The cryptocurrency market under further pressure and no wind in the sails

In 2022, the cryptocurrency market was dominated by macro-political events and concerns about inflation, as well as dubious cryptocurrency applications; Cryptocurrencies showed a strong downtrend for much of the second quarter. The cryptocurrency narrative has changed, and many members of the cryptocurrency community have come under pressure.

Bitcoin - digital gold, fool gold or something else?

The original purpose of the creation Bitcoin was the first decentralized cryptocurrency to be the transfer of money over the Internet beyond any central control. As with physical gold, bitcoin's supply is limited; both of these assets are popular in countries with high inflation. Consequently, bitcoin has been dubbed "2020st century gold". Technically speaking, the correlation between bitcoin and physical gold was significant throughout 2021 and into early 1, as shown in Figure XNUMX.

However, market events in 2022 ended this narrative and the correlation between these assets is currently low. Concerns about the use of cryptocurrencies as a means of storing value increased even more in May, when it became known that the so-called stable currencies (Ang. stablecoins) are by no means stable. Free Course terra USD - a cryptocurrency token that was supposed to be pegged to a value of $ 1 - raised even greater concerns about the stability of cryptocurrencies.

So what kind of investments are cryptocurrencies? Given the correlation between the Nasdaq-100 index and bitcoin in Chart 1, it is at a record high in 2022. Cryptocurrency investments therefore behave more like regular high-risk assets, in particular showing a similarity to stocks of tech companies. This applies not only to bitcoin, but also to most major cryptocurrencies. The fact that more professional investors are considering including cryptocurrencies in their portfolios is putting these cryptocurrency investments under a risk management framework as opposed to the actions of speculative investors under previous cryptocurrency bubble speculative trends. These risk management frameworks tend to minimize portfolio risk during periods of increased market volatility, causing a cryptocurrency discount similar to that of high-risk stocks, thus demonstrating that the correlations are high. During periods of high correlation, cryptocurrencies are less likely to in any way improve portfolio diversification to spread risk.

Weekly correlation based on a XNUMX-month sliding window. Correlation is a measure of the covariance of price movements: high correlation is when the price of two instruments tends to move in the same direction, and low correlation is when one of the instruments substantially loses in value while the other gains it. On the other hand, there is zero correlation when there does not appear to be any relationship between the two instruments.

The pressure lingers in all areas of the cryptocurrency community

As a result of the difficulties in the cryptocurrency market in 2022, an answer to the question of whether cryptocurrencies can withstand the pressure and sustain growth in the long run is increasingly being sought. This would require the proper functioning of all elements of cryptocurrency networks, as well as synergies between them - cryptocurrency traders, brokers / developers and validators, not to mention the use cases of specific tokens.

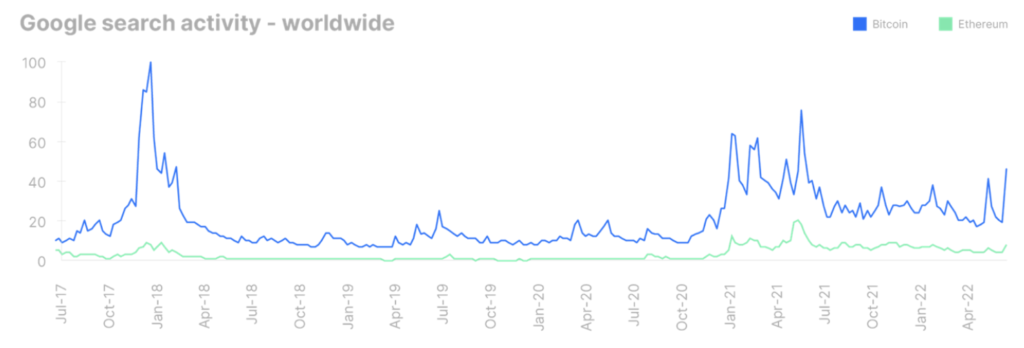

Cryptocurrency users and traders: The strong decline in cryptocurrency markets this year eliminated some speculative investors profiting from the wave of uptrends in 2020 and 2021. Analyzing Google search activity as a method of quantifying public interest shows that interest in cryptocurrencies has dropped to a moderate level, as shown in Chart 2. The remaining indicators, however, suggest a different direction, as investments in cryptocurrency exchange funds hit a record high in June, showing increased investor interest in general equity, even though bitcoin's price is now half of its peak. Also, the results of the Bank of America survey show that consumer interest remains high, although it should be noted that the survey was conducted in early June.

Google search activity for bitcoin and ethereum, two of the largest cryptocurrencies.

Programmers / brokers: The declines in the cryptocurrency market, coupled with rising inflation rates and worsening global economic conditions, has forced a number of cryptocurrency companies such as Coinbase, Crypto.com or Geminito downsize. This is similar to the situation in 2018, when cryptocurrency startups had to reduce the number of employees, which caused the industry to stagnate for several years. However, not all cryptocurrency companies share this view: Binance, Kraken and FTX saw the bear market as an excellent opportunity to prepare for the next boom - making acquisitions and investments at low prices, and recruiting the best talent.

