New Lithium Regulations in Chile; QXNUMX results still do not improve moods

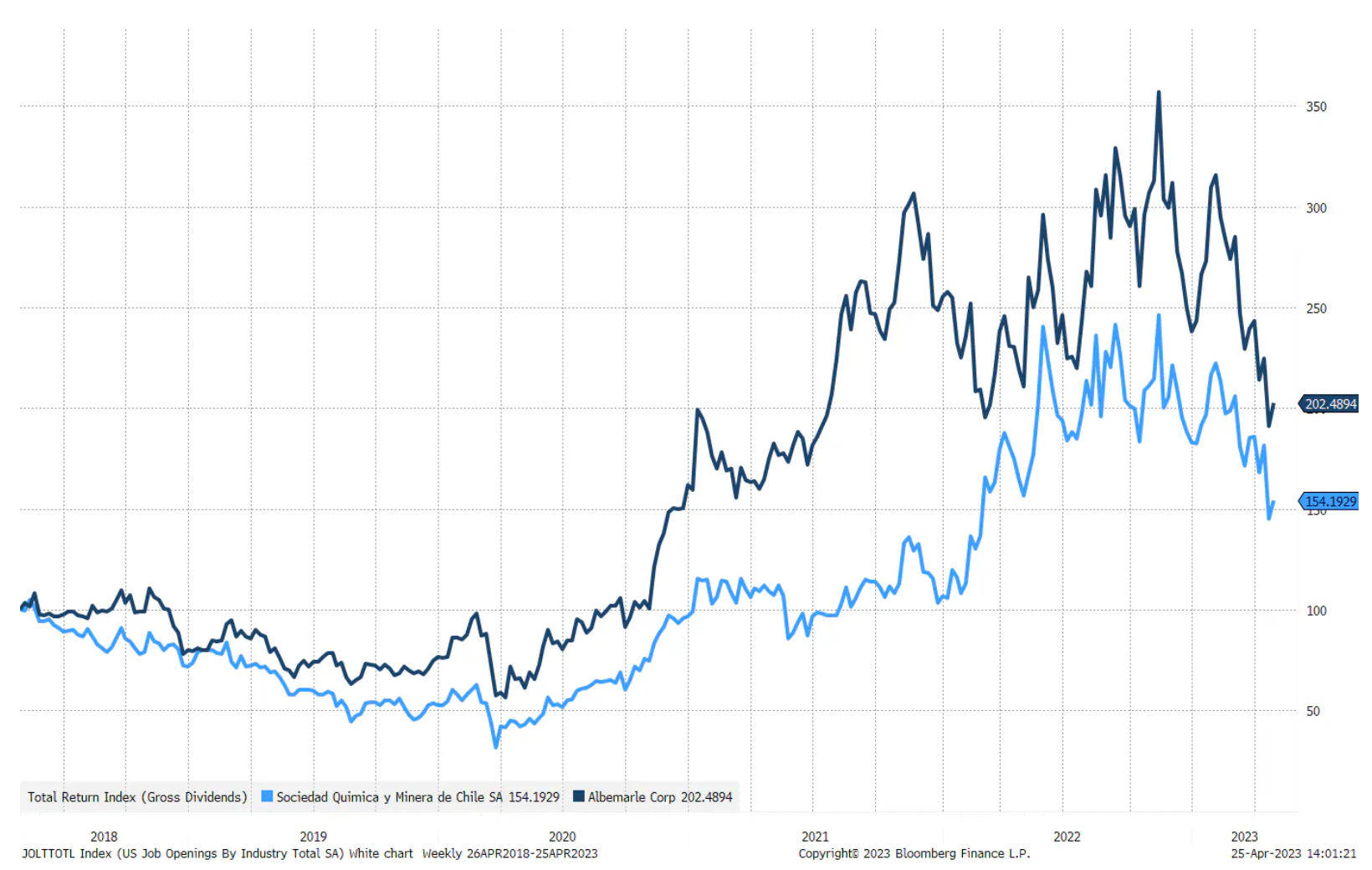

Lithium is one of the most important metals for electrification in the coming decade, and investors are showing interest in the industry. Last week, news spread around the world that the Chilean government would soon publish a new regulatory framework for the lithium industry, including the establishment of a new state-owned mining company. The initial reaction of investors in SQM and Albemarle shares was relatively negative. It's worth taking a look at this industry and what it means for these two mining companies. Similarly, a brief summary of recently released corporate earnings reports will be useful.

