Real profitability supports increasingly constrained commodity markets

After a solid year on the commodity markets, we maintain a positive forecast for the fourth quarter and subsequent periods. This year's strong boom in many key commodities was fueled by an increase in consumer spending following a pandemic recession - the largest in recent history. As public spending faded out and government support in Europe, China and the United States began to gradually cool down the market. In our opinion, however, supply constraints will continue to support prices despite the worse growth trajectory.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

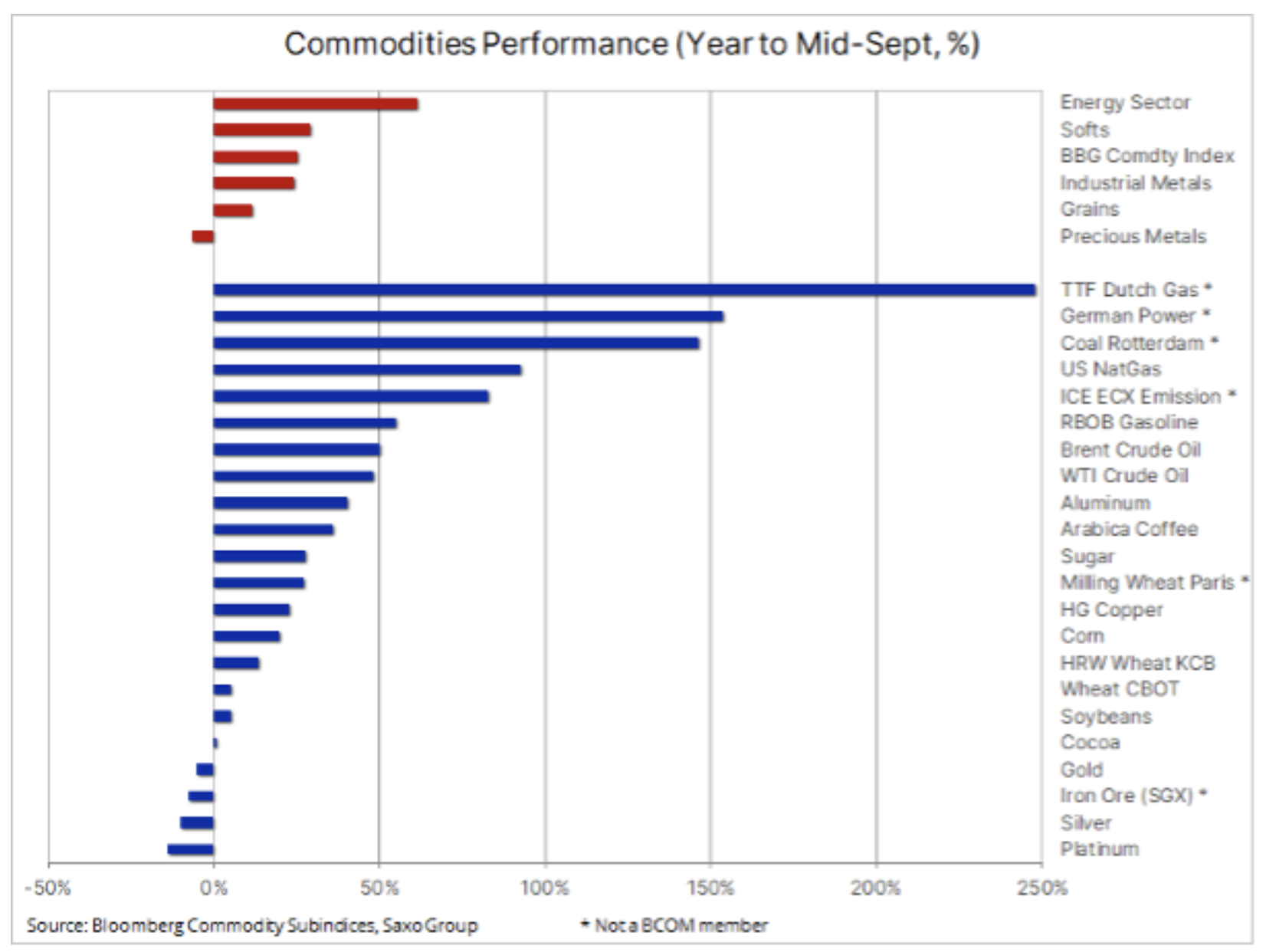

Just before the start of the last quarter of 2021, the Bloomberg commodity index - which monitors a basket of major commodity futures with equal shares of energy, metals and agricultural products - surged by 25%; All sectors appreciated, except for precious metals. Later in this forecast we will discuss the reasons why gold, the most sensitive to changes in interest rates and the dollar exchange rate of all commodities, failed to strengthen despite theoretically favorable conditions in the form of near-record low negative real yields.

