Recession, inflation, market volatility - what is BlackRock and Fidelity forecasting?

What investment views do the world's largest asset managers hold for the coming months? How are they going to invest the enormous financial resources of their clients? We just got to know the latest quarterly reports from Fidelity (Q4 2022 Investment Outlook - Into the unknown) of the BlackRock (Global outlook - Q4 2022 update). We present a summary of the main investment theses contained in these reports and explain what it means for individual investors.

The recession is coming

Both companies expect more global slowdown and finally recession - as a result of central banks' struggle against high inflation, with larger and earlier in Europe, and smaller in the US, and not until next year. In Europe, the recession will be deeper because of energy crisis i wars in the east of the continent. Fidelity is talking here about a possible decline in GDP in the euro area by 4-5%. Further economic slowdown also means a further decline in the profits of listed companies, and analysts forecasting the profits of these companies for the coming quarters and years have not yet included the recession scenario in their forecasts. And when they do, the stocks will be able to decline further.

Hence, both companies underweight the stocks in their portfolios (they have fewer than usual) in the next 6-12 months. At the same time, BlackRock is particularly underweight stocks of developed markets (such as the US, Europe, UK). Fidelity, on the other hand, is particularly underweight in European stocks relative to American stocks.

Inflation decline uncertain

What makes the two companies significantly different is their view of future inflation. According to BlackRock, inflation will be more persistent in the horizon of many years to come, so it is unlikely to return to the central banks' target too soon (e.g. 2% in the USA, 2,5% in Poland). Higher inflation must also be priced in by bonds (bond yields may generally only fall in line with falling inflation). So BlackRock expects in 5 years higher government bond yields than they are today! Even in the shorter horizon, they are (tactically) underweight treasury bonds expecting even higher yields, especially long-term bonds (which could happen mainly as a result of a surprise with higher inflation readings). Fidelity, on the other hand, in the baseline recession scenario (80% probability) believes that inflation will fall over the next 12 months.

