Pepco shares - what is worth knowing before the stock exchange debut? [Guide]

Pepco shares will debut on the stock exchange. How were the shares valued? When will the debut take place? What does a potential investor need to know about this company? This is what this article will be about. First things first. In recent months, many large companies, for which Poland is the main market, debuted on the Warsaw and Amsterdam stock exchanges. Just replace Allegro, Inpost, Czy answear.

The company, which is currently debuting, manages a pan-European chain of discount multi-branch stores. At the end of March 2021, the enterprise had nearly 3250 stores in 16 countries. The group's stores offer home furnishing products, clothing, toys, and fast moving consumer goods (FMCG). However, the Pepco group includes stores such as Pepco, Pundland, dealz and the main supplier of goods Assoc. The stores' offer is aimed at attracting customers who have a limited budget (mum on a budget).

Poundland was founded in 1990. The first store opened in Burton-upon-Trent. In 2009, the company began its geographic expansion, launching operations in Northern Ireland. In the following years, expansion in continental Europe began. In 2011, she also opened the Dealz chain of stores. In 2014, the company made its debut on the London Stock Exchange, with a valuation of £ 750 million. In September 2016, the company was acquired by Steinhoff International's 610 million GBP.

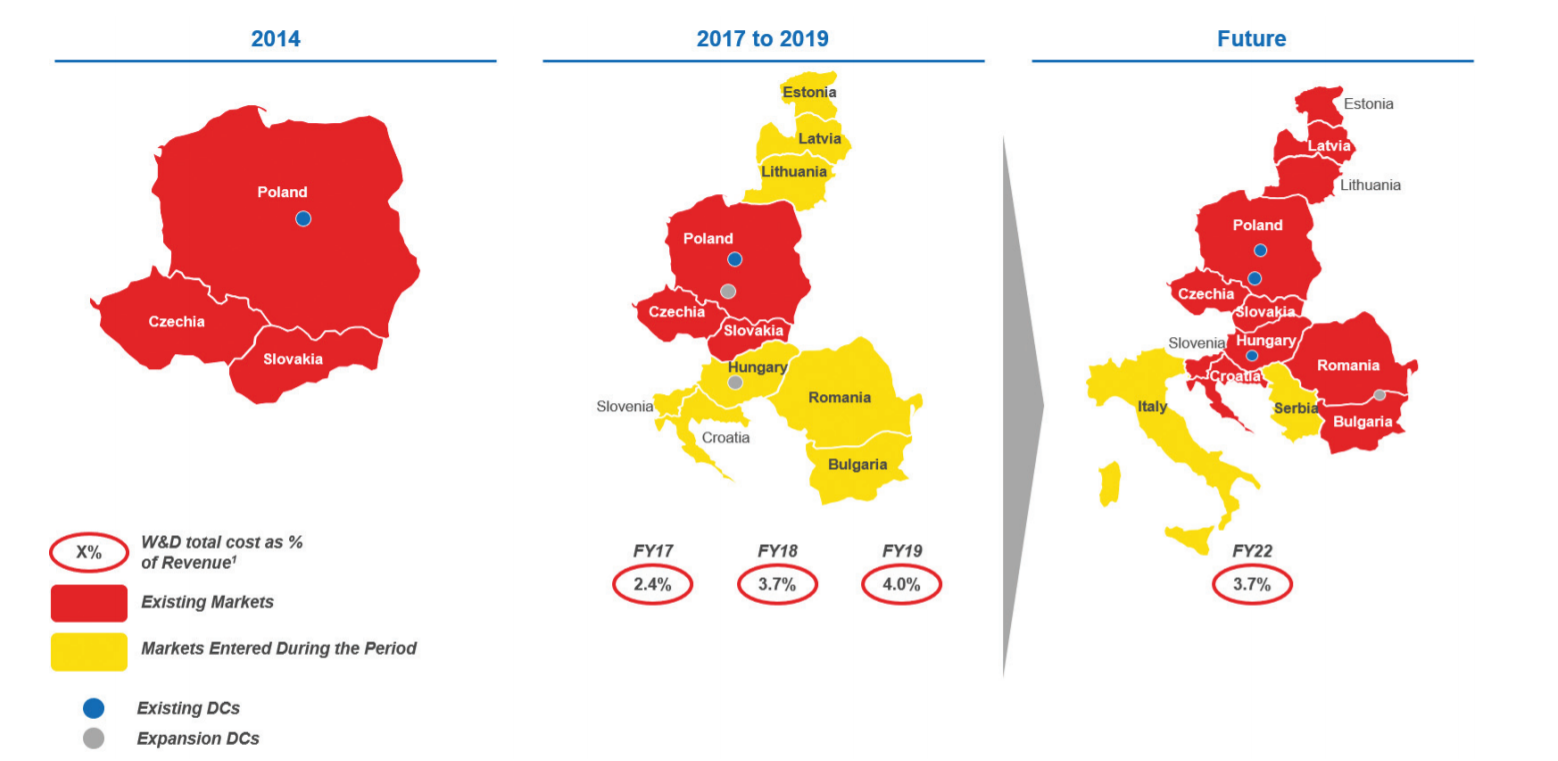

PEPCO was founded in 1999 by Brown & Jackson. Initially, the stores operated under the name of Poundstretcher. The company was acquired by the South African Pepkor SA in 2003. Then the name was changed to Pepco. In the following years, there was a rapid expansion in Poland and other CEE countries (Central and Eastern Europe). In 2013, Pepco started operating in the Czech Republic and Slovakia. Two years later, stores were opened in Hungary and Romania. In 2015, Pepkor SA took over Steinhoff International. The following years brought another geographical expansion (Croatia, Lithuania, Slovenia, the Baltic states).

In January 2018, the Pepco group integrated operations to obtain goods from stores. They were transferred to the PGS unit. Poundland (Hong Kong office) sourcing operations were also included in this unit. Most of the products offered in stores are purchased through the subsidiary PGS (products mainly come from countries such as India, China, Bangladesh, Pakistan).

Later in the article you will learn, among others about:

- IPO

- The shareholding structure and the main characters of the company

- Business activity

- Financial results and debt

- Future plans

Public offering (IPO)

Pepco has announced that it is selling 80,4 million of its existing common stock, of which 2,5 million will be offered to individual investors and 77,9 million to institutional investors. At the same time, it is possible to increase the number of shares offered to a total of 92,4 million shares. The seller of the shares is Pepco Holdco, which is a subsidiary of Steinhoff International. The Pepco share price was set at PLN 40. At the same time, 23,11 million existing shares were offered to selected financing entities for a price of PLN 0,9 billion. The main shareholders and financing entities undertook not to sell the shares (lock-up) within 180 days from the IPO. After the offer is closed, the company will be valued at PLN 23 billion.

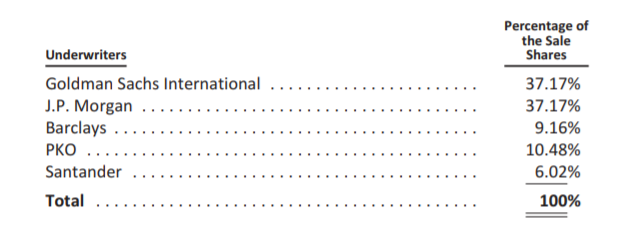

The offer is coordinated mainly by American banks (Goldman Sachs and JP Morgan). One of the major co-coordinators is the Polish PKO Bank Polski.

