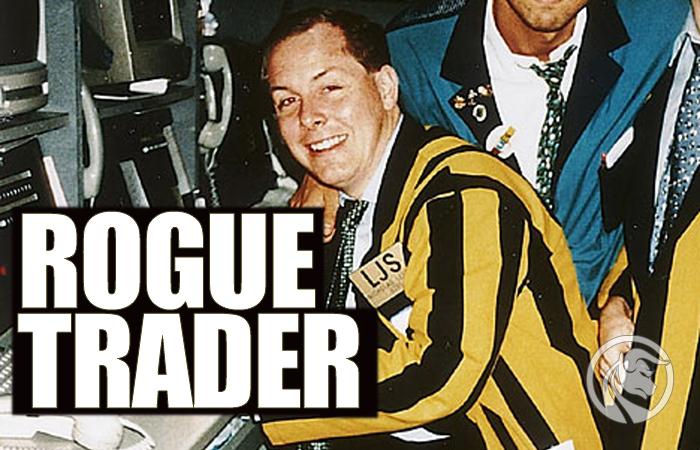

Nick Leeson - the broker who took down Barings Bank

On the pages of the Forex Club we describe the profiles of famous traders (#GreatTraders) who impress, inspire and educate with their investment achievements. This time, however, we want to introduce you to the profile of a well-known broker, such as Nick Leeson. It owes its "fame" to the story of how one man can bring down a huge investment bank. But let's start from the beginning.

yuppie is an acronym for the phrase Young Urban Professional, which meant representatives of the young generation focused on career development. The yuppie community was characterized by pragmatism, individualism, consumerism, conformism and professionalism. Yuppie people were mainly focused on quick professional promotion, which translated into financial success. Their motto was famous: "Work hard, play hard". Yuppie is the generation of the "new wave" of the XNUMXs. In Poland, visible during the transformations of the nineties. The Polish acronym for the American acronym was yuppie. He was the most famous representative of this generation on the stock exchange Nick leesonwhich contributed to the collapse of one of the oldest British banks.

Nick Lesson - the beginning of his career

Nick Leeson was the son of a plasterer and nurse from the English city of Watford. He graduated from the school with poor results, passed the Level A exams in English Literature and History with a result of C and D. However, he failed in mathematics. At the age of 18, he started working at the Cottus & Co bank, where he cleared paper checks, credited and debited customer accounts. In 1987, he moved to the back office in Morgan Stanley. He was employed in a unit responsible for trade futures contracts i options. His task was to clear derivative transactions. After another two years, Nick decided to look for a better paid job. His next employer was Barings Bank. His salary was not very high, around £ 12 a year. His first major assignment was to travel to Hong Kong to resolve problems at the Jakarta's Indonesian branch of the bank. His job was "Cleaning up the mess"as a result of poor documentation of shares and bonds. Despite a long backlog, Nick solved the problem in less than a year. This won the trust of his superiors, which translated into a further career in the bank.

Career in Singapore

The success in organizing the documentation and Nick's diligence opened another door for him in the development of a career in the bank, which was to be the development of the Singapore branch. The branch operated under the name of Barings Securities Singapore Ltd (BSS). Initially, it was supposed to be exclusively involved in brokerage in the stock market, but the increased interest in trading in derivatives slightly changed the profile of the branch's operations. As a result, the branch had to hire more brokers to handle orders on SIMEX contracts. In 1992, he entrusted the energetic Nick Leeson as branch manager of Barings Bank. The branch had a very high degree of autonomy compared to other institutions that were "closer to the headquarters". Nick was responsible for the team of brokers that would trade the securities and derivatives on the Singapore Stock Exchange.

Organizational structure of the bank

It is worth noting that Nick Leeson has held several positions in Singapore, being both a director and a back office manager. As a result, Nick was both his supervisor and subordinate at the same time. Additionally, as the head of the back office, he controlled the registration and booking of transactions concluded by brokers. So in effect, Nick was one-man control of the entire Singapore branch.

The supervision of the Singapore branch was also poorly designed. As a result of a poorly implemented organizational change, Leeson was subject to four people working in different countries at the same time. Fuzzy supervision made the control not very thorough. This, in turn, was one of the reasons for the problems that followed.

However, according to the bank, the "leaky" protection was not a problem. This was due to the trust management had in Nick. The trust was driven by the Indonesian facility's rapid improvement in its operational performance. Additionally, the activity of the Singapore branch was not to cause additional operational risk. The activities of BSS were to focus on the execution of client orders and arbitrage transactions on index futures. Arbitration was possible due to the fact that there were times when futures on the Osaka Stock Exchange had a different value than the futures contracts traded on the Singapore Stock Exchange. According to the bank, these transactions did not require additional supervision.