Volatility - this is a new reality

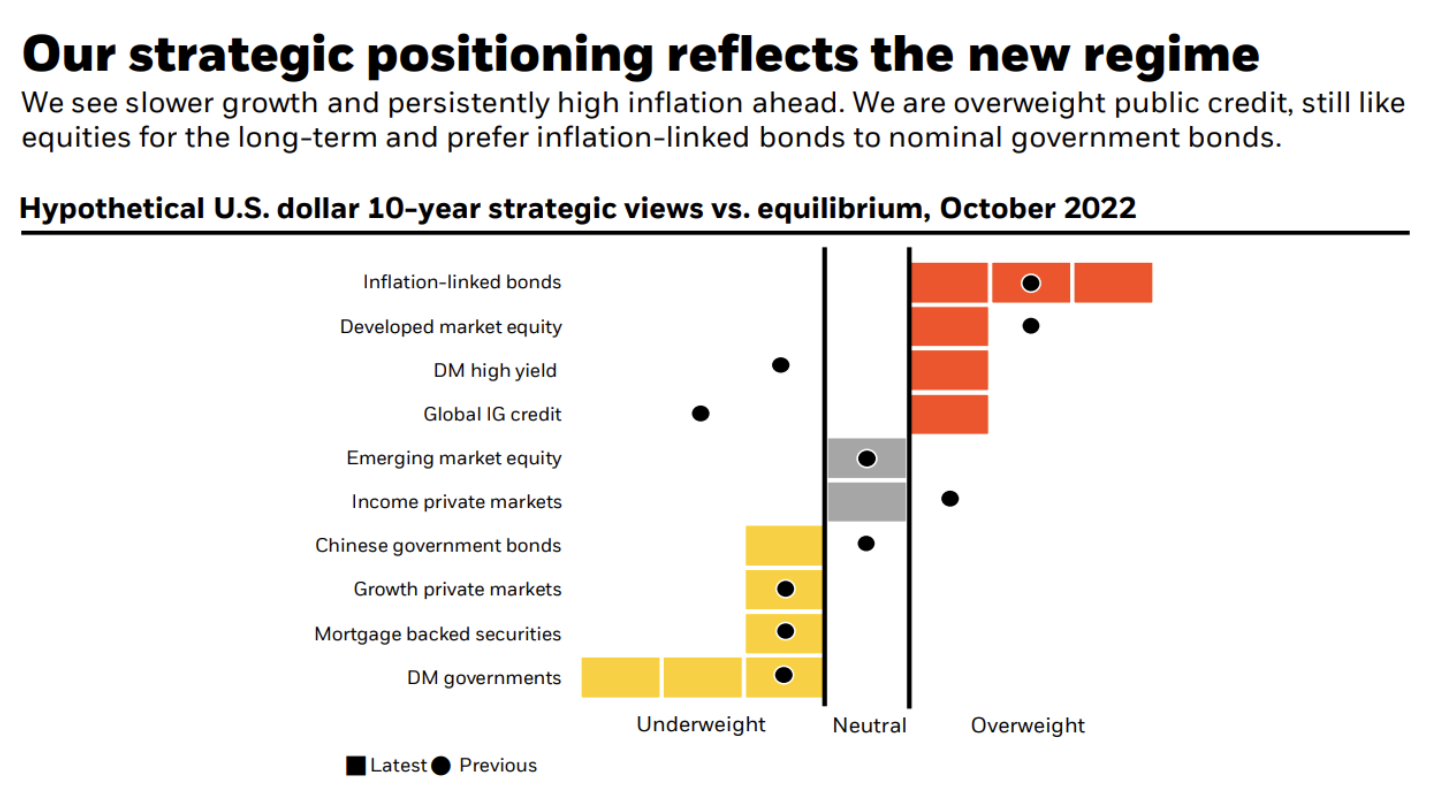

BlackRock looks forward to the coming years higher inflation volatility and economic growthwhich we have not experienced in 40 years. This has implications for portfolio management (more frequent changes will be required) and strategic asset allocation. The chart below shows the strategic asset allocation over the next 10 years. The new regime of volatility of inflation and growth results in a large overweight in inflation-indexed government bond portfolios at the expense of regular government bonds. This approach is simply a consequence of forecasting inflation higher than forecast by the market. If this scenario materializes, it will simply be possible to earn more on inflation-linked bonds than on regular bonds.

Strategic view of different asset classes. Source: BlackRock

Both companies are expecting a recession and their stocks are underweight in their forecasts. Fidelity especially emphasizes that at the moment, investors should maintain the maximum level of cash in their portfolios (preferably in US dollar). Whereas BlackRock believes that corporate bonds are already cheap enough that it is worth increasing their share in the portfolio.

What does it mean for an individual investor?

Certainly a conservative approach to risky assets like stocks. The fight of central banks with inflation is not over yet, which means further interest rate hikes. High interest rates are not conducive to stocks and are also slowing economic growth. In the BlackRock scenario, higher future volatility in terms of inflation and economic growth also means more volatility on our portfolios (we should simply be more responsive to changing market conditions). In this case, low-cost multi-asset ETFs may be a good idea, where the manager decides on an ongoing basis about the optimal allocation of assets. On the WealthSeed platform, you can easily purchase multi-asset funds of all major managers, even for free with an appropriate transaction value. An example of a conservative multi-asset EFT is BlackRock ESG Multi-Asset Conservative Portfolio UCITS ETF EUR (Acc). Additionally, in the case of this ETF, at least 80% of assets meet the relevant ESG standards (i.e. criteria related to environmental protection, society and corporate governance).

Disclaimer

This document is only informative material for use by the recipient. It should not be understood as an advisory material or as a basis for making investment decisions. Nor should it be understood as an investment recommendation. All opinions and forecasts presented in this study are only the expression of the author's opinion on the date of publication and are subject to change without notice. The author is not responsible for any investment decisions made on the basis of this study. Historical investment results do not guarantee that similar results will be achieved in the future.

About the Author

Jaroslaw Jamka - Experienced fund management expert, professionally associated with the capital market for over 25 years. He holds a PhD in economics, a license of an investment advisor and a securities broker. He personally managed equity, bond, mutli-asset and global macro cross-asset funds. For many years, he managed the largest Polish pension fund with assets over PLN 30 billion. As an investment director, he managed the work of many management teams. He gained experience as: Member of the Management Board of ING PTE, Vice-President and President of the Management Board of ING TUnŻ, Vice-President of the Management Board of Money Makers SA, Vice-President of the Management Board of Ipopema TFI, Vice-President of the Management Board of Quercus TFI, Member of the Management Board of Skarbiec TFI, as well as Member of Supervisory Boards of ING PTE and AXA PTE. For 12 years he has specialized in managing global macro cross-asset classes.

Jaroslaw Jamka - Experienced fund management expert, professionally associated with the capital market for over 25 years. He holds a PhD in economics, a license of an investment advisor and a securities broker. He personally managed equity, bond, mutli-asset and global macro cross-asset funds. For many years, he managed the largest Polish pension fund with assets over PLN 30 billion. As an investment director, he managed the work of many management teams. He gained experience as: Member of the Management Board of ING PTE, Vice-President and President of the Management Board of ING TUnŻ, Vice-President of the Management Board of Money Makers SA, Vice-President of the Management Board of Ipopema TFI, Vice-President of the Management Board of Quercus TFI, Member of the Management Board of Skarbiec TFI, as well as Member of Supervisory Boards of ING PTE and AXA PTE. For 12 years he has specialized in managing global macro cross-asset classes.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)