After an increase in investment and physical demand, oil is heading towards the 2021 high.

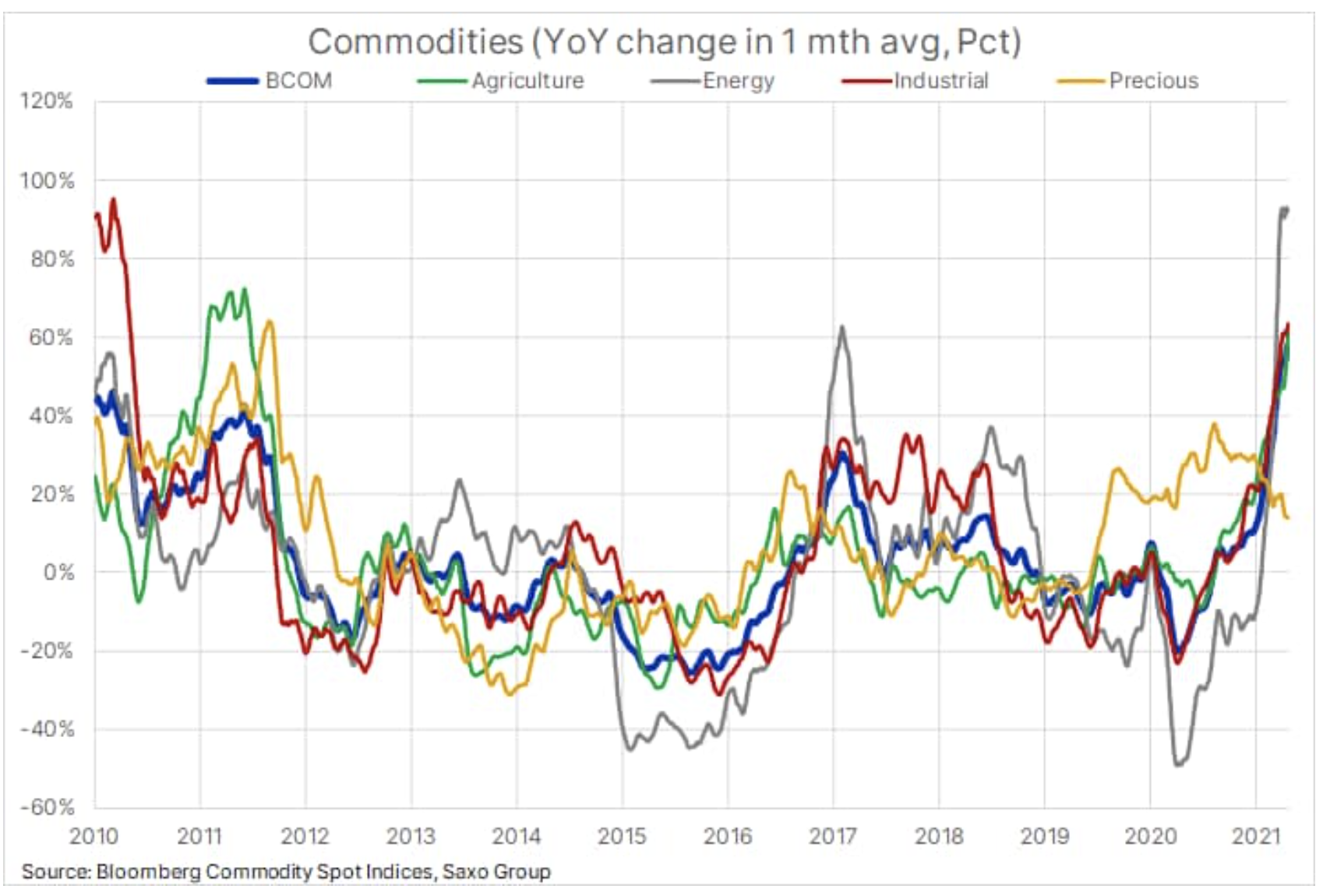

Most commodities continue to strengthen amid predictions that the popandemic growth dynamics will create supply bottlenecks, as well as the pressure for a green transition, weather concerns and increasing demand from traditional and speculative investors who are taking advantage of the current momentum and at the same time, they are looking for hedging against the risk of accelerating inflation. As a result, the Bloomberg spot commodity index rose by 19% year-on-day, and on a year-on-year basis the index grew by more than 60%.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

The year-on-year dynamics of changes has reached levels that have not been recorded for at least a decade, and coupled with rising production costs forcing businesses to pass costs on to consumers, the possibility that the current sharp rise in inflation is by no means a temporary phenomenon, contrary to the opinion of global central banks . After strengthening inflation pressures the reversal will become very difficult and there is a risk of a self-perpetuating loop with commodity prices likely to rise even more in the coming months and quarters, which is why we are placing so much emphasis on the new supercycle.

