Bonds - the potential of Chinese debt and emerging markets

We have got used to the reality of practically zero interest rates. We dealt with reductions in practically every economy and it is hard to find exceptions. The situation related to the first wave of coronavirus forced central banks to carry out a number of actions aimed at cushioning the decline in GDP. Have they succeeded? We don't judge. The effects of the actions taken are of a long-term nature, so we will observe the actual changes in the economic situation and market structure for years. The first COVID-19 hit was a fight against the "unknown". We did not know exactly how or what to fight. Hence we can explain the quick reactions of the central banks to the news of the new arriving patients. In the meantime (between the first and second waves), new solutions of fiscal policy were applied - average inflation. Tactic adopted by Federal Reserve she declared us quite bluntly that the pressure on possible interest rate hikes due to inflation would be abolished in the near future. So where to look for profitability?

Greater profitability

Emerging markets are (and have been) a place that has been a strong capital absorber in times of increased risk appetite. This is due to the simple fact - they offer higher rates of return. How is it at the present time?

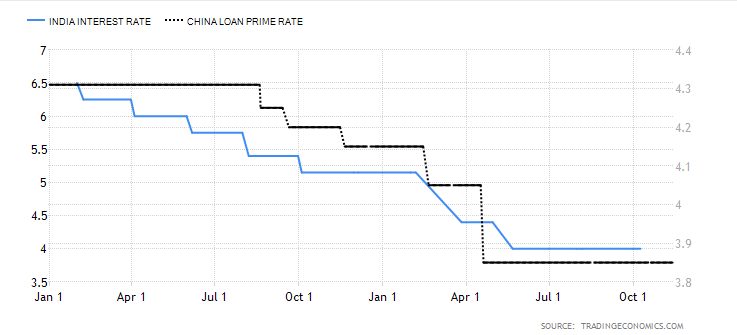

Source: Trading Economics

Above we have presented the current India and China interest rates. We are deliberately omitting Russia or Turkey as the next representatives of Emerging Markets. It is more about showing the values which, despite the fact that the historical rates were much higher compared to the current rates in the United States or Europe, remain quite high. Of course, there are a lot of factors that influenced (and influence) their shape. What is significant, however, is that longer market interest rates did not fall as significantly as in the US. Therefore, debt securities, despite a higher credit risk, will be a more interesting alternative for investors than US government bonds.

How much is the Chinese debt market worth?

It is worth saying in this regard that the Chinese debt market is currently the second largest debt in the world. Its value is estimated at nearly USD 16,4 trillion. So there is a lot to choose from and be interested in. The potential of Chinese bonds also comes from the economy itself, which is more flexible, contrary to appearances, than other global economic conditions. Central control makes it more predictable. It can even be said that the government can tailor it to the needs of the present world (from export to import and production). Hence, if we look at Chinese and US government bonds, they are not very correlated with each other. The ability of the Chinese authorities to efficiently and effectively implement the policy they have presented in the past. This is certainly China's strong point. The strong influence of the government on Chinese markets is nothing new.

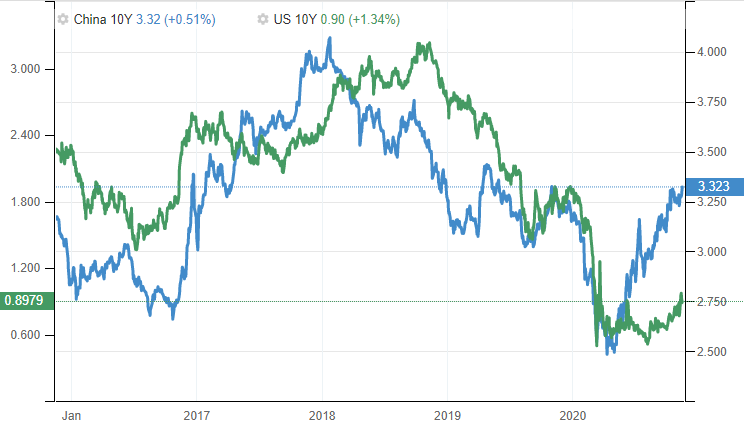

Of course, there are arguments about the return and profitability. Nevertheless, the Chinese debt market looks very promising at the moment. The comparison above the securities are collected over a 5-year period. If we looked only at the current year, the profitability of the "emerging" ones reached levels close to 3,2%, while the American equivalent fell by about 0,9%.

