The never-ending story - extraordinary EU meeting on energy

Czechwhich currently preside over the EU Council, convened an extraordinary energy meeting in Brussels on 9 September. The topic of the meeting will be specific measures aimed at counteracting the energy crisis in the face of record-high electricity prices.

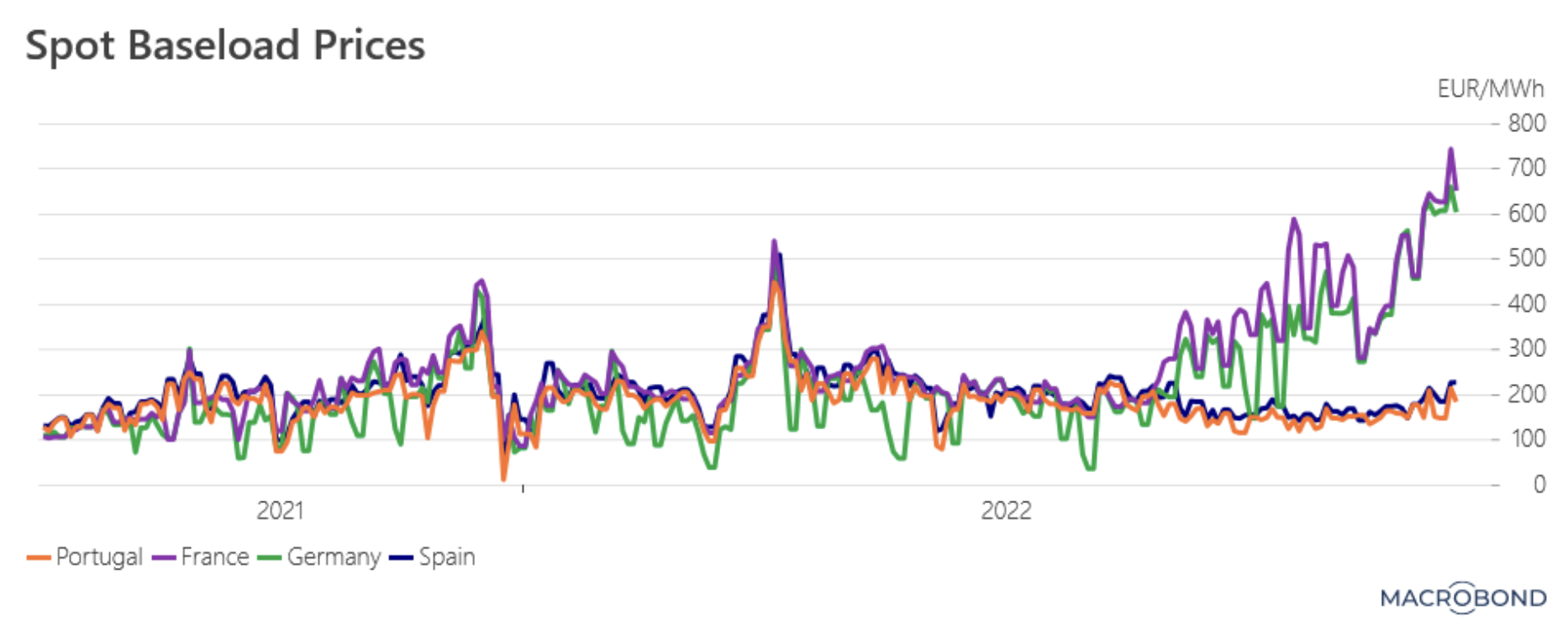

Last week, electricity prices in France in 1-year futures exceeded EUR 1000 per megawatt-hour (MWh) for the first time in history, while pre-crisis rates in excess of EUR 75-100 per MWh were considered high. Three options are mainly considered: targeted compensation measures for low-income households, application of the "Iberian exception" across the EU (temporary decoupling gas prices on electricity prices) and a more fundamental reform of the European electricity market. The answer to which of these options will work best is not straightforward. Each of them has its drawbacks. In our opinion, the energy crisis will stay with us for longer. Cheap energy won't come back. We have entered a new reality of high inflation and high energy prices.

About the Author

Christopher Dembik - French economist of Polish origin. He is global head of macroeconomic research at a Danish investment bank Saxo Bank. He is also an advisor to French parliamentarians and a member of the Polish think tank CASE, which took first place in the economic think tank in Central and Eastern Europe according to the report Global Go to Think Tank Index. As a global head of macroeconomic research, he supports branches, providing analysis of global monetary policy and macroeconomic developments to institutional and HNW clients in Europe and MENA. He is a regular commentator in international media (CNBC, Reuters, FT, BFM TV, France 2, etc.) and a speaker at international events (COP22, MENA Investment Congress, Paris Global Conference, etc.).

