Upcoming trouble on the bond market

It's time for investors to light up the red light as amidst strong inflationary pressures and more aggressive monetary policy, the bond market signals a rapid rise in interest rates. Until now, risky assets have suffered from rising interest rates. However, the situation can quickly reverse when spreads in the corporate bond market start to widen as financial policy tightens. As Federal Reserve as it prepares for an interest rate hike, one can expect a decline in breakeven rates and an acceleration in real returns, which poses a risk to risky assets. Nominal rates of return will also continue to grow. Even at this point, they are recording much higher levels compared to the entire year. Taking into account the market volatility, it cannot be ruled out that by the end of the year the United States 10-Year TIPS yield will increase to 0,5% and the nominal yield to 2%.

About the Author

Althea Spinozzi, Marketing Manager, Saxo Bank. She joined the group Saxo Bank in 2017. Althea conducts research on fixed income instruments and works directly with clients to help them select and trade bonds. Due to his expertise in leveraged debt, he focuses particularly on high yield and corporate bonds with an attractive risk-to-return ratio.

Althea Spinozzi, Marketing Manager, Saxo Bank. She joined the group Saxo Bank in 2017. Althea conducts research on fixed income instruments and works directly with clients to help them select and trade bonds. Due to his expertise in leveraged debt, he focuses particularly on high yield and corporate bonds with an attractive risk-to-return ratio.

What is the future of the bond market?

Investors should start to worry about their investments as rising US Treasury yields are driving lower-rated lending.

HYG, iShares iBoxx High Yield Corporate Bond ETF, broke the key support level of 86. Moving averages are declining, which could signal further declines for the fund. After breaking the weak support line at 85,7, the ETF is likely to continue its decline to 84,8.

