Crude oil seems ready to break up

Petroleum it is heading again towards the upper end of the range in which it has remained for the last six weeks. The relatively calm market behavior at the time, however, provided a cover for the fact that the market was still in chaos and that oil prices remained within the range as a result of key opposing forces. The sanctions against Russia and the exit from the Russian market of international service companies, which limited Russia's ability to maintain production, as well as the easing of lockdowns in China, indicate a renewed risk of price increases.

Crude oil prices are likely to rise

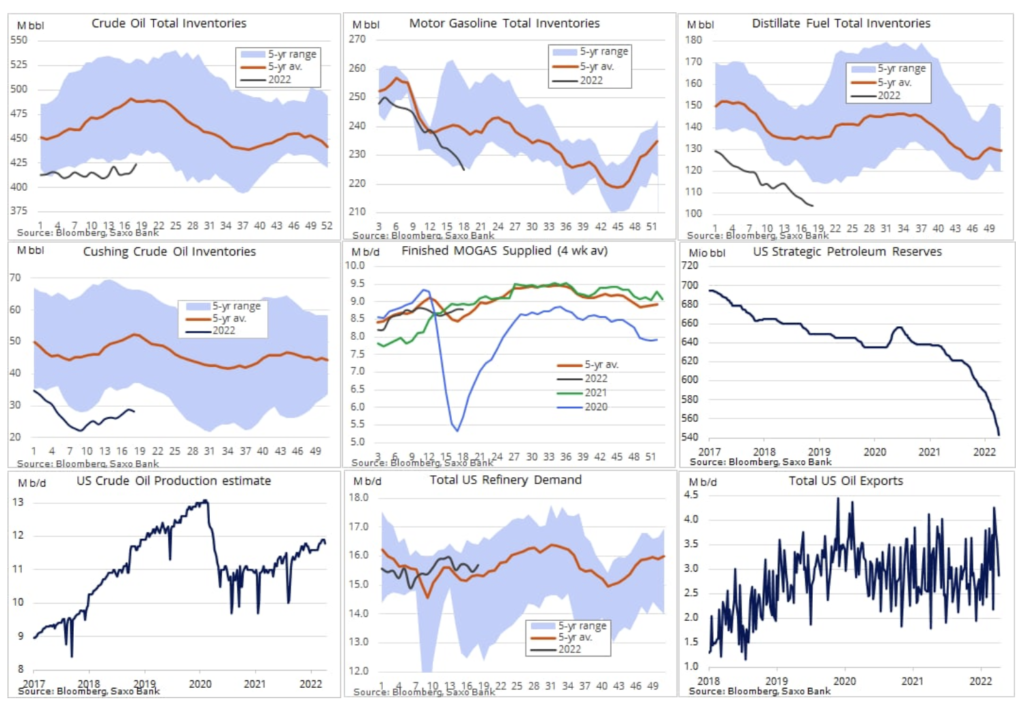

Crude oil is once again heading towards the upper end of the range in which it has remained for the past six weeks. The relatively calm market behavior at the time, however, provided a cover for the fact that the market was still in chaos and that oil prices remained within the range as a result of key opposing forces. Meanwhile, the US government, in an unsuccessful attempt to contain price increases, provided the market with a million barrels injection, while Chinese demand suffered from its 'zero Covid' strategy.

The fact that the market has not dropped below USD 100 underlines its strength - support is provided by the limited supply of key fuels, self-sanctioning of Russian crude oil recipients, OPEC with increased production and political tensions in Libya. Due to the possible easing of lockdowns in China and an aggravation of the situation in Libya, the short-term price risk still strongly indicates an increase in prices.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