Source: prospectus

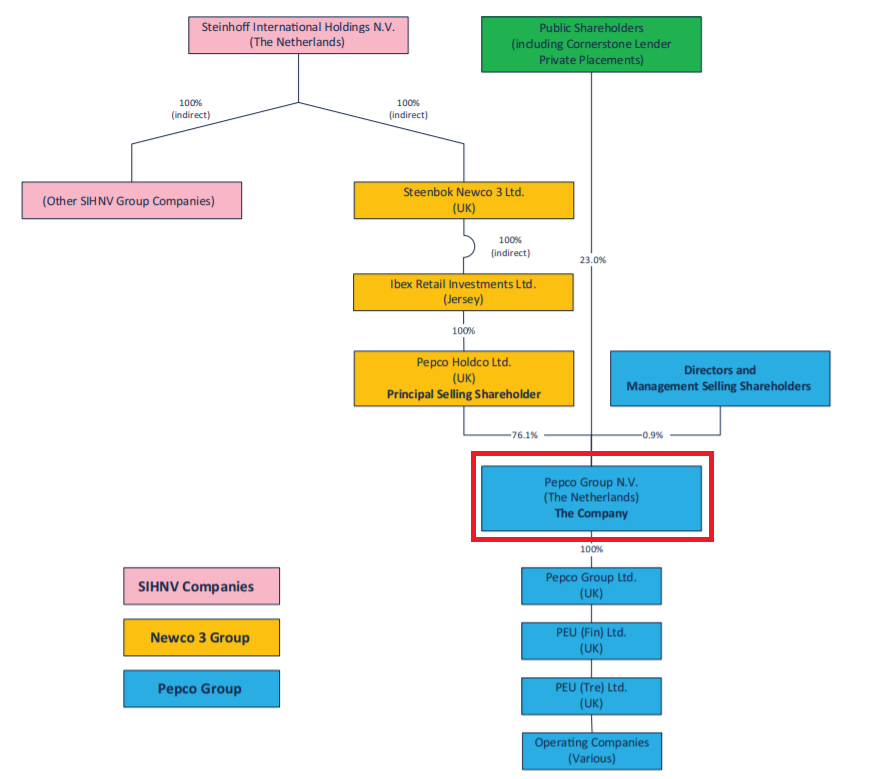

Prior to the IPO, Pepco Group NV was 98,8% owned by Pepco Holdco (100% owned by Steinhoff International Holdings). The remaining 1,2% belonged to the management team. After the public offering, Steinhoff will indirectly own 76,1% of Pepco Group shares. The management staff, on the other hand, still owns 0,9% of the shares. Below is Pepco's organizational structure.

Source: prospectus

General information about the Pepco Group

The activities of Pepco Group are divided into two segments: Pepco and Poundland and Dealz.

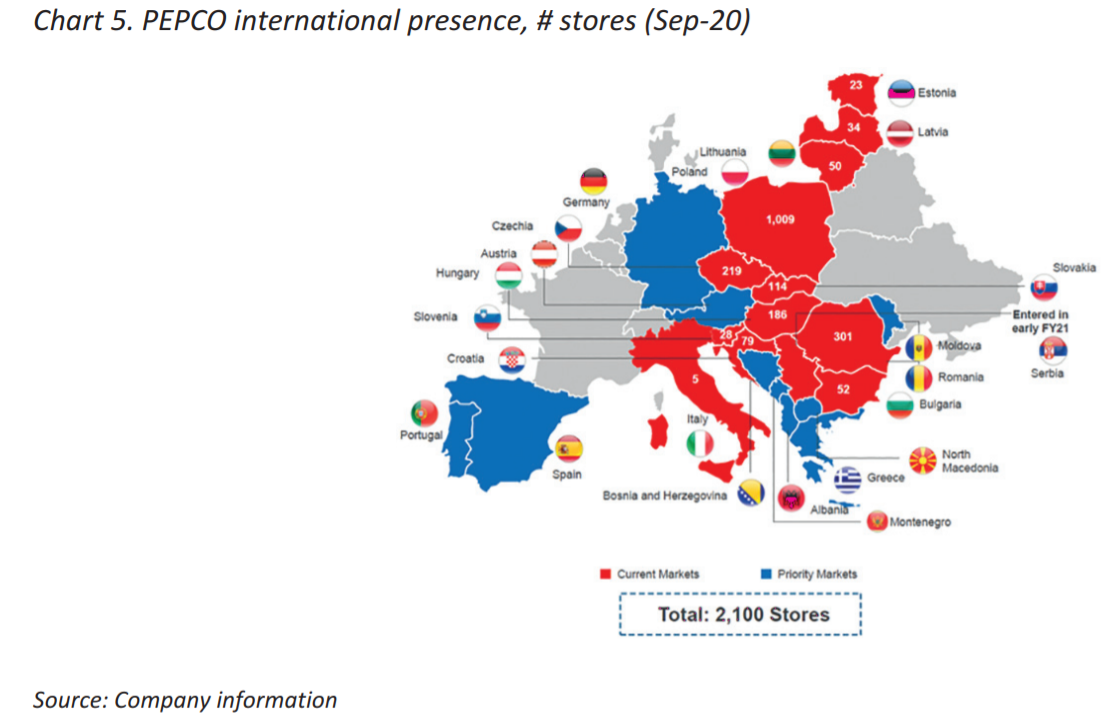

In Pepco stores you can buy products with various prices. The leading category is clothing (also with children's clothing). Products are another important category home furnishings, toys, seasonal products or footwear. Pepco is a leading retailer in Central and Eastern Europe. At the end of March 2021, the company operated 2 stores in 229 CEE countries, Italy and Serbia. In April, the company also planned to expand the Pepco store network in Spain.

The second segment is stores offering FMCG products (fast moving consumer products) at harmonized price levels a price-anchored segment) under the names Poundland and Dealz. Poundland operates in the United Kingdom and Ireland. At the end of March 2021, there were 818 stores under this brand. Dealz, on the other hand, was founded in 2011. Currently, the stores operate in 199 stores in Ireland, Spain and Poland.

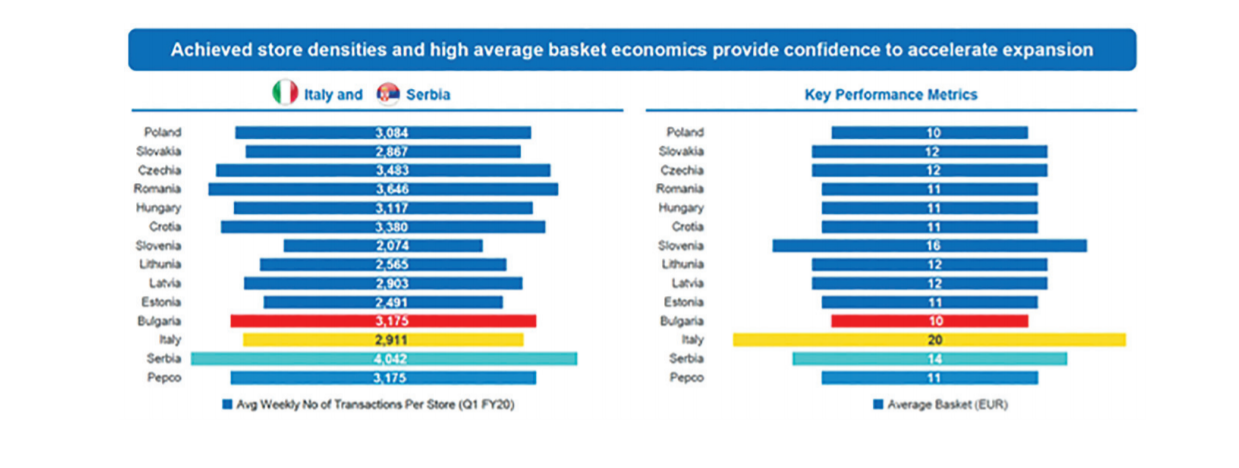

Until recently, all stores were based in the European Union and the United Kingdom. At the end of November, Pepco stores were opened in Serbia. The company informed that the Serbian market generates higher revenues than assumed by the company. The reason was the greater number of customers and the higher average transaction value. In the coming quarters, the company intends to dynamically develop in Serbia and Italy.

