A year ago, crude oil was headed towards the bottom (and below!). What has this taught us?

Crude oil has always enjoyed considerable interest among traders. After all, it is a key commodity on a global scale, with good volatility, low transaction costs and high liquidity. What could a real speculator ask for more? However, last year was full of amazing ones "Twists and turns" and showed that any scenario is possible, even one that seems improbable. Were the speculators prepared for this?

Check it out: How to invest in crude oil [Guide]

A barrel of $ 26

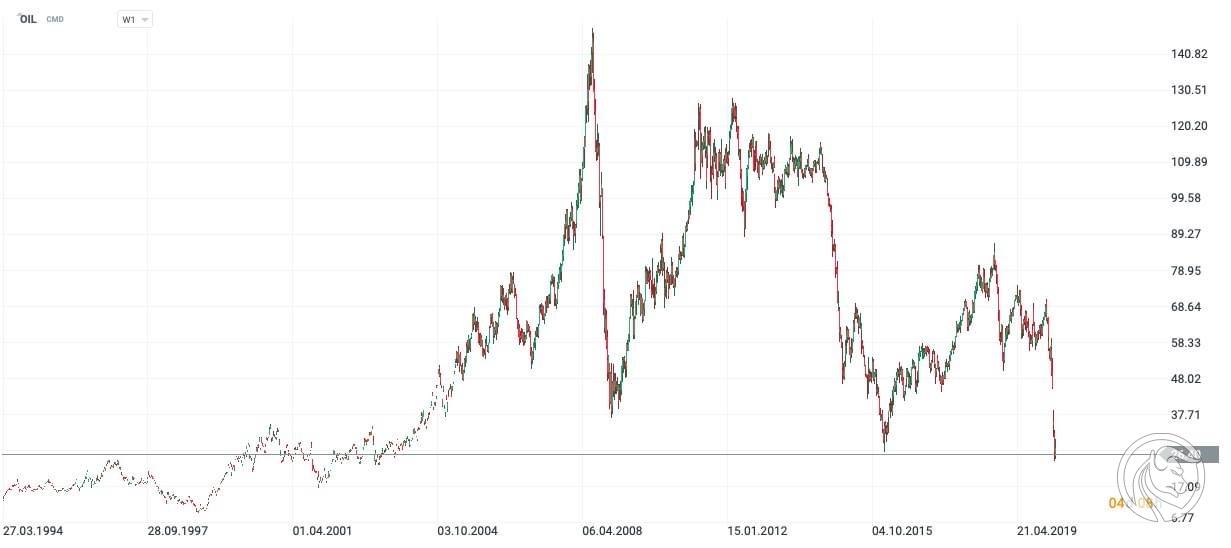

A year ago, the price of Brent Crude crude oil fell to USD 26 a barrel. Back then it was the lowest level since September 2003, ie for 17 years. Earlier in history, there had been violent events "Sales" on the market black gold. In 2008, the rate fell from $ 148 to $ 37 (-75%) in just 4 months. In 2014, from $ 115 to $ 27 (-77%) but the sale lasted 6 months. Something more distant? 1996-1998, the rate fell from USD 25 to less than USD 10 (-62%).

By the time the pandemic intensified in March, the oil price was hovering around 50 and it was over "Discount" -30% since the beginning of January 2020 (then oil was valued at $ 70). The continuation of the sell-off wave to the above-mentioned USD 26 resulted in a total decline of -63%.

Crude oil chart, interval W1. As of March 31, 2020 Source: xNUMX XTB xStation

Looking at the history, it was a worthy entry level for many, despite the fact that blood was shed on the market. There was a general belief that:

"After all, oil cannot be for free."

Can not?

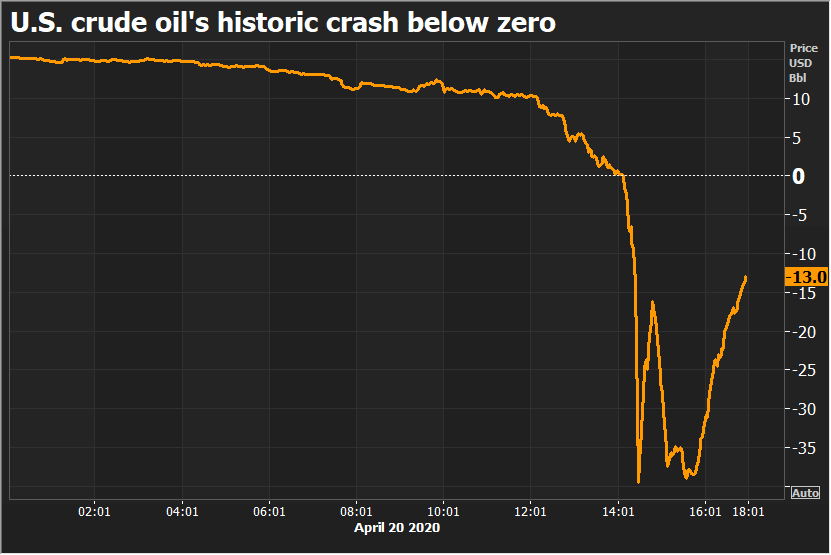

A barrel of oil at ... $ 0 (and lower!)

And everything is correct. Oil wasn't free, but oil futures valuation flew through tier 0 like a sieve through water, eventually April 20, 2020 reaching negative values (!). Of course, only where the brokers allowed it, without defending themselves "Extra" rollovers.

Negative price for crude oil. As of April 20, 2020 Source: Reuters

After this devastation, the rate finally rebounded, reaching $ 1,5 in 40 months, where it stabilized. Somewhere along the way, most of the speculators have learned what is contango and how much it makes it difficult to earn from contracts using the strategy "I'll wait for it to bounce".

What does all this teach us?

It can be said that the oil market situation already "Back to normal". Of course, tourism still lies and squeals, we are waiting for key OPEC + decisions, and geopolitical risks have not disappeared - but these have always been. However, almost no one expects a repeat from a year ago. But a year ago no one (?) Expected such a turn of events.

Crude oil chart, interval W1. The current state. Source: xNUMX XTB xStation

This is perfect proof of the unpredictability of financial markets. Just because something has never happened before doesn't mean it can't happen. Just because something is low doesn't mean it can't get any lower. There are no certainty, there are only more and less likely scenarios.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)