Economic prospects for global markets and Poland for 2023

The past year was marked by a coordinated action of monetary policy tightening carried out by most central banks. This action was caused by soaring inflation, which became a major problem for the global economy last year. The decisions of central banks resulted in a sell-off of many asset classes. In the past year, both stocks and bonds lost their value. The latter experienced the biggest discount in over a hundred years. Thus, we witnessed a very turbulent end to the “zero interest rate” experiment.

In the coming year, the macroeconomic environment will still be characterized by high uncertainty, and the subsequent phases of the economic slowdown may take different forms. Major central banks are determined to contain the hydra of inflation. In our opinion, investors have not fully discounted this "determination" in monetary policy. We believe that if interest rate hikes stop, economies should slow down, but contrary to appearances, they will do quite well, despite persistently high inflation (the so-called "soft landing"). On the other hand, too high interest rate increases may lead to a coordinated recession in the global economy, which would result in a dynamic decline in inflation (the so-called "hard landing"). In each of these cases, each asset class will behave differently.

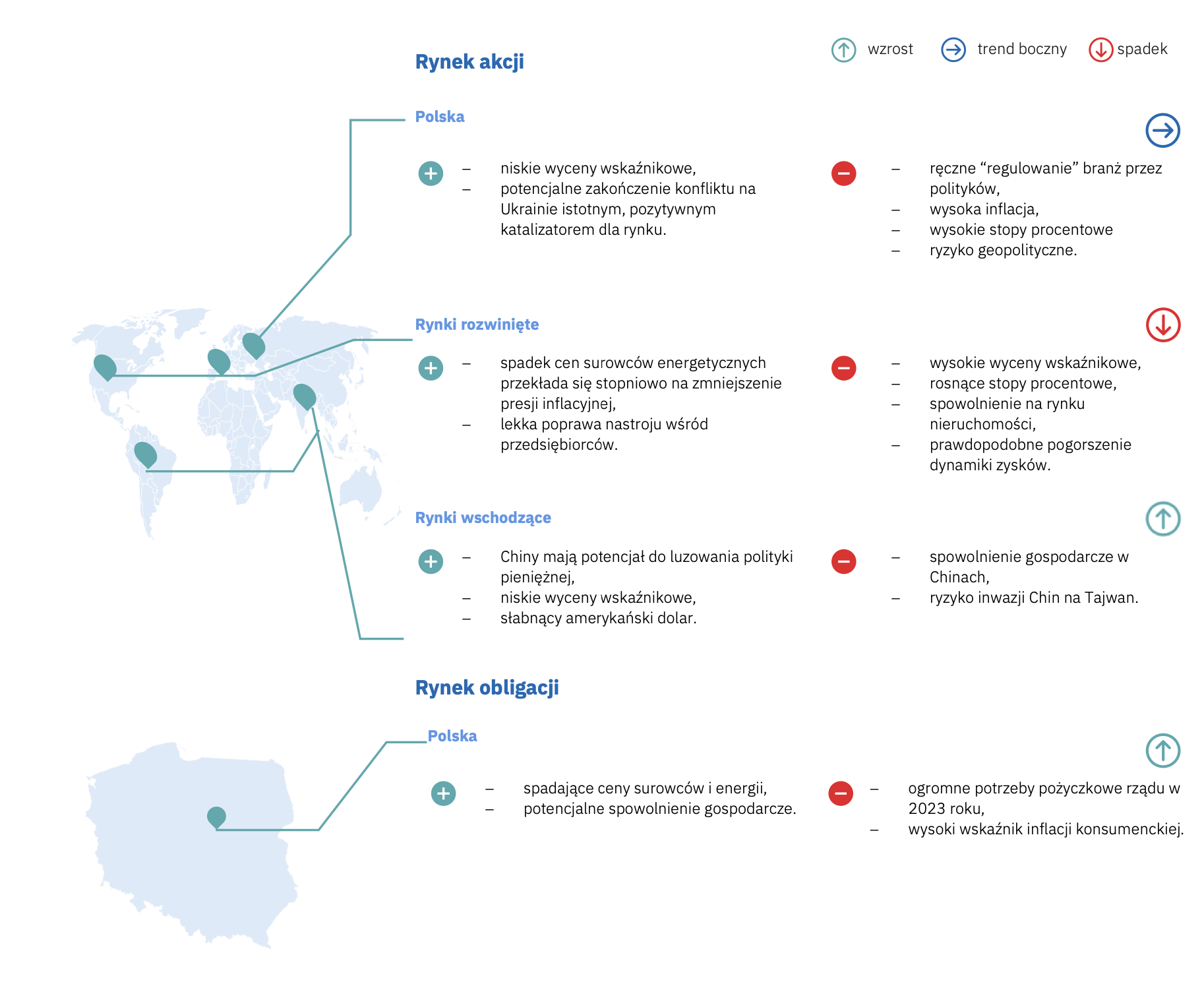

Global markets - stocks

Global developed markets are in a slowdown in economic growth. The sharp increase in interest rates caused a decline in activity in construction and a decrease in the number of new orders in industry. The next stage of the slowdown, which we have been entering since the beginning of 2023, is the phase of declining profits and reducing employment. Interest rates are still high and will probably stay at a similar or higher level until the end of this year.