Source: prospectus

The Group assumes that it will be able to increase the number of new locations by approximately 8000 stores in the coming years. Of these, approximately 4300 stores could be established in the markets in which the Pepco Group currently operates.

Approximately 900 stores under the Pepco brand may be created on the CEE market, approximately 2250 on the Spanish and Italian markets, and 2700 stores on the Portuguese, German, Austrian and Greek markets. Another potential market is the Balkan markets (including Bosnia and Herzegovina), where there is room for 200 stores.

In turn, in the case of Dealz stores, the company sees room for 600 stores in the current CEE markets. Approximately 600 stores may also be opened on the markets of Western Europe (EC) and 80 stores on the new EC markets. Additionally, expansion into other CEE markets is planned (700 stores).

Managers

Andy Bond - CEO

Andy has been the CEO of Pepco since 2015. He has many years of experience in the retail industry. From 1994 to 2010, he held various positions in the Asda supermarket (including Managing Director). Between 2005 and 2010, Andy Bond was COO (Chief operating officer) and CEO (Chief Executive Officer).

Nick Wharton - CFO

Nick had over 20 years of experience in the retail sector. From 2018, he was the CFO in the Pepco Group. He also served as Chief Financial Officer in Superdry (clothing industry) and Hafords Group (including sales of car and bicycle parts). He also served as CEO of the Dunelm Group.

Grazyna Piotrowska-Oliwa

A Polish woman is also employed on the board. Grażyna Piotrowska-Oliwa has extensive experience in managerial positions. In 2015-2020 she worked as the CEO of Virgin Mobile Polska. In 2011-2012, she was the CEO of the Polish Oil and Gas Industry (PGNiG). In the years 1997-2001 she worked in various positions at the Ministry of Treasury.

Pepco board remuneration

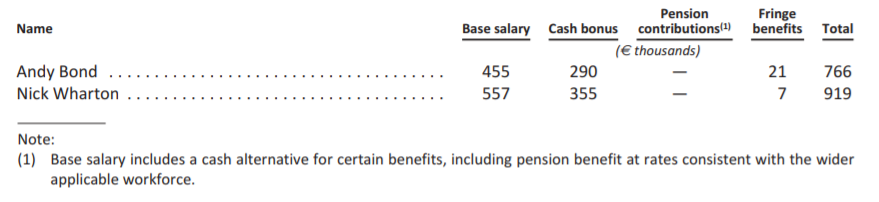

The salary of top managers is divided into basic salary and bonuses. The current basic CEO salary was £ 400, for a CFO the "base" salary was £ 000. The base salary is changed every year. The annual bonus can be up to 490% of your base salary. The bonus is paid when goals are met (e.g. EBITDA).

Earnings in the financial year 2020:

Source: prospectus

During employment, senior management must maintain the equivalent of 300% (for the CEO) or 200% (for the rest) of the base salary.

At the same time, the value of the awards granted in shares is limited by The Personal Annual Cap (PAC). This means that this type of prizes cannot exceed € 20 million (CFO) and € 10 million (CFO) in a year.

Market

The Pepco Group operates on a market of € 130 billion in 2019 (Pepco & Poundland). According to an analysis by OC&C, the market was to grow by 2025% annually by 3,2. This means that in 4 years the value of the entire market in which the company operates will amount to € 157bn.

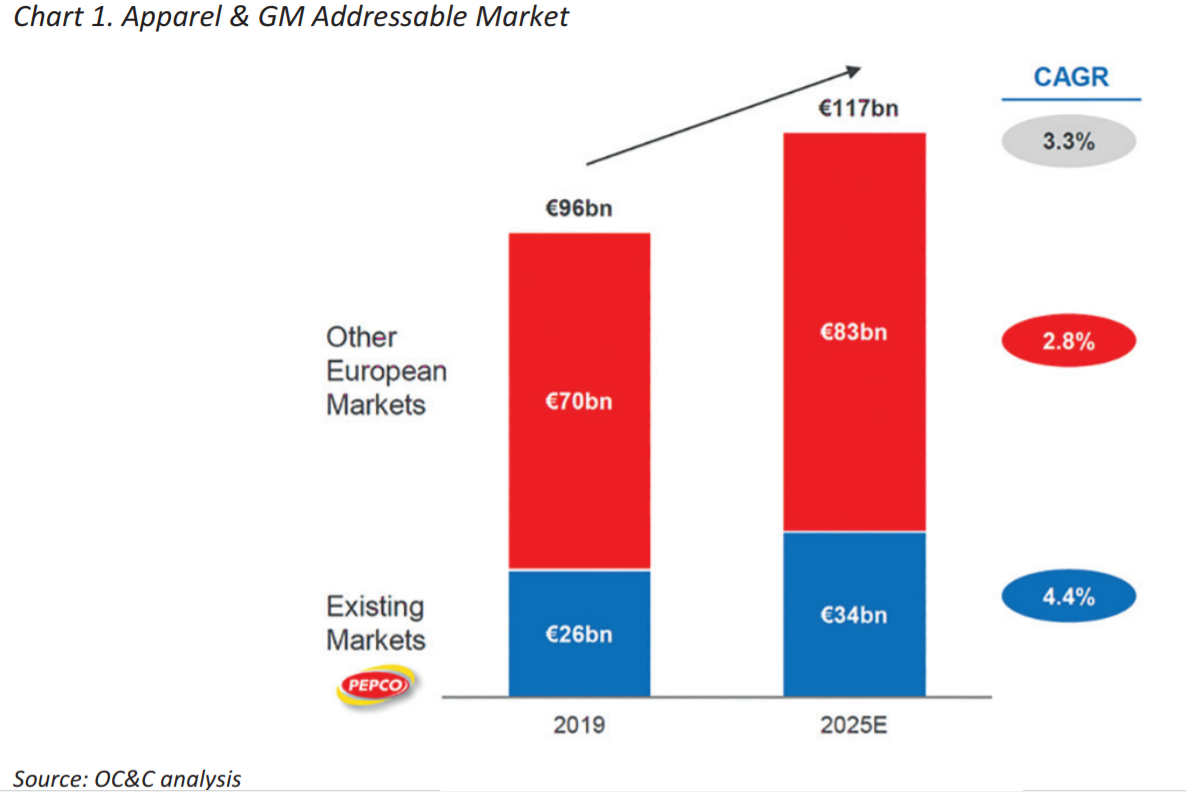

In the clothing and general merchandise segment, the market was estimated at € 96bn. In 2019-2025, this market will grow by 3,3%. In the markets where Pepco is already operating (Poland, Romania, Czech Republic, Hungary, Slovakia, Croatia, Lithuania, Slovenia, Bulgaria, Latvia, Estonia, Serbia and Italy), growth in these years will amount to 4,4% per annum. In other markets, growth will be 2,8%. According to OC&C forecasts, the entire market will be worth € 117 billion in 2025.

It is worth noting that the penetration of the discount market in the clothing market in Poland and the main CEE markets is approximately 19%. For the United Kingdom and Ireland, the penetration of discounters in this market is 28%. It is worth noting that even such mature markets as UK and Ireland show faster growth of the discount segment than the entire market.

