Commodity markets ignore concerns about the banking sector and recession

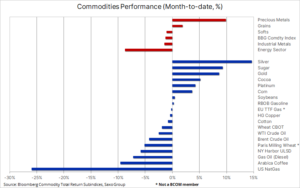

The Bloomberg Commodity Index fell slightly on a monthly basis of 1,2% after a month of high volatility, midway through a banking crisis that pushed the index to a XNUMX-month low. Despite doubts about financial stability, the market temporarily concluded that the recession, if it materialized in the European Union and the United States, would be shallow and offset by rate cuts and growth elsewhere. Gold, silver and sugar were the best performers, while natural gas, one of the world's most important energy sources, lost more than a quarter.

After a month of turbulence in the banking sector, the Bloomberg commodity index recorded a slight monthly decline of 1,2% The index managed to strengthen strongly after a sell-off in the middle of the month, which briefly took it to a XNUMX-month low - thus avoiding a deeper sell-off , despite fears of an economic slowdown affecting demand, particularly in Europe and the United States, where the financial strain was most felt. The improvement in sentiment was supported by signals that the economic recovery in China gained momentum in March, and better readings for manufacturing, services and construction translated into more positive forecasts for economic growth.

The worst result was recorded by the energy sector, which went down 9%; this result was deepened by the drop in prices of futures contracts for American natural gas by as much as 26%. On the other hand, gold and silver benefited from a large fall in US Treasury yields, the depreciation of the dollar and a sharp downward revision of expectations for future interest rates by the US Federal Reserve. Although the turmoil in the banking sector subsided at the end of the month, precious metal prices remained close to the cycle high as investor demand continued to pick up on expectations that positive factors would continue in the coming months.

The cereals sector posted a profit on a monthly basis for the first time this year thanks to higher corn prices as export demand increases and after funds were forced to go short after four weeks of record-breaking selling activity as technical and fundamental outlooks began to show signs of improvement. Cocoa prices hit a three-year high amid tight supply and concerns about a slowdown in supplies from West Africa, driven in part by disease and adverse weather conditions. At the same time, sugar prices hit a six-year high on disappointing cane production in places like Thailand and India, and after a change in state fuel tax rates in Brazil raised concerns that more cane would go to ethanol production instead of sweetener.

Oil is going down, but not out of the game

Two of the world's most important futures contracts on oil – Brent and WTI – managed to recover about half of the losses from early March, which accelerated in the middle of the month as the banking crisis intensified. However, the strength of this discount was mainly due to it from the need to reduce net long positions by speculative investors and hedge funds rather than the fact that the market has factored in the deteriorating demand outlook in pricing, which explains why the price, after the initial selling phase, managed to recover to around USD 80 for Brent and USD 75 for Brent WTI oil.

Until the unexpected sell-off, crude oil prices had been trending sideways for months and therefore little volatility, forcing speculative investors - targeting a certain level of volatility in their portfolio - to increase their positions. With Brent crude within a favorable repatriation structure, the focus was primarily on building long positions ahead of expected price increases as demand improved. When the crisis broke, oil broke support, paving the way for selling, not only as longs were liquidated, but also as more attempts were made to short.

For the two-week period ending March 21 hedge funds were selling WTI and Brent crude at the fastest pace in more than a decade, and the total net long position decreased by PLN 233 thousand. flights, i.e. 233 million barrels of oil, to the level of a three-year low, i.e. 241 thousand. flights. This wave of selling dealt a particularly hard blow to WTI oil, with the net long position dropping to just 71. lots and is the smallest since 2016. When prices started to rise as risk appetite improved, investors were forced to cover short positions.

Oil prices were solid towards the end of the month, with the recent gains being driven by continued supply disruptions from northern Iraq amid the Baghdad-Kurdistan dispute, a weaker dollar, the largest fall in US oil inventories since November, a further recovery in China and an improvement in risk appetite forcing short positions to be covered. In a monthly survey released by the Federal Reserve Bank of Dallas, representatives of shale oil mining companies said that "due to uncertainty about the depth and duration of the banking crisis, we are concerned about planned capital spending in 2023." In addition to access to credit, record labor costs and supply chain problems have led to a slowdown in production growth.

We sustain moderately positive outlook for crude oil, as we fear that most of this year's +2 million bpd increase in global demand, still expected, will come in the second half of the year. As such, a deeper than expected slowdown, signaled by current expectations of US interest rate cuts, could dampen eventual growth, thereby limiting the upside potential for oil prices later this year. However, in the short term, a break above $80,40 for Brent crude is likely to signal a return to the range before the mid-March correction.

Short-term gold price upside potential threatened by interest rate gap

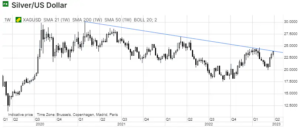

After a month of chaos in the entire banking sector gold and silver posted monthly gains of around 8% and 14%, respectively. Despite the easing of tensions last week, both metals managed to hold most of their gains in anticipation of peaking interest rates in the US in the near term, which should be followed by a series of rate cuts. However, this forecast may be negatively impacted by the fact that the current 60% probability of a recession is likely too high, especially when paired with economic data readings that continue to show high inflation, full employment and resilient consumers.

