There is no escape from the bond market

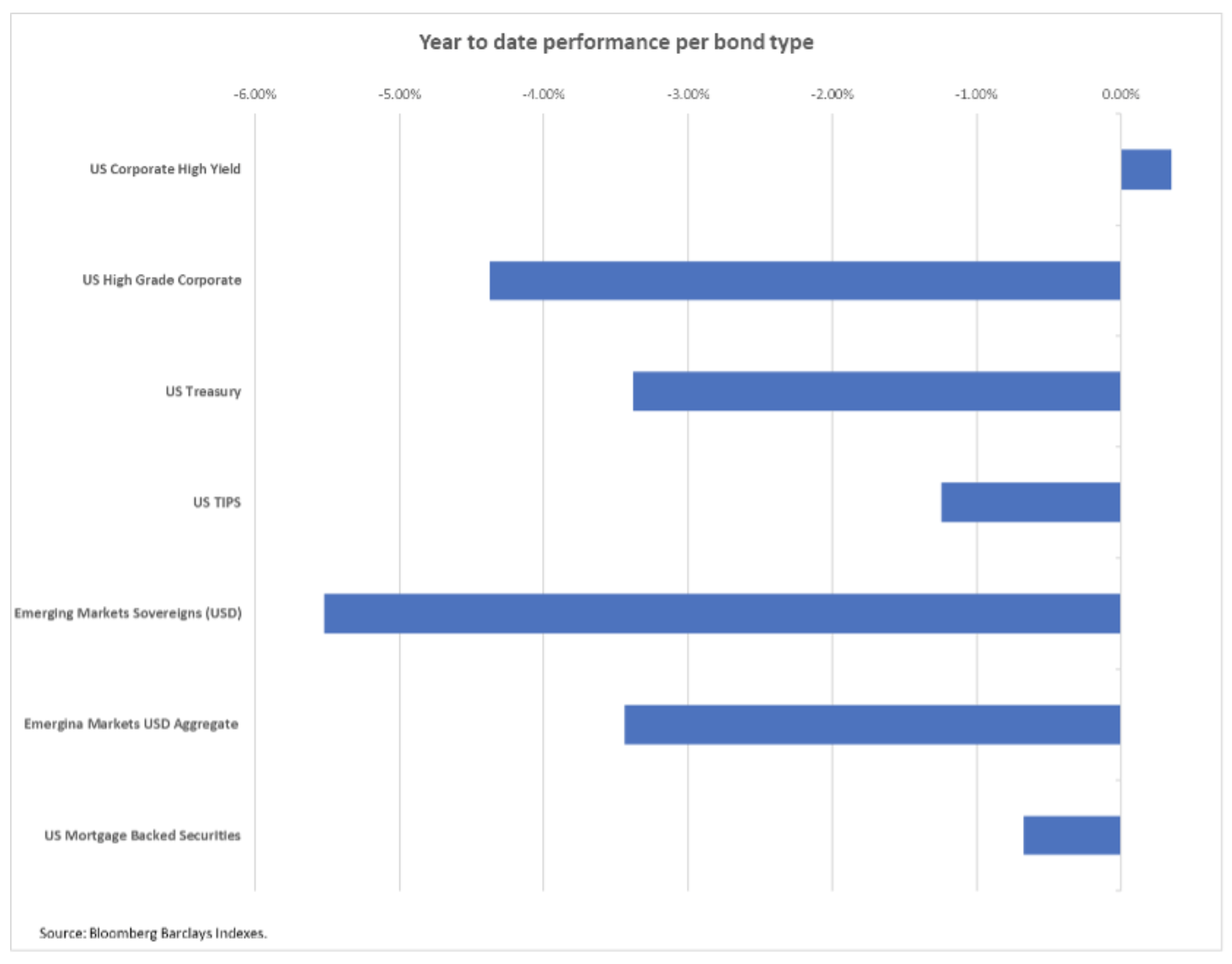

In the current quarter there will be no room for maneuver on the bond market. What was considered a safe investment last year has now become too risky as concerns about inflation and optimism about the future are pushing up interest rates rapidly. Everything - from treasury bonds to emerging market and investment grade corporate bonds - are losing value at a rapid pace. Junk bonds are the only asset that may end the first quarter with a positive value. However, in our opinion, their streak will end soon, as the pressure increases along with the higher cost of capital.