Analyzing historical data for the price/book ratio, we believe that long-term valuations of US and European companies remain at high levels. Against this background, emerging market equities are attractive – both in nominal terms and relative to long-term averages. To sum up, it seems that in both soft and hard landing scenarios, emerging market stocks should yield higher returns than developed markets.

It is also worth paying attention to the companies included in the index of technology companies (Nasdaq 100). Their price/book valuations have fallen to the long-term average. This makes their relative attractiveness increased. What is needed now are new catalysts - this year, our attention will be focused mainly on analyzing the potential of companies and finding those that may positively surprise with the increase in revenues in a weak macroeconomic environment (within the segment of small and medium-sized companies) and those that will be more willing to reduce operating costs ( in the group of large enterprises).

This year, it is worth deepening the analysis of cyclical companies, which may show relatively weaker results. Geopolitical risks should also be mentioned, especially in the context of American-Chinese-Russian relations. Chinese stocks are still attractively priced, but carry geopolitical risks with the risk of China's invasion of Taiwan. The fact that in recent weeks there has been a certain warming of mutual relations (i.e. the appointment of the former Chinese ambassador to the US as foreign minister) does not change the fundamental change in the approach in relations between the two countries, which can be described as correct at best.

To sum up – after a very successful 2021 and despite double-digit negative rates of return on investments in shares of developed market companies in 2022, share valuations remain relatively high compared to historical averages, which implies a still difficult environment. Emerging market equities seem to have the potential to provide higher returns than developed markets. The scenario of a gradual rotation of assets from the best sectors in 2022 (fuel and raw materials) to those most affected by the current environment (semiconductors, modern technologies, retail and industry) also seems very likely.

Domestic market - shares

In our opinion, the domestic stock market has the potential for growth, even in the event of a decrease in aggregated company results on an annual basis. This is based on our underlying assumption that emerging markets will outperform developed markets. Due to the fact that Poland belongs to the basket of emerging markets, we see a chance that it will be to some extent a beneficiary of the inflow of funds to funds from this market segment.

By analyzing historical data for price/book value ratio, valuations of Polish companies remain low in the long term. Nevertheless, it is worth noting that between August and December last year a lot happened on the domestic stock market - it can even be said that we have returned from ultra-low to low valuations (the "price/book value" ratio for the WIG index is currently 1,1x vs. 1,2x for the long-term average). All this happened in just five months. This should naturally indicate that we can expect further increases in the future.

Due to the fact that we assume that high interest rates in Poland will remain high, banks are the natural and main beneficiary of this situation. Enterprises from other industries will have more difficulties to significantly improve their results on an annual basis. Higher interest rates combined with a decrease in the disposable income of middle-class consumers may have a negative impact on consumption.

The main risks for the domestic stock market are related to the armed conflict in Ukraine. The end of the war would mean that Poland would cease to be a frontline country. However, despite Ukraine's major successes, the outcome of the war remains uncertain.

The second important risk is waiting for the opinion and judgment of the CJEU on CHF loans. This is a key risk for the banking industry, which has a significant share in the WIG index.

An election year brings additional risks. We fear that loose fiscal policy, as well as increased regulation in industries dominated by companies controlled by the State Treasury, is dangerously evolving towards the Hungarian scenario. There, overregulation led to significant disturbances in the economy.

In conclusion, we believe that domestic companies have the potential for growth in 2023, but at the same time, we expect increased volatility on the domestic stock market to continue.

Corporate bonds

In 2022, floating-coupon corporate bonds yielded single-digit returns. However, it was not an easy year for the market – assets were flowing out of corporate bond funds, and Catalyst experienced high price volatility with low liquidity. The consequence was the collapse of the primary market, which woke up only in December, when issuers announced corporate bond issues exceeding PLN 3 billion.

Despite the relatively small amount of redemption at Catalyst in 2023 (PLN 2,4 billion - excluding maturing PKN Orlen bonds in the amount of EUR 750 million - vs. PLN 6,6 billion in 2024) we do not expect the conditions for issuers to improve significantly in 2023 . We also do not assume that there will be much to choose from on the primary market. Relative calm with buyouts in 2023, however, should help achieve high single-digit rates of return on investments in corporate bonds of good quality issuers. According to the National Bank of Poland, in the first quarter of 1, inflation will reach 2024% per annum - so there is a chance that an investment in corporate bonds will allow you to earn real profits within a year.