Source: prospectus

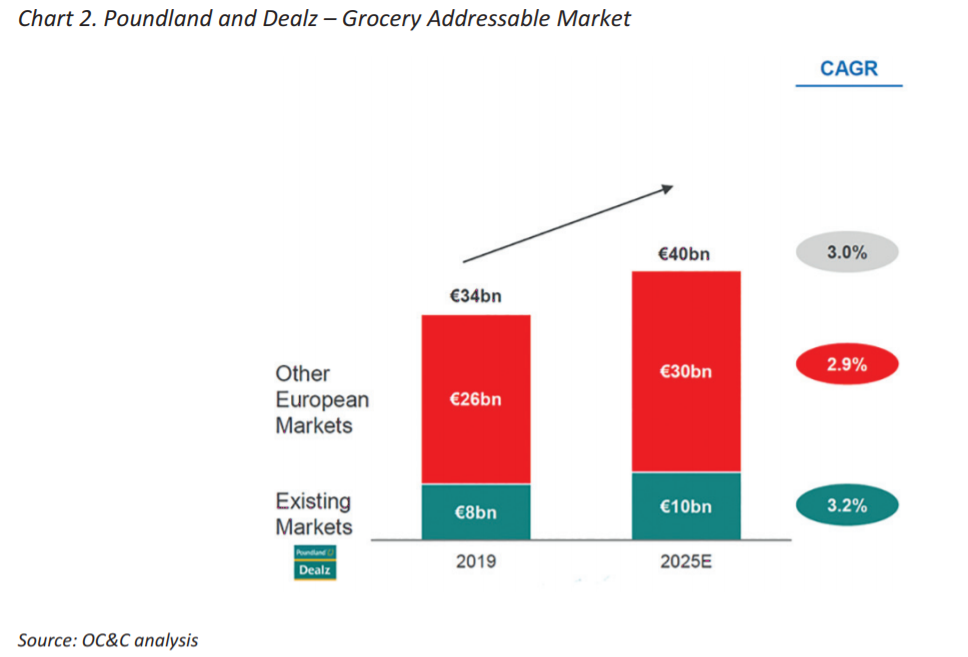

Poundland and Dealz operates in the food products market. According to analysts' forecasts, this market will grow by an annual average of 3% in 2019-2025. In the case of the markets where these stores operate, the growth is expected to be 3,2%. In 2025, the market value is expected to amount to € 40 billion.

It is worth mentioning that in periods of recession, the discount market performs better (in terms of sales) than the entire market. An example can be Poundland in 2009-2012, during this period the increase in sales was on average 24,5% annually.

Source: prospectus

CEE region

Poland is the largest market for the Pepco brandwith 1009 stores. This is 2,9 times more than in the case of the largest non-food competitor (according to OC&C). Important competitors on the Polish market are Kik, JYSX and TXM, which together have 784 stores in Poland (OC&C).

In Romania, the Czech Republic, Hungary and Slovakia, Pepco is the undisputed leader. It has 820 stores in these roars. The most important competitors are Who, JYSK extension and takkowhich have 434, 311 and 281 stores.

In other countries of the CEE region (Bulgaria, Croatia, Estonia, Lithuania, Latvia, Slovenia and Serbia), Pepco has 266 stores. As a rule, there is no clear competitor in these markets, the market is very fragmented.

Source: prospectus

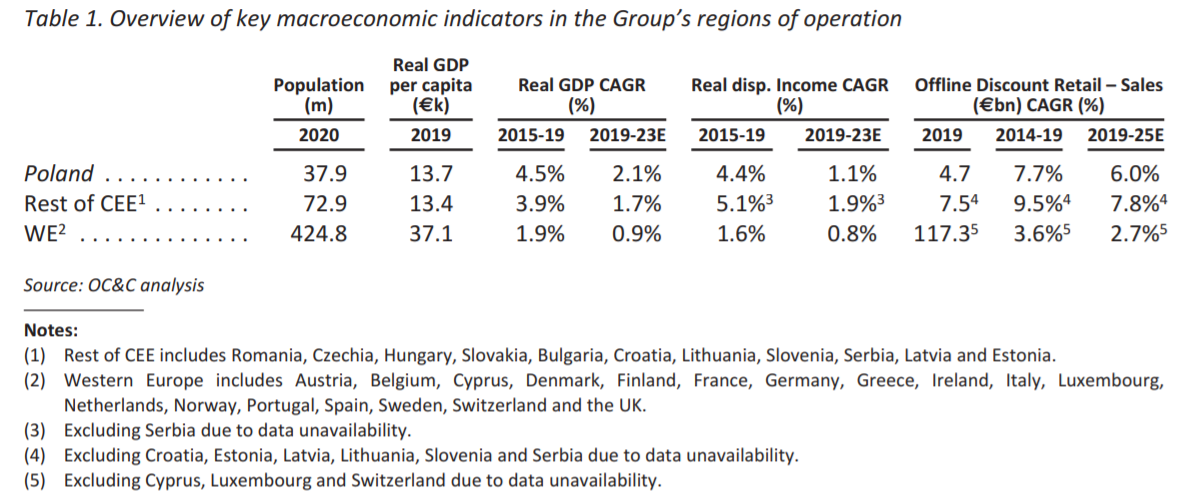

Over 100 million people live in the Pepco (CEE) market. However, these markets are much less developed than the countries of Western Europe (EC). This blow to GDP per capita which accounts for around 37% of the EC markets (not affected by purchasing power parity).

Source: prospectus

Western Europe

According to OC&C analysts, countries included in Western Europe (EU - including Germany, UK, France, Spain, Italy, Benelux, etc.) have a population of around 425 million people and GDP of $ 15 737 billion (2019). In 2015-2019, the region's real GDP grew at a rate of 1,9% annually. Of course, the coronavirus has hit some European economies hard. Even so, the long-term stability of these economies is not upset. Real GDP can still be expected to grow by around 1% per year over the next few years.

The brick-and-mortar retail market was worth around 2,5 trillion euros (2019). In the coming years, it should be expected that the “offline” segment will lose its share in relation to the dynamically developing online sales.

The Pepco Group operates on the FMCG market in this market. Stores operate in the price-anchored segment (unified price level). The brands operating on the EC market are Poundlan with 756 stores in the United Kingdom and Dealz, which has a chain of stores in the Republic of Ireland (69), Spain (28) and Poland (68).