Most commentators focus on the increase in demand as the main driver of the further boom in commodities, but the demand for investment plays an equally important role. Current investor demand can be channeled directly to specific commodities through the futures market or publicly traded funds, or through products such as bank swaps or index funds following recognized commodity indices.

Check it out: How to Invest in Oil? [Guide]

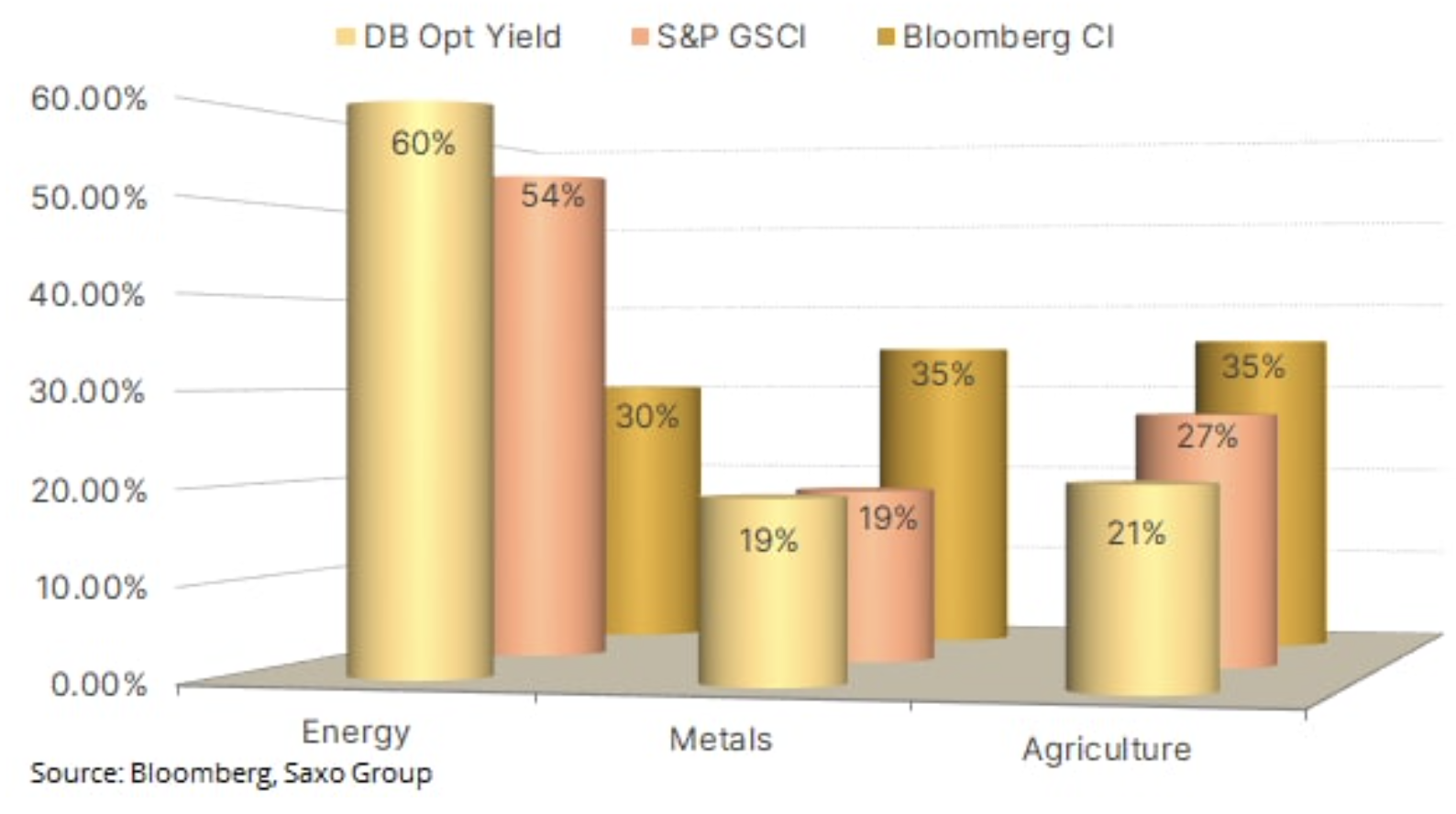

The three most popular of these are the Bloomberg Commodity Index, which we frequently use due to our broad exposure to all three sectors - energy, metals and agricultural products - as well as the S&P GSCI and the DBIQ Optimum Diversified Commodity Index.

The composition of each of these three indices is provided below to help understand why energy, and in particular oil, has benefited so significantly from increased investment demand. 30-60 cents of every dollar an investor places in an index-tracking or swap fund is invested in energy products ranging from crude oil and fuel to natural gas. If we look closely at this, 15-30 cents of every dollar invested is invested in Brent and WTI crude oil.

Brent and WTI crude oil further gains this week, with the price of Brent crude closer and closer to $ 70 / b, a level that briefly broke two months ago before there was a 15% correction. The market, already supported by the demand