Christopher Dembik - French economist of Polish origin. He is global head of macroeconomic research at a Danish investment bank Saxo Bank. He is also an advisor to French parliamentarians and a member of the Polish think tank CASE, which took first place in the economic think tank in Central and Eastern Europe according to the report Global Go to Think Tank Index. As a global head of macroeconomic research, he supports branches, providing analysis of global monetary policy and macroeconomic developments to institutional and HNW clients in Europe and MENA. He is a regular commentator in international media (CNBC, Reuters, FT, BFM TV, France 2, etc.) and a speaker at international events (COP22, MENA Investment Congress, Paris Global Conference, etc.).

Unbearable cost

According to calculations by a Brussels think-tank Bruegel, since September 2021, EU governments have earmarked nearly EUR 280 billion to help businesses and households cover higher energy bills. Statistically, the largest European economies allocated the most funds for this purpose (Germany EUR 66 billion, Italy EUR 49 billion, and France EUR 44 billion). In terms of percentage of GDP (which allows for a more reliable comparison), the greatest financial support in this regard was provided by Greece (3,7%), Lithuania (3,6%) and Italy (2,8%). However, this situation cannot last forever. Several countries plan to reduce financial support by replacing it with a more targeted approach, focusing mainly on low-income households. In France, the government has cut energy prices for 2022 (gas prices have been frozen at their fall 2021 levels, and electricity prices have only risen by 4% this year for households). However, this is an expensive approach, requiring almost € 20 billion - or roughly half the country's annual education budget. Given the current energy prices, it is expected that this year these costs will rise to 40 billion euros. In light of higher interest rates and the risk that large-scale financial support will further accelerate inflation, we believe that many European governments will opt for the French model. They will decide to reduce the financial package aimed at easing the energy crisis. In addition, several EU countries face the need to rescue energy companies that are threatened with insolvency (eg German Uniper and two Viennese municipal companies). This situation is only just gaining momentum.

Electricity intervention is back on the table

On Tuesday, the President of the European Commission (EC) Ursula Gertrud von der Leyen admitted that the EU electricity market no longer fulfills its role. This is a delicate statement. There are usually two options on the table. Both of them will be discussed at the next extraordinary meeting on September 9.

The first involves the introduction by the entire EU of the so-called "the Iberian exception" in order to establish electricity prices. In mid-April 2022, the European Commission agreed that Spain and Portugal would create a temporary mechanism to make the gas price independent of the electricity price for a period of 12 months. In practice, gas prices have been capped at an average of EUR 50 per megawatt hour. As a result, electricity bills were halved for around 40% of Spanish and Portuguese regulated consumers. This type of solution could be applied across the EU. They are especially supported by countries such as Germany, Austria, Belgium, Spain and Portugal. However, it has its drawbacks. It led to a sharp increase in energy exports to France. As a result, much of the subsidy actually went to that country. Additionally, prices for the remaining 60% of consumers continue to rise rapidly.

The second option is the separation of the wholesale electricity market into two segments: a mandatory pool for the low variable cost technology market (including wind, solar and nuclear) and the conventional fossil fuel market. Greece is in favor of this option. It would represent a more fundamental reform of the EU's electricity market. However, it has a few downsides, especially with regard to existing long-term contracts. Many more such emergency meetings will be needed before a coherent approach is approved. Rather, one should not expect major decisions to be announced next week.

The atomic option

In our opinion, the European energy crisis is an opportunity to rethink the political position on nuclear energy. Last week, several NGOs launched a petition against Switzerland's planned departure from nuclear energy by 2027. The decision was made after the 2011 Japanese nuclear power disaster at Fukushima. July's World Nuclear Association statistics show that France and the UK are the two main European countries with the greatest nuclear energy potential. Other countries, however, do not seem to consider this option. In Germany, the Greens prefer to restart coal-fired power plants rather than rethink a plan to abandon nuclear energy. This approach is puzzling. Nuclear energy is not without its drawbacks (eg corrosion problems in nuclear reactors in France). On the other hand, it guarantees energy independence and lower energy prices in the long run. While Asia is moving towards nuclear power (South Korea is withdrawing from its plans to decommission nuclear power, and China is accelerating the construction of a huge number of reactors), there is concern that the EU will continue to look unfavorably on this energy sector for ideological reasons. Whether we like it or not, nuclear power is currently the best way to reduce dependence on expensive fossil fuels and advance rapidly in the ecological transition.

Spot electricity prices in France and Germany are still at record highs - EUR 641 and EUR 604 per MWh, respectively. In Spain and Portugal, however, they remain relatively low - around EUR 200 per MWh. However, this is about 10 times more than before the COVID-19 pandemic.

EUROPE'S ENERGY PROBLEM [Video report by Forex Club]

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response