In the commodity markets, it's too early for the war premium to be priced

The commodities sector is in constant motion, with numerous factors making it increasingly difficult to navigate. An unprecedented increase in the price of key raw materials since then Russia's invasion of Ukraine over three weeks ago, it lost strength last week; this was most noticeable with crude oil, which momentarily fell below $ 100 per barrel, ending a $ 85 fluctuation while eliminating most of the war premium. The ongoing, though so far unsuccessful, peace talks between Russia and Ukraine, the first of a series of interest rate hikes in the United States and the commitment of the Chinese deputy prime minister to support the economy, contributed to a further increase in volatility in the commodity sector.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

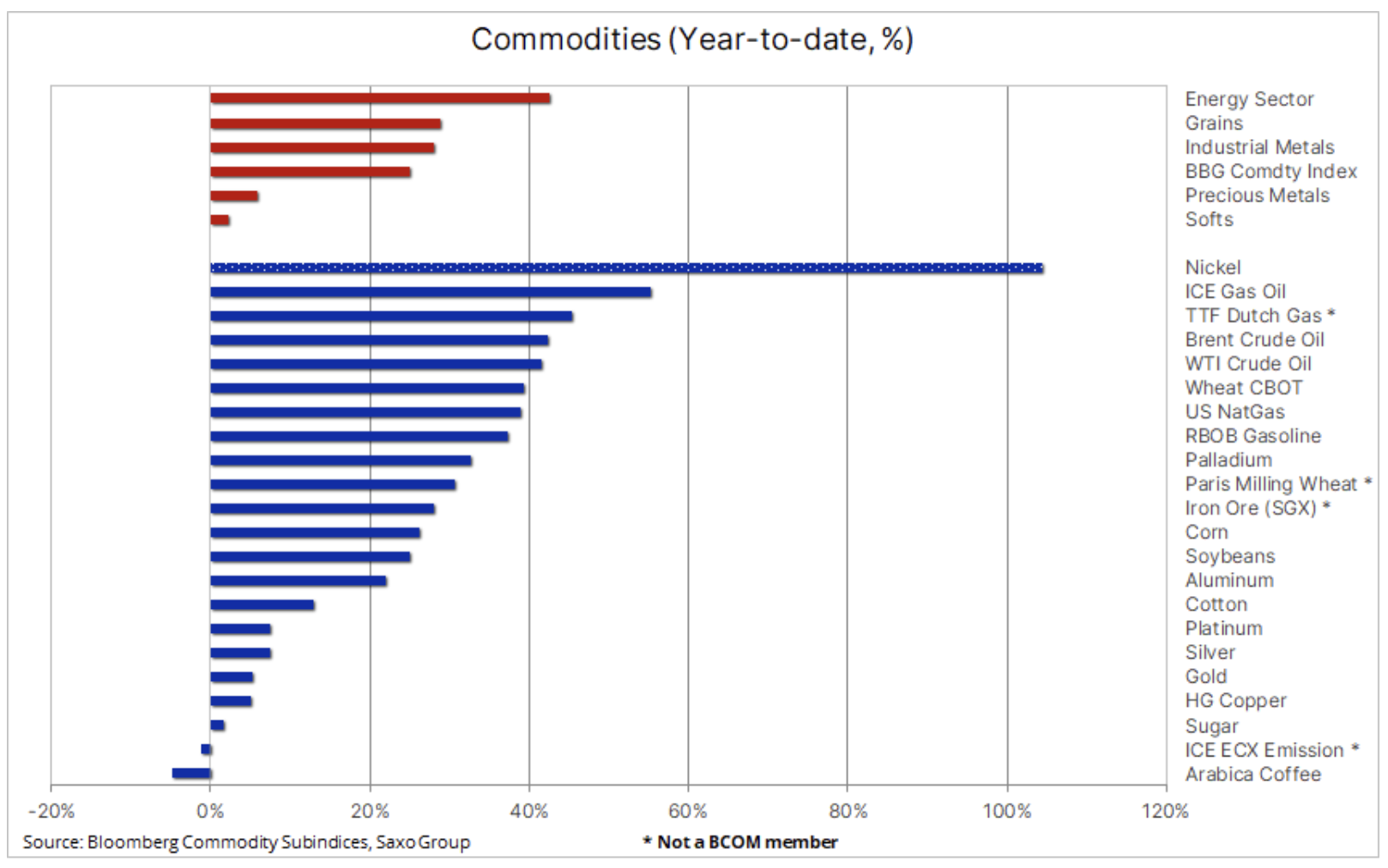

Raw materials, with isolated exceptions, have experienced strong growth since President Putin ordered his attack on Ukraine, resulting in a shift in a market that was no longer worried about supply constraints, but saw its actual decline. As Russia is the second largest supplier of raw materials to the world economy, we are now witnessing a historic move - Russia's increasing isolation and "self-sanctioning" by the international community are cutting off major energy, metals and agricultural supply lines. Before triggering a weekly decline in the commodities sector, these changes resulted in historic movements in terms of prices and price ranges.

