Commodity markets are again focusing on inflation as energy prices rise

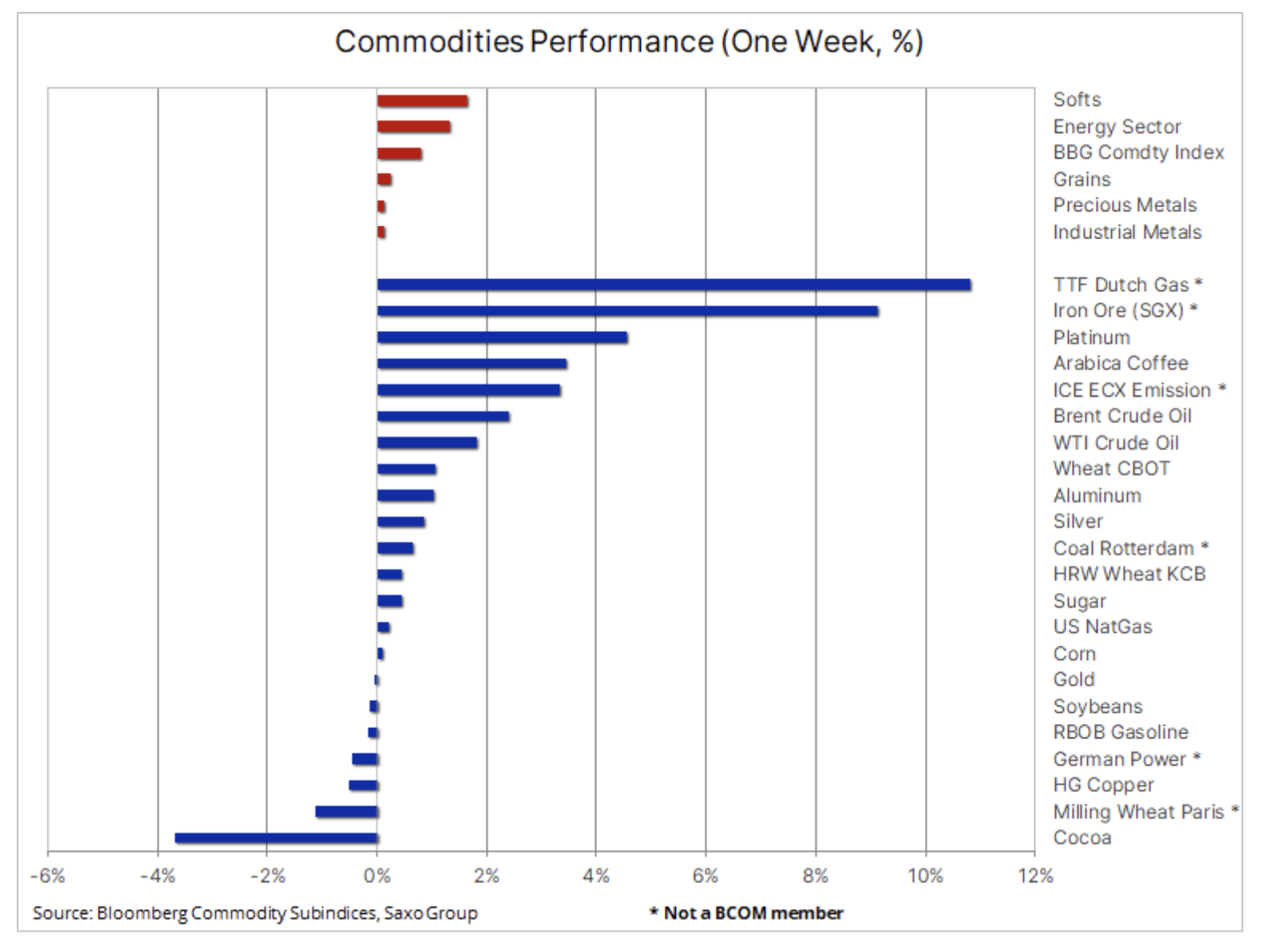

Last week, the commodities sector attracted new buyers after intense and potentially price-negative market interest subsided the Chinese capital group Evergrande and its debt service capacity. While the world's most indebted real estate development company may still present a nasty surprise, the People's Bank of China's continued cash inflow to the financial system has helped minimize the risk of contamination to markets outside China.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

MSCI World Index it went down 4% and then recovered, bringing the 233% time since the last correction in the global stock market to 5 days. This is probably a key reason why investment metals such as gold and silver are experiencing such difficulties this year. Although it is often closely correlated with the movements of the dollar and yields, demand for gold is also inversely correlated with confidence in financial assets, which is now, along with financial market valuations, at a record high.

Another event last week that helped pave the way for commodities, particularly those with a high inverse correlation to US Treasury yields and the dollar, was the sharp jump in US bond yields. He contributed to this Bank of England on Thursday, baffling investors with aggressive rhetoric about the timing of the first interest rate hike. The sell-off of British bonds set the pace of yields in the Eurozone, and US Treasuries recorded the largest one-day rise in ten-year bond yields in months.