The forecast for lithium remains unchanged despite the interference of the Chilean government

On Friday, we published an extensive one analysis of the global lithium market, focusing on the associated opportunities and threats. Shortly after the publication, however, information appeared that the Chilean state-owned copper companies Codelco and Enami were in talks with the private sector to increase lithium production. State involvement in the lithium market through Codelco and Enami is short-term and will last until a national mining company is established. Left-wing president Gabriel Boric is about to present a new strategy for the development of the lithium industry in Chile, which will mean the establishment of a new state-owned company dealing with the extraction of this metal. Chile is trying to attract capital to its own lithium industryto increase production in order to secure more tax revenues while protecting the environment. SQM and Albemarle are currently mining in Chile, and the media release was presented as a plan to nationalize the industry in Chile, causing SQM and Albemarle shares to drop by 17,8% and 10% respectively on Friday.

While the initial market reaction to SQM and Albemarle was negative, the reality is that Chile needs new lithium resource rules. Lithium is classified as a "critical metal", which means that the government does not issue new exploration licenses under current regulations from the 70s. This naturally prevents production from growing to its full potential, bringing Chile's share of the global market down to 25% and projected to be just 2030% by 10 if nothing changes. Although the media presents the new rules as de facto nationalization, a new hybrid model involving not only the state treasury but also the private sector is more likely. A number of sales companies argue that the new lithium regulatory framework may prove marginally positive for SQM and Albemarle. Time will tell whether the market agrees with this thesis. The only thing that everyone can agree on is that Chile's new regulatory framework will mean more lithium supply by the end of this decade.

If we look at the lithium outlook, it still looks solid. The demand for lithium in the future will be driven primarily by the demand for lithium-ion batteries, which in turn is driven by the demand for electric vehicles. There are many different demand forecasts, and judging by the rate of growth in electric cars, we believe that these forecasts are on the low side and that the industry will continue to grow dynamically until 2030, constantly creating a picture of demand that exceeds the available supply. In the fourth quarter, the increase in deliveries of electric vehicles amounted to approximately 52% y/y, and taking into account the prognostic indicators, this growth will slow down this year, but not too much.

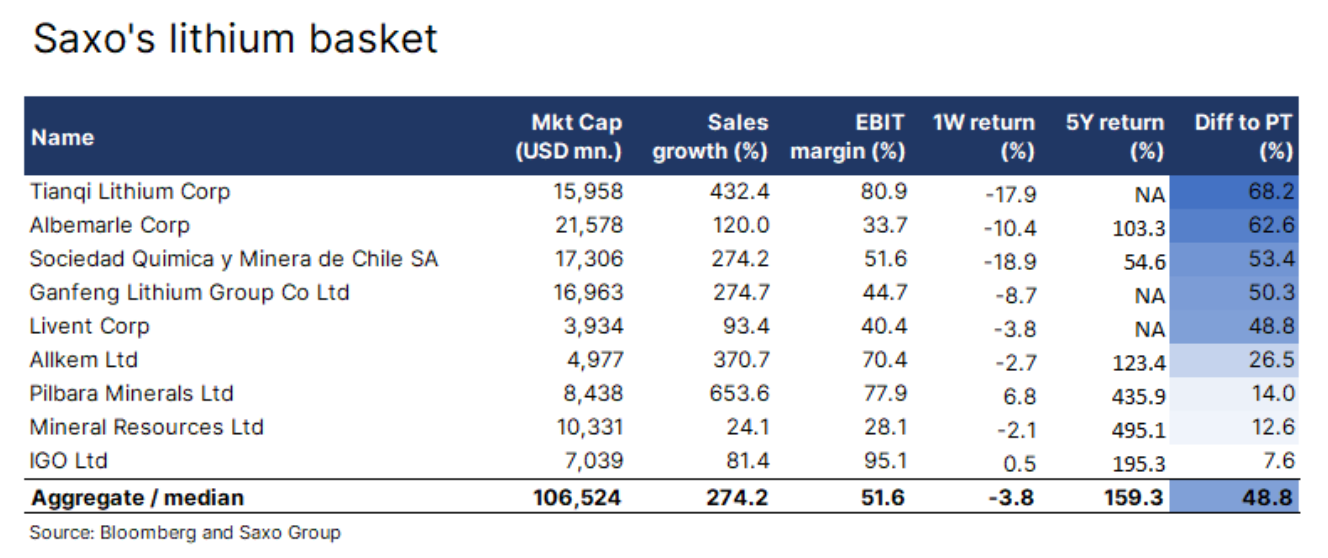

The table below presents the shares of the largest listed companies mining lithium. It is worth noting the high dynamics of revenue growth and very attractive operating margins. Analysts on the sales side are also very positive about the lithium industry, and the statements of representatives of the BHP and Rio Tinto capital groups show that the world's largest mining companies are considering acquisitions in this industry.

