How to invest in Feeder Cattle? [Guide]

Derivatives were created for many commodities, currencies, indices or shares. In the case of commodities, futures contracts for copper, nickel, crude oil, orange juice and wheat were created. Of course, there are also less popular instruments. These include futures and futures contracts options na breeding cattle (feeder cattle). Livestock futures contracts originated on Chicago Mercantile Exchange (CME). These instruments went public in 1971. After 16 years, the Chicago Stock Exchange introduced the possibility of trading options on this commodity. From this text you will learn how to invest in livestock and what are the pros and cons of trading this instrument.

Download ebook: Futures and Options

Basic information

Despite the fact that there is a fashion for vegetarianism and veganism, animals still play an important economic role. Cattle are used for the production of meat or leather products (leather goods, footwear). The weekly weighted average of cattle prices calculated by the USDA (United States Department of Agriculture) is very important for the valuation of livestock derivatives. The price is calculated based on the average of 12 states. They are:

- Iowa,

- Kansas,

- Colorado,

- Missouri,

- Mountain,

- Nebraska,

- New Mexico,

- oklahoma,

- South Dakota,

- North Dakota,

- Texas

- Wyoming.

One contract is for 50 pounds of cattle, which roughly corresponds to about 000 tonnes of livestock.

Futures contracts are settled in cash. This means that the investor does not have to worry that if he forgets to close or roll over the contract before settlement, he will have to deliver or pick up the commodity.

Participants in the Feeder Cattle market

Who is interested in concluding contracts for breeding cattle? Not surprisingly, there are five main players in the market:

- cattle suppliers,

- cattle recipients,

- speculators,

- arbitrators,

- market makers.

Livestock suppliers they want to hedge against a fall in the price of cattle. For this purpose, they usually take a short position in the feeder cattle market. Of course, they don't have to protect their entire inventory. They can partially hedge a position or take a position greater than the value of the cattle. In the latter situation, the supplier behaves like a speculator who wants to profit from the change in the price of the underlying instrument.

Cattle recipients are mostly companies from the meat sector. For this type of company, the most important thing is to purchase the raw material as cheaply as possible and then process it into a finished product for the final consumer. The worst case scenario is the increase in raw material prices, which cannot be compensated by a price increase. In such a situation, the company is exposed to a decrease in the margin, or even reporting a loss on operating activities. In order to avoid such a scenario, receivers can go long on the feeder cattle contract. In the event of an increase in the price of livestock, the higher buying prices in the spot market will be compensated by futures profits. There are many security methods. It can be full hedging, incomplete hedging and taking a position on futures contracts that exceeds the recipient's demand. Then, partly, the company enters into a speculative transaction that may bring additional profit or loss.

Speculators enter into transactions in order to generate a profit by correctly predicting changes in livestock prices. This type of market participants can choose to trade based on fundamental, technical or price action analysis. The investment horizon of speculators can also be different. Some may want to trade medium term, others may prefer fast trades.

Arbitrators they are the type of investors who try to find inefficiencies in the market and enter into a cost-free arbitrage deal. Thanks to the operation of arbitrage, the forward price oscillates around the model price change. Currently, arbitrage is most often performed by algorithms that try to catch even the smallest market inefficiencies.

Market makers they deal with ensuring sufficient liquidity on the selected financial instrument.

READ: Live Cattle Contracts - How to invest in live cattle? [Guide]

How to invest in breeding cattle?

