Return on Assets - what is the ROA indicator

The profitability of an enterprise can be calculated in many ways. Many focus on calculating the operating or net margin. However, this does not allow for an answer to the question of whether the company is properly using its assets. There are many indicators to help the analyst or investor analyze the effectiveness of the company's asset management. One of the most famous is ROA (Return on Assets). In today's article, we will present how to calculate the indicator, its use and what are its advantages and disadvantages.

What is ROA?

ROA is short for Return on Assets, i.e. the profitability of assets. The formula for calculating the index is very simple. It is the division of the net profit by the total assets of the enterprise, so it can be represented by the following formula:

ROA = net profit / total assets of the enterprise

The net profit can be found in the company's financial statements in the Profit and Loss Account (RZiS). It is the result of subtracting all costs and taxes from revenues. It should be remembered that the net profit is not the same as a cash inflow into the company's account. Net profit is a statement of recognized revenues with commensurate costs (the principle of matching revenues and costs). Therefore, it omits the aspect of the need for working capital or capital expenditure. Nevertheless, the net profit is a measure of the profitability of an enterprise.

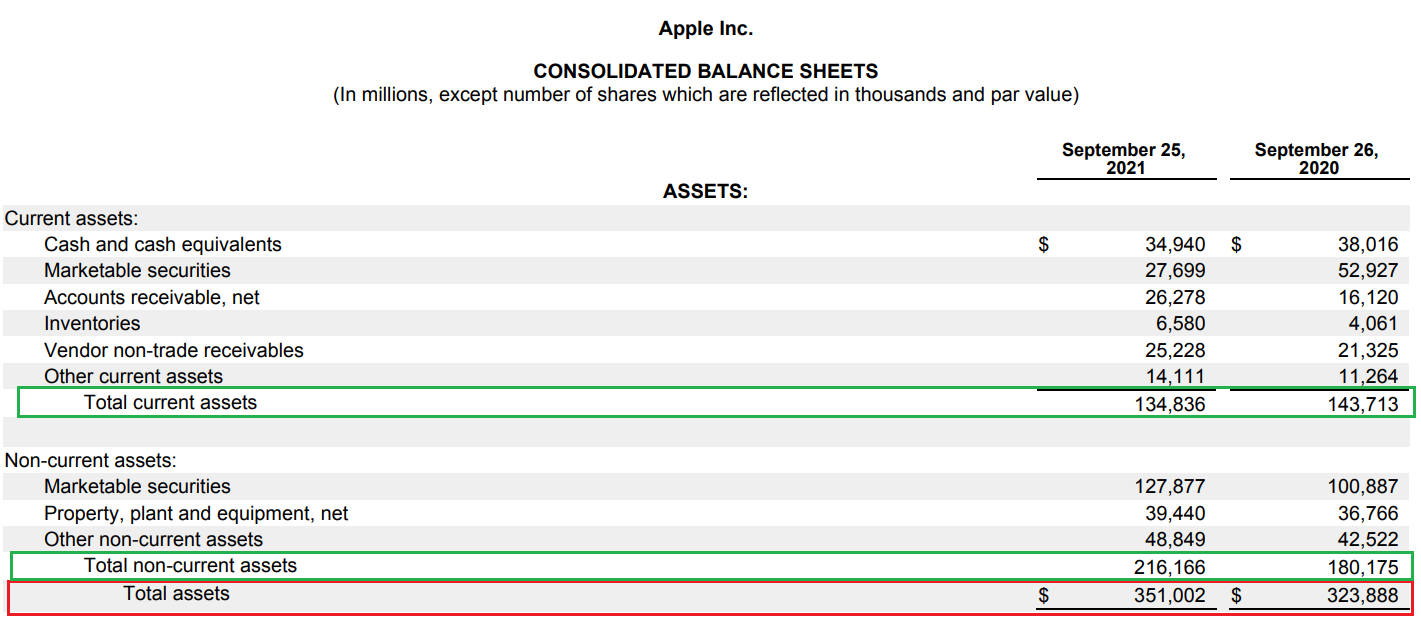

Total assets can be found in the financial statements in the Balance sheet of the enterprise. All assets of the enterprise are assets. In the balance sheet, assets are divided into current and non-current assets.