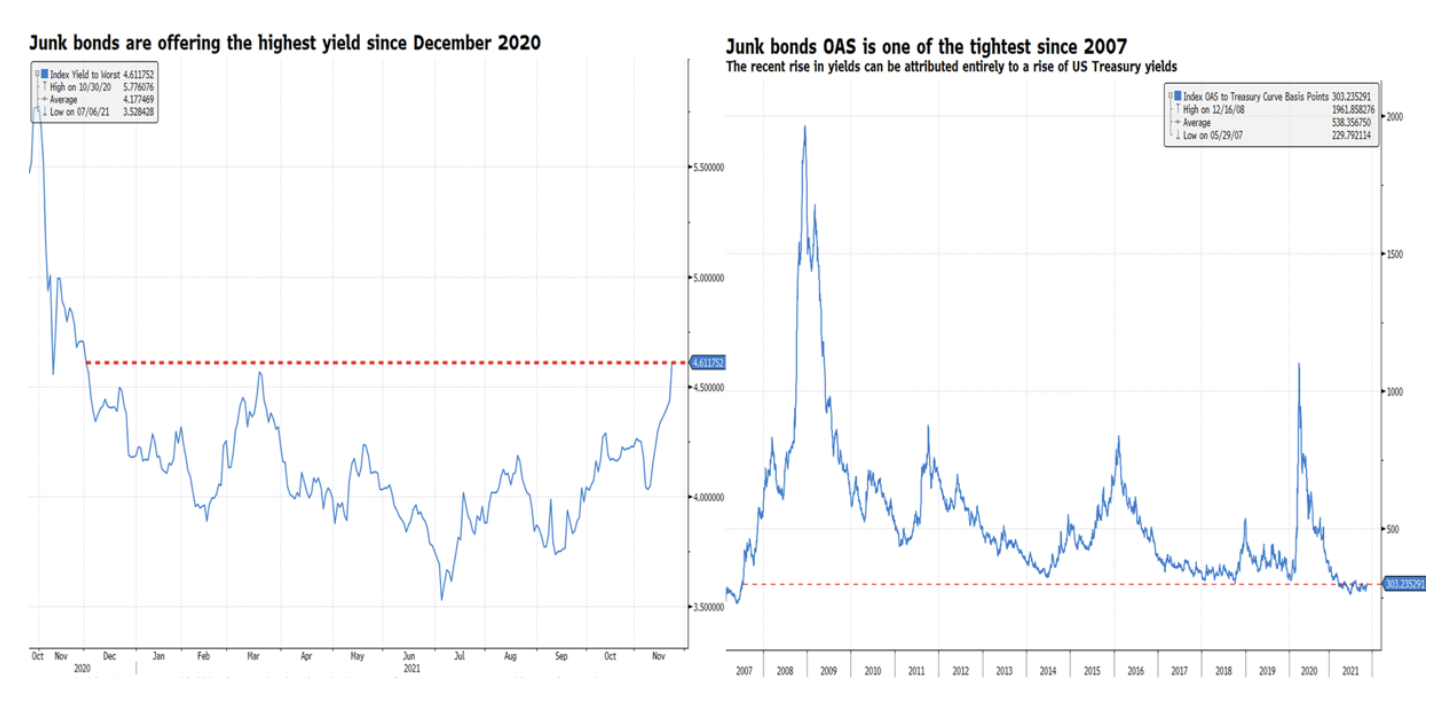

However, do not jump to conclusions. The current decline in HYG and JNK (SPDR Bloomberg High Yield Bond ETF) quotes is entirely due to the recent rise in profitability. While the average yield of the worst of the so-called US corporate junk bonds has risen to 4,6%, the highest level since December 2020, their Option Adjusted Spread (OAS) remains around 300 basis points. This level is identical to the level observed before the 2008 global financial crisis. This means that JNK and HYG are falling due to rising interest rates, and not due to problems in the weaker part of the corporate bond market. While in the case of the bonds themselves, it can be minimized risk of rising interest rates by keeping them until the maturity date, just in case ETFs it is impossible, as there is no such time limit for these products. This means that in the conditions of high inflation and rising interest rates, in order to maintain profitability, the duration of bonds should be shortened as much as possible. The junk bond market may allow this, but be prepared to hold these bonds until maturity.

The problem is that the higher US Treasury yields rise, the greater the pressure on weaker bonds, which will eventually increase credit spreads. At this point, it is too late for risky assets as volatility will become a hallmark of both the bond and equity markets.