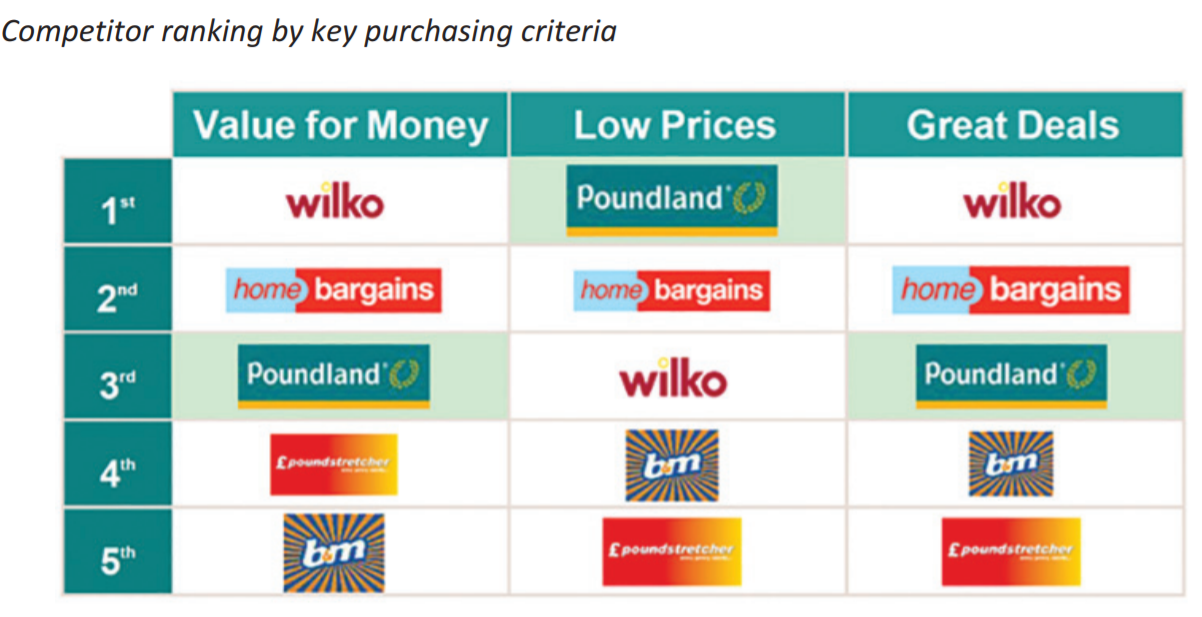

The biggest competitors on the UK market are B&M, Wilko, Home Bargains and Poundstretcher. Below is a comparison of "brand strength" in individual purchasing criteria. Poundland dominates low-cost products.

Source: prospectus

Pepco

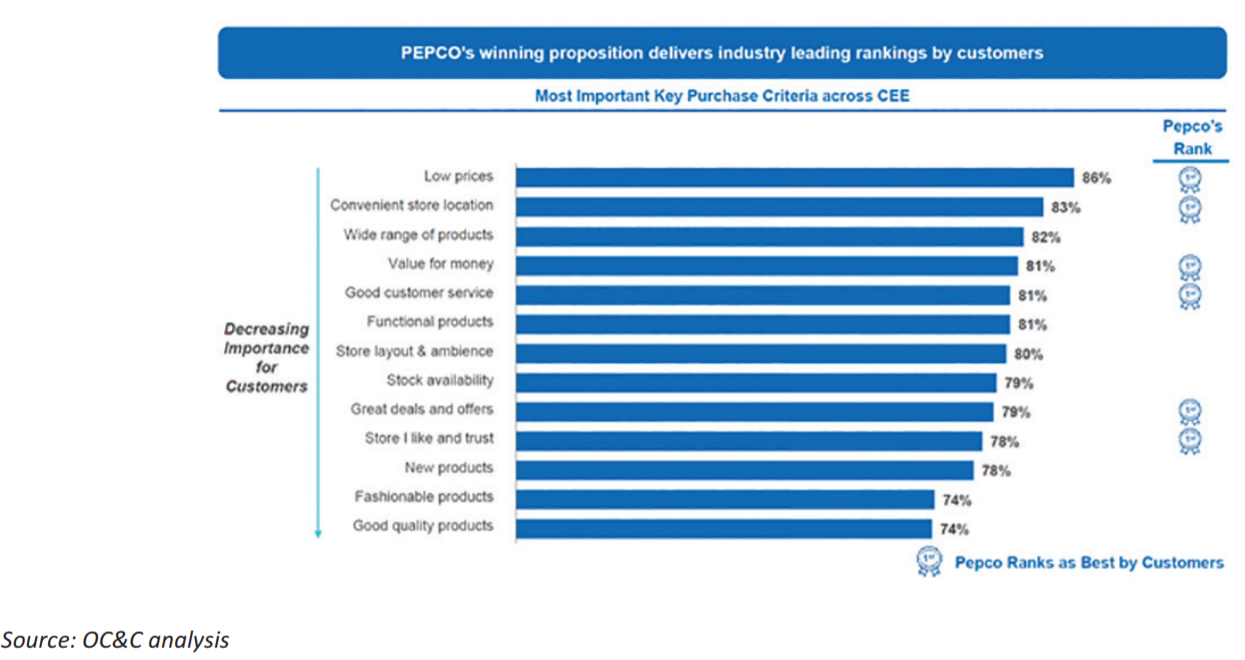

Shops under this brand offer, among others clothing and household goods in various variants and at discounted prices. Often there are promotions to increase the number of products purchased, which allows you to increase the "value of the basket". According to the OC&C report, Pepco is liked by customers thanks to its good price-quality ratio. As a result, it won the ranking in such categories as: "low prices" and "value for money". According to Pepco, before the coronavirus, the average value of the customer's basket was PLN 35. Interestingly, more than half of customers paid for purchases in Pepco's networks in cash. A typical shopper is a 36-year-old shopper with one or two children who lives in a medium-sized city.

A typical Pepco store ranges from 350 to 550 m2. Over the years, the area of opened stores has increased. In 2014-2016, the open stores had an area of 11,4% larger than the Pepco stores opened in 2009-2010. The location of the stores is extremely important. The key is to locate the store close to the "stream" of potential customers. It is not surprising then that at the end of 2020, around 76% of stores were located near or next to the grocery store, or in the mall itself.

Store rental contracts are usually signed for 3-5 years, with a possible extension of the rental for an additional 3 years. At the end of Q2020 3, the average duration of the lease agreement was 5 years and XNUMX months. The company also has distribution centers in Rawa Mazowiecka and Gyál (Hungary), which are owned by Pepco Group. Pepco's third distribution center (Wolbórz) is leased.

Pepco stores are largely located in small towns, where competition is usually local. About 35% of Pepco stores are located in areas with approximately 20 inhabitants. The appearance of Pepco in such a location significantly reduces the chance of more competition in the vicinity (too much saturation of stores in relation to potential customers). This is due to, inter alia, due to the fact that competitors operate in stores with a larger area, which makes the potential opening of a store in the vicinity of Pepco much less profitable. Regions with such a density fit in with the policy of opening stores with an area of about 000 m400.

Source: prospectus

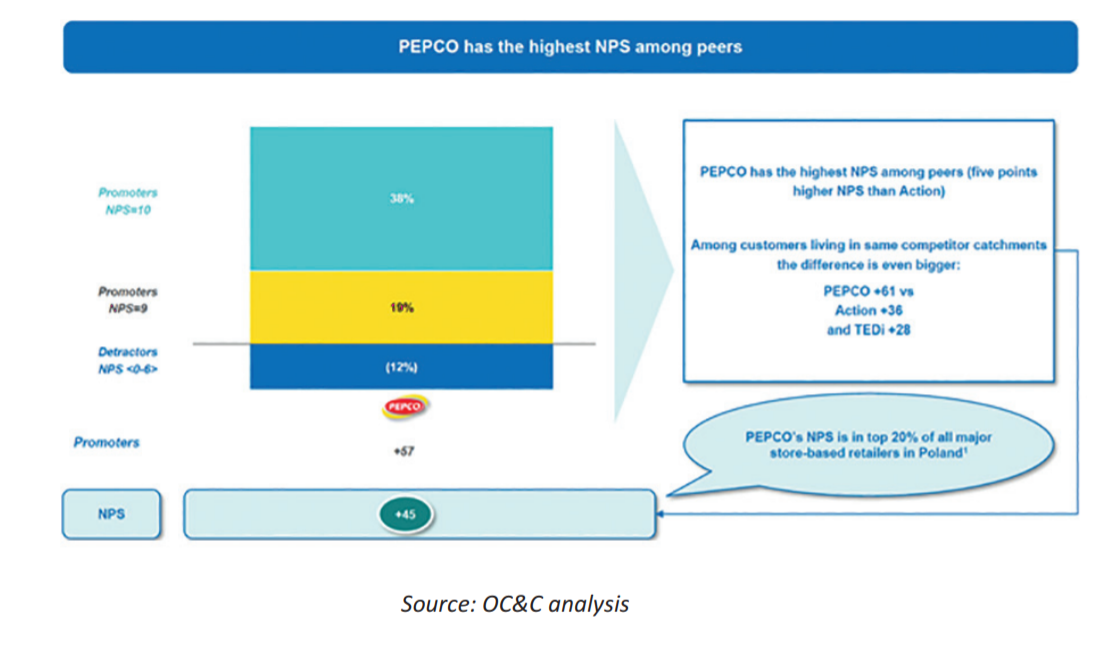

Good customer feedback is reflected in the net promoter score (NPS). The company boasts that the aforementioned ratio is higher than that of competitors operating in the same market segment.

