WTI oil: only optimistic forecasts are pushing up prices

WTI oil is on track to record a third consecutive week of growth. The July contract rate rose from almost USD 3 and approaches USD 29. Optimism is also visible in calendar spreads, which have returned to levels before the start of the price war and have narrowed radically. Less than a month ago for WTI oil in the June contract, almost $ 10 less was paid than in the July contract. Currently, the spread is only 25 cents!

HOW TO BUY CRUDE OIL

WTI oil and forecasts

Positive information reached the raw material market throughout the week. First, the Gulf countries will voluntarily and harder reduce their production from June (by over 1 million b / d). Secondly, it seems that Russia is meeting its commitments and is on the way to extract the 8,5 million b / d assumed in May. Thirdly in the US, oil reserves have fallen for the first time since mid-January.

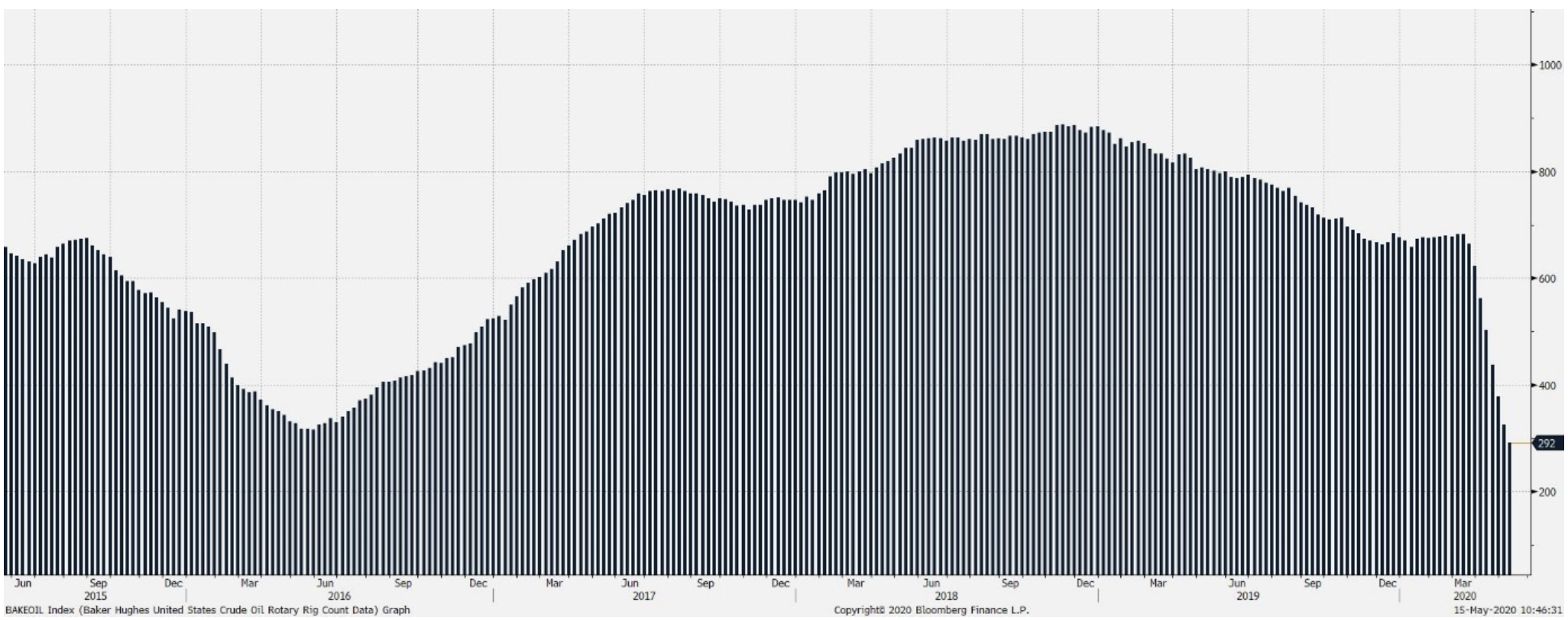

Raw material production fell for the sixth week in a row. It currently amounts to 11,6 million b / d, which means a decrease by over 11%. relative to the ceilings of mid-March. As a side note, let's add that tonight's Baker Hughes analyst statistics regarding the number of active drilling wells will be published. These data should confirm the trend of expiration of mining activity. Since mid-March, the number of active shafts has fallen from over 680 below 300. It is worth monitoring this indicator, bearing in mind that in 2016 the slump on the raw material market turned out to be too short to permanently hit the least effective representatives of the sector. In addition, it did not prevent the US from obtaining the status of the highest mining country in the world.

