Saxo Bank Predictions Q3: Europe - New Cryptocurrency Center?

Cryptocurrencies won the hearts of the Swiss: canton of Zug begins to be called "Cryptocurrency Valley", Switzerland has the highest cryptocurrency implementation rate in Europe, and in 2018 the local economy minister announced that the Swiss should become "Cryptocurrency nation".

Some European countries are more open to new technology than others, and regulation is made at the local level of individual countries. The ideal scenario for the EU is to establish uniform regulations in all Member States that would support technological innovation as part of the digital transformation and protect citizens from using and investing in digital assets. This requires an exceptionally balanced legal basis and stringent cybersecurityas well as becoming an active player in this industry.

About the author

Anders Nysteen - joined Saxo Bank in 2016 to the department Quantitative Strategiesand its main goal is to develop mathematical trading strategies and asset allocation models. Anders holds a degree in physics and nanotechnology from the Technical University of Denmark and a PhD in quantum photonics.

Anders Nysteen - joined Saxo Bank in 2016 to the department Quantitative Strategiesand its main goal is to develop mathematical trading strategies and asset allocation models. Anders holds a degree in physics and nanotechnology from the Technical University of Denmark and a PhD in quantum photonics.

Valdis Dombrovskis, Executive Vice-President for an Economy that Works for People at the European Commission, he stressed, that "The future of finance is digital" and that "technology has so much more to offer consumers and businesses, and we should proactively seize the opportunities of digital transformation while minimizing any potential risks."

The risk related to the failure to introduce digital currency

Imagine a world where larger-scale cross-border payments and transactions are made using cryptocurrencies provided by suppliers from other countries or private entities, impregnated with the possible influence of individual governments. This is the vision of some cryptocurrency enthusiasts and cryptocurrency independence promoters, but central banks see it as a growing threat, as exemplified by the announcement Facebook on the introduction of its own digital currency Libra (now called Diy), which met with strong opposition from supervisory authorities.

Clear signal sent European Central Bank (ECB) in early June 2021, identifying significant risks to stability if the central bank decides not to offer digital currency. According to the ECB report, the issuance of the digital currency of the central bank ( Central Bank Digital Currency, CBDC) "(…) Would help maintain the autonomy of national payment systems and the international use of currency in the digital world”And to support cross-border transactions at lower costs. Research conducted by the ECB showed that citizens and entrepreneurs in Europe as the most important feature of the potential digital euro they consider privacy (though not complete anonymity), while the other key feature is security. More than two thirds of respondents believe that the digital euro should be integrated with existing payment and banking systems.

Many countries are running pilot projects: CBDCs have been put into public use in both the Bahamas and Cambodia, and China is one of the most important pilot countries. In Europe, many countries such as the Swedish Riksbank and its e-crown, is quite positive about CBDC. A more distrustful stance towards CBDC was taken by the president of the German central bank. Already in March he warned Since the widespread use of CBDC may have serious consequences and the business model of banks will fundamentally change, the possible introduction of CBDC should therefore be well thought out. Germany is running its own pilot project on digital assets and the Deutsche Bundesbank announced the successful completion of the clearing interface test for electronic securities using distributed ledger technology of ten-year federal bond issuance, with settlements using the new technology. This technology is an alternative to infrastructure based on blockchain technology, does not require tokenization of assets and money, and its implementation would be much faster than the CBDC issue.

The structure of CBDC should be slightly different from many of today's key cryptocurrencies. According to Goldman Sachs, the underlying distributed ledger should use an authorization-based version where the central bank can choose who should be part of the system, as opposed to the Bitcoin network which is open to the public. To avoid promoting the use of CBDC for crime-related activities and transactions, full anonymity will not be taken into account.

Finding the Holy Grail for regulating cryptocurrencies

The EU is making steady progress towards developing harmonized regulation of digital assets. Already in January 2020, with the introduction the Fifth Anti-Money Laundering and Terrorist Financing Directive, cryptocurrency companies have been required to follow the same data exchange, anti-money laundering and procedure requirements meet your clientwhat central banks.