But first, let's look at European electricity and natural gas markets. In September, prices in these markets were more than four times higher than their long-term average. At the time of writing this forecast, Dutch gas - the European benchmark - was growing by 250% per annum, while electricity and coal prices in Germany went up by about 150%. These three markets, along with growing the price of European CO emission permits2are not included in the index; if that were the case, the index would have climbed more than the XNUMX-year high recorded in September.

Rising gas and electricity prices were also felt outside Europe, where the heat-related demand was not satisfied with an adequate supply from producers. Add to that the worst quarter in years for wind energy production and the pressure on traditional fuels such as natural gas or even coal is increasing even more. As a result, despite the approaching winter in the northern hemisphere, the level of inventories - both in the United States and in Europe in particular - is well below the average of recent years. Unless winter turns out to be milder than usual, or supplies do not increase, both for LNG and for gas from Russia via the pending Nord Stream 2 pipeline, European consumers and energy-intensive industries can face a dismal - and costly - winter.

Agricultural sector

After a very volatile sowing and cultivation season, made difficult by unfavorable weather conditions around the world, the agricultural sector in Q33 can expect markets to become more calm. However, with the FAO World Food Price Index growing at an annual rate of XNUMX%, the sector needs a period of normal weather for producers to replenish their stocks. Accordingly, the market is now focused on South America, which is entering the season of growing key products, from soybeans and corn to sugar and coffee.

Energy

Price range for Brent oil it rose by five dollars, from around $ 65 to our projections of around $ 75, and it held sustained for most of the third quarter. The stabilization of oil prices within the range after the dramatic increase in the first half of the quarter was accompanied by a decline in reflation transactions, contributing to lowering investors' appetite for commodities. The weakening momentum and the return to the end of the range reduced the funds' total net long position in WTI and Brent oil futures by 23%.

Due to the more optimistic outlook for Covid-19 towards the end of the year, the IEA forecasts a global oil recovery of 1,6 million barrels per day in October and continued growth until the end of this year. If we add to this the production loss of more than 30 million barrels during the hurricane season in the United States, and the risk of not reaching a nuclear deal with Iran, the OPEC + group of producers is likely to continue to support gradual price increases, keeping monthly production growth steadily at around 400,000 barrels a day.

In analogy to the decline in reflation, as oil has stabilized within the range, the prospects for higher prices towards the end of the year and beyond may prove to be the necessary impetus to restore pressure on reflation, thus supporting reflation favorites such as copper and potentially even gold. .

Industrial metals

Industrial metals remain a key element in the decarbonisation process and despite signs of slowing growth in China, we may face a decade in which the physical world proves too small to fulfill the aspirations and visions of our politicians and environmental movements. The more we move away from coal under the current model, the more our economy will be metal dependent. At the same time, supply chains are inflexible due to the lack of support for licensing, board approval, and the lack of capital flows to the 'dirty' side of production due to priorities ESG.

In this context, and taking into account China's current efforts to reduce pollution by reducing the production of a number of the most polluting metals, incl. steel, as well as two so-called "Green" metals - aluminum and nickel, we still see the strength of this market contributing to higher prices of "green" metals, a group that includes - apart from the two already mentioned - copper, tin, silver, platinum, lithium, cobalt and many rare earth metals.

This year's strengthening of copper to a record level was to some extent due to reflation transactions. Until a decline in Q10, it was a key source of support for this metal. While the supply constraints have pushed nickel and aluminum prices up, copper is waiting for another strong recovery in demand - both physical and investment - and the long speculative stance is at its lowest in more than a year. A breakout and a return above $ 000 would most likely signal a new move towards record highs. We believe that in the last quarter of this year the bull market will resume at some point.

