Stock records are still being beaten. When can it end?

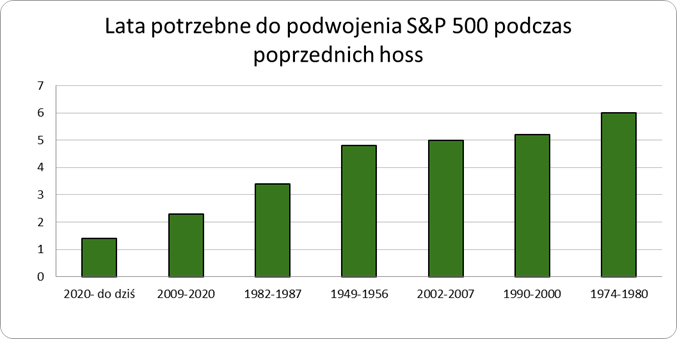

S&P 500 index has doubled on 23 March last year's crisis low of 2 points. It was the fastest start of the boom in the last century (chart) and we see room for more. The rebound was broad, fueled by raw materials, financial and technology firms, further backed by an unprecedented fiscal and monetary response to the pandemic crisis. Finally, the stakes were safe industries such as consumer goods, broadly pharmaceutical companies and real estate. A biotechnology company Modern (MRNA) increased by over 1%, followed by it Caesar's Entertainment (CZR) i Tesla (TSLA).

About the author

Ben Laidler - global markets strategist in eToro. Capital investment manager with 25 years of experience in the financial industry, incl. at JP Morgan, UBS and Rothschild, including over 10 years as the # 1 investment strategist in the Institutional Investor Survey. Ben was the CEO of the independent research firm Tower Hudson in London and previously Global Equity Strategist, Global Head of Sector Research and Head of Americas Research at HSBC in New York. He is a graduate of LSE and Cambridge University, and a member of the Institute of Investment Management & Research (AIIMR).

Ben Laidler - global markets strategist in eToro. Capital investment manager with 25 years of experience in the financial industry, incl. at JP Morgan, UBS and Rothschild, including over 10 years as the # 1 investment strategist in the Institutional Investor Survey. Ben was the CEO of the independent research firm Tower Hudson in London and previously Global Equity Strategist, Global Head of Sector Research and Head of Americas Research at HSBC in New York. He is a graduate of LSE and Cambridge University, and a member of the Institute of Investment Management & Research (AIIMR).

Record highs

The S&P 500 recorded this year 49 new records of all time and is on track to challenge the multi-year 1995 record of 77 records. This is another indicator of how unusually strong the index has achieved this year. This, however, is not inevitable. For example, for twenty-four years between 1930 and 1954, the S&P 500 recorded no new highs, and between 2001 and 2012 it recorded only nine new highs.

Increases by the end of the year

It looks like we will see further gains in the future as stronger expectations for corporate results continue to offset the risks of the Delta variant, the reduction in Fed printing and lower valuations of companies in the stock market. We believe earnings growth in 2022 will end twice as much as the projected consensus of 9% as leverage for opening economies is underestimated. It is also an insurance policy against valuations falling from the current high of 21x P / E as the Fed tightens its policy. We expect greater volatility in the future at the bottom VIX index and a statistically delayed market pullback, but our observations show that markets are well supported, as was before the Fed's announcement of a tightening of monetary policy in 2013 and the recent spike in bond yields seen in QXNUMX.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)