Options: Rack Strategy - Playing for Increased Volatility

Many investors use directional strategies. This means that they are either long (playing for high) or short (playing for low). However, sometimes the investor is not sure which way the market will move. In such a situation, the directional trader remains out of position and waits for the situation to clear up. However, options offer the opportunity to profit from a sharp change in price, regardless of the direction. An example would be rack strategywhich belongs to combined strategies (combination). The frame consists in the simultaneous purchase of call and sale options at the same strike price and the same time of expiry. Due to the fact that it is necessary to pay a premium for two options, it is quite an expensive strategy. However, the advantage is the possibility of achieving a profit many times greater than the invested capital. From this text you will learn about:

- Advantages of the strategy;

- Disadvantages of the strategy;

- Rack management;

- Short rack strategy.

Frame - building a strategy

The rack strategy is created by purchasing it at the same time put and call options with the same parameters (price and expiry date). Most often it is creating two options with the strike price close to the current price. These options are called ATM. They consist of a time bonus only (no intrinsic value). As a result, when the share price does not change until the expiry of the option, the options expire worthless.

An example would be the creation of a rack Facebook shares May 12, 2021. That day, the shares of the owner of the popular social networking platform were valued at $ 300. As a result, the investor creating the frame had to buy a call option expiring in September 2021 with an exercise price of $ 300 and a put option with the same parameters.

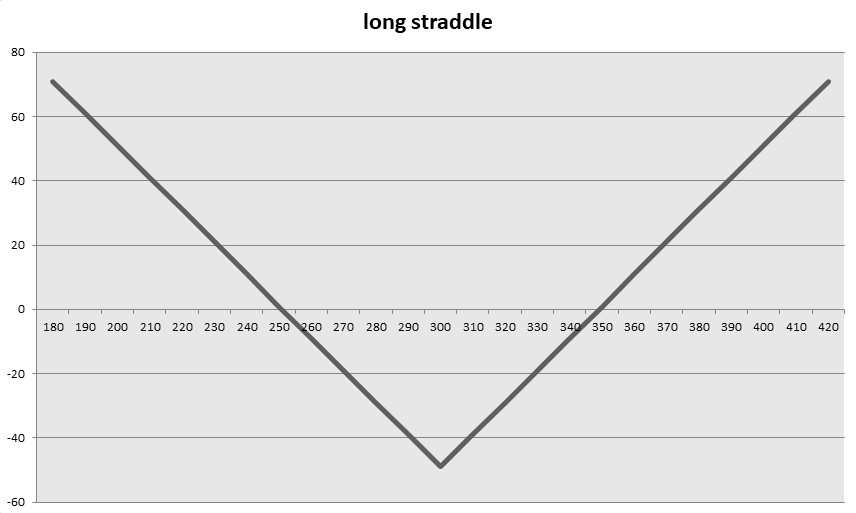

On May 12, an investor paid a premium of $ 17 per share ($ 2021) for a call option that expired on September 25, 1. At the same time, a put option was purchased which expired on September 2500, 17 and with an exercise price of $ 2021. The bonus was $ 300 per share ($ 24). The total cost of building the strategy was $ 1 plus a commission. As a result, the strategy will start generating a profit on the transaction should Facebook's share price rise above $ 2400 or fall below $ 4900. The payout profile was as follows:

At the end of August 11, 2021, Facebook shares were worth $ 359,96. In less than three months, Facebook's shares grew by 20%. This resulted in an increase in the value of the call option and a decrease in the value of the put option. This can be seen in the charts below.

Between May 12 and August 11, 2021, the price (premium) of the call option increased to $ 60,2.

The put option dropped from $ 24 to $ 0,7.

If the trader closed the position on August 11, he would have made a profit of $ 11,9 per share ($ 1190). The return on invested capital would be 24,9%. In this example, the profit from the call option more than covered the costs needed to create the strategy.

Creating a frame "in installments"

A slightly more aggressive structure of the rack strategy is to occupy the “legs” of the rack in various terms. This may mean that the investor first buys a call option, and only after the price of the underlying instrument increases, a put option with the same strike price as the call option is purchased. This procedure allows you to save on the premium paid for the put option. The risk comes from the initial directional position. If the trader is right, he will save on the premium paid and have a better reward / risk ratio.

