Silicon Valley Bank's troubles weigh heavily on the dollar

EUR/USD quotes it moved back above $1,07 after making a dynamic upward move from the important support area around $1,05. Dollar loses due to fears related to Silicon Valley Bank and the US banking industry.

Will the Fed limit rate hikes?

The situation around Silicon Valley Bank (and other smaller banks) not only exposed the problems of the US banking sector, but also increased fears about the negative consequences of the recent rapid and large interest rate increases by Fed, at the same time leading to a partial reduction of expectations for further increases in the cost of money. Goldman Sachs analysts are a perfect example of this. Currently, they assume that the recent turmoil around the banking system will cause the Fed to hold off on raising interest rates at next week's meeting. Thus, they changed their forecasts from a week ago, when they assumed a hike of 25 basis points (bp) in March. This resulted in lowering the target level of interest rates in the US to 5,25-5,50 percent. from 5,50-5,75 percent. predicted a week ago. Currently, the fluctuation range for the US federal funds rate is 4,50-4,75%.

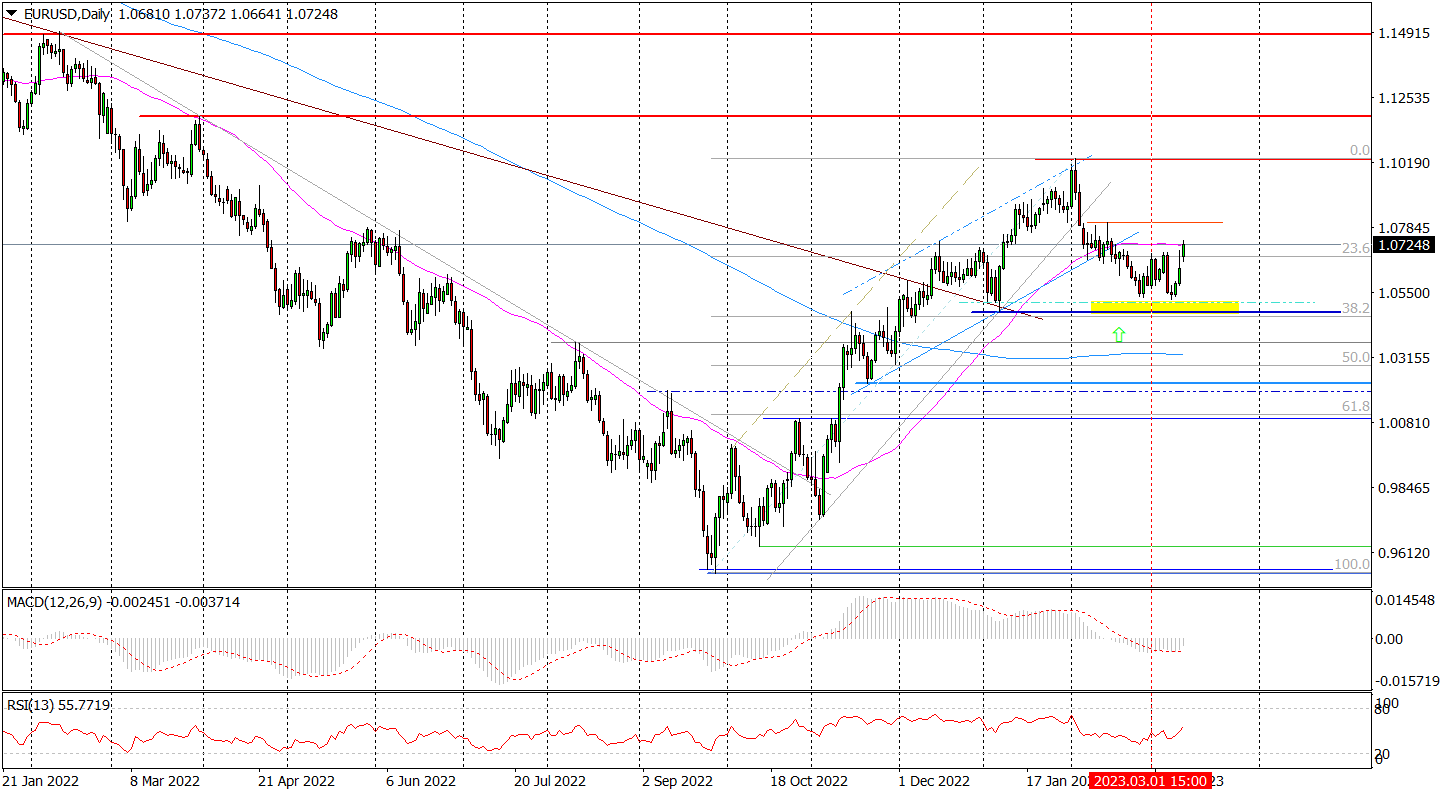

Banks' problems and limited expectations as to the scale of interest rate hikes by the Fed translate into a weakening of the dollar against the main currencies. Including the single currency. This morning, EUR/USD is up for the third day in a row, breaking above the March 3 local high (6), having previously made a turnaround from the wide support area of 1,0694-1,0462. On the daily chart, this leads to the formation of a local double bottom formation, which should definitely end the downward correction lasting from the first days of February. Especially that such a scenario is also indicated by the recent improvement of the situation on daily indicators (e.g. MACD) and good chances of EUR/USD returning above the 50-day average.

Daily chart EUR / USD. Source: Tickmill

The market awaits the US inflation data

Right now, the dollar market, like most markets, is in turmoil Silicon Valley Bank, but in the coming days it will not be the only topic affecting investors' moods. It must not be forgotten that on Tuesday and Wednesday data about February inflation in the US, on Wednesday we will find out how retail sales developed in the world's largest economy, while the week will end with the publication of a report on industrial production.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)