After the Fed decision: Wall Street up, dollar down

As expected, the Fed raised interest rates and announced further increases, but the financial markets know their stuff and are already playing at the end of monetary policy tightening in the US. As a result, Wall Street indices soared, breaking important resistance levels, and the dollar weakened against other currencies.

This is not the end of the increases, but ...

American yesterday Federal Reserve (Fed) increased interest rates by 25 basis points to 4,50-4,75 percent. This decision was widely expected by the market. In the statement, the Fed also announced that further increases would be appropriate to maintain restrictive monetary policy and bring inflation in the US to the target level of 2 percent.

At the press conference after the meeting, the head of the Fed Jerome Powell he said that now the central bank will raise interest rates in steps of 25 bp, but he did not specify how many increases and to what target level interest rates in the US will increase. He noted that the time for this will be at the March meeting, when new macroeconomic and interest rate projections will be published.

Euphoria in the stock markets

Financial markets perceived the results of yesterday's Fed meeting as a confirmation of their earlier expectations that the Fed will raise interest rates in March and end the cycle. And as they were already focused on a hawkish statement from the central bank, such results became an impulse for increases on Wall Street and weakening of the dollar.

S & P50 index0 ended Wednesday's session with an increase of 1,05 percent. to 4119,21 points, thus surpassing the local peaks at the turn of November and December and mid-December. technological Nasdaq Composite increased by 2 percent. to 11816,32 points, testing the highest levels since September and, above all, plotting a large double bottom pattern on the chart. Only DJIA failed to close the day with a big gain, ending it at 34092,96 points. (+0,02%).

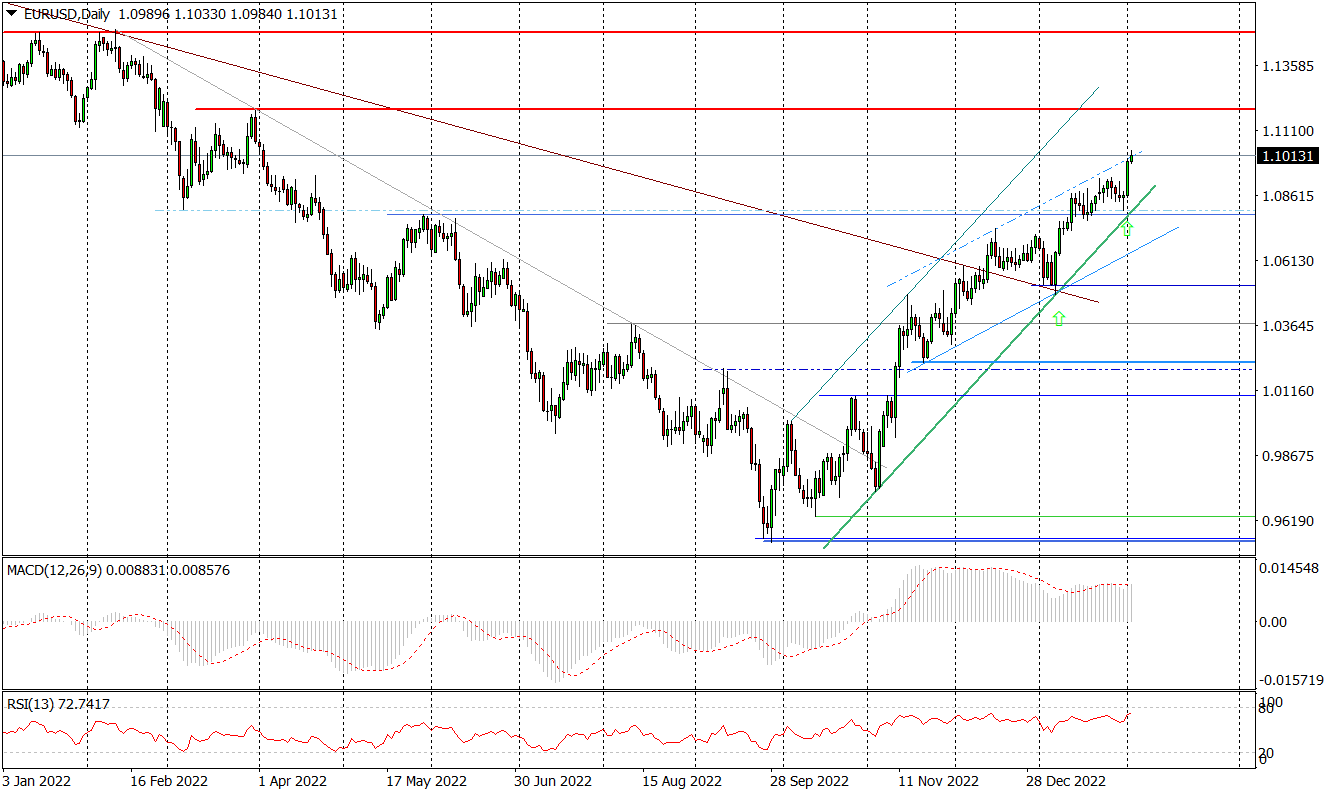

It was even hotter on the currency market. The dollar clearly weakened against a basket of currencies. EUR / USD exchange rate shot up sharply, breaking the psychological level of $1,10. This move was probably helped by waiting for today's results of the meeting European Central Bank, which, according to forecasts, will raise interest rates in the euro area by 50 bp and at the same time will announce further increases.

Daily chart EUR / USD. Source: Tickmill

The dollar clearly weakened against the zloty as well. The USD/PLN exchange rate broke the support zone of PLN 3-4,30, defended for 4,32 weeks, at the same time breaking the upward trend line drawn after the lows of June 2021 and February 2022, and finally the dollar fell below PLN 4,27. The only thing that can be worrying now on the USD/PLN chart is the persistent oversold and still current divergences on the indicators.

USD / PLN daily chart. Source: Tickmill

The gold market also reacted to the results of the Fed meeting. Gold prices soared, breaking recent highs and rising to $1959,68 today. The last time gold was so expensive was in April 2022.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)