Profitability limits the prices of raw materials; oil has reached its maximum

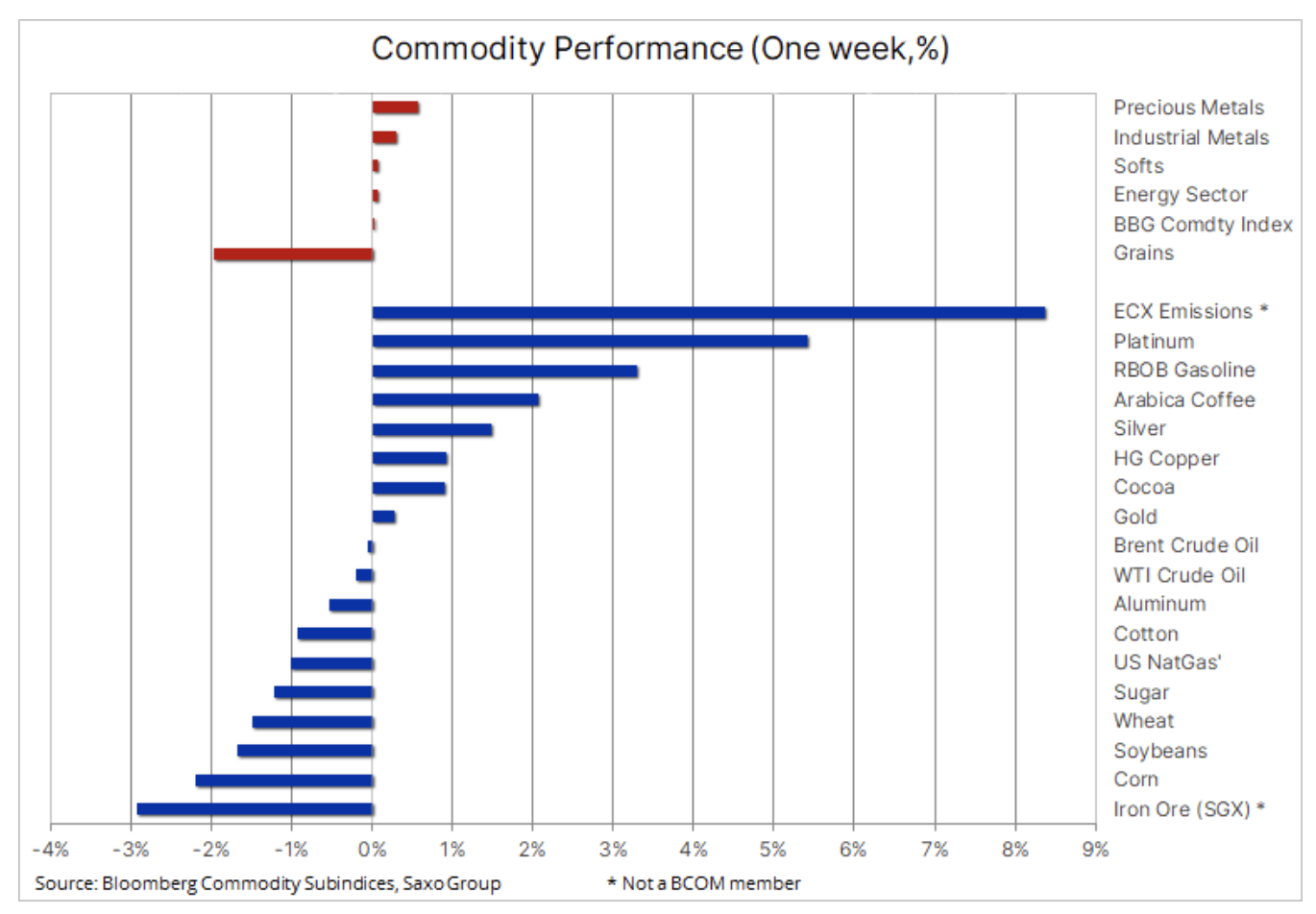

The month-long bull market in the commodities market continues to struggle with increased volatility, causing another increase in US bond yields, which in turn contributes to the intensification of risk aversion and the strengthening of the dollar. As a result, the Bloomberg commodity index remained almost unchanged around the two-and-a-half-year high, and coupled with a record-high long position by funds, the sector is now exposed to consolidation risk despite strong fundamentals.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Most metals saw price fluctuations in line with changes in the dollar and bond yields. The approval of the US fiscal stimulus package supported copper despite signs of an increase in supply, in particular in the Chinese market, where stocks monitored by stock exchanges began to rise seasonally, despite the fact that this came from a price-favorable multi-year low. Platinum has risen in value after the global council investment in platinum - World Platinum Investment Council (WPIC) informed in the published report that in 2020 the deficit of this metal was the largest in history, and 2021 will be the third consecutive year of the deficit.