Cryptocurrencies are widely recognized as legal across the EU, although the process of regulating cryptocurrencies in Europe is not over yet. There has been a shift away from local regulation in favor of the EU announcing its first comprehensive plan on how to regulate cryptocurrencies in September 2020; there is still a clear regulatory loophole with regard to investor protection and fraud avoidance. The title of the European Commission project is Crypto Markets Regulation (Markets in Crypto-Assets Regulation, MiCA) and complements the existing regulations MiFID II on traditional activities and financial instruments in the Union. It is part of a bigger one digital finance package, which aims to improve digital resilience in the financial sector by increasing Europe's innovation and competitiveness, as well as reducing market fragmentation and enabling authorized cryptocurrency companies to provide services across the Union. The package also includes a "digital operational resilience legal act" to ensure that all players in the digital financial system are ready for the increased vulnerability of the monetary system to cyber attacks.

Green Cryptocurrency Mining

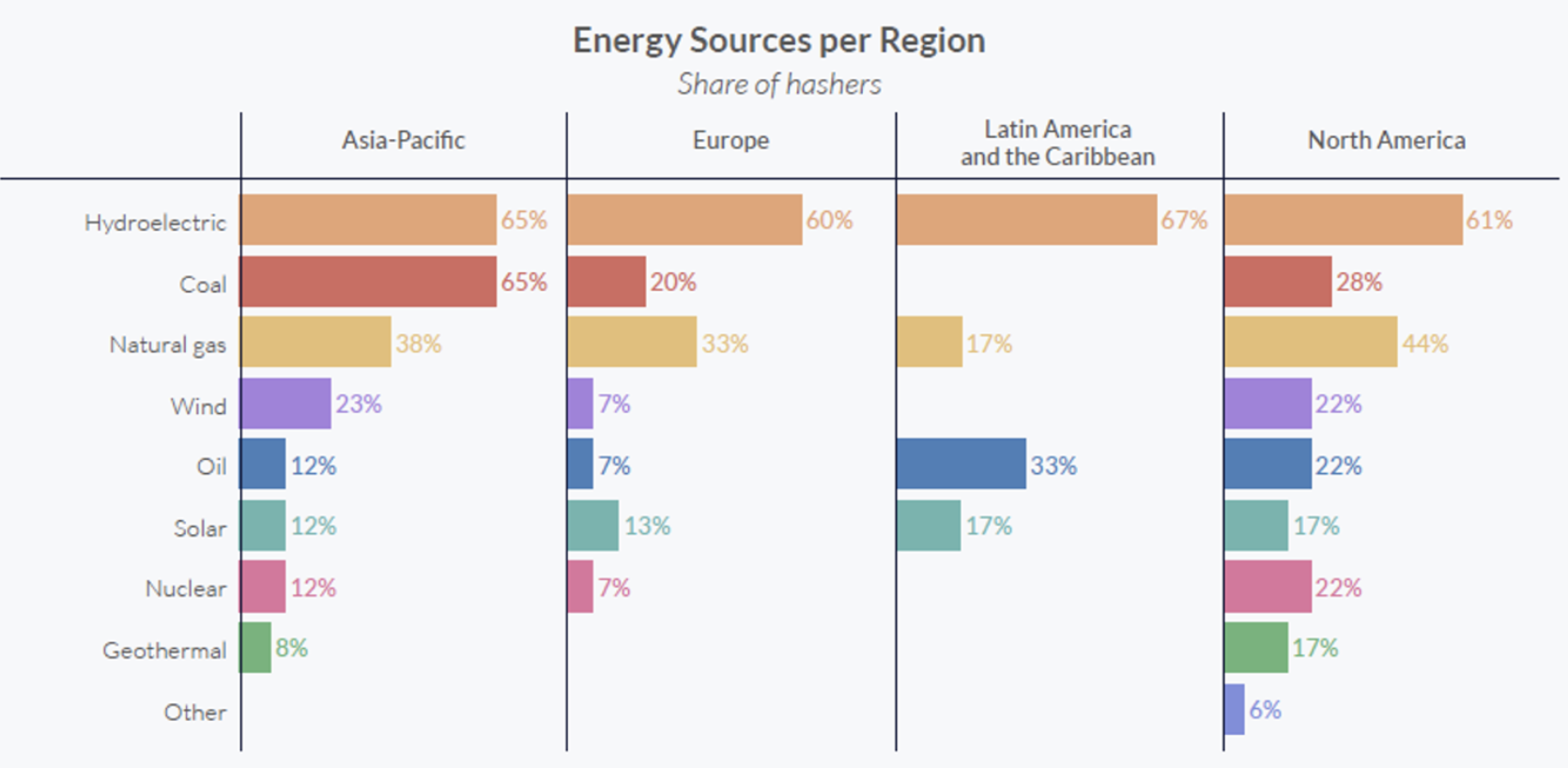

The two largest cryptocurrencies, bitcoin and ethereum, use a protocol to verify transactions on the network proof-of-work, which is an energy-consuming process carried out by cryptocurrency miners, requiring high computing power. According to Cambridge Center for Alternative Finance, for about 75% of miners, a part of their energy mix is renewable energy sources, although less than 40% comes from renewable sources total consumption. As can be seen in the chart, European miners are leaders in the use of renewable energy sources. The Nordic countries are famous for sustainable cryptocurrency mining because electricity there is cheap and comes mainly from renewable energy sources such as hydropower.

The percentage of miners that rely on a specific energy source. Source: study conducted by the Cambridge Center for Alternative Finance.