About the Author

Althea Spinozzi, Marketing Manager, Saxo Bank. She joined the group Saxo Bank in 2017. Althea conducts research on fixed income instruments and works directly with clients to help them select and trade bonds. Due to his expertise in leveraged debt, he focuses particularly on high yield and corporate bonds with an attractive risk-to-return ratio.

Althea Spinozzi, Marketing Manager, Saxo Bank. She joined the group Saxo Bank in 2017. Althea conducts research on fixed income instruments and works directly with clients to help them select and trade bonds. Due to his expertise in leveraged debt, he focuses particularly on high yield and corporate bonds with an attractive risk-to-return ratio.

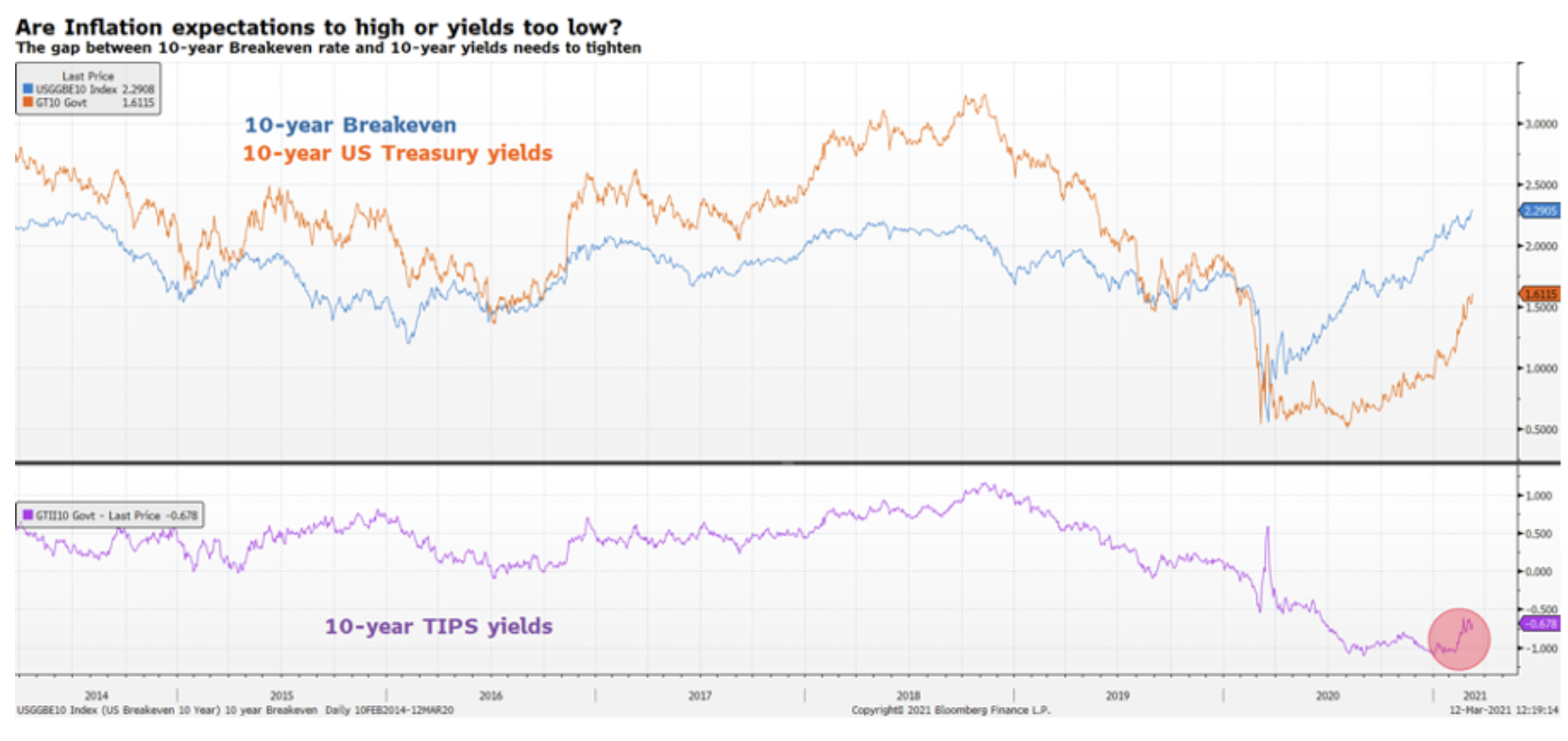

Higher real yields threaten high-risk assets

Despite the fact that the US yield curve has experienced a bearish upward since last August, the situation is very different this year due to changes in real interest rates. In the second half of 2020, nominal yields went up, while real yields fell, which provided enterprises with favorable financial conditions. Until December, ten-year inflation-protected government bond yields (Treasury-Inflation Protected Securities, TIPS) fell to their lowest level in history, ie to -1,1%. This trend suggests that the upward trend in the nominal yield