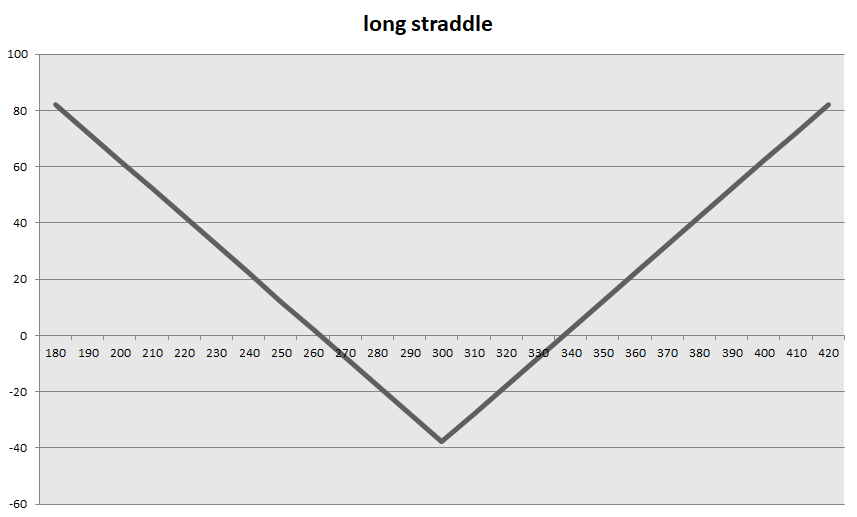

Let's go back to the example with Facebook. The investor, as in the first example, takes a long position on call options on May 12, 2021, paying $ 2500 ($ 25 per share). At the same time, the put option is not purchased until May 24, 2021. The price paid for the put option was $ 12,8 per share ($ 1280). As a result, this rack strategy cost $ 3780. At the end of the session on August 11, the call premium increased to $ 60,2, while the put premium dropped to $ 0,7. The net profit on the transaction was $ 2310, which gave a return on invested capital of 61,11%.

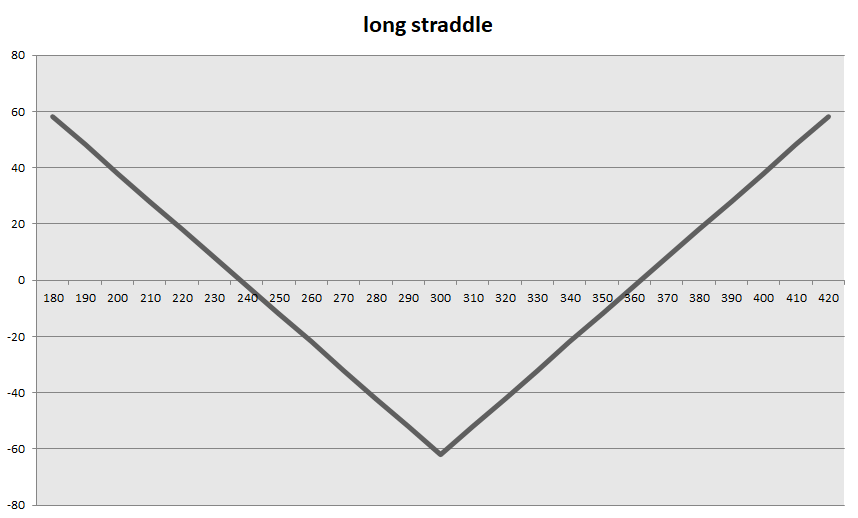

If the situation on Facebook stocks is reversed, building an installment strategy will not bring any benefits. An investor purchased a put option on May 12 for $ 24 per share ($ 2400). At the same time, the investor waited until May 24, 2021 to take a long position on call options expiring on September 17. The premium for this option was $ 37,95 per share. As a result, the cost of the strategy increased to $ 61,95. If the trader had closed the rack position on August 11, the transaction loss would have been $ 1050 or 16,95% of the invested capital.

Rack strategy and volatility

Volatility plays a vital role when building your rack strategy. For an investor in call and put options, which are ATM the most favorable situation is when the implied volatility of the option is low. In such a situation, the options are "cheap" and, as a result, the cost of building a strategy is lower. This gives a more favorable ratio of potential reward to risk.