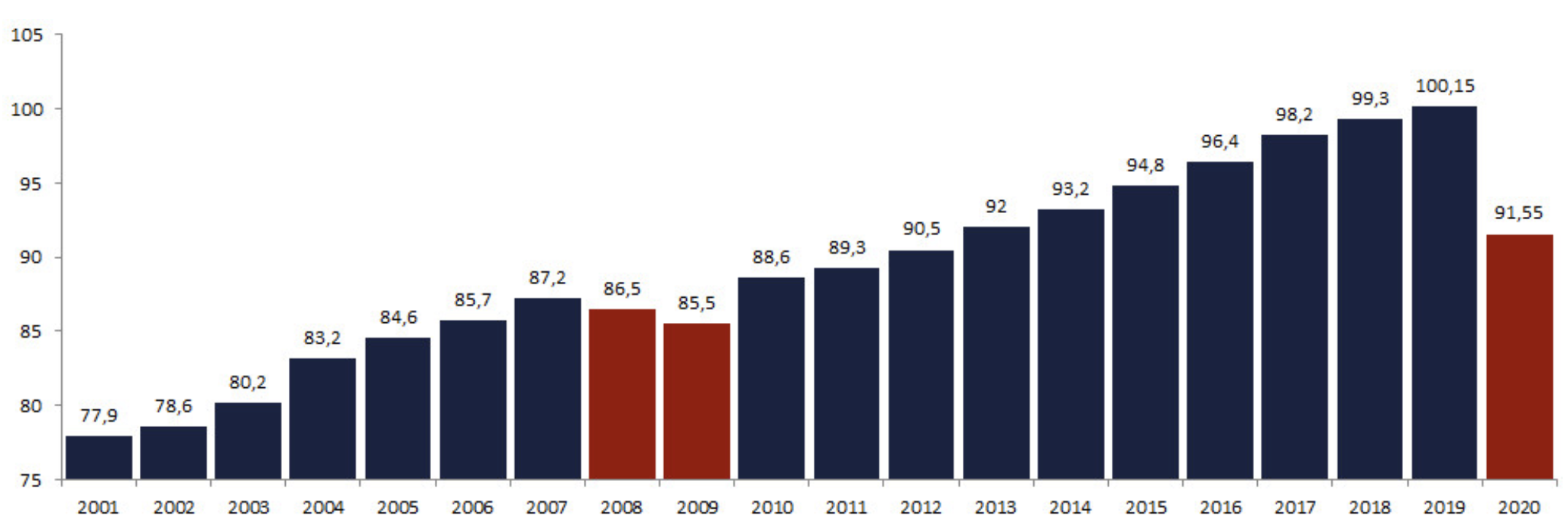

The new installment of the commodity price rally were refreshed forecasts published on Thursday IEA regarding oil demand. Compared to the April estimates, they have been clearly revised upwards. This is allowed by gradual defrosting of economies and relaxation of restrictions. Demand is expected to collapse by 19,9 million b / d in the second quarter. This represents about 20 percent. last year's average consumption. Previous estimates assumed a consumption drop of over 3 million b / d stronger. Throughout the year, demand is expected to decline by 8,6 million b / d, not 9,3 million b / d as expected.

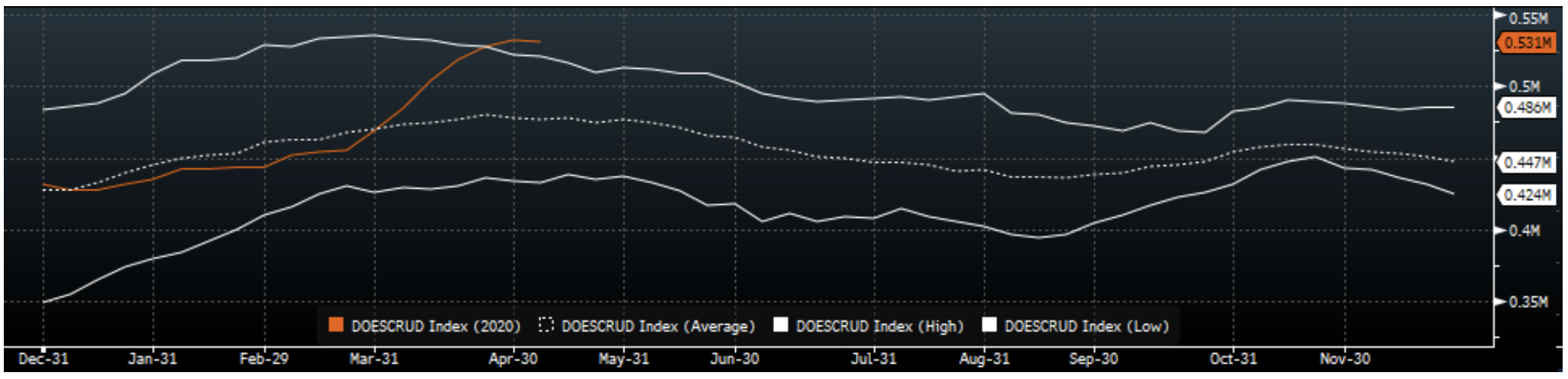

As a result, the IEA assumes that in the second half of the year, the inventories now being built will be reduced rapidly. There is no doubt that the fundamental situation is starting to improve significantly. Nevertheless, we are still in an environment of clear oversupply. During the pandemic, U.S. inventories increased by 17%. and over 10 percent exceed the average of the previous five years. Investors' indifference to most of the positive news and the course of the futures curve indicate that the upside potential may have been exhausted for now. With a noticeable cooling of the risk appetite - crude oil is in danger of a strong downward rebound from the last rally.

Author Bartosz Sawicki, TMS Brokers

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)