Source: prospectus

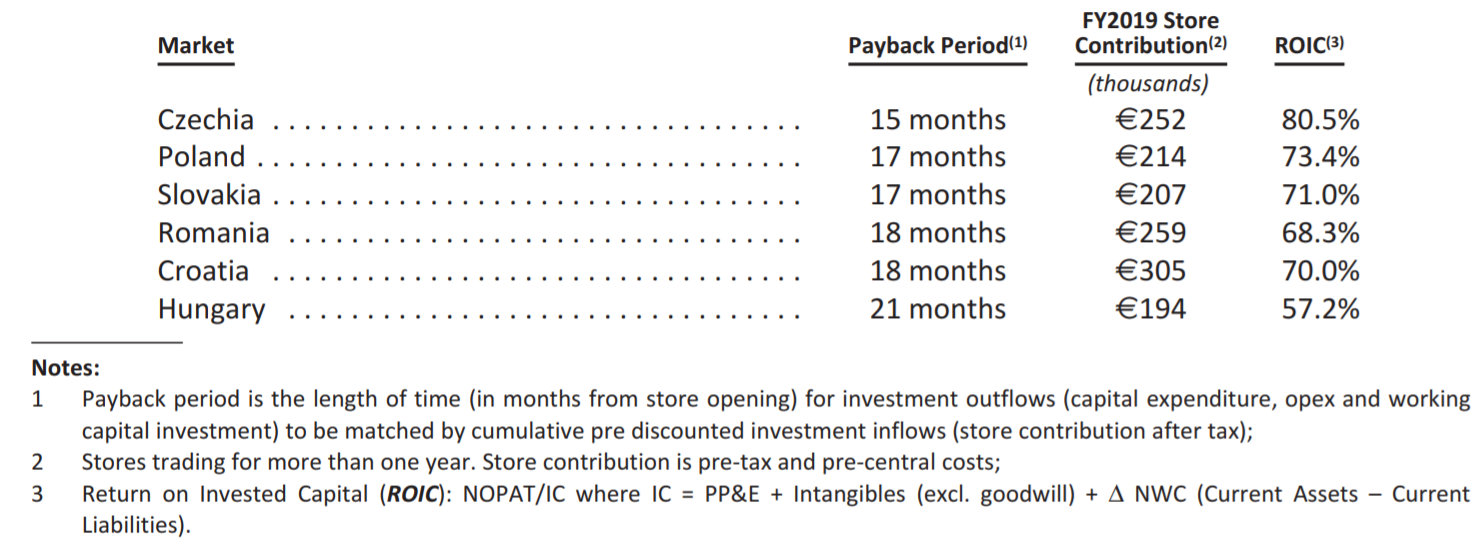

About 99,9% of Pepco stores that have been operating for more than 12 months (mature stores) were profitable at the end of Q2019 2019. In XNUMX, the indicator store contribution (profit before headquarters, depreciation, interest and taxes) was € 235.

It's also worth looking at the payback period (payback period), which is calculated based on how quickly the profit of the store covers the expenses associated with opening the store (capital expenditure, investment in working capital, rent). In Poland, it is 17 months, while the return on investment in Czech stores is the fastest. Better profitability of Czech investments results from a smaller presence on the market (branches with potentially the best return on invested capital are opened - ROIC). Below is a summary of selected markets where Pepco operates:

Source: prospectus

Pepco realizes that in order to attract customers it has to introduce new product categories. This, in turn, requires the optimization of the distribution of products in the store and better management of the SKU (Stock Keepig Unit). In recent years, the introduction of FMCG products for children (including wipes and diapers) has been a success.

The company believes that the Pepco concept has a chance for further development. It is planned to open 900 new stores within 3 years (counting from the end of Q2020 XNUMX). The opening of stores is to concern both markets in which Pepco has a strong position, as well as expansion into new markets (including Italy, Serbia).

Source: prospectus

Poundland and Dealz

Brand Poundland defines her "typical client" as a woman aged 18-44 with an annual household income of less than £ 30 a year who wants to buy brand name products at a reasonable cost. Stores under this brand offer numerous FMCG products (fast moving goods). In addition, there are also products for children (toys) and seasonal products (Halloween, Christmas). Following the acquisition of Fultons Frozen Foods, the range of frozen products has also expanded. Currently, they are sold in 000 stores, and in the next two years the offer will be expanded to over 80 stores. The number of stores at the end of March 400 was 2021 stores. Poundland stores generally range in size from 818 m400 to 2 m1000 (depending on location). Shops try to locate in places with high traffic of potential customers (main streets, shopping malls). Average sales per square foot are just under £ 2.

In turn, in stores Dealz company profiles its stores to a woman aged 19-45, who has two or three children. At the end of Q2021 199, the number of chain stores was XNUMX. As in the case of Poundland and Pepco, the range of products in Dealz stores is increasing. There is an offer of clothes and care products.

A characteristic feature of the stores under the Poundlad and Dealz brands was a "fixed price", which was to facilitate shopping for the customer. In the case of Poundland it was 1 pound, in Spain and Ireland (1,5 €) and in Poland 5 PLN. Along with the development of the product category, in stores there were products with prices lower and higher than the "fixed price". However, the pricing architecture still remains simple (In the UK, Poundland stores generated a basket value of £ 6,04, while in Ireland, Dealz reported an average basket value of € 7,92.

The development of the clothing category was well received by customers. As a result, the company's UK stores were the 18th largest clothing retailer by volume in 2020 (according to Kantar).

The company signs contracts for the rental of Poundland and Dealz stores, usually for 3 to 5 years. In addition, the tenant has the right to extend the lease for an additional three years.

Assoc

The Pepco Group has a special unit for purchasing goods through Asian hubs. The company believes that an integrated product purchasing model is one of the key factors to keep prices low and exert pressure on competition. Lower prices are due to the fact that the company avoids intermediaries (agents, wholesalers, distributors), which allows to keep a significant part of the margin that middlemen kept. Thanks to such a policy, the company can achieve a 25% higher gross margin on sales.

PGS was established in 2012. The headquarters of the company is in Shanghai, where about 350 procurement experts are employed (as of December 31.12.2020, 90). PGS operates in five countries and regions in Asia: China, Hong Kong, Bangladesh, Pakistan and India. The company determined that additional suppliers can look for in Cambodia and Turkey, which, according to PGS, have very high production potential. Currently, PGS works with 154 Chinese suppliers of clothing and footwear and 43 suppliers of home products. The company cooperates with 72 suppliers of products from Bangladesh and 60 from India. Asian suppliers, through PGS, are responsible for over 75% of the total supply in the Group's stores. In the case of the clothing category, the share was around XNUMX%.