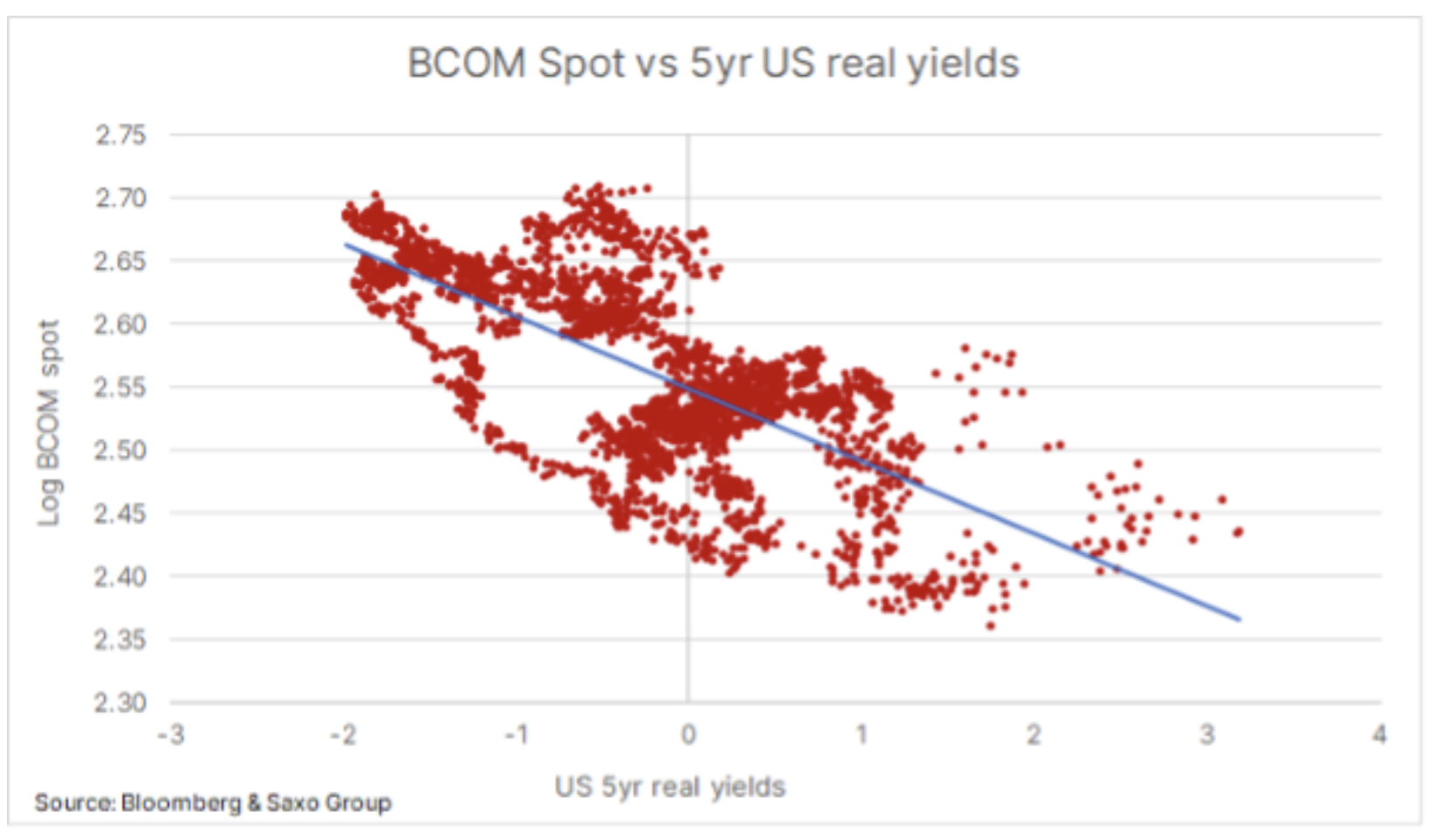

Impact of negative real rates on commodity prices

Real interest rates have a significant impact on the prices of raw materials. Low rates tend to increase the price of a stockable commodity by lowering the cost of holding stocks and encouraging greater speculative investment, as in an environment of negative real returns, this eliminates the opportunity cost of holding commodities that generate no coupon or interest profit. Investing in bonds at a time when inflation exceeds the yields on these securities also does not protect the investor's purchasing power. Combined with the recent supply constraint after many abundant years, this has prompted investors to diversify part of their portfolios in terms of raw materials at the expense of debt instruments.