The opposite is true when an investor creates a frame during high volatility, i.e. when implied volatility is very high. As a result, the time bonus of the ATM option is very large. As a result, the rack strategy becomes more expensive, which lowers the potential reward to risk ratio.

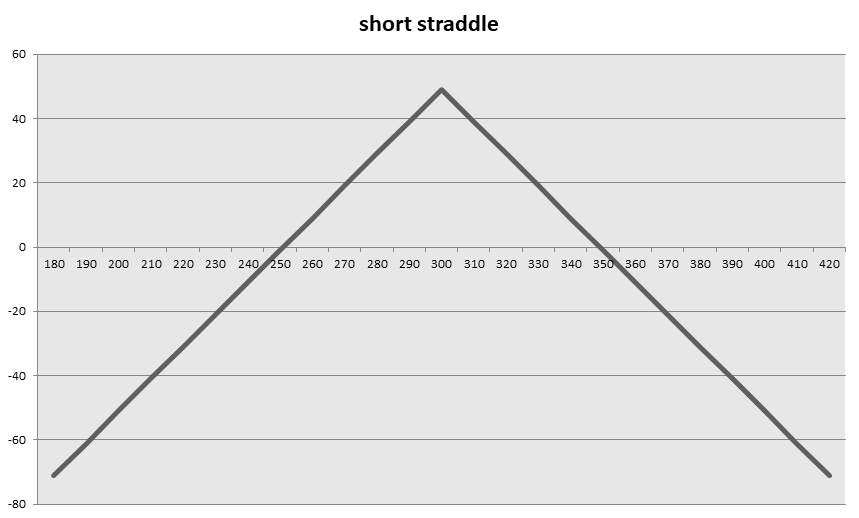

Short frame - construction

It is a strategy that results from the simultaneous issuance of call and put options with the same parameters (strike price and expiry period). In the case of this strategy, the investor assumes that the price of the underlying instrument will not change too much in the assumed time horizon. The maximum profit from the strategy is the received bonus. On the other hand, the potential loss is unlimited (in the event of an increase in the underlying asset). Also, a sharp drop can cause your loss to far exceed your "premium earned".

An example of a large loss generated on a short rack is a transaction on Facebook shares. By issuing call and put options expiring on September 12, 2021, the investor received an approximately $ 17 in equity premium ($ 2021). On August 49, 4900, the put premium dropped to $ 11 (transaction profit). At the same time, the call option premium increased to $ 2021, which generated a loss on the transaction. If the trader closed the position on August 0,7, the net loss on the transaction would be $ 60,2 (the spread and commission aspects for opening and closing the position were omitted).

Short frame and variability

Volatility plays a vital role when building your short rack strategy. For an issuer of call and put options, which are ATMs, the best situation is when the implied volatility of the option is high. In this case, the options are "expensive", as a result, the premium on writing the options is higher than "under normal market conditions". This gives a larger "area" of profitability (option strike price +/- premium received).

The opposite is true when the trader creates a short frame in low volatility when implied volatility is very low. As a result, the time premium of the ATM option is very low. This significantly worsens the relationship between your maximum profit (bonus received) and potential risk.

Wnioski

- To create a rack strategy, it is necessary to buy put and call options with the same strike price and the same expiry date;

- The strategy is profitable when the price of the underlying goes up or down more than the premium paid for both options;

- The potential profitability of the strategy also depends on the level of volatility at the time the rack is made;

- If the price is not changed, the rack strategy generates losses;

- In the case of the short-term strategy, the investor earns if the price does not change significantly within the assumed period.

Do you know that…?

Saxo Bank is one of the few Forex brokers that offers vanilla options. The investor has a total of over 1200 options at his disposal (currencies, stocks, indices, interest rates, raw materials). CHECK

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to invest in Feeder Cattle? [Guide] how to invest in livestock - feeder cattle](https://forexclub.pl/wp-content/uploads/2023/09/jak-inwestowac-w-bydlo-hodowlane-feeder-cattle-300x200.jpg?v=1693821591)

Leave a Response