curve was entirely due to reflation transactionsas a result of which nominal yields went up on the basis of higher inflation resulting from the improvement in economic growth. However, since the beginning of 2021, the situation has changed: real yields started to rise simultaneously with nominal yields, indicating an unexpected increase in the cost of capital.

Higher cost of capital negatively affects venture capital assets. However, for a deep sell-off, yields should increase rapidly and remain at a high level. While there was enough time to overestimate the risk before the rise in nominal yields could trigger a significant sell-off, we now believe such a sell-off could materialize shortly after US 2-year government bond yields break above XNUMX% and stay above that level.

Junk bonds are a risk, but ...

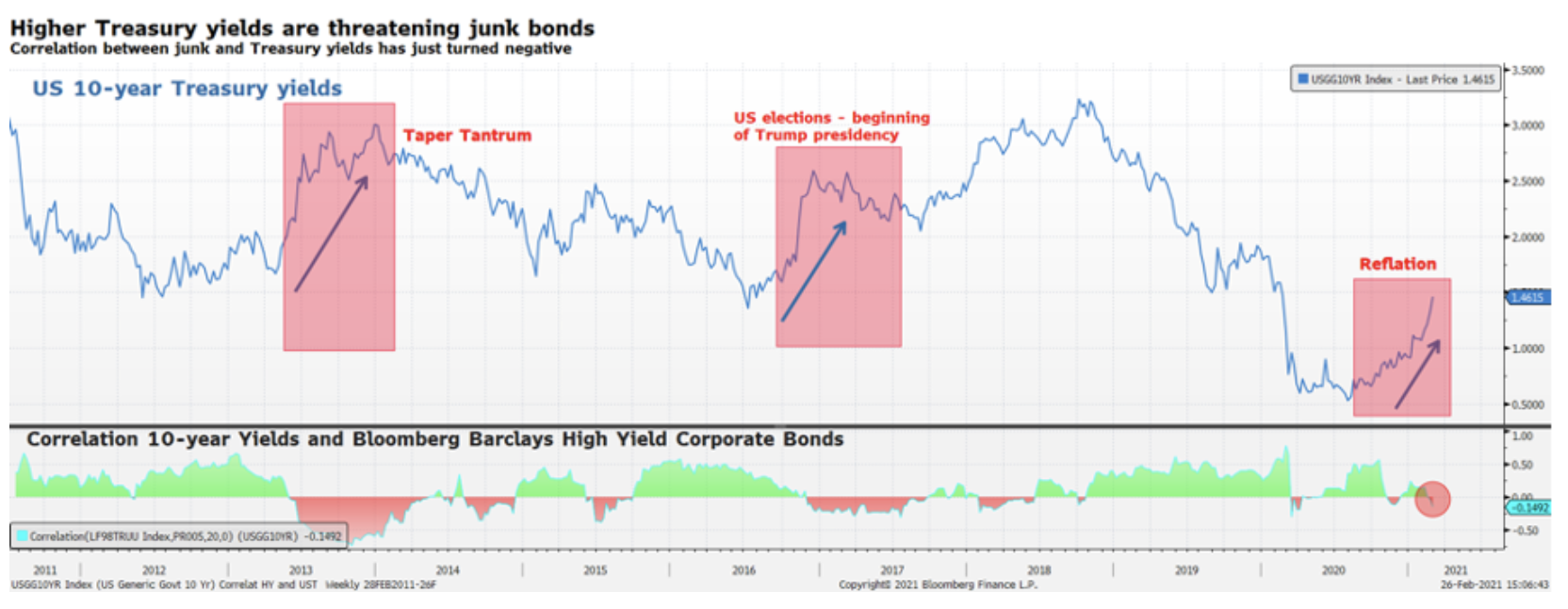

WHowever, a greater risk is the change in duration due to reflation transactions. Bond investors should be aware that something has changed over the past few weeks that has made junk bonds particularly dangerous: the correlation between government bond yields and junk bond yields has turned negative, meaning that further increases in yields will cause the bonds to collapse junk. This is what happened in 2013 over time "Limiting hysteria" and in 2016 after Trump sat at the White House.