The countries producing the most lithium in the world in 2021 are:

- Australia (53%)

- Chile (25%)

- China (13%)

- Argentina (6%)

- Other (3%)

Based on identified lithium deposits, the five countries with the largest reserves in 2021 are:

- Boliwia

- Argentina

- Chile

- United States

- Australia

Legal notice: the analyst owns SQM shares

Conclusions from the publication of profits

Many companies have recently posted their profits; below is our short summary and opinions. It should also be remembered that the two most important publications, i.e. company reports A i Microsoft, were expected after the US stock market closed. Taking into account the earnings for the first quarter published so far, as well as market reactions, these publications did not turn out to be the positive catalyst that investors were hoping for.

Banco Santander

The net result in the first quarter turned out to be better than expected due to a strong increase in net interest income generating the rate of return on tangible equity (return on tangible equity, ROTE) at the level of 14,4% compared to the previously estimated 12.4%. A negative phenomenon is the outflow of deposits from Spanish companies and the lack of profit in Brazil. The banking sector is not yet seen as an attractive investment again.

Nestle

Higher than estimated organic revenue growth as a result of implementing a strong pricing policy. The result shows that stocks of the largest capitalization companies from the global consumer staples sector are a strong defensive investment.

Novartis

Revenues and profits in the first quarter exceeded expectations, and as a result, the Swiss pharmaceutical company revises its forecast for 2023 upwards. The planned spin-off of Sandoz will most likely take place in the second half of the year. The results confirm the positive momentum both across the industry and within Novartis.

UBS

Q1,03 net income was $1,86 billion vs. $8,1 billion expected; revenues were also disappointing compared to previous estimates. The rate of return on tangible equity (ROTE) fell to 14.6% compared to the expected level of XNUMX%. This is partly due to the establishment of provisions for litigation related to residential mortgage-backed securities (residential mortgage-backed securities, RMBS) in the amount of USD 665 million. The share buyback has been temporarily put on hold to allow for liquidity and balance sheet management while Credit Suisse is absorbed by UBS. The results indicate that the company will be loud in the future, in particular in the context of the integration of Credit Suisse.

Spotify

Strong results for Q22: monthly active users increased by 515% y/y to 15 million, and premium subscribers - by 210% y/y to 156 million. Both of these values significantly exceed previous estimates. On the other hand, the streaming service reported an operating loss of EUR XNUMX million in the first quarter. Despite lower yields in the short term, investors are happy as QXNUMX forecasts for paying and active users are above consensus, suggesting a higher rate of growth. Overall, Spotify is still an entity that has yet to get firmly on its feet and become extremely profitable.

UPS

Worse-than-expected revenues and profits in the first quarter were the result of lower prices and lower volumes. Projected revenue and operating margin are low and UPS expects volume to remain under pressure. UPS also points to disappointing US retail sales. From a macro perspective, this result is slightly worrying.

PepsiCo

Impressive Q8 results: both revenue and profit easily exceeded estimates, leading to an upward revision of the forecast for organic revenue growth for the current fiscal year to 6% from the previous XNUMX%. Unlike UPS, this result shows that the Beverages and Snacks segment is still in good shape, with consumers continuing to shop despite inflation.

CHECK: Pepsi Co. – Much more than sweet drinks [Guide]

GE

Better-than-expected profits for Q2023 and GE slightly raise the free cash flow forecast for XNUMX, which is in the lower parts of the range. As in QXNUMX, the renewable energy segment will continue to generate losses in QXNUMX as well. The results highlight that industry demand is quite stable at the moment.

3M

Further changes in the management of 3M and the announcement of job cuts by 6. The company continues to struggle with rising costs and seeks to restructure its operations. 3M still predicts revenue growth of -2 to -6% this year, and consumer markets remain weak. From a macro perspective, this is not the most optimistic message.

McDonald's

Impressive results for the first quarter: both revenues and profits significantly exceeded estimates; Q12,6 revenue grew 8,2% vs. 45% projected, indicating that consumers are accepting higher prices with little demand disruption. McDonald's expects this year's operating margin to be XNUMX%. The results only underscore that McDonald's is a fantastically managed company.

About the Author

Peter potter - director of equity markets strategy in Saxo Bank. Develops investment strategies and analyzes of the stock market as well as individual companies, using statistical methods and models. Garnry creates Alpha Picks for Saxo Bank, a monthly magazine in which the most attractive companies in the US, Europe and Asia are selected. It also contributes to Saxo Bank's quarterly and annual forecasts "Shocking forecasts". He regularly gives comments on television, including CNBC and Bloomberg TV.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![CRB index – one of the popular commodity market benchmarks [Guide] crb index](https://forexclub.pl/wp-content/uploads/2024/05/indeks-crb-184x120.jpg?v=1715055656)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response