Fixed and current assets

While understanding what net profits are generated from does not pose a big problem, a thorough analysis of assets is necessary to know why the ROA has a certain level. Each company has a different asset structure. Therefore, it is worth knowing what constitutes the sum of the company's assets.

Below is a breakdown of the company's assets Apple Lossless Audio CODEC (ALAC),. As you can see in the case of this company, you can see significant cash ($ 35 billion) as well as short- and long-term securities ($ 27,7 billion and $ 127,8 billion respectively).

Fixed assets

Fixed assets are those assets whose economic useful life is longer than the financial year. Therefore, these are assets that cannot be classified as current assets. Fixed assets include:

- Intangible assets (intangible assets) - these are not physical assets but acquired property rights. These types of assets include, inter alia, licenses, patent rights, acquired goodwill. For example, the rights to a brand such as Lay's and Colgate are of considerable value and therefore cannot be disregarded when valuing a business. In the case of many companies, the share of WNiP in the company's assets is considerable.

- Property, plant and equipment - this type of fixed assets consists of the most "intuitive" elements of the company's assets, such as buildings, machines, cars or land. These types of assets are reported net of depreciation. The purpose of depreciation is to bring the book value close to the real value. However, there are times when the book value is much less than the market value. When such an asset is sold, the enterprise may recognize a profit on the disposal of the asset.

- Long-term receivables - these may be trade liabilities of other companies (product recipients), the repayment of which takes more than 12 months.

- Long-term investments - these are the company's investments that are qualified to be kept for a period longer than 12 months. This item may include investments in shares of other entities, securities purchased for investment purposes (e.g. bonds).

- Long-term prepayments - in this position there are, among others costs incurred now but to be recognized in the future. For example, part of a pre-paid 5-year license may qualify as long-term costing.

Assets

On the other hand, current assets are those assets whose economic useful life is shorter than 12 months. This means that these assets are to be consumed, sold or otherwise used in the near future. Current assets include the most liquid components of the company's assets. They are the easiest to cash in order to finance your expenses. Current assets include, among others:

- Inventories - Inventories include all materials, semi-finished products or products ready for sale. Inventories are valued at the cost of their production or purchase. It is worth remembering that it is possible to measure this asset using various methods, such as LIFO, FIFO or, for example, at the average cost of manufacturing a product. Stocks themselves have different durability. For example, for housing developers, stocks are e.g. flats available for sale. This type of inventory does not deteriorate significantly over time. On the other hand, for a company that sells sunflower sprouts, their shelf life is very short. Due to different business models, the inventory size of different companies may be different.

- Short-term receivables - this item of the balance sheet includes the trade liabilities of the company's clients. Companies very often sell their products, offering the possibility to pay for e.g. 30 days. In such a situation, the recognized revenues do not immediately translate into an increase in the level of cash in the enterprise. For 30 days, the value of the products sold "lands in receivables". When the customer pays his debts, the receivables decrease and the cash level increases. It happens, however, that a contractor is in a very poor financial situation and is unable to pay its liabilities. In such a situation, the company's accountants should write off the unrecoverable receivables.

- Short-term investments (financial assets, cash) - it is the most liquid type of asset. This position includes, among others cash and its equivalents. It improves liquidity and allows you to generate interest income (e.g. from deposits). Another element classified as short-term investments are financial assets intended for sale within the next 12 months. Examples include bonds or equity securities that the company intends to cash in the near term. It is worth remembering that there is no single level of cash that is optimal for all businesses. A lot depends on the industry in which the company operates and the level of its debt. Companies with a long operating cycle must have a larger cash reserve than companies that collect their receivables quickly and do not need inventory (e.g. SaaS companies).