Junk bond valuations have been supported so far as investors seeking hedge against rising inflation have been forced into this area. In fact, investment grade corporate bonds offer an average yield of 2%. Given that the ten year foot breakeven (the level of inflation that should be achieved so that the yield on fixed-coupon (nominal) and inflation-indexed bonds with the same maturity is the same in nominal terms) is 2,2%, the yield on investment grade bonds will be completely offset by inflation. In addition, a duration (duration) of 15 years, making the portfolio even more exposed to interest rate risk. On the other hand, in the area of junk bonds, a significant reduction in duration is possible, as a yield above 2,5% can already be secured with an average duration of 4 years.

Therefore, while we believe junk bonds will inevitably be overestimated as yields continue to rise, they remain an important part of the portfolio in terms of risk management and diversification. However, it is necessary to carefully select the credit risk in terms of possible bankruptcy of a given company and to maintain the debt to maturity in order to ensure the desired return in the context of a potential repricing.

We believe that duration in the second half of this year will become a greater threat to the market than credit risk. The exceptionally accommodative monetary policy pursued by central banks since the global financial crisis has led to a global decline in profitability. Investors have been forced to take more risks or accept longer durations in order to secure additional returns. Those who chose risk over duration may be in a better position with regard to possible profitability gains, as the coupon yield will act as a buffer. Investors who choose the high relief will, however, become owners of a portfolio that is highly exposed to yield fluctuations. For example, in one month of issuance, a new French 0014001-year government bond (FR8NN0,5) with a coupon of 13% went down 2120 points. Austrian bonds with a maturity of 00 (BBG2VPK82L0,85) and a 30% coupon year-on-day fell by 2120 points. Petrobras bonds maturing in 71647 (US93NAN15) proved to be more resilient, losing only 6,85 points - half as much as the XNUMX-year Austrian bonds. Why? Certainly not because Petrobras is considered a safer investment than the Austrian state, but rather because the coupon of these bonds is much higher, around XNUMX%, which translates into a significant reduction in duration. It is worth noting that the uncertainty about the company's leadership and the risks associated with Brazilian politics affect the price of Petrobras bonds as much as the rise in US Treasury yields.

The current quarter will therefore be crucial in the context of a cautious approach to convexity and the elimination of assets offering near-zero yields while continuing to build protection against an increase in rates with corporate bonds with higher yields.