In this comparison, I deliberately omit the short-term debt issues because of the larger discrepancies and the long-term debt analysis. The basic question that we should ask ourselves at this point is - where do such large discrepancies come from? Of course, one argument is the economic model, the other, in my opinion much more important - the behavior of the central bank. While the US Fed was buying mass debt securities from the market, the People's Bank of China remained relatively passive.

An opportunity or a threat to the Chinese currency?

Renminbi can gain. Approaching this topic strongly analytically, opening markets to foreign investors is synonymous with the arrival of new capital. Moreover, central banks can see the profitability of the Chinese debt market and buy securities, even for their own reserves. Of course, the bonds are denominated in their own currency, so there is an interesting opportunity for the Renminbi to grow in importance as a reserve currency. The appreciation of the yuan in international markets would of course be a lengthy process. In the short term, however, due to the favorable profitability of Chinese debt, the capital allocation process in the east may accelerate significantly.

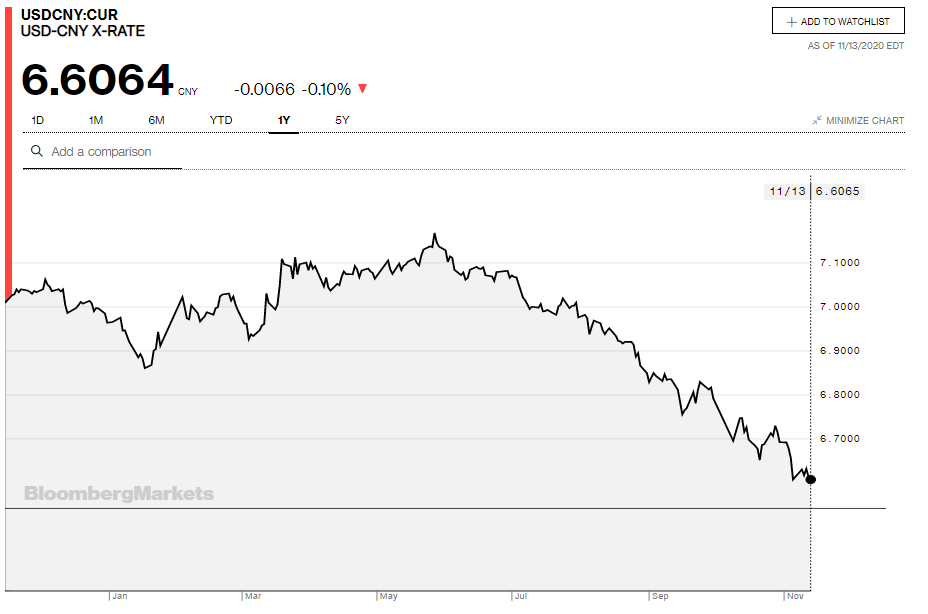

Source: Bloomberg

This year, the Chinese currency gained slightly against the dollar, which is clearly seen in the chart above. China's current policy goes in quite the right direction. It uses a period of US weakness to bring some freshness and liquidity into its own debt market. In addition, FTSE Russell announced in September that Chinese bonds will be gradually included in the index of global government debt securities, which de facto will increase their demand.

The Chinese government itself is increasingly moving away from US debt securities. This year, the Treasury Department reported that since mid-September 2020, the Chinese government has disposed of nearly $ 1,08 trillion in US debt securities. It was the biggest sale since 2015. The American economy, which currently lives mainly on issued loans, is in a way losing its largest credit partner.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)