PGS acquires approximately $ 1 billion worth of goods annually. Thanks to this, the company has operational efficiency (cost-to-serve ratio) on a similar level as global companies specializing in procurement organization (including Li & Fung).

PGS operates in accordance with ETIBC (Ethical Trading Initiative Base Code), which requires factories to meet work standards or the ability to report irregularities. The factories are regularly audited at least once a year. In 2020, over 1200 audits were carried out annually.

PGS purchases a lot of clothing products, home products as well as seasonal and FMCG products (including care products, sweets). PGS services are used by both Pepco, Poundland and Dealz stores.

The financial data

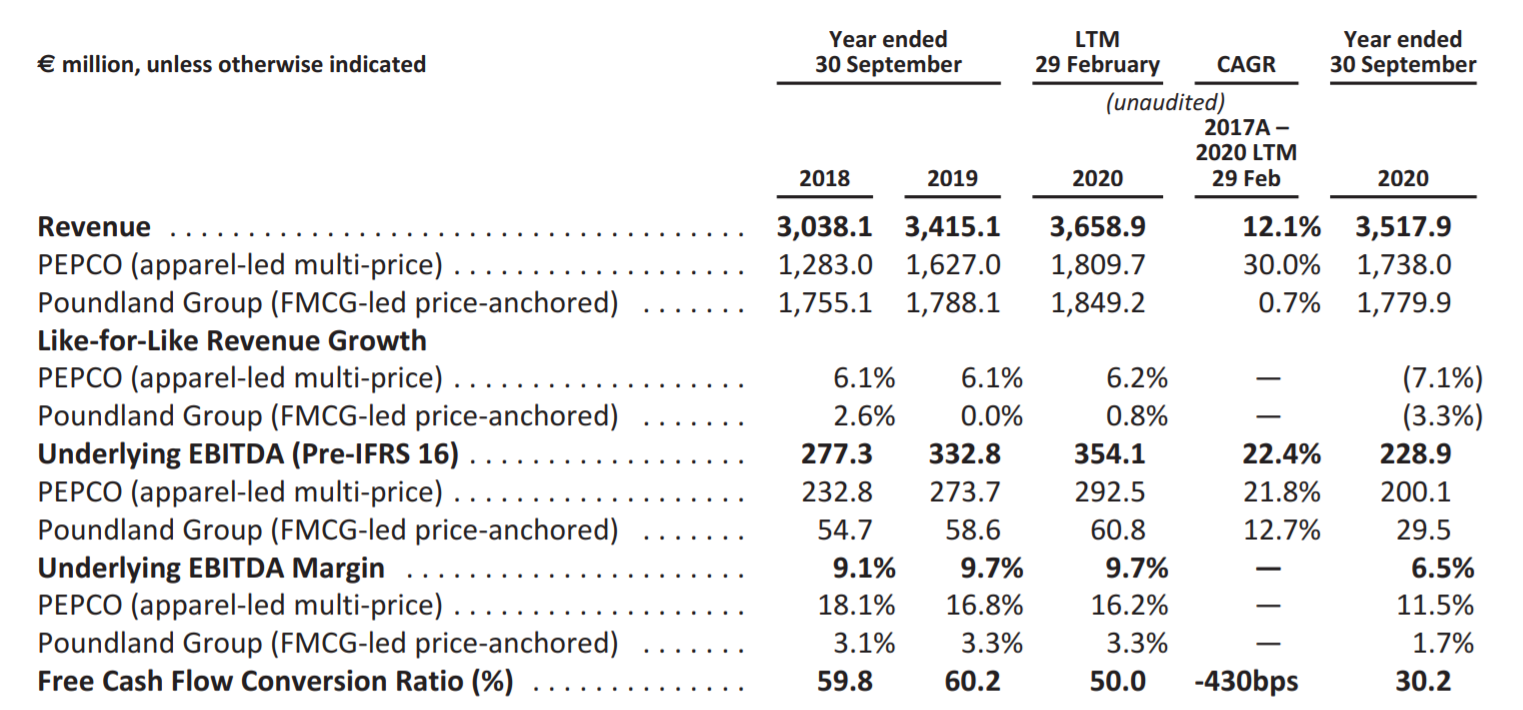

The chart below shows the financial results for 2018 - 2020. For 2020, two results are distinguished: LTM (Last Twelve Months), which ended in February 2020, and the financial year ending in September 2020. As you can see, the increasing impact on Pepco stores have revenues. This is because Poundland's revenues grow below 1% per year. Pepco is growing as a result of the increase in LfL (like for like) sales and expansion of the store network. Before the crisis, Pepco's LfL grew by around 6% per year. At the same time, due to the nature of the stores, Pepco generates much more operating profit. Prior to the coronavirus, Pepco's operating profits were approximately 5 times the nominal operating profit of the Poundland and Dealz stores.

Source: prospectus

For this reason, the company will rather dynamically develop the concept of Pepco stores, which generate much more operating profit and generate a much higher margin. The opening of one Pepco store (including pre-opening expenses and stocking up) was around € 157 in the past. Overall, the return on investment period was around 000 months, although there are markets (Czech Republic, Slovakia) with better return on invested capital. On the other hand, the payback period on the Hungarian market was 17 months.

In the financial year 2022, in the medium term, the company intends to continue the strategy of developing the Pepco store concept. The plan provides for an increase in the number of stores by 300 per year. Pepco Group also plans to expand the Poundland chain of stores by 10-20 stores a year. In the case of the Dealz concept, the company plans to increase the number of stores by 100 in the financial year 2022. The company's plans are to expand the network at the rate of 150 outlets per year. In the following years, in addition to the expansion of stores, the company plans to increase LfL sales in the Pepco, Poundland and Dealz concepts.

Store development requires increased capital expenditure. The company assumes that the opening of a new Pepco store will cost € 180. For the Poundland concept, opening a single store costs € 000. One Dealz store will cost 300 €.

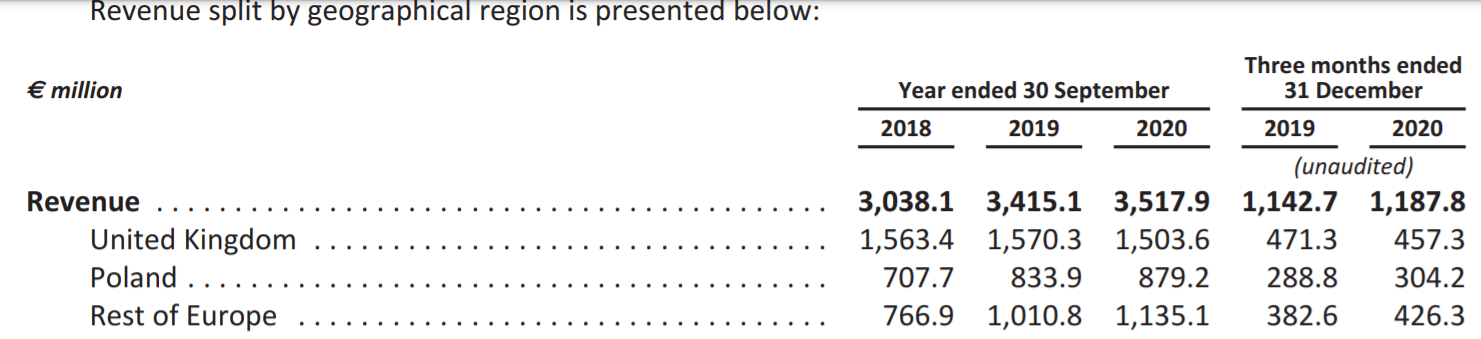

It is also worth mentioning the geographical distribution of revenues. The United Kingdom is still the most important market in terms of revenues, accounting for 42,8% of total revenues in the financial year. The second largest market is Poland, which accounted for approximately 25% of the company's revenues.