Account 88888

The Chinese pay a lot of attention to symbols. One of them is the number 8, which is considered a lucky number. This is because the number eight, Eight bā) is pronounced very similar to 发 fā which means Get rich fācái - get rich.

In the Singapore branch technical account 88888 was used to post incorrect transactions. But the account turned out to be the nail in the coffin of one of the oldest British banks. Initially, the account was intended to hide the erroneous transaction of one of Leeson's subordinates. However, with time it became a "storehouse" of losses that resulted from Nick's unsuccessful speculation. At first, speculation paid off for Barings Bank, but their origins were hidden. The board thought the gains were due to the arbitrage deals. Due to the fact that many managers did not have sufficient knowledge about derivatives, they did not ask uncomfortable questions. As Leeson was responsible for the registration of the deal and supervision was fuzzy, no one had the full picture of the situation.

It's just that the initial success wasn't lasting. Lack of experience and youthful fantasy resulted in generating large losses on speculative transactions. In 1992, the losses on the lucky account "amounted to 2 million pounds. However, due to the forgery of documentation, the Singapore branch was still generating profits. Nick's yuppies' ambition prevented him from admitting defeat. Therefore, he increased positions, averaged losses. He made the "basic" mistakes of a budding speculator. The problem, however, was that he wasn't losing his own money, only his clients' money.

In 1993, the loss already amounted to over 23 million pounds. However, it was not the end of the trader's losing streak. In order for Nick to be able to maintain the margin required by SIMEX, Lesson issued options, falsified bills and documents. He forged signatures or fabricated correspondence. This allowed me to gain time. Nick hoped the streak would reverse and he would cover the losses generated on account 88888 from the profits.

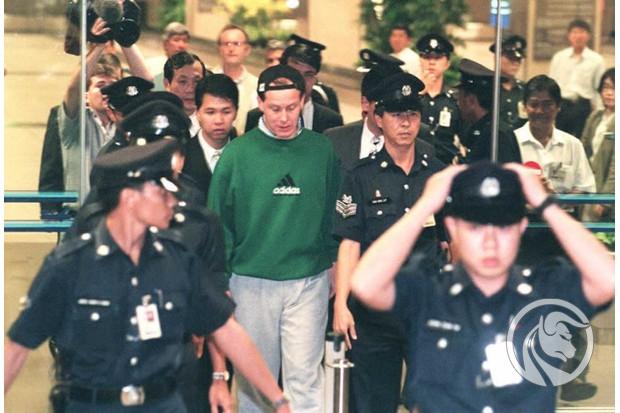

Nick Leeson after being detained in Singapore

At the same time, Lesson continued to send out reassuring reports. According to them, the branch generated over £ 28,5 million of profit from arbitration transactions. As a result, he got a bonus of around £ 0,5m. Nick has become a real bank star. However, the "lucky bill" deficit grew worse. At the end of 1994 the loss on account 88888 was already over £ 200 million.

But Nick didn't give up, he increased the leverage to make up for the losses faster. In early 1995, he created a short straddle strategy. The transaction was supposed to bring profits in a situation of low volatility, but in the event of a sharp change in the price of the underlying instrument, the losses would be very large. Moments after the position was established, the Kobe earthquake occurred, which caused an increase in losses on the account. Nick hoped the market would return to gains, and he was increasing long positions as a result. However, the growth scenario did not materialize. In February 1995, the bank's loss amounted to as much as 827 million pounds. Then Nick Leeson decided to leave the bank branch and flee to Kuala Lumpur. He left a note on his desk with the words on it "excuse me".

Escape and further fate

Leeson's escape did not last long, he was detained at the Frankfurt airport. After his arrest, he was deported to Singapore, where he was charged with embezzlement. He was sentenced to 6,5 years, but did not serve a full sentence. In 1999, he was released from prison following a diagnosis of colon cancer. However, despite the negative prognosis of doctors, he regained his health.

Barings Bank, which had to file for bankruptcy, was not fortunate in the same way was acquired by ING for a symbolic pound. The bank, which in its history served the royal family, operated during the Napoleonic Wars and colonization, ended its activity due to the lack of supervision and the greed of one trader.

Ewan McGregor as Nick Leeson. Source: Rogue Trader movie, 1999.

The story of Nick Leeson is contained in his autobiography - Rogue Trader (Polish title: "Łajdak on the stock exchange"). The book was screened in 1999 under the same title (Polish title: Spekulant). He played the main role Ewan McGregor. After his release from prison, Nick gave lectures at universities and private companies. He also served as manager of the Irish football club Galway United.

The history of this speculator shows that one should not trade under the influence of emotions and that one should always admit defeat. History shows that leverage can be a fantastic tool, but if misused, it can cause huge losses. Nick's infamous place at the top was taken away from Nick only in 2008 thanks to a trader Jerome Kerviel, its shortcomings in risk management cost Societe Generale around € 5bn.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)