Return on Invested Capital (ROIC) - an indicator measuring the profitability of a business

The profitability of an enterprise can be calculated in many ways. Many fundamentally analyzing enterprises focus on calculating the operating or net margin. However, this does not allow for an answer to the question of whether the company is properly using its assets. There are many indicators to help the analyst or investor analyze the effectiveness of the company's asset management. Indicators such as ROE or ROA are known to a wider group of investors. However, they have their drawbacks. ROA takes into account all assets, even those that are not needed in operating activities. On the other hand ROE is sensitive to the level of leveragebecause it focuses on the level of equity capital. An indirect solution is the ROIC, which calculates only the capital that is actually needed to conduct operational activity. Thanks to this, ROIC can be used as a measure of efficiency. In today's article, we will present exactly what this indicator is, we will mention how it is calculated and what are its advantages and disadvantages.

What is ROIC?

ROIC is short for Return on Invested Capital, or profitability of invested capital. The formula for calculating the index is very simple. It is the division of NOPAT by the total assets of the enterprise, so it can be represented by the following formula:

ROIC = NOPAT / invested capital

NO PAT

In the case of ROA and ROE, the numerator included the net profit. ROIC is calculated quite differently. NOPAT, or Net Operating Profit After Taxes, is calculated instead of the net profit. So it is the operating profit less the effective tax rate. Why is operating profit selected in this indicator and not net profit? The answer is simple. Operating profit is the basic measure of a company's profitability. NOPAT is therefore an indicator of the potential cash generated if the company is not indebted. This ratio also excludes post-operative one-off gains or losses. NOPAT can also be used as a basis for calculating Free Cash Flow to Firm (FCFF).

Invested capital

This is the most important component needed to calculate the ROIC. Invested capital, unlike all assets and equity, is not readily visible in the financial statements. It is necessary to correctly calculate it. The invested capital can be calculated in two ways:

- Based on liabilities,

- Based on assets.

Regardless of the ROIC calculation method adopted, the result will be the same. Therefore, it is up to the investor whether he prefers to calculate the invested capital from the side of assets or liabilities.

Calculating invested capital based on liabilities is a simpler method for many. The capital invested includes equity, long-term interest debt and short-term interest debt. Additionally, the invested capital should be increased by the lease liability. The aforementioned equity capital should be reduced by the surplus of cash. How do I calculate my excess cash? Not all cash is needed for operational activities. According to the book Valuation Measuring and Managing the Value of Companies, surplus cash is any level of cash or its equivalents that is higher than 2% of the company's sales. The rest of the cash is only charged to the balance sheet and should either be reinvested in the company's business or returned to shareholders.

Calculating based on assets is more complex for many. At the outset, you should calculate the current assets minus any excess cash. This value should be decreased by operating short-term liabilities. The result of the subtraction should be increased by the company's tangible assets and intangible assets.

Of course, depending on the level of detail of the calculations, you can calculate the invested capital using the detailed method (carefully analyzing each component of the balance sheet), as well as in a simplified manner.

What does ROIC tell us?

ROIC is a measure that allows you to determine whether a company is creating value or destroying it. To answer this question, you need to compare your ROIC with the Weighted Average Cost of Capital (WACC). If ROIC is higher than WACC, the company, by increasing the scale of operations, creates value that can be used by both shareholders and creditors. If ROIC is lower than WACC, the increase in the scale of operations paradoxically reduces the value of the enterprise. This is due to the fact that increasing the scale of operations will cost the enterprise more (WACC) than the economic benefits resulting from the increase in business scale (ROIC).

ROIC and revenue growth are the two main engines of corporate value growth. Depending on the ROIC relationship and growth rate, corporate strategies may be different. For example, a company with a high ROIC and low revenue growth rate should focus on increasing the scale of the business rather than increasing its ROIC. In the case of enterprises with a lower ROIC, it will be better for the enterprise to focus on improving the efficiency of capital management than on increasing scale.

A high ROIC indicates that the company has a significant moat that separates it from the competition. Thanks to the moat, the company has an operational advantage over the competition, which allows it to generate high return on capital. Of course, the level of profitability itself also depends on the industry. As a rule, high ROICs are recorded by companies operating in the asset light model (which do not need large capital to scale up).

An example of industries in which many companies generate high ROIC are, among others companies from the sectors:

- software producers,

- pharmaceutical manufacturers (the largest companies),

- IT services,

- manufacturers of medical equipment.

On the other extreme there are companies from the following sectors:

- Airlines,

- extraction and processing of oil and gas,

- mining sector.

Of course, as in every industry, there are better and worse-managed companies, which means that even in a "weak" industry, a company may generate above-average profits.

ROIC restrictions

ROIC is a great tool for determining the profitability of a business, but it has its limitations. One of them is the difficulty in using this indicator when analyzing companies from the banking and insurance sectors. This is due to the specificity of these enterprises and a different look of the balance sheet and income statement than in the case of "normal" enterprises. For this reason, it is better to use ROE when analyzing companies from these sectors.

In the case of cyclical companies, the results of which, for example, depend on the prices of raw materials, the ROIC value alone does not say much. In a situation where the market is close to the peak (e.g. high oil prices), companies from this sector generate very high profits, which increases the ROIC index. However, when there is a trough in the market in which ROIC operates, it may deviate significantly in minus from the historical values of this indicator.