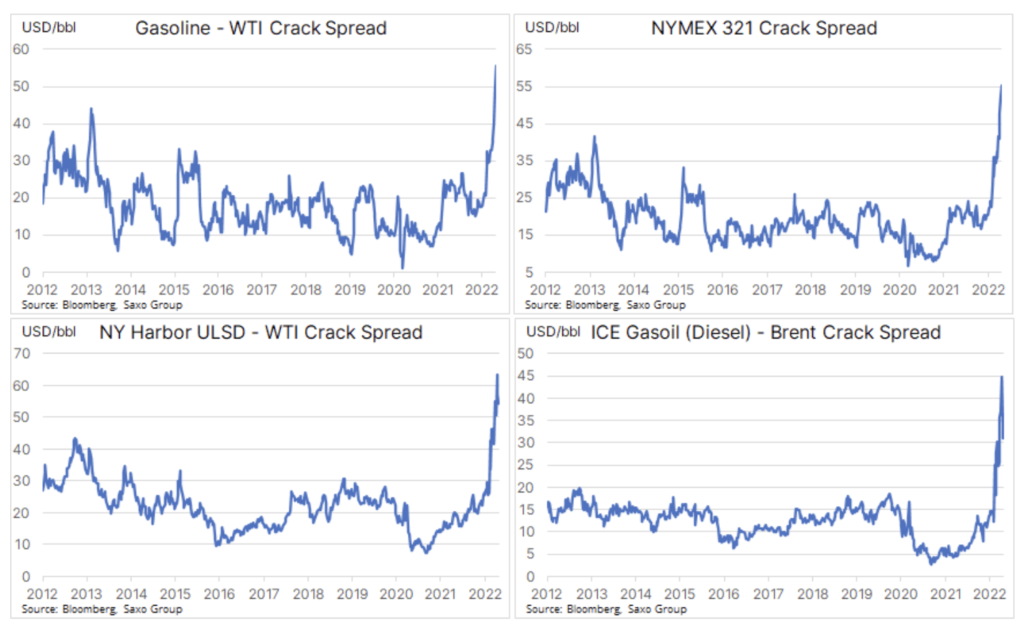

Over the past few weeks, investors have shifted their focus to a fixed range for crude oil prices, focusing instead on the crude oil product market, where gasoline, diesel and jet fuel costs have risen to levels unseen in years - or never. As a result of refinery renovations, the reduction of production capacity after the pandemic and the phenomenon of self-sanctioning of recipients of Russian petroleum products, the supply decreased on an unbelievable scale. This is particularly true of North America, where refineries are working at full capacity to produce as much as they can while taking advantage of exceptionally attractive margins.

As a result, strong demand for WTI crude oil by both domestic and foreign refiners has led to the complete elimination of its traditional discount to Brent crude oil, with the June contract (CLM2), which will expire soon, is trading above the July contract for oil. Brent (LCOM2).

While the so-called crack diesel oil, a ratio that reflects the USD per barrel of WTI barrel refining profit to the price of the diesel oil contract quoted on the New York Stock Exchange (NY ULSD, ticker: Hoc1), has dropped somewhat over the past week, crack Gasoline is on the rise, with US drivers now paying a record average price of gas in the region of $ 4,5 a gallon.

So far, there are no signs of this demand for diesel and gasoline It was starting to decline, and with a few weeks to go before the holiday season in the United States, the risk of an even greater drop in supply is still to be expected in the period of heightened summer demand.

Energy in the lead

After key commodity prices peaked in early March, Bloomberg's industrial metals index fell by 25%, the agricultural sector rose by 3%, and the energy sector - by nearly 13%as a result, the year-over-day growth is as high as 72%. Unfortunately, given the behavior of the market in this period, only a sharp deterioration in the outlook for global economic growth could keep the oil price from rising further in the coming months.

One of the potential olive branches for the market could be a relaxation of sanctions on Iran and Venezuela, which would pave the way for increased exports. The Venezuelan government on Tuesday confirmed that the United States has allowed US and European oil companies to start negotiations to restart operations. The move will enable the US oil company Chevron, which is the only one still present in Venezuela, to negotiate a license with the state-owned oil company PDVSA to continue its operations in the country. Venezuela, which produced over 3 million barrels a day at the turn of the century, has since recorded a decline in production to around 700. barrels per day due to sanctions imposed as a result of Washington's pressure on the governments of Chávez and Maduro.

While the price of the soon expiring WTI oil contract in June has risen, the price of the Brent oil contract lags as lockdowns in China continue to constrain further price increases. However, we see a short-term risk of price increases as the destruction of demand is not yet significant enough to compensate for the tight supply in the market.

As my colleague Peter Garnry writes in his latest article on the stock markets, "stocks of global energy companies are the cheapest in 27 years. " According to the article, equities of global energy companies are currently priced at the FCFY (Free Cash Flow Profitability) index. free cash flow yield) of a staggering 10%, and forecasts point to higher oil and gas prices in the coming years as the world tries to close the gap left by Russian sanctions. Energy companies show enormous profitability - 18% return on equity, but in our grotesque capital markets in 2022 investors mainly talk about buying in the bottom. buying the dip) for technology stocks. As we wrote recently, the inconvenient truth about the energy market and GDP is that the world will need a lot of oil and gas in the next decade, so the outlook for energy companies investing in equities remains overwhelmingly positive. The article mentions some of the world's largest energy companies by market capitalization.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response