Futures contracts

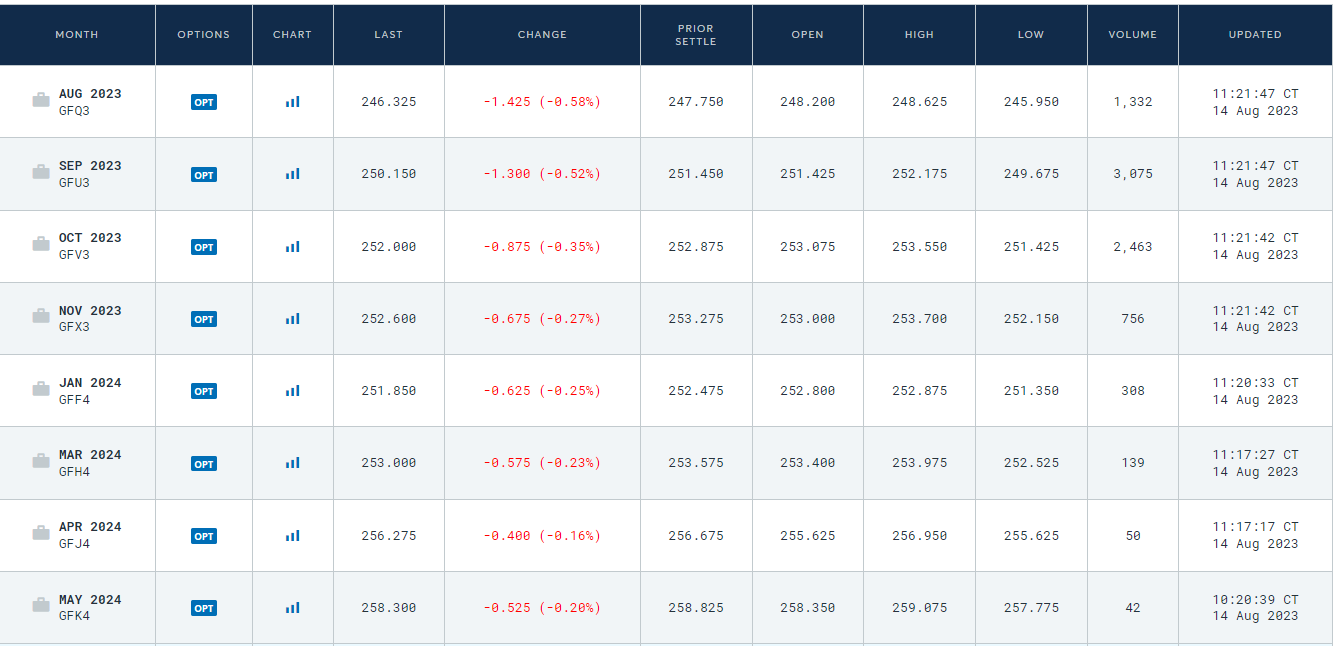

In the image below you can see a breakdown of livestock futures. As you can see, the market prevails contagion. This means that the forward price increases as the time to expiration of the contract increases. For example, the price of the contract expiring in August 2023 was 246,325. However, for the contract expiring in April 2024, the forward price was 256,275.

It is also not surprising that earlier series of futures contracts have the highest turnover. In the example below, it was a contract expiring in September and October 2023.

The simplest livestock strategies are the directional trade. If a trader expects the price of cattle to rise, he can go long. If he thinks the market will fall, he can go short on futures contracts.

The downside to investing in cattle futures is certainly the size of the position.

One contract is for 50 pounds of cattle. This means that the minimum price move on the contract is 000 cents, or $0,025.

The current contract price is 250,475 cents per pound. This means the face value of the contract is over $125. Of course, the investor does not need to have the entire amount to set up a position. The minimum margin required by the exchange is $3.

CFDs

Breeding cattle is not very popular among retail investors. Among the popular Forex/CFD brokers, it is very hard to find a company that offers CFDs for this instrument. However, there is one exception. Plus500 is a broker that offers CFDs on feeder cattle (under the name fodder cattle - GF) with a leverage of 1:10 and a floating spread of (0,2 pips / 0,08% of the instrument value).

Brokers offering trading on Feeder Cattle

How to invest in breeding cattle? We found two offers that offer the opportunity to trade in this market, both in the form of CFD instruments (Plus500) and futures contracts (Saxo Bank).

* PLUS500 CY offer

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. From 72% to 89% of retail investor accounts record monetary losses as a result of trading CFDs. Think about whether you understand how CFDs work and whether you can afford the high risk of losing your money.

Investing in breeding cattle: Advantages and disadvantages

Before deciding to take any position, the investor must know what are the pros and cons of investing in this type of instrument.

Disadvantages

One of the biggest disadvantages is the relatively large face value of the futures contract. As a result, investors with a small portfolio will not be able to invest in this instrument using futures contracts. The solution may be CFD trading, however, it is a more expensive solution than futures trading.

Another disadvantage is that you need to be able to trade in foreign markets in order to invest in livestock futures. Not all brokers operating in Poland offer this option.

Advantages

The advantage of investing in breeding cattle is that the correlation of this asset with bonds or shares is relatively small. For some investors, this can be a big advantage.

Another advantage is that the cattle market moves in clear trends, which can be of great value to trend traders. Livestock futures can also be used for numerous investment strategies. One of them is long-short strategy or the spread between different assets.

Summation

The cattle futures contract is not a very popular derivative. This is due to the fact that the use of this commodity is less crucial for many industries than it is in the case of copper or oil.

Even futures contracts for wheat or corn have much more liquidity. This does not mean that this financial instrument is not useful. Derivatives for breeding cattle are used by both recipients and suppliers of cattle. Speculators can also use this market to profit from price movements.

It is worth remembering that access to this instrument is limited. To trade it, you must have access to the US futures market. Not all brokers offer this. The solution may be to use CFDs on this instrument. However, it is worth remembering that CFDs have higher spreads and often higher costs of holding a position than a futures contract. On the other hand, the advantage is a much lower position value.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to invest in Feeder Cattle? [Guide] how to invest in livestock - feeder cattle](https://forexclub.pl/wp-content/uploads/2023/09/jak-inwestowac-w-bydlo-hodowlane-feeder-cattle.jpg?v=1693821591)

![How to invest in Feeder Cattle? [Guide] bitcoin wallets](https://forexclub.pl/wp-content/uploads/2023/09/portfele-bitcoin-102x65.jpg?v=1693824352)

![How to invest in Feeder Cattle? [Guide] Recep Erdogan and Vladimir Putin](https://forexclub.pl/wp-content/uploads/2023/09/erdogan-i-putin-102x65.jpg?v=1693901427)

Leave a Response