After bankruptcy of Silicon Valley Bank caused a 180-degree turn in future interest rate expectations - from additional hikes to cuts of +100 basis points over the coming months - the market seems to be headed for a recession. However, in our opinion, we are facing a "slow recession" rather than a sharp economic downturn. At Saxo, we do not anticipate any cuts until September, leaving the precious metals market at risk if the economic data, particularly inflation, continue to be strong.

Overall, it doesn't change the fact that the date of reaching the peak of interest rates is much closer, and the combination of new demand for gold from exchange-traded fund investors, momentum buying from hedge funds, and continued physical demand from central banks is likely to push gold and silver prices up as soon as there is a wide gap between current and future ( lower) Fed funds rates will start to decrease.

$2 remains the key level to watch while support is at $000, a 1% retracement from the recent uptrend to $933. For silver, note the weekly close above $38,2, which could signal a break from the two-year downtrend.

Grain prices rise ahead of key sowing report

The Bloomberg Grain Index, which monitors the performance of the six most important U.S. grain futures and soybeans, hit a five-week high as corn prices surged 3,6% on rising Chinese demand for U.S. grains. Simultaneously the price of wheat briefly topped $7 amid concerns that Russia may seek to temporarily halt the sale of wheat and sunflower oil in order to drive up prices. In addition, drought in the US Great Plains contributed to an increase in the May price of hard red winter wheat from Kansas (HRW), thus offering some support to the soft red winter variety listed on the Chicago Stock Exchange (SRW).

In addition to these favorable price developments that followed an aggressive sell-off, particularly in corn, by speculative investors, the market was preparing for the release of a key US Department of Agriculture report. Quarterly Stocks and Prospective Planting reports were expected to show the lowest levels of wheat and corn stocks in 15 and 9 years, respectively. In addition, a 19% reduction in cotton acreage to 11 million acres and reductions in other minor crops led to expectations of increases in soybeans (up 1% to 88,3 million acres), corn (up 2,6% to 90,9. 9 million acres) and primarily wheat (up 48,9% to XNUMX million acres), which will be the largest increase in acreage in seven years. Note: Data from these potentially impacting reports were not known at the time of writing.

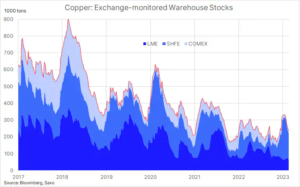

Copper continues to be supported by declining inventories and demand in China

Copper managed to recoup the losses incurred in the middle of the month during the sell-off related to the banking crisis. This underlines that growing demand from electric vehicle manufacturing, renewable energy generation and energy storage and transmission is already offsetting the slowdown in the Chinese real estate market – which has been a significant source of demand in recent years – and the economic slowdown in the West.

Over the past five weeks, visible copper inventories, which are monitored by the futures exchanges in Shanghai, London and New York, have fallen by 29%. If the current trend of increasing demand in China continues, according to Goldman Sachs, the world's apparent copper inventories may be exhausted by August. On the other hand, global production continues to recover from the losses suffered in the fourth quarter, when mining problems in Chile and Peru and lockdowns in China caused a 19% quarter-on-quarter decline in production, which was the worst result in six years, according to S&P Global.

HG copper has been on a downward trend since mid-January, initially as a result disappointment with the pace of economic recovery in China and concerns about economic growth in other countries. More recently, as concerns over banking have eased, a further drop in inventory monitored in warehouses has pushed the price of the metal to a range of $4,00-$4,15. After changing the net position from a +40 contracts long position on January 000st to a 31 contracts short position seven weeks later, the money management funds will be forced back to the buy side in the event of an upward breakout.

Finally, a warning against leveraged exchange-traded funds

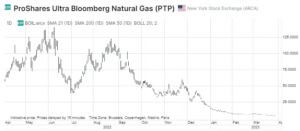

We usually don't spend much time on leveraged exchange traded funds (ETFs) - products that are often misunderstood by investors and have a terrible ability to follow the performance of the underlying - because they are best left alone or only used for very short-term strategies directional rotation.

We are all human and are often drawn to reversal trades, i.e. we look for stocks that will rebound after a strong sell-off. A classic example is the BOIL ETF, which aims to achieve daily investment performance equivalent to twice (200%) the performance of the Bloomberg Natural Gas Sub-Index. In March, the fund, despite a 47% drop in prices, managed to generate $235 million in new investment from investors and now needs to grow more than 87% to cover this loss.

In the long run managing this fund is difficult, and the annual loss of 93% speaks not only of the current weakness in the natural gas market, but also of the very high contango that absorbs the return on each rollover of the underlying futures contract. Over a five-year period, the near-to-expiration natural gas futures price has fallen by 25% and the BOIL ETF has lost nearly 99% of its value.

More analyzes of commodity markets are available here.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![CRB index – one of the popular commodity market benchmarks [Guide] crb index](https://forexclub.pl/wp-content/uploads/2024/05/indeks-crb-184x120.jpg?v=1715055656)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![CRB index – one of the popular commodity market benchmarks [Guide] crb index](https://forexclub.pl/wp-content/uploads/2024/05/indeks-crb-300x200.jpg?v=1715055656)

Leave a Response