One of the key European countries in the field of cryptocurrency mining is Iceland due to its hydro and geothermal energy sources, and the first mining center Bitcoin opened there in 2014. Until four years ago, Iceland accounted for about 8% of global bitcoin production, however, mining operations have raised concerns among ecologists about the damage done to waterfalls and nature. Over the years, Iceland appears to have reached its limits on the use of excess energy, and indeed Iceland's global share of bitcoin mining has dropped to just around 1%. In terms of mining potential, Norway has taken the lead with its oversupply of energy; Sweden also has a similar potential, as the conditions there are similar to those in Iceland. However, cryptocurrency mining competes for excess renewable energy with other industries such as the manufacturing industry "green steel”, In which the steel industry is shifting from coal energy to renewable energy and hydrogen. According to data from 2020, the Nordic countries together generate only a few percent of global production capacity (hash rate), and therefore the renewable energy program in these countries does not have a large impact on global extraction, although they hope to set new standards in this area.

Co dalej?

Christine Lagarde, President of the ECB.

The European Commission wants the EU to become a leader in the field of blockchain technology, both as an innovator and as an entity facilitating the activities of companies and applications based on blockchain technology, and many projects are under preparation to achieve these goals. IN interview President of the ECB for Bloomberg Christine Lagarde If ECB decision-makers back the digital currency project, the digital euro would be rolled out in about four years, she said. Looking at how much the cryptocurrency industry has grown over the past four years, it seems unpredictable whether cryptocurrencies will be widely deployed for financial transactions and payments, or some of the current problems with major cryptocurrencies such as high transaction fees or limited bandwidth will prevent the cryptocurrency breakthrough. If the cryptocurrency industry continues to grow rapidly, it may be necessary to consider other methods of digitizing the financial industry than CBDC, as exemplified by Germany. Regulatory initiatives in the EU have a much shorter timeframe and, if implemented, will mark a quantum leap towards cryptocurrency regulation and could pave the way for Europe to become a global benchmark for standards, as well as improving sentiment about digital assets.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)