Another example is growth companies that spend a lot of money on supporting growth. High sales and marketing expenses can distort the company's potential to generate high profitability. During the spike in the scale of operation, ROIC can still be negative. This does not mean that the company "destroys value". In such a situation, it is worth focusing on the relationship between the client's LTV (long-term value) and CAC (acquisition cost).

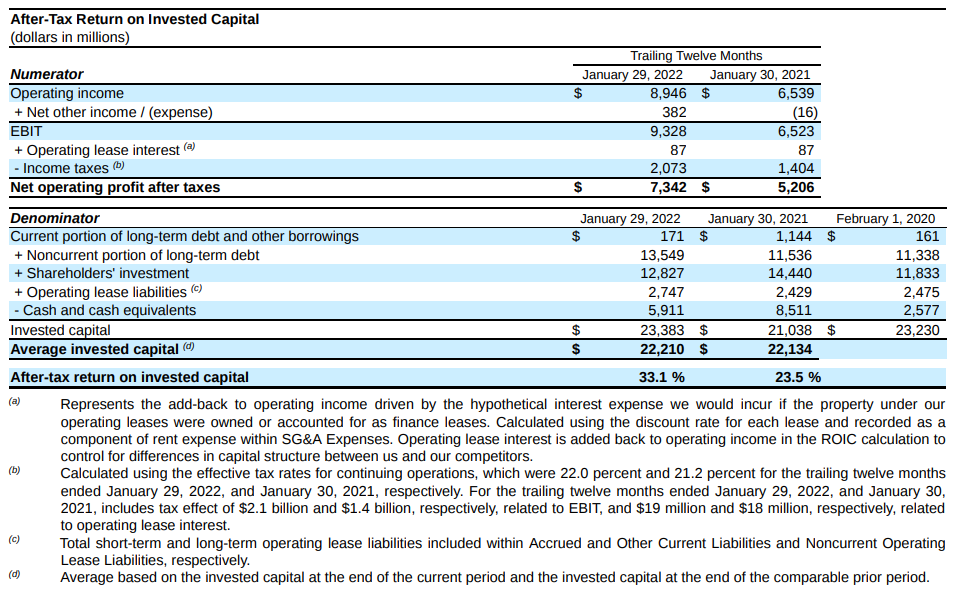

Some companies look very carefully at this indicator because, in their opinion, it is an important measure of the company's effectiveness. One example is Target, whose report provides an ROIC calculation.

Source: company's financial report Target

What is the optimal ROIC?

There is no definite answer to this. It all depends on the industry in which the company operates. The more capital-intensive the business, the greater the capital involved necessary for the operation of the company. In such a situation, it is very unlikely that a double-digit ROIC could be generated in such an industry. An example of a company with a low single-digit return on assets is the US airline Southwest Airlines, which before 2020 was generating a single-digit ROIC, which was sometimes lower than the WACC.

On the other hand, a company operating in the technology sector, with little debt and with a "light balance sheet", may generate a very high return on assets. An example of such an enterprise is the creator of stock exchange indices - MSCI (ROIC about 25%). Another example of companies that have a high ROIC is, among others, the technology company Adobe or the provider of credit ratings FICO.

It is precisely because of the differences in business models that the analyzed enterprise should be compared with the return on the invested capital to the closest competitors. Investors look at this indicator in order to find market champions. High ROIC is synonymous with having a profitable business and effective capital management. This may be a signal that the industry in which the company operates is potentially "healthy" and that the company may have significant advantages over the competition. ROIC is not sensitive to the level of leverage and therefore ROIC can be a useful indicator for companies operating in non-financial industries.

ROE, ROA, ROIC, ROCE - differences

ROIC stands for Return on Invested Capital. Therefore, it calculates how well the enterprise allocates capital (the source of this capital is irrelevant). The denominator includes the capital that is needed to generate profits from the company's operations. Therefore, the surplus cash is ignored. ROIC as opposed to ROA focuses on assets actually used in operating activities. For example, a ROIC deducts 'excess cash', which is cash that a company has in its account but does not need to carry out its core business. This is especially important for companies that have a large stock of cash that is kept in the account. Such a financial policy is very conservative and reduces the real profitability of the enterprise.

The main difference between ROE (return on equity) and ROA (return on assets) is the way they calculate the effectiveness of enterprise asset management. ROE focuses on equity, i.e. net assets (assets less liabilities), while ROA divides the net profit by the value of all assets owned by the enterprise. If the company generates a net profit and the company's debt is greater than zero, the ROE is always greater than the profitability of the assets.

ROCE stands for Return on Employed Capital. It is therefore an indicator "between" ROA and ROIC. ROCE focuses on return on fixed capital, which is the sum of equity and long-term debt. Return on equity should be higher than the company's cost of capital (WACC). If it is lower, it means the company is not producing shareholder value.

Summation

ROIC is an indicator that allows you to estimate the profitability of the invested capital, which includes both equity and interest and leasing debt less excess cash. This means that this indicator combines some of the ROA and ROE features. Of course, this indicator also has its drawbacks. Among them is the difficulty in interpreting ROIC in the case of growth companies (not generating a large NOPAT) and companies from the cyclical sector. ROIC is also not suitable for analyzing banks and insurers.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)