The drop in inflation is probably temporary. Market forecasts

In the latest December commentary of VIG/C-QUADRAT TFI experts, we will find, among others: information on how much the messages and actions taken by the FED affect global markets and what conclusions we draw from this, whether it is time to invest in shares of Polish companies, whether bonds are already earning, and if so, which ones, and finally what next inflation – with forecasts for 2023.

Global markets - stocks

Situation on global stock markets is influenced by the policy of the US Federal Reserve Bank (Fed), and Jerome Powell's recent comments seem to point to one thing - the cycle of interest rate hikes is coming to an end (at least for the time being). The Fed's more cautious approach to further rate hikes has been a major catalyst for the weakening of the US dollar. The weaker dollar translated into investors returning to risky assets, in particular emerging market equities and technology companies.

However, after two months of strong gains, US and European stocks have returned to levels above their long-term averages, reducing their relative attractiveness.

Hopes related to the extinction of inflation i approaching the end of the cycle of interest rate increases may turn out to be futile and even disappointing for investors. 2023 promises to be a difficult and changeable year. In this environment, it seems worth paying attention to a slightly higher level of cash in the wallet.

Domestic market - shares

In accordance with the principle - no bad news is good news - investors continued to return to Polish shares. In the period from October to November, we could even observe double-digit increases in exchange rates.

What could be another catalyst for growth on the domestic stock market? Data on GDP and inflation. VIG/C-Quadrat TFI experts believe that still low valuations combined with low expectations of institutional investors regarding the Polish market, positive surprises in macroeconomic data and company results are the preferred combination for continued increases on the domestic stock market. An interesting change is the subtle but noticeable shift of investors from the direction of large and medium-sized companies towards small-cap shares.

What risks do VIG/C-Quadrat TFI experts see? First of all, geopolitics, i.e. in the case of the domestic stock market - further escalation of the conflict in Ukraine. Every day of war means gigantic costs on both sides - both human and economic. Another risk is domestic politics – let's remember that an election year is not a time to save money. That is why we observe growing expenses and social transfers, which make inflation in Poland one of the highest not only in the region of Central Europe, but also in the entire European Union.

In short, stocks Polish ones are still cheap, but after such large increases (without breaks) in the past two months, we may be dealing with partial profit taking by investors. This does not change the fact that the shares remain attractive in the medium-term investment horizon.

Corporate bonds

In November, the corporate bond market was stagnant. The prices of corporate bonds on the secondary market fared pale compared to treasury bonds. While the prices of government bonds increased in November, the prices of corporate bonds did not fluctuate much. Again, not much happened on the primary market. Leaving the reference rate unchanged by the Monetary Policy Council contributed to the decrease in WIBOR reference rates.

Treasury bonds

The Polish treasury bond market has been experiencing extraordinary volatility in recent months, and investors' sentiment is changing like in a kaleidoscope. There is no trace of the bond panic sale in October. In November, the domestic debt market experienced the strongest rebound in its history. Yield on treasury bonds in a month fell 177 basis points (prices have increased).

The sudden reversal of sentiment was supported by several pillars. On the one hand, after a dramatic sell-off in October, bonds again looked attractive in nominal terms (temporarily yields exceeded 9%!). In addition, demand was supported by global expectations for the start of deinflation processes in the global economy (continuation of the fall in inflation in the US), and on the local market, the decision-makers' assurances that next year's expenditures would be subject to strict control and conducted in a prudent manner were the driving force.

These factors were decisive for the increase in treasury bond prices. The readings of inflation and GDP dynamics on the last day of November show that the Polish economy is doing quite well (GDP +3,6% vs. +3,0% market expectations), and the recent declines in energy commodity prices also had a positive impact on the CPI in Poland (inflation reading 17,4% vs. 18,0% forecast by economists).

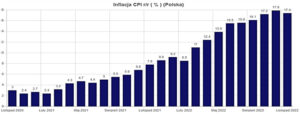

What about inflation?

In the opinion of VIG/C-Quadrat TFI experts, the last month in a short period of time exhausts its potential for further increase in bond prices. Looking further, they see some threats that still loom on the investment horizon. The fall in inflation is likely to be temporary, and in the first quarter of next year we will see its rise again, and the index itself will reach new highs due to the end of some shields, indexation of pensions and the minimum wage. Next year's borrowing needs are still well above long-term trends, which will generate the need to compete for investors' funds.

CPI inflation in Poland y/y. Source: Macronext

The coming months will show whether the current disinflationary trends are sustainable. However, observing the growth path of core inflation, we see that the Polish economy is experiencing a wide spread of inflationary tendencies in the economy. These elements should contribute to maintaining increased volatility in the debt market. Declaring a lasting victory over stubbornly rising inflation will require a little more evidence than a one-off fall in the CPI.

Extended commentary available on VIG/C-QUADRAT TFI website.

Source: Michał Szymański, VIG/C-Quadrat TFI press materials

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)