There is agreement and reduction after the OPEC + summit. What does this mean for the oil market?

Recent opponents reconciled, but oversupply is a foregone conclusion. Coronavirus will wipe out five years of consumption increase oil. To fight to balance the market - OPEC + decided to initially cut production by 10 million b / d. This means its reduction by 22 percent.

OPEC + decisions

The production management schedule for the next year was presented. It is to go hand in hand with a reduction in production in other countries (USA, Brazil, Canada, Norway), by a total of 5 million b / d. There is no information as to how these expectations refer to these countries. Decisions are to be made on Good Friday at the G-20 summit.

Delegates agreed that the market outlook is very tough and the fundamentals are the worst ever. OPEC assumes that the global economy will shrink by 2020 percent in 1,1. Even in March, global GDP dynamics was forecasted at 2,4%. Every year. The collapse in growth is reflected in the projections of oil demand. Rystad Energy estimates say that the demand is now 27,5 million b / d lower than before the epidemic. US gasoline demand is at its lowest since the 90s, and the third largest oil consumer, India, has cut consumption by 70%.

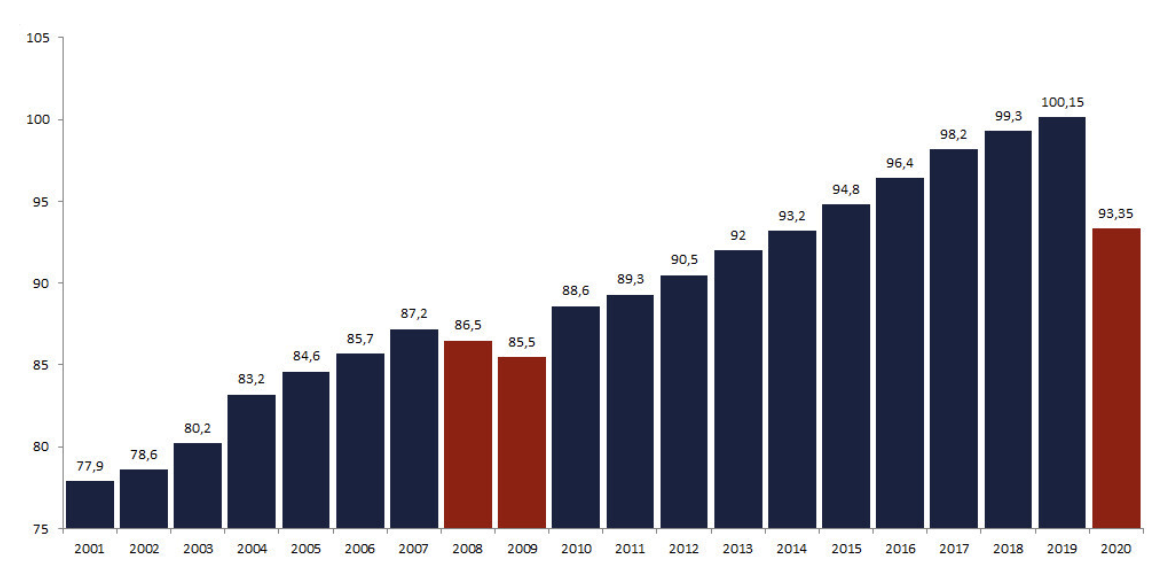

As a result, OPEC assumes that in the worst quarter, demand is expected to collapse by 12 million b / d on average, and as much as 6,8 million b / d in the whole year. The average annual demand for oil in 2019 was slightly over 100 million b / d. This will be the first drop in demand since the Global Financial Crisis, but it will also be clearly more powerful, by as much as 6,8 percent. Every year.

To combat the oversupply of OPEC +, he took the following steps:

- in May and June production will be reduced by 10 million b / d compared to current levels;

- from July to the end of the year, the scale of reduction will be 8 million b / d;

- in the first quarter of 2021 the cut is expected to reach 6 million b / d.

The effectiveness of the cuts is to depend on the efforts of Saudi Arabia and Russia. Both countries are to reduce the amount of oil pumped each day to around 8,5 million barrels. The reaction of the markets is far from euphoric. WTI fell on Thursday over 10 percent and quotations were returning to the point they were a week earlier when Donald Trump announced to the world that oil producers would severely limit oil production.

The adopted solution does not guarantee that the market will avoid a gigantic oversupply in the second quarter. At the same time, the fact that the restriction in the coming months will be less stringent - will extend the absorption of huge reserves of raw material, which are currently being accumulated. Recall that last week alone, US inventories rose by a record 15,2 million barrels. The already cited calculations of Rystad Energy show that the demand is almost 30 million b / d lower than the average. April is likely to be the month of the highest overproduction, with restrictions set to take effect in May. Consequently, over the next three weeks, oil stocks could see a huge increase.

INOPERABILITY IS AN OPEC PROBLEM

It should also not be forgotten that the Achilles heel of the OPEC + agreement was its low effectiveness. In the past, numerous manufacturers have chronically failed to fulfill their obligations. In the last eight months of the previous OPEC + agreement, Russia never cut production as much as it had been agreed. Only half of the twenty signatories met the target when the negotiations broke down. The statistics are even worse for non-cartel states. Out of ten countries - only the smaller players, ie Azerbaijan and Oman, fulfilled the assumptions. Apart from Russia, Kazakhstan and Mexico also had problems with this. Anyway, the resistance of the second of these countries to accept the required reduction in output at the April 9 summit shows that coordination of production will be very difficult and will raise reservations. All the more so as it will also include a number of countries that have not yet coordinated mining with OPEC (as long as they join the agreement).

Iran, Libya and Venezuela are again exempted from production reduction due to very low production on a historical background. Each of these countries will strive to increase production. Particularly high risk exists in the case of Libya, which is in a civil war, which produces little, and last year it pumped almost a million barrels each day on average. General Haftar realizes that he must resume oil supplies to global markets to provide funding and calm his army's mood.

Average annual oil demand according to EIA and its OPEC forecast for 2020. Source: EIA, OPEC

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)