A surprise from OPEC + during the week with the omicron variant

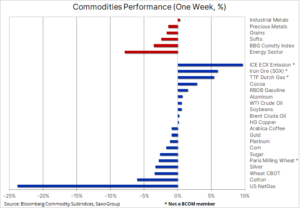

Commodities saw a decline for the second consecutive week in response to recent concerns about demand and economic growth over a new variant of the coronavirus. Moreover, as we mentioned in our latest forecast, the US Federal Reserve has officially shifted its approach from focusing on job creation to tackling soaring inflation, thereby increasing the likelihood of a faster reduction in fiscal stimulus and accelerated interest rate increases. The bi-weekly loss as measured by the Bloomberg Commodity Index is at its highest since March 2020, but would be even greater if OPEC + group it has not been possible to "sell" to the market another decision to increase production.

Agricultural products

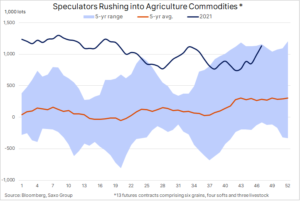

After weeks of strong demand for agricultural products, there was a slight reversal after the omicron variant and improved regional weather conditions contributed to profit taking on some of the recent record holders, most notably cotton, sugar and wheat. In recent weeks until November 23, funds have been aggressively purchasing agricultural products while reducing their exposure to energy and metals. As a result, their combined long position in 13 major futures contracts rose to a six-month high of 1,13 million lots, corresponding to a face value of $ 43,5 billion.

This explains some price declines in the past week, when recently open longs have been reduced, not least due to changes in the fundamentals of individual futures markets, but as part of an overall effort to minimize risk in response to the uncertainty surrounding the omicron option.

The FAO released its monthly index of world food prices for November, which showed a rise of 1,2% m / m, while the y / y growth slowed to a still very high level of 27,3%. This index is now less than 0,5% below its 2011 record, and last month's growth was fueled by strong increases in the prices of cereals such as wheat, as well as dairy and sugar.

The divergence of world natural gas prices continues

In the US, it has dropped to nearly $ 4 / MMBtu, while in Europe, the Dutch benchmark TTF gas contract remains above $ 30 / MMBtu, driven by tight supply and strong cooling demand. On the other hand, US gas prices have come under pressure from milder-than-usual weather and rising production; This week it led to a 22% drop in prices this week, the biggest weekly drop since 2014. While the EU is already experiencing a severe energy crisis, which could worsen even more with another cold winter, the US has stock levels in underground tanks has returned to the long-term average, which almost completely excludes the risk of winter shortages.

Petroleum

For crude oil, the past week was characterized by high volatility. Traders have faced the risk of another coronavirus-related decline in demand, the recent announcement of the release of US strategic reserves, and a no less important response from the OPEC + producer group that met on Thursday to set its January production target. Prior to this meeting, Brent crude oil fell 21% from its October high, and the very broad bands reflected deep uncertainty in the market, which experienced huge volatility as bad and less-bad news for the omicron swelled in.

Before Thursday's meeting, the market expected the group to defend oil prices by reducing or potentially even canceling January's output boost. Meanwhile, OPEC + managed to accomplish an extraordinary feat, supporting the price while increasing production by the current 400. barrels a day. It was successful for the following reasons:

- The market had previously priced in a significant and as yet unrealized decline in demand related to the omicron variant.

- The group has kept its meeting status "in session" which means that it can meet and adjust the production level shortly before the next scheduled meeting on 4 January.

- The decision was made to ease the political tensions with regard to large consumers, led by the United States, with the potential to limit the amount of strategic reserves released due to the lack of demand from refineries.

- Members with production reserves such as Russia and Saudi Arabia wanted to increase production, in part to compensate for shortages from producers such as Nigeria, Angola and Equatorial Guinea, which currently produce around 500. barrels per day below their allocated quota.

- Finally, the recent drop in WTI oil below $ 70, and even lower further down the curve, potentially reduces the threat from US producers who may now adopt more cautious spending plans for 2022.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Despite a potential shift of several quarters, we maintain a long-term positive outlook for the oil market as it faces long years of potential underinvestment - major players are losing their appetite for big ventures, in part due to uncertain long-term outlook for demand, but also, increasingly, , due to credit constraints on banks and investors due to ESG (environmental, social and governance issues) and the emphasis on green transition.

Chart: From a technical point of view, Thursday's price action created the so-called hammer formation, which often signals a reversal of the latest trend. For this to be true, Brent crude oil would need to close back above the two-hundred-day moving average, currently standing at $ 72,85.

Gold

For the next week, gold did not show any spectacular results: it was unable to find buyers, even though concerns about the omicron variant caused US Treasury yields to decline and the dollar to weaken, at least temporarily. Adding to this the progressive destruction of the value of many so-called and until recently very popular "bubble actions" (covered in one of our daily podcasts), the associated exodus also did not increase the demand for investment metals as collateral.

Instead, the price had dropped to a one-month low of $ 1, less than three weeks after the failed bullish breakout to $ 762. This is an example of a market that has seen many failed breakouts in both directions over the past five months, and has ultimately become a noisy, but within range, market unable to take a clear direction. It is not known what could affect this in the short term - on the one hand, gold finds support in the form of persistently low real yields and increased uncertainty related to the coronavirus, on the other hand, it struggles with the possibility of a more aggressive approach by the US Federal Reserve in the issue of fighting inflation.

Following reappointment, both Powell and Brainard, the new vice president, presented a marked shift in rhetoric. Among other things, Powell said: “We know that high inflation is dealing a blow to families, especially those who are less able to bear the higher costs of basic products and services such as food, housing and transportation. We will use our tools both to support the economy and a strong labor market, and to prevent the strengthening of higher inflation. ”

Chart: As we mentioned, the current technical picture looks very chaotic: resistance is currently at $ 1, which is in line with the average price seen over the past five months, while the closest support area can be found around $ 792, while then $ 1.

Industrial metals

The industrial metals sector did not see any major price movements last week on non-ferrous metals such as copper and aluminum. The market has begun to focus on what may await us in 2022, in particular the potential impact of the slowdown in growth in China on prices and the growing demand for the so-called green metals, which will be the key elements of the energy transformation, based on the shift from fossil fuels to renewable sources.

In our view, over the past few months, copper has performed relatively well, given rising concerns about the economic outlook for China, and in particular for the Chinese real estate sector, where a number of companies are on the brink of bankruptcy and housing sales have plunged sharply. An additional handicap is the stronger dollar and central banks are starting to focus more on inflation than on fiscal stimulus. To counter concerns about economic growth in China, Deputy Prime Minister Liu He announced that this year's growth should exceed its targets, and the government plans to increase support for enterprises.

Against this background, we believe that the current negative macroeconomic factors related to the slowdown in China's housing market will begin to weaken in early 2022, and with both copper and aluminum stocks already low, this could trigger prices to return. to record levels from the beginning of this year and will even exceed them.

Staying on the subject of inventories, we recently saw aluminum and copper inventories on the LME fall to their lowest levels since 2007 and 2005, respectively. In fact, six industrial metals listed on the London Stock Exchange are now deported, and such a synchronized reduction in demand could have been the case recently. observed in 2007

Chart: Copper HG has remained at an average level of USD 4,35 since April, with the current stock tied to a range between USD 4,2 and USD 4,5 with the main support found in the USD 4 region. The lack of momentum in recent months has resulted in a sharp reduction in speculative hedge fund long positions, which could lead to a significant spike in activity when the technical and / or fundamental picture improves.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)