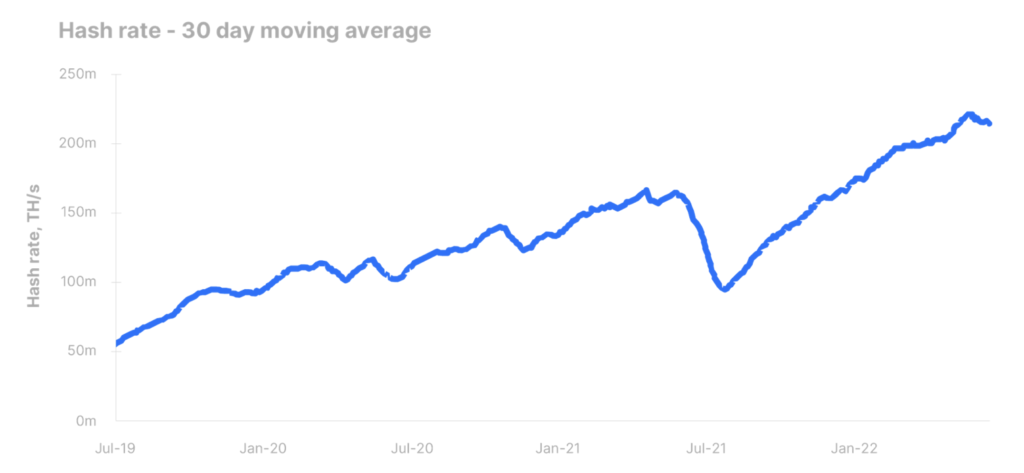

Validators: Transactions are verified by validators as part of individual blockchain technologies; the most famous are bitcoin "miners" or "miners". Miners' profitability has fallen drastically along with cryptocurrency prices, reaching levels where the net profitability of running mining rigs is close to zero. In addition, an increasing proportion of mining awards are going to exchanges rather than personal wallets, signaling a broad-based intention to sell in the short term. On the other hand, the computing power provided by the miners is only slightly below the peak level as seen in Chart 3, indicating that miners are showing no sign of surrender to the price pressure.

The hash rate on the Bitcoin network is a measure of the total computing power on the network. The higher this index is, the more secure the network is.

Use Cases: Throughout 2021 and early 2022, many large companies increased their involvement in the cryptocurrency area, both through partnerships with payment service providers and through investments in infrastructure or other aspects of the cryptocurrency industry, such as Metaverse - the virtual world concept. in which all property is governed by blockchain technology via digital currency. Some of these investments are based on direct business cases, while others appear to be the result of fear of missing an opportunity (known as FOMO, fear-of-missing-out), common during the boom in the cryptocurrency market. As 2022 passes, involvement in cryptocurrency technology applications appears to be waning.

One popular application is where customers deposit digital currencies with a high interest rate company that then borrows the currencies to make a profit. Regulators have warned that an interest rate this high seems "too good to be true," and 2022 showed how easily such companies can fail in a bear market. One example is a cryptocurrency lending company - Celsius Network - which in mid-June froze withdrawals and transfers to customers, citing "extreme market conditions" and starting a shockwave in the cryptocurrency markets.

Overall, cryptocurrency stakeholders, from users to developers and miners, are split in their cryptocurrency outlook for the next few months. When it comes to current and potential use cases, the cryptocurrency area urgently needs an appropriate regulatory framework to operate and protect investors.

About the author

Anders Nysteen - joined Saxo Bank in 2016 to the department Quantitative Strategiesand its main goal is to develop mathematical trading strategies and asset allocation models. Anders holds a degree in physics and nanotechnology from the Technical University of Denmark and a PhD in quantum photonics.

Anders Nysteen - joined Saxo Bank in 2016 to the department Quantitative Strategiesand its main goal is to develop mathematical trading strategies and asset allocation models. Anders holds a degree in physics and nanotechnology from the Technical University of Denmark and a PhD in quantum photonics.

Cryptocurrency bear market - market recovery?

The sharp decline in cryptocurrency market capitalization from the peak in November 2021 has definitely shaken the cryptocurrency community, and the clean-up of the industry may have just started, making it difficult for entities pursuing unreliable business models, as well as eliminating speculative investors and initiators of fraudulent projects from the market who do not are already able to obtain quick financing. However, a major purge is still expected when the US and European Union announce a regulatory framework for digital assets, as it will have a major impact on the role that cryptocurrencies may play in the future. In addition, the crash of the terraUSD stability currency and growing concerns about decentralized financial services could make regulation stricter than originally anticipated.

Cryptocurrencies are currently in abeyance, waiting for a change in overall macroeconomic sentiment, regulation and institutional decisions, not to mention ongoing research into central bank digital currencies as a potential competitor to traditional cryptocurrencies. Pessimists see 2022 as the beginning of a "crypto-mime", when cryptocurrency prices and involvement in cryptocurrency applications will simultaneously fall in a negative feedback loop. On the other hand, optimists hope for a positive spiral if the appetite for investing in cryptocurrencies grows, driving prices and the propensity to engage in cryptocurrency technologies. They see the current bearish as an opportunity to prepare for the next boom and as a healthy cleansing of the cryptocurrency space that could restore some of the stability and credibility lost in the first half of 2022.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response