Precious metals

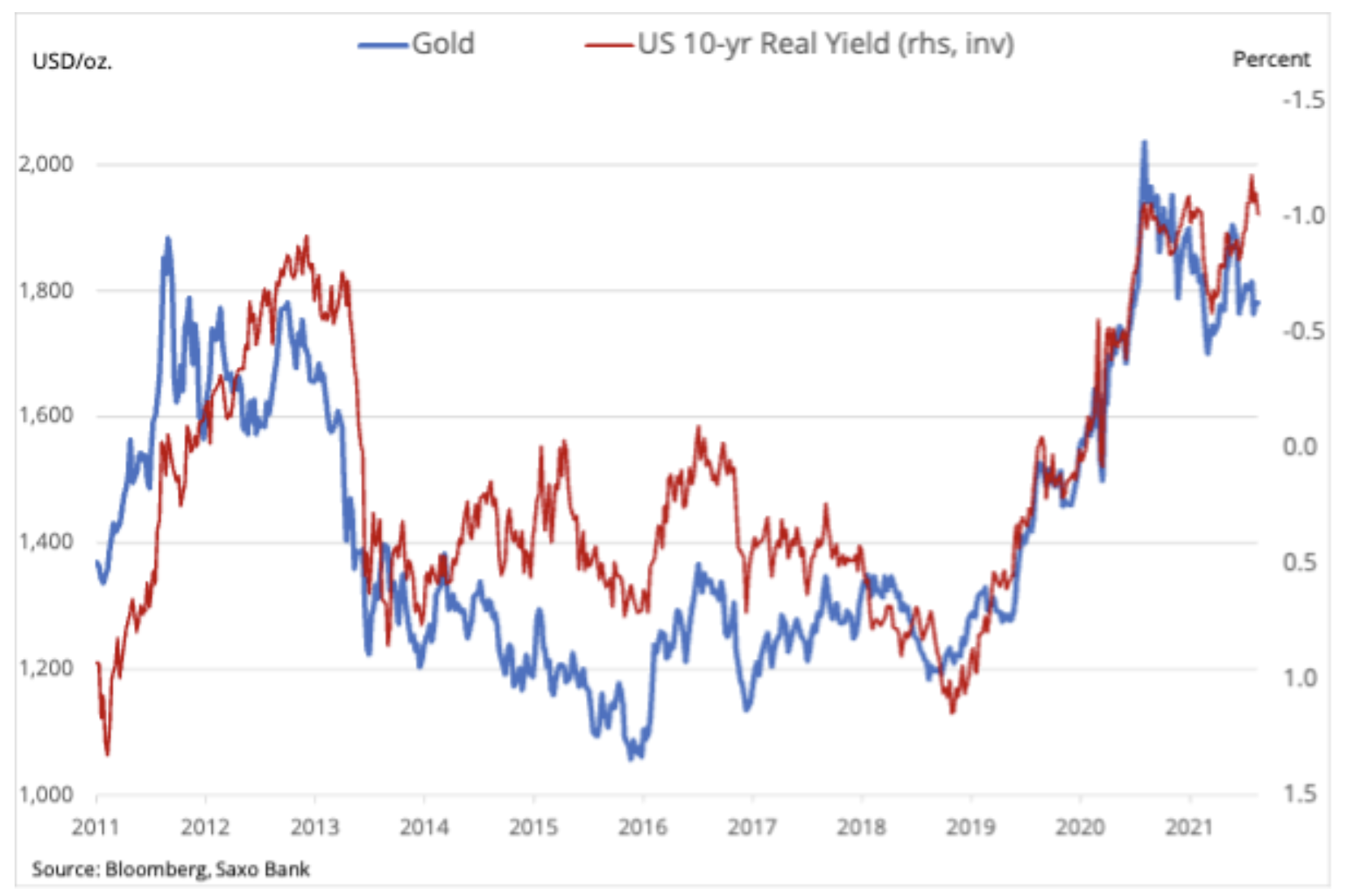

Primarily gold, remain within the range that has lasted for more than a year. Despite an unsuccessful attempt to break out silver above $ 30 in Q200, both metals remained within the range, and gold is currently seeking to move beyond the $ 1 range between $ 700 and $ 1. One of the most interesting developments in the last quarter was the inability of gold to strengthen despite another decline in US Treasury yields, primarily ten-year real yields, which at one point reached a record low of -900%.

Gold's inverse correlation with real interest rates is well documented and can be seen in the chart. The key factors in determining the direction of gold include the movement of the dollar and the overall level of risk appetite. Due to the sustained strong appetite for risk, the value of gold as an element of diversification has declined during this year - at least until August -. As central banks successfully persuaded the temporary nature of inflation, financial investors' demand for the so-called "Paper" gold such as futures, quoted funds, and swaps began to weaken.

This is evidenced by the fact that fund managers have come to see the risk in nominal interest rates as higher than the risk in the tail end of inflation, including in response to rising expectations regarding the accelerated schedule of reducing asset purchases, unveiled by the US Federal Reserve. At the same time, consumer demand remains strong in key physical supply hubs in India and China, while many central banks are using gold to diversify their foreign exchange reserves. Due to the divergence of gold price and real yields in July, we believe - unless there is a significant dollar change - gold should withstand a 20-25 basis point increase in XNUMX-year real yields from the current historically low levels.

We reiterate the view that the rising cost of everything will keep inflation high for an extended period of time, and as peak growth is likely behind us, the outlook for equities is more challenging. If we add the perspective of a less aggressive policy of central banks, we will get the foundations for another period of demand for safe investments and diversification. Gold must break above $ 1 to attract investors again, and that will signal a return to record highs.

All Saxo forecasts are available at this address.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Will global warming help wheat? [Webinar] wheat raw materials webinar](https://forexclub.pl/wp-content/uploads/2024/03/pszenica-surowce-webinar-300x200.jpg?v=1711099347)

Leave a Response