Summary of the XNUMXnd week of the TMS Brokers competition. The market is trapped.

Competition during 6th edition of the educational competition TMS Brokers is fierce. The second round fell on a period of declines on the global dance floors. Return rates were no longer as high, a the best trader obtained more than twice lower result than the winner of the first round.

The global financial market is still stuck. On the one hand - in many areas of world economies - we are witnessing a dynamic rebound, on the other hand, concerns about a second wave of cases are growing.

Equity markets were under pressure last week, which resulted in declines in indices such as the Dow Jones, S & P500 and DAX. The German benchmark broke down from short-term consolidation. On Thursday it reached a minimum of 11925 points. It was true that we saw a rebound in the following hours, but at the end of the week the index was heading south again.

A potential RGR formation has emerged on the US NASDAQ100 technology index. At the end of last week, the price broke the neckline, which theoretically gave investors a sell signal. Popular market WTI oil noted a larger correction in quotations. The price managed to close the bear market gap in March, after which the rate dynamically "returned" to the level of 37 dollars per barrel.

It was also interesting on gold market. Metal was, again, the most expensive since 2012. In the second half of the week there was a slight cooling and the rate was again below 1750 dollars per ounce.

TMS Brokers competition - Ranking

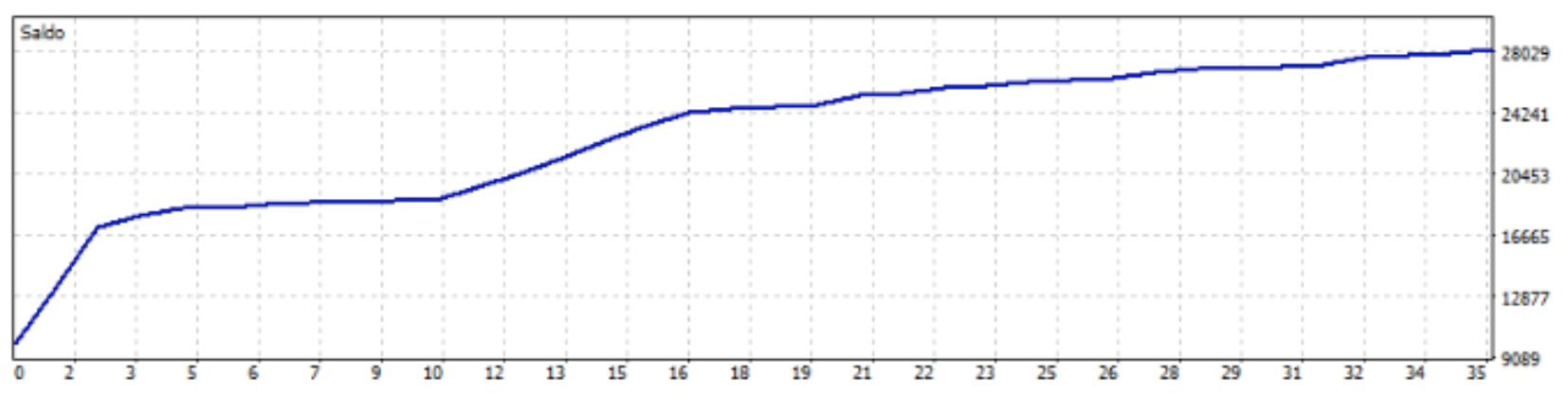

The participant won the second round with the result over 197 proc. He chose only stock market indexes. In his competition portfolio we found positions for DE30 (contract for DAX) and US US100 (contract for NASDAQ100). The best single position guaranteed him a profit of 4354 euros. It happened on the last day of the week. The capital curve of the winner of the second round shows that the participant also noted worse periods, and the road to the first place was not littered with roses. In the middle of the week the player noted several severe losses. We notice risk management strategy and the use of defense orders on many transactions Stop Loss.

2nd place with a score over 179 proc. it was taken by a trader who, like many other participants, chose the German index market. He made 31 trades, which is an average of 6 positions per day. The participant did not use any defense orders, therefore he did not record any lossy result. You could say he was very lucky. It would be enough for the player to buy at least once uphill or sell downhill. Then its result could be radically different. However, the final result counts, and as we know - luck is also needed in trading.

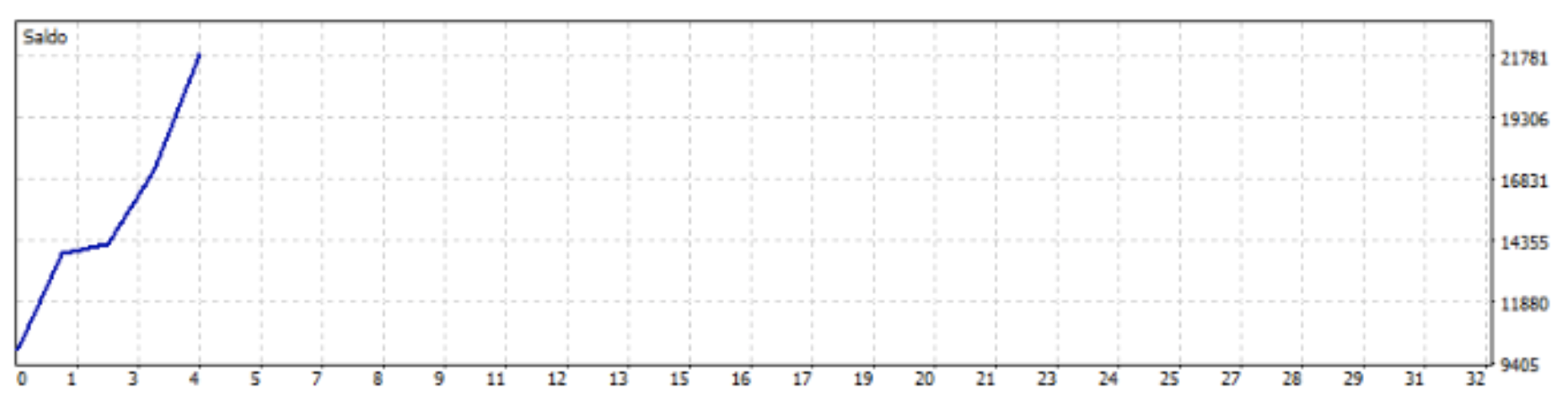

However, the competition portfolio of the XNUMXrd place participant looks the most interesting. And it's not about a good result 162,5% and about the number of transactions carried out. There were just very few of them. 6 sales transactions of DE30, which took place on June 23, 24 and 25, gave a profit of over 16. euro. Each of them closed after a few or several hours. The contestant did not bother with the orders of Stop Loss and Take Profit. It can be said that the trader perfectly took advantage of the drops of the German stock market, which lasted from Tuesday to Thursday morning.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Where to look for investment opportunities? Forecasts for the XNUMXth quarter [Download Ebook] forecasts for the fourth quarter](https://forexclub.pl/wp-content/uploads/2023/10/prognozy-na-iv-kwartal-300x200.jpg?v=1697785512)