Turnover on Emerging Markets currencies returns to normal

Turnover on Emerging Markets currencies returns to normal. Is this the first signal of a return to stability in the markets?

Coronavirus has undoubtedly disrupted global stock exchanges. We have witnessed numerous anomalies in the valuations of some financial instruments that have grown against common sense. In the meantime, investors have got used to this state of affairs. Analysts are also much more cautious about all kinds of forecasts, due to a kind of "inability" to predict the behavior of market participants. The past quarter was even fantastic proof that the bad macroeconomic environment or poor condition of economies are not an obstacle to the growth of even such instruments as stock. Returning to the currency market, however, during "pre-pandemic" there were some relationships between currency baskets that we did not observe during the hottest period of COVID-19 spread. Emotions are falling somewhat, therefore enthusiasm and demand for Emerging Markets currencies also. Volume reports for June clearly indicate a liquidity outflow from Emerging Market. We invite you to a short summary.

Emerging Market returns to old levels

Old, i.e. better or worse? A lot in this matter is explained to us by the study conducted by Mosaic Smart Data, which, among others, deals with broadly understood currency market analysis. As part of a joint project with CLS (which provides research data), it was noticed that liquidity, especially on emerging market currencies, was returning to pre-COVID-19 levels. The last three weeks of June were particularly authoritative in this respect. Major currencies have lost their "popularity". Practically at USD 2-3 a day, turnover on EUR / USD or USD / JPY decreased. Therefore, we could conclude that investors feel quite at ease in the markets. Risk aversion is slowly and gradually coming back, as demonstrated by recent strong increases in indices.

Little progress

A large proportion of liquidity providers and brokers in June it recorded a small, positive change in turnover at Forex market. Volatility decreased slightly. Despite good results in terms of m / ma even y / y, the dynamics clearly decreases. However, an adjustment should be made to the data presented. The holiday period is usually the time when turnover in the markets clearly decreases.

One of the good examples we have described theoretically above is Saxo Bank. The reports he published show that he recorded a slight increase in trading volume for the month of June. The data indicate that on a monthly basis we observed a slight improvement of 1,7%. Translating this into hard numbers, it amounted to USD 158,7 billion in May and USD 161,4 billion in June.

Source: Saxo Bank

If we were to compare monthly turnover in annual terms (y / y) we already have much better data showing an increase above 20%. However, 2019 was not very good. Given the solid slowdown, we should be guided in the assessment of results by the m / m dynamics rather than comparing June 2020 to June 2019. The actual improvement in market volatility occurred very clearly in March this year. Many brokers and liquidity providers enjoyed record-breaking turnover on their clients' accounts at that time.

Trade boom on European floors

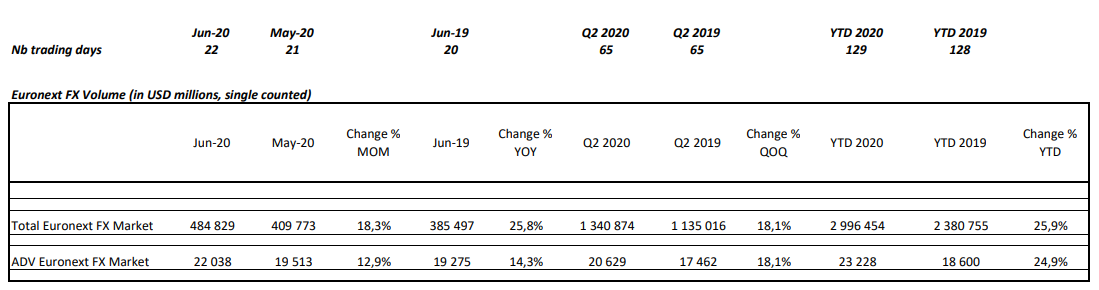

Referring to the title "stability" I will only add that this term covers the condition of the markets before the pandemic. It is important not to equate the word with stagnation. Certainly, we will not observe this or that in the markets of the Old Continent in the coming month. Data from Euronext FX, the largest pan-European stock exchange, are surprising again. Although it was not as good as in March (the third month of the year was the best for the vast majority of liquidity providers and brokers), June can be considered the time when these results were approached.

Source: Euronext

Trading on currencies on the Euronext stock exchange reached a total of $ 484 billion in June 2020. It represents an increase of 18% in m / m (from $ 409 billion in May). Trading platforms operating on other continents reported slightly worse results, but with a similar trend. For Euronext, it is the second best volume reading in 2020 after the platform recorded a record $ 839 billion in March this year. The record day was 09.03, which brought a turnover of USD 54,6 billion.

A slight slowing of interest in main currencies at the expense of Emerging Markets currencies should not be a constant trend. Good moods on stock exchanges and high prices of gold do not favor the dollar, and thus currencies with a safe haven position. It is not surprising then that EUR / USD i USD / JPY they have lost interest, putting them in the direction of EM, which is currently enjoying greater volatility, and thus attracts investors with greater risk appetite.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-300x200.jpg?v=1710999249)