Treasury bonds

Last year brought painful losses on Polish treasury bonds. In response to rising inflation, which at its peak approached 18% per annum, the Monetary Policy Council increased interest rates eight times. We welcomed 2022 with interest rates at 1,75% and said goodbye to 5 percentage points. higher. In turn, the yields on 10-year treasury bonds increased from 3,6% to 6,8%, and this increase in yields does not reflect the volatility that accompanied the market. At the peak of the October panic on the treasury bond market, the yields on government instruments temporarily exceeded 9%! And although the broad bond index earned investors less than 2% in the last two months of the year, the whole year ended with a loss of almost 8%. Undoubtedly, it was a year full of drama, which investors will want to forget quickly.

In 2023, we will continue to operate in a high inflation environment. According to the forecasts of the National Bank of Poland, the average annual inflation will reach over 13%. If inflation does not fall and the economy does not slow down significantly, the Monetary Policy Council may decide to raise interest rates further, which may translate into low single-digit positive annual returns on investments in treasury bonds. In turn, in the case of a "hard landing" and interest rate cuts - which we do not assume in the baseline scenario - the profit may be substantial and achieve low double-digit rates of return.

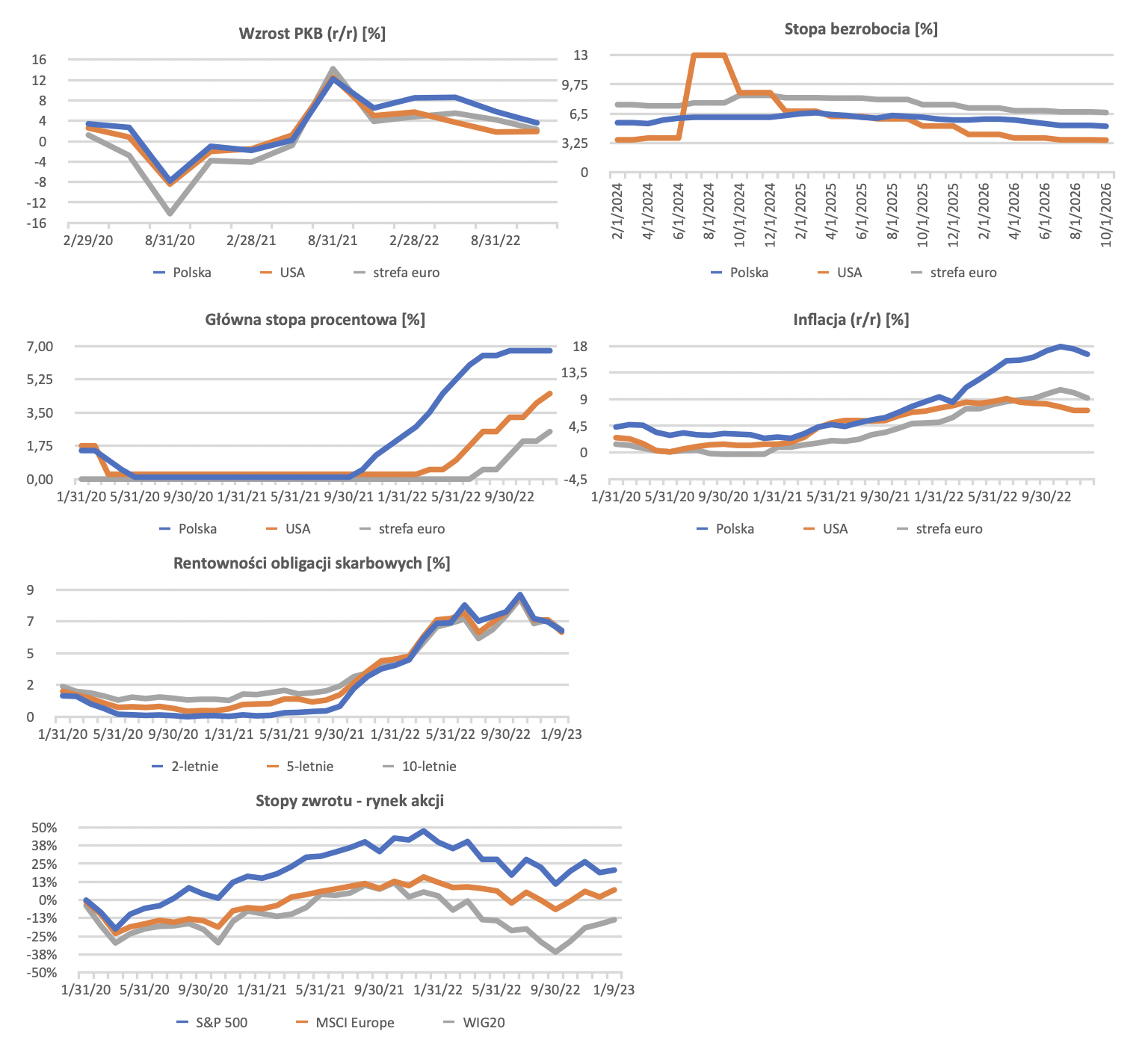

macro indicators

Assessment of prospects

Author VIG / C-QUADRAT TFI Asset Management Department.

Extended commentary available here.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)