Discrepancies in the policy of central banks

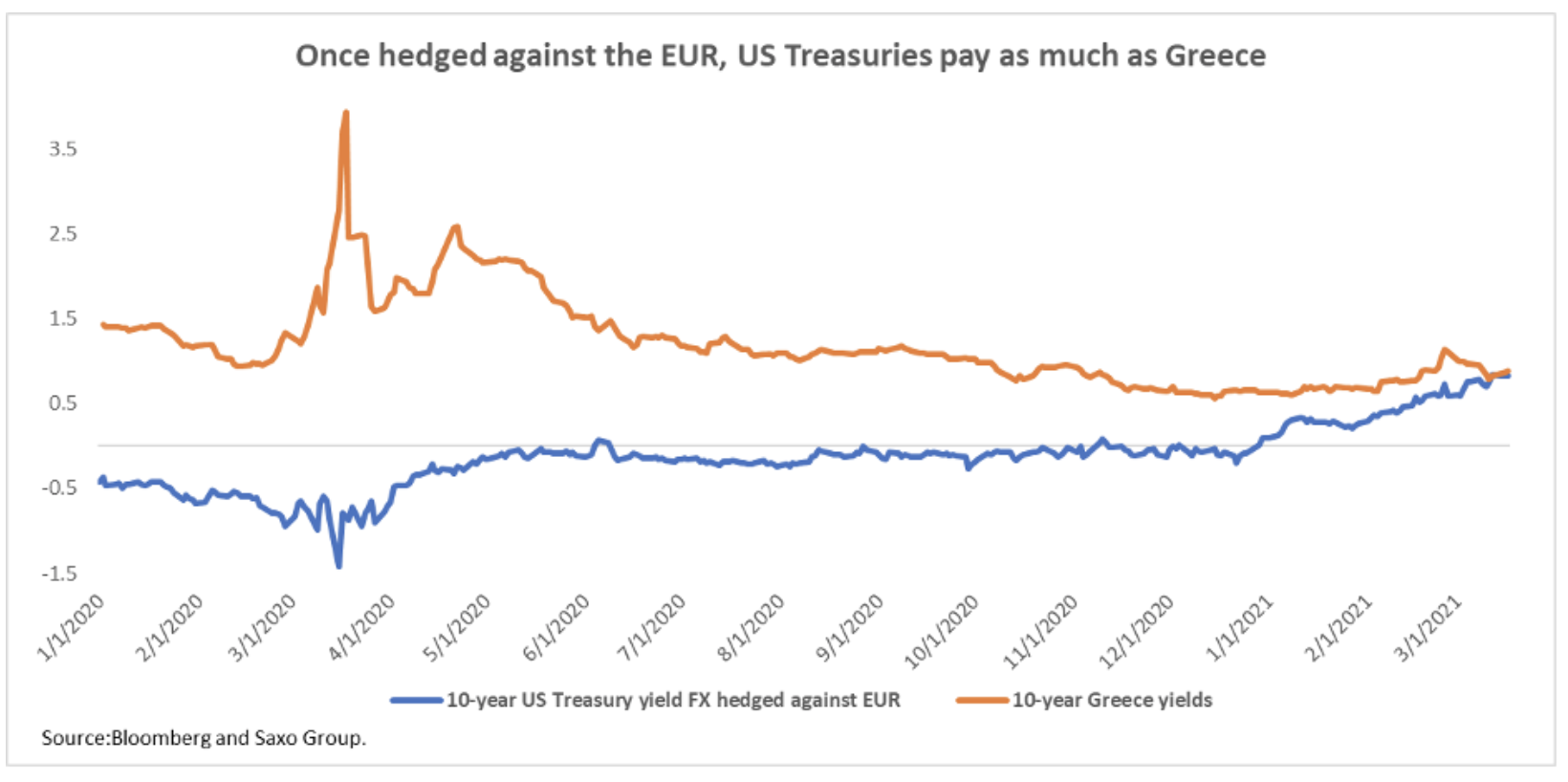

While the economic outlook for the US shows tolerance for an increase in government bond yields, the same cannot be said for Europe. The difference between the two economies stems from the fact that in the United States, monetary stimulus is accompanied by a fiscal stimulus, while in Europe the latter has not been implemented. Thus, an increase in yields in the euro area could tighten financial conditions faster than in the United States, hampering a potential recovery.

European Central Bank (EBC) faces the following problem: as US government bond yields continue to rise, they will become a better alternative to European bonds. Despite the sell-off in the past few weeks, European sovereign bonds, including those of the periphery, which are usually considered riskier, continue to offer historically low yields, well below US bond yields when hedged against the euro. For example, Greek bonds, considered to be the most risky in the euro area, offer a yield of around 0,85% with a ten-year maturity. By purchasing ten-year US treasury bonds and hedging them against fluctuations in the euro exchange rate, an investor can obtain the same profitability as in the case of Greek securities. However, the holding risk of US and Greek government bonds is not comparable, making European bonds subject to rotation risk.

Regarding the rise in yields in the United States, we believe that selling peripheral bonds to invest in safe securities from the other side of the Atlantic is becoming an increasingly attractive risk-reward concept. Such a rotation will hit Greek and Portuguese government bonds in the first place, but may trigger a sell-off of all peripheral bonds, a market phenomenon that will cause a rapid increase in government bond yields. In terms of intensity, such a markdown would not be comparable to the 2011 European sovereign bond crisis, but will require catching up with yield gains on the other side of the Atlantic. This means that yields can rise rapidly from zero to 100 basis points, dramatically stiffening financial conditions in weaker EU Member States.

In this context, the PEPP program initiated by the ECB (Pandemic Emergency Purchase Program) turns out to be insufficient. At present, program purchases of assets must be proportionate to the country's contribution to the ECB's capital. Thus, the ECB purchases proportionally more German government bonds than bonds of other countries, which could further aggravate the collateral shortage, and at the same time not provide an adequate solution to a possible crisis in the context of limiting volatility to peripheral countries. In view of the above, we believe that in the event of another crisis of European government bonds, the ECB should direct its purchases under PEPP to the benefit of the most volatile countries; at the same time, the European Union will be forced to take further steps towards a fiscal union.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-300x200.jpg?v=1709556924)