Q2 Outlook: Increase in production costs is a challenge for the stocks

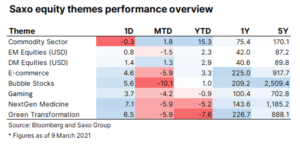

In our QXNUMX forecast, the commodities sector will perform well amid rising inflation expectations, increased interest rate sensitivity and growth stocks may suffer from rising interest rates. We also tried to answer the question of whether the boom in green transformation stocks could be sustained. In this quarterly forecast, we focus on what is missing in the world and financial markets, and how this translates into equity markets.

There is no physical potential in the world

The most important trend since the great financial crisis is the divergence in profit growth between Nasdaq 100 and the global stock market, highlighting the grotesque relative success of the internet economy over the physical economy. Since Q2003 100, earnings per share on the Nasdaq 828 index have risen by 114%, while the MSCI World index has only increased by XNUMX%. For investors, it was a clear market signal that the future belongs to digitization in all its forms, and as a result, there has been an influx of capital towards e-commerce, software, payments, games, etc.

This trend was driven by a rapid decline in interest rates, which lowered the cost of capital for high-growth equity-financed technology companies. Regulation is clearly not keeping up with the digital revolution, which has provided the sector with an unprecedentedly mild regulatory regime. Energy costs continue to decline, which lowers the marginal costs of adding new users, developing neural networks, and processing information. The digital world has been able to develop on the foundation of the physical world that supports it, but today many of these positive factors seem to be fading away.

The success and higher return on capital of digital companies have caused underinvestment in the physical world to such an extent that the World Economic Forum estimates that by 2040 the global infrastructure gap will amount to $ 15 trillion, primarily in emerging markets, but also in the United States.

Raw material prices soaring

Over the past nine months, we have witnessed this under-investment in all its glory in the form of soaring raw material prices, significantly higher container freight rates, port bottlenecks, a semiconductor shortage hampering car production, and the development of last-stage supply chains last-mile delivery). These developments exert a price pressure on the supply side, which will most likely be supplanted by demand pressure after the economies reopen, which will prolong inflationary pressures.

In our view, in the future reflective environment, investors should increase their exposure to the commodities sector and high-quality companies with a low debt ratio. What about entertainment stocks when the economy reopens? The entertainment segment hit record price levels, reflecting an overly optimistic rebound scenario. It simply presents an unfavorable risk-reward ratio.

An increase in interest rates could cause a downward revision of stocks in the most speculative growth segments, such as bubble stocks (stocks with high EV / Sales and negative earnings forecasts), e-commerce, gaming, green stocks and stocks. transformation and new generation medicine, which we observed at the turn of February and March. These pressures may persist as interest rates rise.

Overall, we are not concerned about MSCI World stocks currently valued at a 5,8% future free cash flow return and still offering an attractive risk premium.

Forthcoming inflation will challenge equities

There is consensus that an inflation shock is coming as a result of fiscal stimulus, base effects and rising energy prices pushing up prices for Chinese producers, but there is no consensus on whether inflation will continue. This will most likely be a fundamental question in the financial markets in the coming years and something that will have a significant impact on the return on investment.

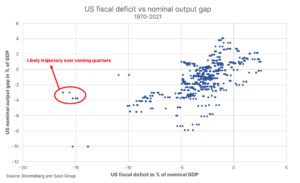

The US economy currently has a deficit of 16,2% against GDP, ahead of the entry into force of the new $ 1,9 trillion fiscal stimulus law. As the immunization program continues, the US economy will reopen and quickly fill the output gap. When this happens, the US economy will find itself in an environment of wide-ranging fiscal stimulus and no output gap. This has the potential to release actual inflation for an extended period of time and keep inflation expectations higher.

Politically, this will be accepted by both Fedand by the US administration, because higher inflation is a hidden means of transferring wealth and reducing wealth inequalities, as well as solving the problem of high debt. We are essentially moving into an environment where labor will be valued more than capital, which will fuel inflation.

About the Author

Peter potter - director of equity markets strategy in Saxo Bank. Develops investment strategies and analyzes of the stock market as well as individual companies, using statistical methods and models. Garnry creates Alpha Picks for Saxo Bank, a monthly magazine in which the most attractive companies in the US, Europe and Asia are selected. It also contributes to Saxo Bank's quarterly and annual forecasts "Shocking forecasts". He regularly gives comments on television, including CNBC and Bloomberg TV.

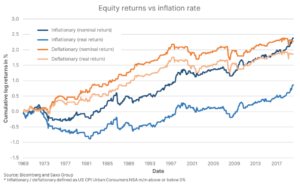

In a recent study, we looked at returns on US stocks since 1969 under various inflation regimes and found that an inflation rate above 3,1% was detrimental to real return on stocks (which still looks good in nominal terms) and that months of rising inflation are linked to relative to lower relative real stock returns compared with months of declining inflation. It should be understood that inflation increases the cost of capital and introduces volatility, making it difficult for companies to make decisions.

Finally, the green transition and the trend towards environment, social responsibility and corporate governance (ESG) will also increase inflationary pressures as they increase the cost of developing both non-renewable energy sources and mining capacity for metals necessary to electrify society. These higher carbon costs associated with production are best seen in the case of the EU's emission allowances, which have just hit their highest price ever.

The EU has long fought US technology giants, and China has stepped up efforts to develop competition and curb monopolistic behavior. As part of the new Biden administration, the US government is hiring the toughest critics of the tech giants with the Federal Trade Commission as a sign that Washington will increasingly regulate large companies, particularly in the technology area. We anticipate that even more negative antitrust and regulation measures will be targeted at major US technology companies. There is simply too little competition in the world.

We are seeing an increase in production costs in every area, and perhaps we will reach a tipping point where inflation will return brutally. Higher inflation, higher cost of capital, more regulation and more antitrust cases are likely to negatively affect profit margins and reverse the positive trend that companies have been using for several decades.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)