Iron ore recorded a weekly loss after the Chinese government launched an action to combat environmental pollution in Tangshan, one of the most polluted cities in the Middle Kingdom. For steel, the government has already announced a production cut as China aims to become carbon neutral by 2060.

Staying with emissions, cost EU carbon dioxide emission allowances, the world's largest emissions reduction and trading program, rose by 7% to a record EUR 42,6 / t. In addition to the continual rise in oil prices, the last phase of the 31% y / y boom was due to gas outages in Norway, which increased the power plant's demand for more environmentally harmful solutions, which in turn means more carbon allowances coal.

Cereals and oilseeds

Another outbreak of African swine fever in China has brought local maize prices down to their lowest level this year, and if the decline is not stopped, the weakness could also translate into overseas markets, in particular cereals and oilseed futures quoted on the Chicago Stock Exchange. As a result of this decline, coupled with the US government-projected increase in corn and soybean supply, the Bloomberg crop index lost weekly. Although losses, especially in maize, were relatively small, the potential slowdown in China could expose the entire sector to the risk of lowering the forecasted demand, and with it the risk of selling contracts by funds that currently have significant exposure to both corn and corn futures. and soy. The decline in wheat prices was mainly related to the weather after long-awaited rain fell on the American plains.

Given that US cereal prices have recently hit their multi-year highs and the UN Food and Agriculture Organization's global food price index is gaining at its fastest pace since 2014, the market will soon focus on the Northern Hemisphere's seeding and growing season. The proportions of corn, wheat and soybeans cultivated by US farmers could become an important catalyst for price action in the coming months. Accordingly, grain traders will await guidance in the form of a report on future crops that will be released by the US Department of Agriculture on March 31.

Precious metals

Gold (XAU / USD) i silver (XAG / USD) came under pressure as the direction of the dollar continued to move and the bond market, where yields rose again in response to the adoption of a $ 1,9 trillion fiscal stimulus package. Although this agreement is favorable for economic growth, it also entails a risk of inflation, although after the weak CPI reading in the US at the beginning of the week the figures do not reflect this risk yet.

We maintain a positive forecast due to the belief that inflation will ultimately exceed current market expectations. Until then, however, the steady rise in ten-year bond yields towards the next key target of 2% from the current 1,6% could once again impact the downside potential. So far, gold continues to trend downward: the key support is in a significant area between $ 1 and $ 670, while potential buyers are in no rush to open long positions until the metal returns to the $ 1 / oz level below which it started the last weakness has come.

Petroleum

Oil price remained almost unchanged on a weekly basis as the market looked for a clear direction. Earlier this week, a failed attack on the Saudi crude oil facility pushed the price of Brent crude above $ 70 / b, but the subsequent 7% correction may indicate that the market has already reached its current high. Despite the support of the US stimulus package and signs of a global recovery in fuel consumption, the market is still waiting for a sustained increase in global fuel demand that would justify current oil prices.

The weekly inventory report of the US Energy Information Administration (EIA) showed another significant decline in gasoline inventories as a result of increasing demand from vehicle owners. A refinery disruption during a Texas blizzard a few weeks ago pushed US crude oil inventories up a fortnight ago by 35,3m barrels, while gasoline and distillate stocks plunged by more than 40mbbl. With a summer departure season on the horizon and an easing of lockdowns on the horizon, refineries face a busy couple of months and gasoline prices are likely to remain high during this period.

Still positive sentiment is somewhat balanced by the continued drive to increase yields and the dollar, as well as the warning tone adopted by OPEC in its monthly oil report. In its March report, the organization lowered its forecast for OPEC oil demand for the next six months due to the worsening of forecasted demand and a more dynamic increase in non-OPEC supply. This requires a longer period of application of the production discipline i restrictions from OPEC + manufacturers. On March 17, the International Energy Agency (IEA) will publish a report on the oil market.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Will global warming help wheat? [Webinar] wheat raw materials webinar](https://forexclub.pl/wp-content/uploads/2024/03/pszenica-surowce-webinar-300x200.jpg?v=1711099347)