US FOMC, including two consecutive 75bp rate hikes in their valuations.

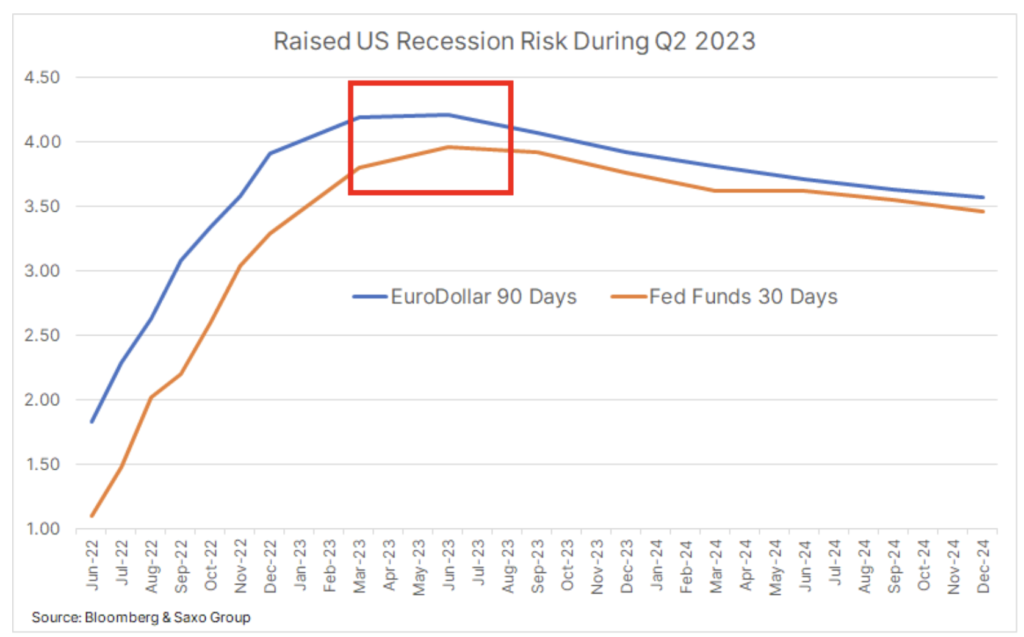

The FOMC meeting will take place on Wednesday, just weeks after Fed chairman Powell has denied the idea that FOMC will increase the rate of rate hikes above 50 basis points, however, the common opinion that the central bank is not keeping up with the curve forced a strong re-evaluation of yields and expectations for rate hikes, at the same time bringing the date of the recession in the United States closer.

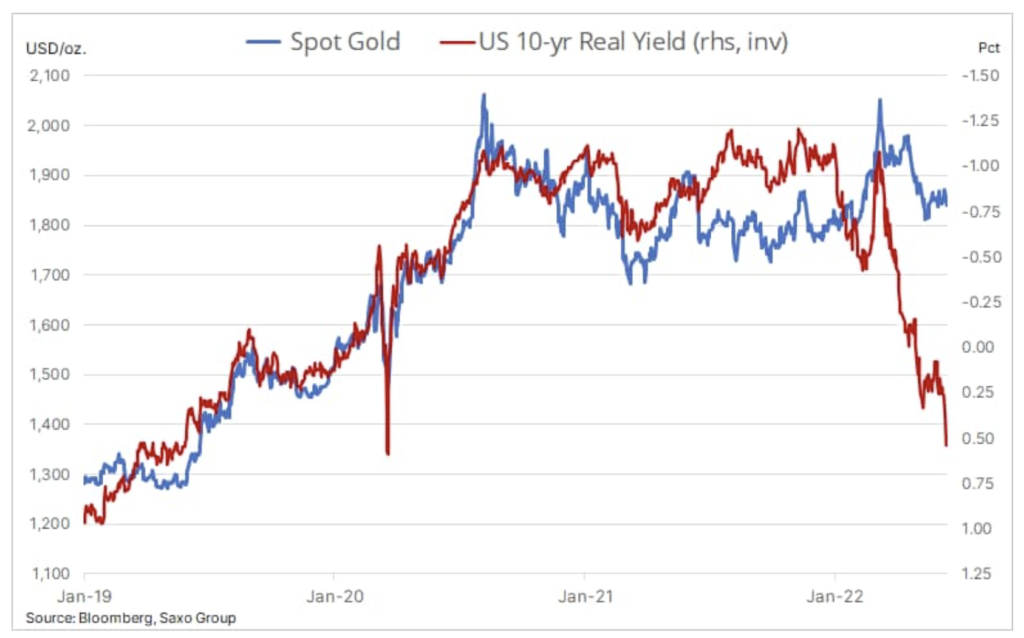

Since Friday, two-year US bond yields have climbed a record 0,54%, reaching a 3,35-year high of 0,65%, while real ten-year bond yields, often seen as an indicator of the gold price trajectory, have reached 2019%. last recorded in March 1, compared to -300% at the beginning of this year. On the basis of gold's historical relationship to real yields, it could even be concluded that gold is currently overvalued by more than $ XNUMX.

Risk of recession

In the context of this significant handicap, we also increasingly see the risk of a hard landing in the sense that a recession in the United States may occur even before inflation is brought under control, thus ushering in a period of stagflation that has historically been favorable for gold. Ben Carlson, author of finance books and market commentator, wrote somewhat playfully on Twitter:

"The Fed needs to raise rates as quickly as possible to contain inflation, thereby creating a recession for us where it can lower rates to save us from recession."

We believe that hedging against the rising stagflation risk with gold along with traders' response to the highest level of inflation in 40 years as well as turbulence in the stock markets and cryptocurrencyare some of the reasons why the price of gold has not fallen at a pace dictated by rising real yields. Accordingly, we observe what investors actually do, in contrast to what they say, based on flows in exchange-traded funds. Over the past month, when gold was in the range of $ 1- $ 787, total gold-backed equity holdings remained within a narrow range of 1 tons, around 878 tons. Any major (negative) shift would be needed to undermine our long-held positive outlook on gold, and hence on silver as well.

From a technical perspective, the short-term forecast remains in question, prompting our technical analyst Kim Cramer to make the following comment:

“On Monday morning, buyers tried to push the spot price of gold up, but sellers quickly took control. The intense selling pushed this precious metal back below the two-hundred-day straight moving average and created a bearish engulfing pattern, showing that the market is now being controlled by sellers. This is confirmed by the relative strength index (RSI - Relative Strength Index), showing a downturn in sentiment indicating an increasing risk that the key support at $ 1 may be put to the test.

The weekly chart shows that if the support at $ 1 is broken all the way to around $ 780, no strong support is seen, and a daily close above $ 1 would be needed to reverse the downtrend. ”

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)