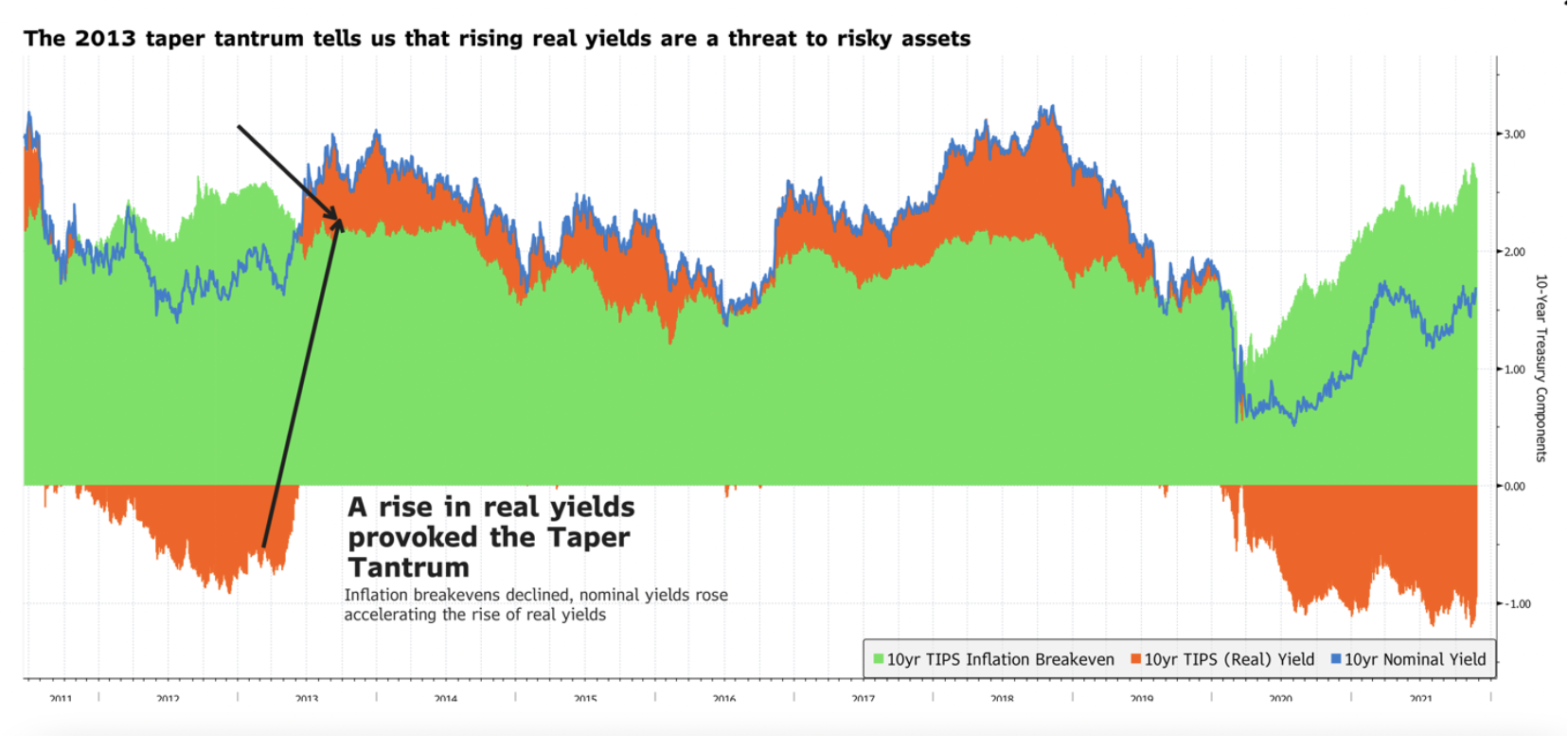

One way to find out if there's a bigger sale is to monitor your real returns. The faster these rates rise, the faster the financing policy for the corporate sector tightens. Real rates of return remain well below zero. However, given that the Federal Reserve is preparing to tighten monetary policy, a decline in breakeven rates and an increase in nominal returns can be expected, which will accelerate the rise in real returns. This can cause a significant outflow not only in the junk bond sector but also in the case of long-term stocks such as stocks, for example tech stocks. This is exactly what happened during the so-called Taper Tantrum in 2013.

It is therefore important to monitor the dynamics of both real and nominal returns. Some important levels are listed below.

Real rates of return

Range trading has been observed on the United States 10-Year TIPS market since August. However, if the stock breaks above the downtrend line, it is likely to rise, testing the resistance at -0,70%. If interest rate hikes accelerate by the end of the year, the real rate of return can be expected to rise to -0,50%. To some extent, negative real rates of return will continue to support the trading. Nevertheless, revaluation will be inevitable due to the rapid increase in real returns.

Nominal rates of return

The United States 10-Year TIPS is in an uptrend. However, it is expected that they will remain roughly the same until the debt limit crisis is resolved, serving as a safe haven in the face of volatility in the money markets. At this point, a break above 1,75% is likely and a further increase to 2% in the face of inflationary pressure and more aggressive monetary policy.

The yield on five-year bonds is also currently in an upward trend and is heading towards 1,50%.

The two-year bond yield is likely to accelerate growth due to earlier interest rate hikes. Yield broke the resistance at 0,55% and is currently in an uptrend, which may quickly increase it to 1%.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-300x200.jpg?v=1709556924)