- Short-term prepayments - in this position there are, among others costs currently incurred but to be recognized within the next 12 months. An example would be paid annual subscriptions that will be recognized in costs on a linear basis over the next 12 months.

What is the optimal ROA?

There is no definite answer to this. It all depends on the industry in which the company operates. The more capital-intensive the business, the greater the company's balance sheet total. In such a situation, it is very unlikely that in such an industry it would be possible to generate a double-digit ROA indicator. An example of a company with low single-digit return on assets is car manufacturer Ford (ROA below 3%). On the other hand a company operating in the technology sector with little debt, and "Light balance" can generate a very high return on assets. An example of such a company is the registrar of domains ending with .com - Verisign (ROA over 40%) or mature eBay marketplace (ROA over 50%). It is precisely because of the differences in business models that the analyzed enterprise should be compared with the profitability of the assets of its closest competitors.

What do investors use ROA for?

Investors look at the ROA indicator for market opportunities. It is worth remembering that the profitability of assets does not distinguish between the sources of financing the company's assets. The higher the ROA, the theoretically higher the company's capital efficiency. ROA can therefore be an excellent measure for comparing companies operating in the same industries. Due to the fact that the ratio is insensitive to the level of the company's financial leverage (unlike ROE), you can compare companies operating in the same industry but with a different capital structure. If the analyzed enterprise has a lower return on assets than its competitors, it may mean that it has an ineffective property structure (e.g. due to overinvestment or maintaining too high cash).

Disadvantages of ROA

The profitability of assets also has its drawbacks. One of them is the inability to compare companies from different industries. This is because different industries require a different asset structure. For example, the asset structure of petrochemical companies differs significantly from that of technology giants.

Another problem is that the ROA is based on the accounting valuation of the asset, which may deviate from its actual value. For this reason, ROA is much better in the analysis of banks, because in this case the valuation of assets better reflects their real value (mark-to-market accounting).

In the case of non-financial companies, ROA has a certain methodological problem. The company's assets belong to both the company's creditors and co-owners. In turn, the net profit is the result after the payment of interest on the debt (interest is payable to the creditors). Therefore, the solution is to replace the net profit with an indicator NO PAT (Net Operating Profit After Tax), i.e. operating profit less tax. Operating profit is profitability before interest on debt is paid.

ROE, ROA, ROIC, ROCE - differences

The primary difference between ROE (return on equity) i ROA (return on assets) is the way they calculate the effectiveness of managing the company's assets. ROE focuses on net assets (assets less liabilities), while ROA divides the net profit by the value of all assets owned by the company. If the company generates a net profit and the company's debt is greater than zero, the ROE is always greater than the profitability of the assets.

ROIC is short for Return on Invested Capital. Therefore, it calculates how well the enterprise allocates capital (the source of this capital is irrelevant). The denominator includes the assets that are needed to generate profits from the business. Therefore, the surplus cash is ignored. Thus, the ROA looks only at the profitability of all the company's assets, and the ROIC only looks at the assets actually used in operating activities. For example, ROIC deducts "excess cash", that is, cash that the company has in its account but does not need it in its core business. This is especially important for companies that have a large stock of cash that is kept in the account. Such a financial policy is very conservative and reduces the real profitability of the enterprise. For this reason, many companies use excess cash to pay dividends or carry out share buyouts.

ROCE it is short for Return on Employed Capital. It is therefore an indicator "between" ROA and ROIC. ROCE focuses on return on fixed capital, which is the sum of equity and long-term debt. Return on equity should be higher than the company's cost of capital (WACC). If it is lower, it means the company is not producing shareholder value.

Summation

ROA is an indicator that allows you to determine the profitability of all assets of the enterprise. Therefore, it is a measure that allows to calculate how effectively the company manages all assets. The disadvantage of this ratio is that it does not distinguish between assets actually used in operating activities and assets that only encumber the balance sheet (e.g. unused buildings, land). Another problem is that companies with a very large share of cash in assets may have a much lower return on assets than they actually are (paying a large dividend will increase ROA). The indicator can be used to compare the effectiveness of management

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)