Powell and co. Ultimately, the markets reacted positively

Yesterday's speech by the boss Fed Jerome Powell w The Economic Club of Washington was the main event of the day in the financial markets. Today, more representatives of the Fed will enter the "stage", which may cause as much excitement as yesterday's.

– The process of disinflation in the US has begun, but we still need to raise interest rates to make sure that inflation returns to 2 percent. purpose – said the president of the Fed on Tuesday (quoted by PAP).

A stock market rollercoaster

Initially, Powell's words pleased the markets, because there were no references to it in his speech at the Economic Club of Washington Friday's data from the US on the situation on the labor market and the ISM index for the services sector, i.e. reports that worried investors, because they could prolong the cycle of tightening monetary policy in the US. As a result, the first reaction to Powell's words was an increase in Wall Street indices and a weakening of the dollar.

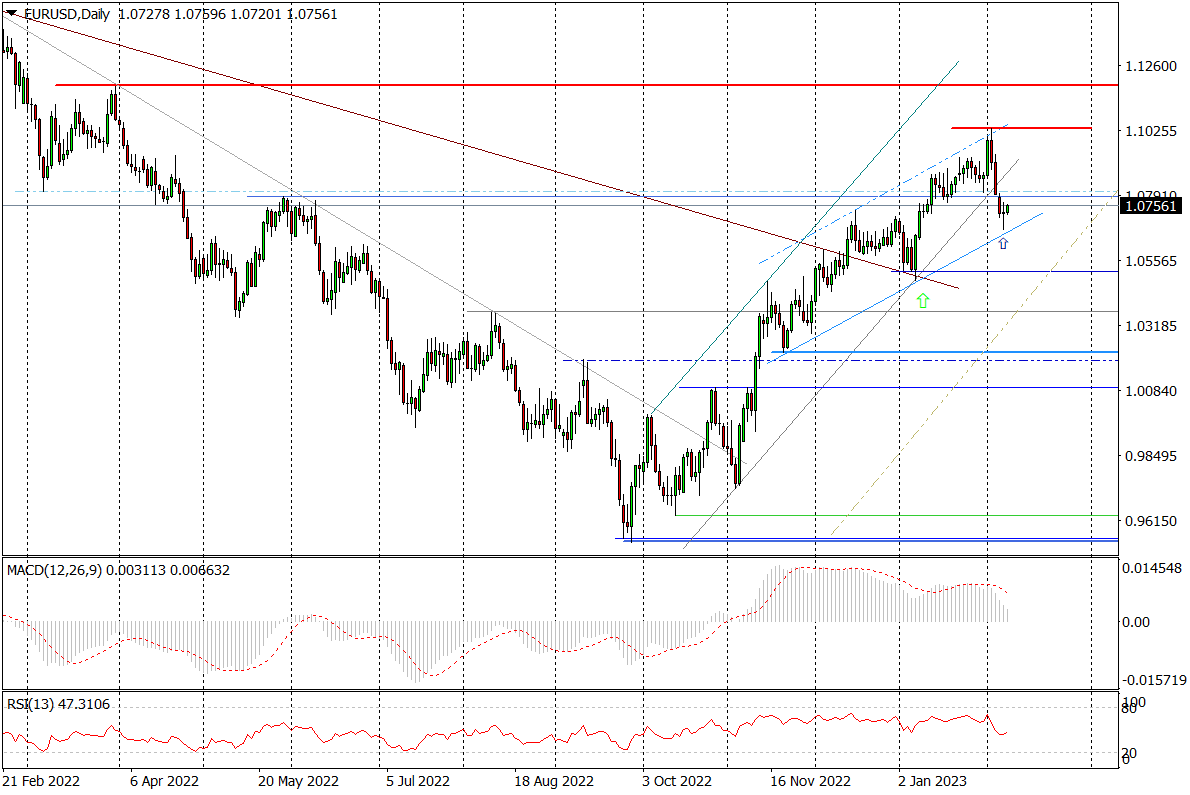

Moments later, however, investors came to the conclusion that Powell's message was basically hawkish, which pushed the indices down and strengthened the dollar. It did not last long and finally investors returned to the original interpretation of the Fed's words. As a result, Wall Street indices moved up and the dollar weakened slightly. The final was that the DJIA at the end of the day increased by 0,78 percent, the S&P 500 by 1,29 percent, and the Nasdaq Composite by 1,9 percent. EUR / USD exchange rate, which fell to $1,0669 during the day, ended the day at 1,0730, and is rising to 1,0750 today.

Daily chart EUR / USD. Source: Tickmill

This ultimately positive reaction to Powell's words on Tuesday does not end the story. Today there will be more comments from Fed representatives, and there will be a lot of them, and they will shape the moods in the markets. The fact is, however, that yesterday the head of the Fed set the market azimuth in a way, so now it will be harder for investors to scare off with larger interest rate hikes in the US or their subsequent reduction.

Calendar of appearances by Fed representatives. Source: macroNEXT

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)