Warning: Quotations nickel on the London Metal Exchange do not reflect the current value, which is about 20% lower. The stock market reopened last week after a forced hiatus of over a week. However, the daily limits prevented the fall to the levels visible on the Shanghai futures exchange, which is currently the only source of price discovery.

After some historic moves and levels hit in the immediate post-invasion period, the Bloomberg Commodity Index, which monitors 24 key commodities futures evenly split into energy, metals and agriculture, calmed down somewhat last week as initial position adjustments and panic responses faded. However, despite a retreat in some markets, this index continues to grow by more than 25% this year, thus exceeding last year's best result since 2000.

Petroleum

Brent oil ended a historic three-week $ 85 fluctuation, which saw the price rise from about $ 97 to $ 139 and then drop back to pre-war levels. The correction from the almost fourteen-year high was the result of talks between Russia and Ukraine, a temporary drop in demand in China due to Covid, and traders downsizing due to high volatility. In our view, the weakening may turn out to be premature, as the decline in supplies from Russia will be felt more and more in the coming weeks, which will more than offset the temporary slowdown in demand in China due to Covid. However, the initiation of a cycle of interest rate increases in the United States will increase concerns about global economic growth, which, despite the supply shortage that has lasted for several months, may prevent oil prices from rising to the last high, but with almost complete elimination of the risk premium, the market will remain sensitive to any deterioration the situation on the Russia-Ukraine line.

In its latest monthly oil market report, the IEA drew attention to a two-way risk to oil prices, as rising commodity prices and international sanctions on Russia could lower global economic growth. On this basis, the IEA has lowered its forecast for world oil consumption this year by 1,3 million barrels per day, largely due to falling demand in Russia, whose economy has slumped to Soviet-era levels; The current lockdowns in China will also contribute to reducing demand. Nevertheless, the possible broadly understood disruptions to Russian oil production remain a threat that, in the opinion of the IEA, is capable of causing a global supply shock on the oil market.

Russia is increasingly isolated and demand for its oil is declining, largely due to self-sanctioning by Western traders in the market. The best indicator to watch in this context is the price of the Russian benchmark Ural oil, which last week showed an almost $ XNUMX discount against Brent crude oil. Considering Russia's limited capacity to store unwanted oil, the IEA is very pessimistic that Russian production of 3 million barrels a day may be suspended from April. Should that be the case, the prices of crude oil, and in particular its products such as gasoline and diesel, would rise to the point where the destruction of demand would begin, and as a result, the fall in demand would be greater than is currently predicted.

Natural gas

European gas market saw a decline along with other raw materials; it was caused by the lack of significant restrictions on gas flow from Russia and the arrival of spring and lower heating demand. The spot price has dropped to close to EUR 100 / MWh, down 70% from the panic peak on March 7, which briefly peaked at EUR 345 / MWh, equivalent to USD 630 per barrel of crude oil oil. Overall, the European gas market is in better shape than feared at the start of the year, following a mild winter and the influx of US LNG supplies, which contributed to the increase in supply, thus preventing fears of depletion. Forecasts for next winter remain problematic, however, as the October-winter futures contract is just below EUR 95 / MWh, pointing to further protracted challenges for industries that consume significant amounts of energy.

Precious metals

Gold, like most other commodities, it fell after a panicked peak, just a few dollars below the 2020 record of $ 2. The combination of lower oil prices, which is currently the best measure of geopolitical risk, and fears ahead of the FOMC meeting on Wednesday, contributed to a correction of $ 074 to key support just below $ 175 per ounce. Then there was a reflection after FOMC Finally, it kicked off a long-awaited cycle of interest rate hikes, and while the stock market surged in response to CEO Powell's optimistic outlook for economic growth, the bullion market was dominated by buy bids amid fears that the Fed would encounter difficulties curbing inflation in an effort to avoid serious slowdown.

The liquidation of long positions by leveraged funds, which have acquired numerous gold futures contracts in recent weeks, may already be over, while participants with a longer investment horizon have been continuously investing in exchange-traded gold funds since the beginning of the war. During this period, the total item increased by 122 tonnes to an annual maximum of 3 236 tonnes, noting that half of this increase occurred during the correction mentioned.

We maintain a positive outlook, believing that inflation will remain high and central banks may find it difficult to slow down sufficiently in the face of the risk of an economic slowdown. In our opinion, the Russian-Ukrainian crisis will continue to support the prospect of rising prices of precious metals, not only due to the potential short-term safe haven offer, which will change, but mainly due to what this tension will mean for inflation which is likely to remain high as global growth slows, which will eventually force central banks, in particular the US Federal Reserve, to abandon further rate hikes and return to the period of fiscal stimulus implementation.

Under such a scenario, we anticipate a further increase in the price of gold, and silver in particular, given our belief in higher industrial metals prices, with a special focus on copper. Gold has already risen 6% in dollar terms and 9,5% in euro terms compared to the 7,5% decline in the S&P 500 index, and the MSCI World index has already shown that despite rising real yields it is able to diversify. Key support at $ 1 / oz and a break above $ 890 / oz will signal new growth potential.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Will global warming help wheat? [Webinar] wheat raw materials webinar](https://forexclub.pl/wp-content/uploads/2024/03/pszenica-surowce-webinar-300x200.jpg?v=1711099347)