Natural gas

One sector that remained immune to concerns about China and the risk of rising bond yields was the energy sector, where oil, natural gas, coal and electricity prices continued to rise due to limited supply and strong demand. Brent crude oil, the global benchmark, reached its highest settlement price since 2018, while in Europe the cost of benchmark Dutch TTF gas hit a record high of EUR 76,5 / MWh or USD 26 / MMBtu, equivalent to USD 150 per barrel of oil before drastically increasing wind energy production in the EU has helped to contain the rise in prices.

In the US, the Henry Hub natural gas futures recovered to above $ 5 / MMBtu, and following the completion of the 50% growth correction to their highest level in August-September 7,5, the technical forecast points to a further strengthening again. This is due to, inter alia, from rising export demand for LNG, as well as the publication of a weekly government report which showed that stocks, as in Europe, are still constrained ahead of the winter peak in demand.

Petroleum

R0pa saw its fifth consecutive week of growth thanks to many new sources of price support. Hurricane Ida, which hit the United States, eliminated more than 30 million barrels from the market, and we continue to see a slow and sustained return to earlier levels. As a result, both US crude oil and gasoline stocks have fallen to the levels most recently recorded in December 2019. Increased winter fuel consumption in the Northern Hemisphere due to the replacement of extremely expensive gas could further stimulate an already booming global demand. In addition, recent months have shown that some OPEC + members, in particular Nigeria, Angola and Kazakhstan, are struggling to reach production quotas, thus helping to strengthen the market by reducing supply below projected levels.

The first historical sale of crude oil from China's strategic reserves was an attempt to counterbalance the current growth, which, however, so far has not had a significant impact on prices. In recent months, China has also been selling off industrial metals from its reserves to counteract rising production costs, as a result of which "factory" inflation has peaked in 13 years. After the first sale of 7,4 million barrels, more may follow in the coming weeks, and Wood Mackenzie analysts estimate that sales may reach as much as 82,5 million barrels.

However, as the impact of this move is limited, it is increasingly likely that the price of Brent crude oil will reach USD 80 per barrel slightly earlier than expected. Technically speaking, the daily chart shows some resistance at the July high of USD 77,84 / b, while the monthly chart for Brent is now breaking above its downtrend from its 2008 high, which could be a sign of further gains.

Gold and silver

Precious metals continue to behave alarmingly: they stabilize during the decline in profitability, and then depreciate sharply when they rise slightly. Last week was no exception - gold struggled both before and in particular after Wednesday's FOMC meeting, when Fed chairman Jerome Powell attended a surprisingly aggressive press conference and announced that Federal Reserve is ready to start reducing asset purchases from November, while postponing the first rate hike to the end of 2022. The biggest drop came on Thursday when, as already mentioned, the Bank of England managed to confuse the market by signaling its first interest rate hike much earlier than the United States - potentially already in February.

The 1,4-year US bond yield broke key resistance at 10% and the corresponding real yield rose by 0,89 basis points to a three-month high of -XNUMX%. Gold is not only a metal that has a tendency to react to changes in the dollar and profitability levels, with both negatively impacting prices for the better part of this year. It is also used by fund managers as a hedge or risk diversifier for all financial assets, but when financial assets and market valuations have hit record highs, demand for them has stalled, which has boosted sales recently.

In other words, if we, as investors, believe that the current market confidence is a mistake, the cost of buying insurance for that fact falls as gold is now near the lower end of the annual range. We will be keeping a close watch on profitability developments in the coming weeks as rising yields have the potential to re-increase uncertainty in other asset classes such as interest rate sensitive growth stocks. Our view that inflation is not temporary will ultimately support a further rise in the cost of most energy sources. For now, however, gold needs a solid break above $ 1; until that happens - and we still believe it will - there is no real reason to rush or open new positions.

Industrial metals

Industrial metals recovered from the sharp decline in Evergrande, which triggered concerns about Chinese demand, in particular from the real estate sector, which is now under pressure. Iron ore, a key raw material for steel production that is now at the epicenter of China's emissions reduction policy for energy-intensive industries, hit $ 110 per ton on Friday after a dramatic drop that cut the price by more than half in just a few months. before it hit a low of $ 90 / tonne early last week.

A sell-off also hit copper, an important metal for the construction industry, but once again the key support around $ 4 / lb in New York and $ 8 / t in London was not called into question before prices rebounded. In our opinion, this is proof of the strength of this metal. And although copper, one of the key elements of the so-called The "green" transformation, continues to show a downward trend since the May summit, we still see the prospect of price increases. While waiting for the next high, initially above $ 600 / lb to attract new buyers, there is still a risk of a deeper correction, although it is slightly smaller after the last failed attempt to drop. With this in mind, we maintain the view that copper remains attractive to buyers in the event of a new strengthening and possible additional weakening.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Will global warming help wheat? [Webinar] wheat raw materials webinar](https://forexclub.pl/wp-content/uploads/2024/03/pszenica-surowce-webinar-300x200.jpg?v=1711099347)