for investment, is increasingly focused on opening up economies in Europe and the United States, which offsets concerns about a worsening demand in those parts of Asia facing a pandemic. This is especially true of India, where analysts forecast a significant decline in fuel demand of 0,5-1 million barrels per day this month.

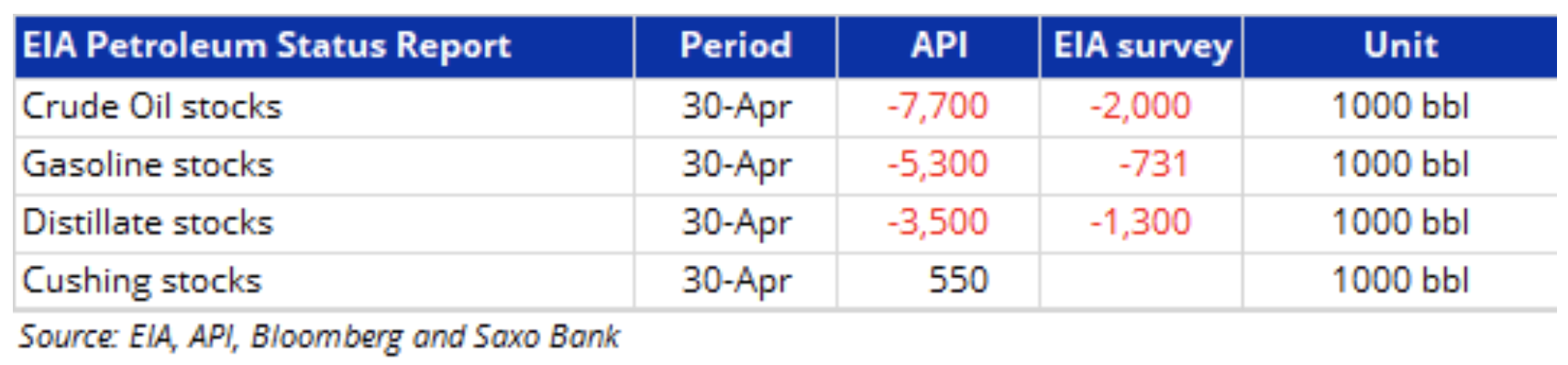

The market received an additional boost on Tuesday after the American Petroleum Institute (API) saw U.S. crude oil stocks plummet as well as both gasoline and distillate stocks plummeting (see table below), thereby bolstering hopes for increase in demand for fuel in the world's largest economy.

Comment from our technical analysis expert Kim Cramer Larsson:

Since late March, the price of Brent crude oil has remained within a narrow four-dollar rising corridor, currently between $ 66 and $ 70. The Relative Strength Index (RSI) is rising without divergence, pointing to the possibility of testing in the higher regions towards the next key level of $ 71,30 / 40, the March high and the trendline connecting the previous three highs. After breaking this level, the contract could move towards the 2019 high of $ 75,60.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Will global warming help wheat? [Webinar] wheat raw materials webinar](https://forexclub.pl/wp-content/uploads/2024/03/pszenica-surowce-webinar-300x200.jpg?v=1711099347)