Source: prospectus

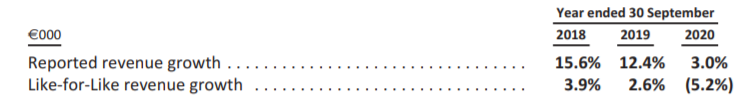

In the analysis of retail companies, one should not only look at total revenues, as they are distorted by the opening and closing of brick-and-mortar stores. For this reason, it is worth analyzing the LfL index, which measures comparable sales by "cleaning" revenues from the impact of changes in the number of stores. The table below shows that the company's stores generated LfL growth of around 3%. The "coronavirus" year 2020 should be omitted from the analysis. from numerous lockdowns that disrupted the operational activity of brick-and-mortar stores.

Source: prospectus

| Pepco Group | 2018FY | 2019FY | 2020FY |

| revenues | € 3 million | € 3 million | € 3 million |

| Operational profit | € 107,2 million | € 257,8 million | € 120,0 million |

| Operating margin | 3,53% | 7,55% | 3,41% |

| Net profit | -3,5 million € | € 210,4 million | -0,5 million € |

Source: own study

Before the coronavirus (fiscal 2019), the company's revenues increased by 12,4%. Of this, about 3% of the increase in revenues was organic, and the remaining 9% was due to the expansion of the chain of stores. In 2019, the net result was significantly influenced by, among others, one-off interest gain of € 80 million (loan cancellation from related companies).

Pepco's operating flows and indebtedness

The significant increase in cash flows from operating activities was caused, among others, by an increase in trade liabilities, which raised the OCF by approximately € 240 million (increase in liabilities to suppliers to € 610 million). The significant increase in OCF increased the level of free cash flow to the level of € 490 million. It should be expected that it will not be possible to extend the payment period to suppliers in the following year. For this reason, the OCF should be lower than in the financial year 2020. Due to the capital-intensive growth, it should be expected that the company will not share its profits with shareholders in the coming quarters. Capital will be used to scale the business.

| Pepco Group | 2018FY | 2019FY | 2020FY |

| OCF * | € 122,3 million | € 235,9 million | € 628,3 million |

| CAPEX ** | € 103,8 million | € 123,3 million | € 139,2 million |

| FCF *** | € 18,5 million | € 112,6 million | € 489,1 million |

Source: own study

* OCF - cash flows from operating activities

** CAPEX - capital expenditure

*** FCF - free cash flow

The company has over € 700m of interest debt. € 224,3 million are borrowed from related parties. The debt expires in 2027 and bears an interest rate of LIBOR + 7,5%. The company also has € 489m in debt provided by financial institutions, where the effective interest rate on loans is 7,8%. Although the financial costs in the financial year amounted to approximately € 106 million, the debt servicing costs amount to € 55,9 million.

Where to buy Pepco shares

Pepco will debut on the stock exchange in May 2021. The allocation of shares is to take place by May 21, therefore only the secondary market remains available to new buyers. Below is a list of selected offers Forex brokers both offering an extensive stock offer.

For example on XTB Today, we can find over 3500 equity instruments and 400 ETFs, a Saxo Bank over 19 companies and 000 ETF funds.

| Broker |  |

|

|

| End | Poland | Denmark | Cyprus * |

| Number of exchanges on offer | 16 exchanges | 37 exchanges | 24 exchanges |

| Number of shares in the offer | approx. 3500 - shares circa 2000 - CFDs on shares |

19 - shares 8 - CFDs on shares |

approx. 3 - CFD on shares |

| The amount of ETF on offer | approx. 400 - ETF approx. 170 - CFD on ETF |

3000 - ETF 675 - CFD on ETF |

approx. 100 - CFD on ETF |

| Commission | 0% commission up to EUR 100 turnover / month | according to the price list | Spread depends on the instrument |

| Min. Deposit | PLN 0 (recommended min. PLN 2000 or USD 500, EUR) |

0 PLN / 0 EUR / 0 USD | PLN 500 |

| Platform | xStation | SaxoTrader Pro Saxo Trader Go |

Plus500 platform |

* PLUS500 CY offer

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. From 72% to 89% of retail investor accounts record monetary losses as a result of trading CFDs. Think about whether you understand how CFDs work and whether you can afford the high risk of losing your money.

Pepco shares - Summary

Pepco Group is a company that runs a chain of stores under the Pepco, Poundland and Dealz brands. The Pepco chain of stores, which operates mainly in the markets of Central and Eastern Europe (CEE), has the greatest impact on the operating result. The company has the largest number of stores in Poland (over 1000). Pepco operates mainly in countries located in the European Union, but from the end of 2020 the network is present in Serbia. It is planned to add 300 stores of this brand in the following years. The plans include expansion in the most promising CEE markets and developed markets of Western Europe (EC), including in Italy. The Pepko chain of stores can boast an organic growth of around 6% per year.

The gorcery segment (Poundland, Dealz) has much weaker profitability (around 3%) and a slight increase in LfL (around 1%). Although the revenues of this segment account for half of the group's revenues, due to low profitability, this segment has little impact on the operating result. The Dealz store concept is expected to develop strongly (over 100 stores a year).

The company, despite net losses, can generate over 100 million FCF (after capital expenditure). At the same time, the profitability of invested capital in Pepco stores is very high, as it allows you to "pay off" the initial investment after 17 months. However, the IPO will not result in the company gaining additional capital for development. This is because the shares are sold by the main shareholder (Steinhoff International), which will still hold over of the company's shares. It should be remembered that Steinhoff was the main hero of the 2017 accounting scandal, which caused the company's share price to drop by over 90%. Many commentators referred to the situation as "the South African equivalent of the Enron affair."

After the IPO, Pepco Group will be valued at the level of PLN 23 billion, which gives the price to sale ratio (P / S) below 2. At the same time, if it is assumed that the company is able to generate approximately € 140 million FCF, this gives P / FCF capitalization. at the level of 36,5. Therefore, it cannot be said that the company is valued at a considerable discount to the market. It should be remembered that the enterprise is not a fast developing one (revenue growth below 20%). The decent LfL growth in Pepco stores is certainly a strong point of the company. At the same time, the company has an interesting concept of stores (Pepco), which, however, operates in the offline market, not online. In the future, the company will certainly have to invest a lot of money in the development of the omnichannel. The company will also have to deal with increasingly fierce competition on the market, not only from stationary stores with a similar concept, but also from strong players operating in the e-commerce channel. One thing is certain - it will be one of the biggest IPOs on the WSE this year.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Pepco shares - what is worth knowing before the stock exchange debut? [Guide] debut pepco shares](https://forexclub.pl/wp-content/uploads/2021/05/akcje-pepco-debiut.jpg?v=1621234362)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)

![Pepco shares - what is worth knowing before the stock exchange debut? [Guide] High inflation - an increase in interest rates](https://forexclub.pl/wp-content/uploads/2021/05/Wysoka-inflacja-podwyzka-stop-procentowych-102x65.jpg?v=1621244534)

![Pepco shares - what is worth knowing before the stock exchange debut? [Guide] SHIBA INU coin](https://forexclub.pl/wp-content/uploads/2021/05/SHIBA-INU-coin-102x65.jpg?v=1621240118)